Kentucky Debt Agreement

Description

How to fill out Debt Agreement?

If you wish to calculate, obtain, or print legal document templates, utilize US Legal Forms, the foremost collection of legal forms accessible online.

Utilize the site's simple and efficient search feature to find the documents you need. Various templates for business and personal purposes are organized by categories and regions, or keywords.

Use US Legal Forms to acquire the Kentucky Debt Agreement in just a few clicks.

Each legal document format you obtain is yours forever. You have access to all forms you downloaded within your account. Click the My documents section and select a form to print or download again.

Stay ahead and download and print the Kentucky Debt Agreement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Kentucky Debt Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/state.

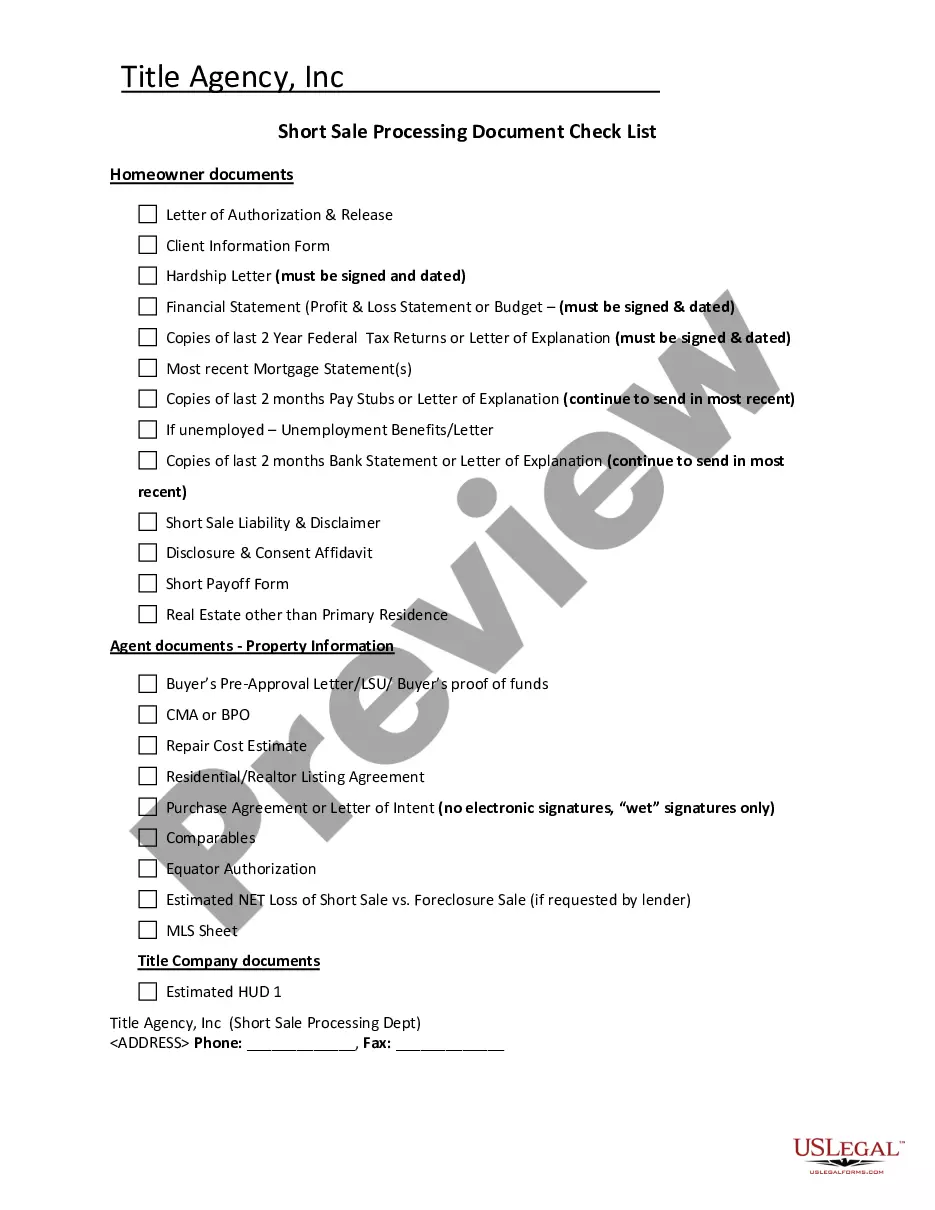

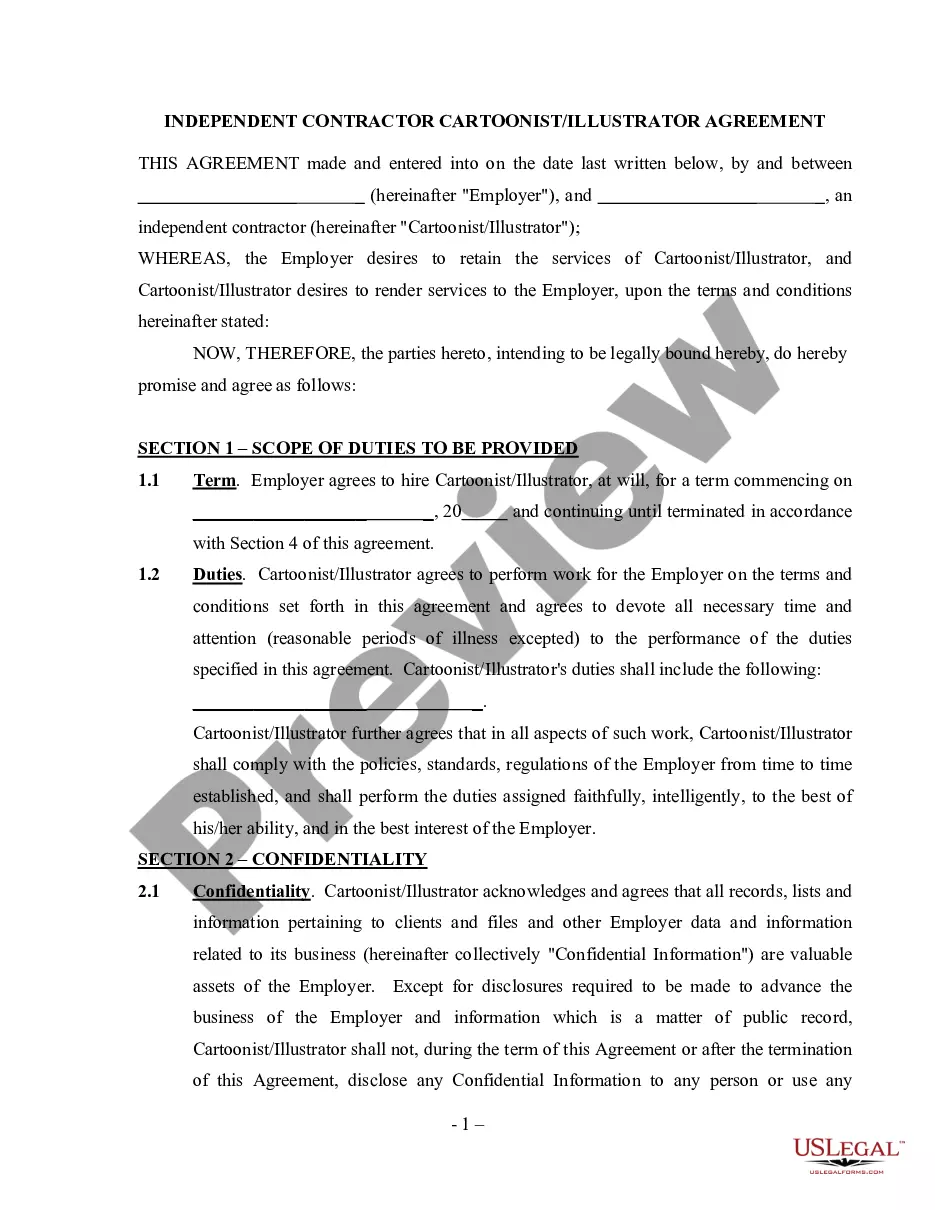

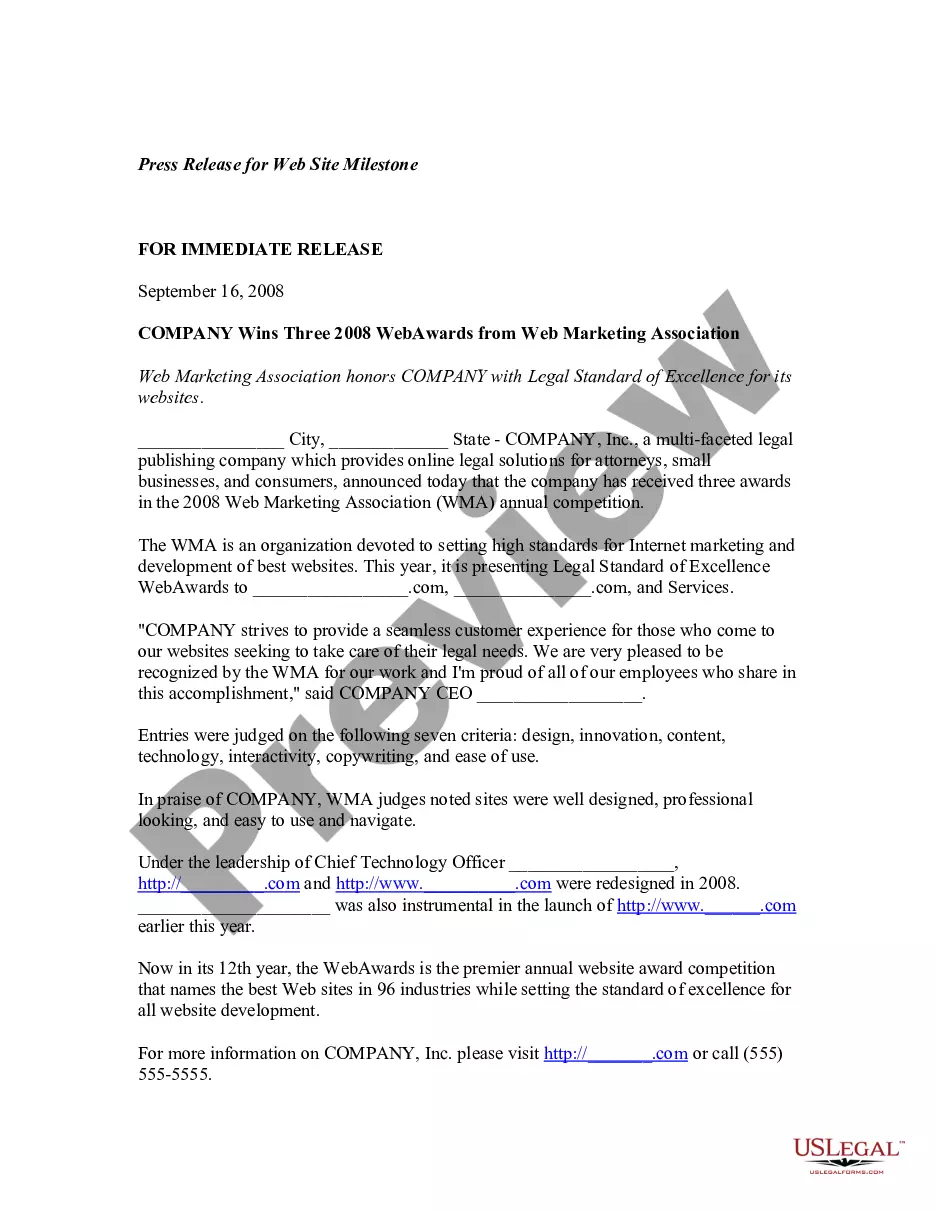

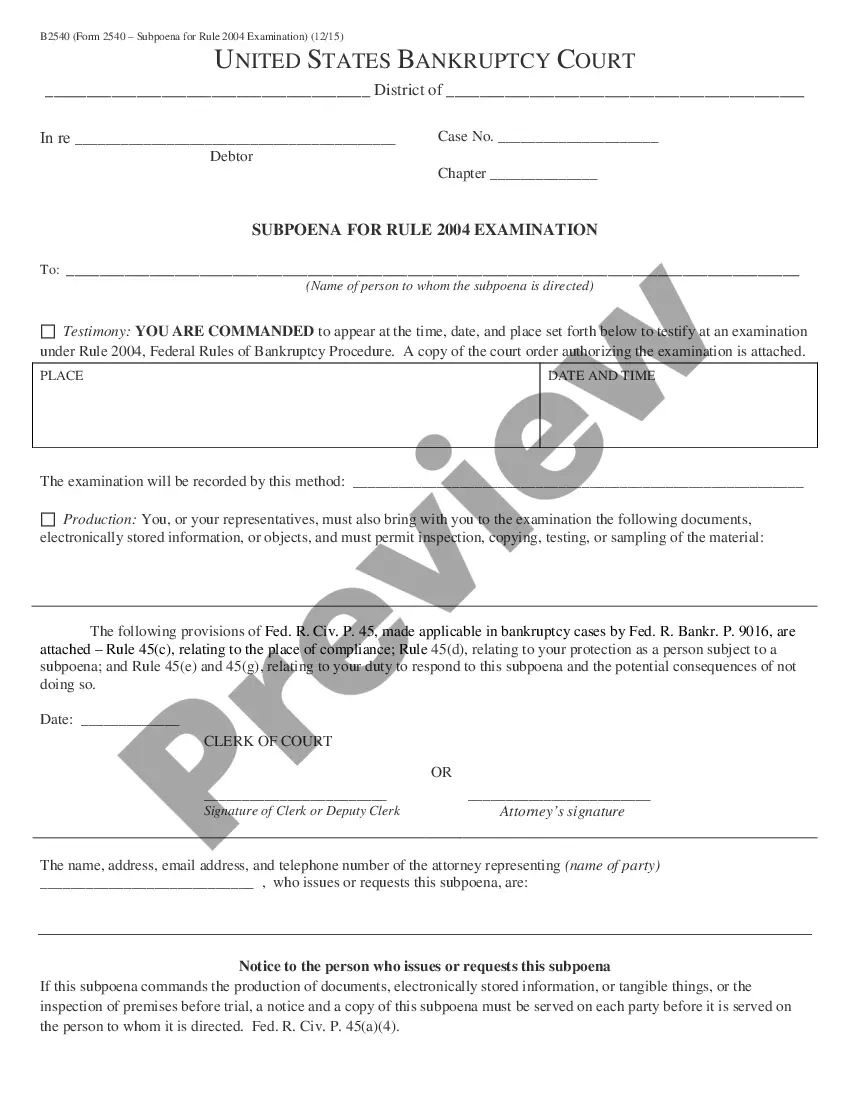

- Step 2. Utilize the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Kentucky Debt Agreement.

Form popularity

FAQ

In many cases, a 10-year-old debt may be too old to collect in Kentucky, depending on its type and when the last payment was made. By law, certain debts can become uncollectible after the statute of limitations expires. If you're unsure about the status of an old debt, a Kentucky Debt Agreement can help clarify your options and guide you through potential resolutions.

In Kentucky, the statute of limitations for most debts is typically around five to fifteen years, depending on the type of debt. Once this period expires, creditors can no longer legally pursue collection. Understanding your timeline is vital, particularly if you are considering a Kentucky Debt Agreement as a potential solution for your financial challenges.

In Kentucky, creditors typically have one year from the date of death to file a claim against an estate. The estate must settle valid claims before distributing assets to heirs. Establishing a Kentucky Debt Agreement may help manage outstanding debts and ensure a smoother process during estate settlements. It's essential to address these matters promptly.

Kentucky law outlines specific practices for debt collection to protect consumers. Collectors must adhere to guidelines that prevent harassment and ensure transparency. If you face challenges with debt collection, exploring a Kentucky Debt Agreement could provide a structured way to manage your obligations. Knowing your rights can empower you during this process.

As of recent reports, Kentucky's total debt stands at approximately $42 billion. This figure encompasses various forms of debt, including general obligation bonds and other liabilities. Understanding the state's financial position is crucial, especially when navigating a Kentucky Debt Agreement. Being informed helps residents make better choices regarding their financial obligations.

In Kentucky, debts typically become uncollectible after a statute of limitations period of five years for most types of consumer debt. This period begins from the date of the last payment or the last activity on the account. Understanding this timeline is vital if you are exploring options such as a Kentucky Debt Agreement, as it can provide insight into your rights and potential strategies for managing your debts. Always consider legal advice to navigate this process successfully.

As of now, California holds the title for the highest state debt in the United States. This debt largely arises from its extensive budget deficits and high spending needs. It is noteworthy, however, that understanding debt levels of different states, including Kentucky, can be crucial when considering options like a Kentucky Debt Agreement. This knowledge empowers consumers to make informed decisions about their financial futures.

The state of Kentucky has accumulated a significant level of debt, primarily related to pension obligations and infrastructure spending. As of recent reports, Kentucky's public debt includes bonds and other forms of borrowing that fund essential services. Understanding this debt is important for state residents, especially when engaging in discussions about financial agreements like the Kentucky Debt Agreement. Awareness of the state's financial health can influence local economic decisions and personal finances.

In Kentucky, debt collection laws protect consumers from unfair collection practices. Under these laws, debt collectors must follow specific procedures, including notifying consumers of their rights. It is essential to understand these laws, especially if you find yourself navigating a Kentucky Debt Agreement. Familiarizing yourself with your rights can help you handle potential debt collection more effectively.

If you owe KY state taxes, the state may take measures to recover the funds, such as wage garnishment or property liens. It's essential to address the situation promptly to avoid escalation. By creating a Kentucky Debt Agreement, you can potentially negotiate terms that allow you to repay your state taxes over time while minimizing penalties.