Kentucky Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

You might spend hours online attempting to locate the sanctioned document template that satisfies the federal and state requirements you have. US Legal Forms offers a vast selection of legal forms that have been evaluated by experts.

You can download or print the Kentucky Contract for Sale of Goods on Consignment from my support.

If you possess a US Legal Forms account, you can Log In and then click the Obtain button. Subsequently, you can complete, modify, print, or sign the Kentucky Contract for Sale of Goods on Consignment. Every legal document template you purchase is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of your document and download it to your device. Make alterations to your document if needed. You can fill out, alter, and sign as well as print the Kentucky Contract for Sale of Goods on Consignment. Obtain and print a wide array of document templates via the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for your region/town of choice. Review the form description to confirm that you have chosen the right form.

- If available, utilize the Preview button to view the document template as well.

- If you wish to locate another version of your form, use the Search field to find the template that suits your requirements.

- Once you have identified the template you want, click Acquire now to proceed.

- Select the pricing plan you desire, enter your details, and sign up for your account on US Legal Forms.

Form popularity

FAQ

Certain vendors, such as corporations and tax-exempt organizations, are generally exempt from 1099 reporting. However, the specifics can vary, so be sure to verify the tax guidelines that apply to your situation. When using a Kentucky Contract for Sale of Goods on Consignment, clarify the terms with vendors to understand their reporting obligations.

Accounting for consignment sales involves tracking the revenue generated from sold goods and recording costs incurred for unsold items. You can recognize sales revenue upon successful transactions. Implement a Kentucky Contract for Sale of Goods on Consignment to help you manage financial records effectively.

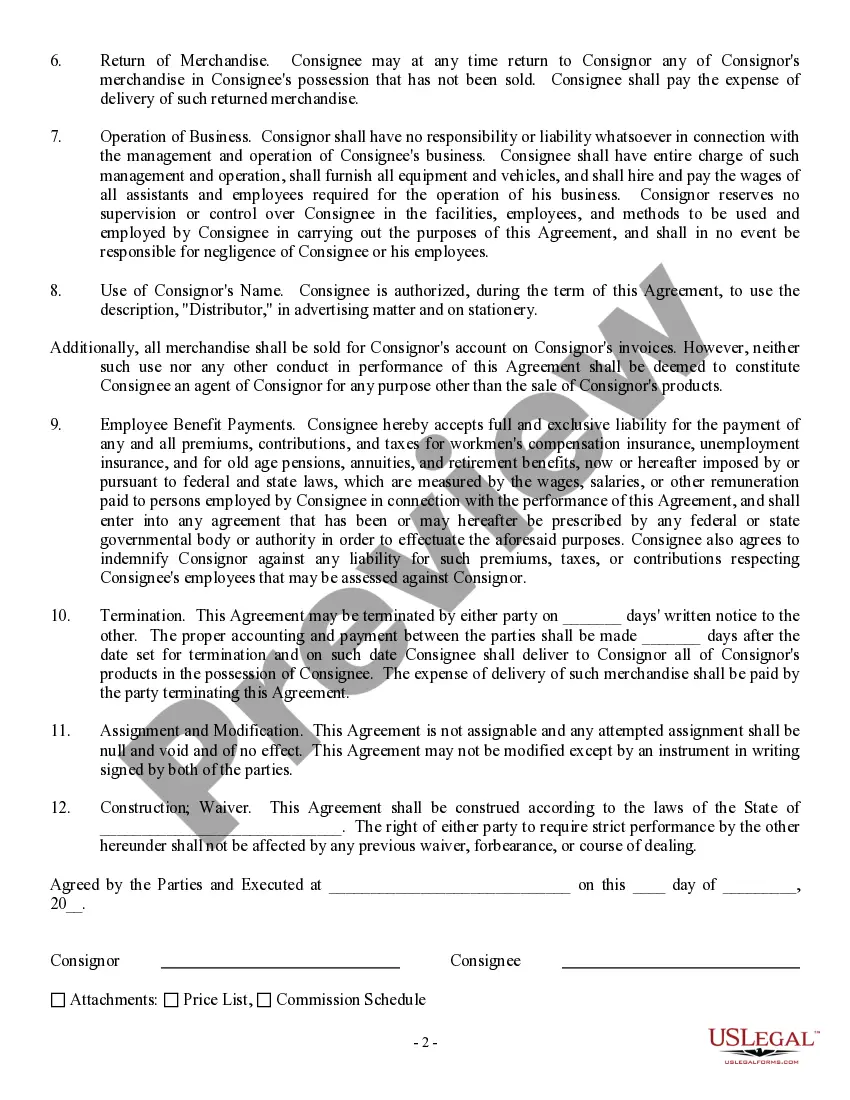

In a consignment arrangement, a Kentucky Contract for Sale of Goods on Consignment explicitly outlines the sale of specific goods. This contract clarifies the responsibilities of both the consignor and the consignee regarding the sale process. Therefore, ensure that this document details the goods involved to avoid future disputes.

You usually issue a 1099 for consignment sales if you fulfill the payment requirement of $600 or more to the consigner in a year. This form helps report income to the IRS accurately. To maintain compliance, leverage a Kentucky Contract for Sale of Goods on Consignment that outlines financial terms clearly.

Yes, consignment sales count as income for tax purposes. When you sell goods on consignment, the revenue generated from those sales is typically classified as taxable income. It is essential to keep accurate records to report this income correctly, particularly when you utilize a Kentucky Contract for Sale of Goods on Consignment.

A fair percentage for consignment typically ranges from 20% to 50%, depending on the type of goods and market conditions. Factors like the type of product and sales volume can influence what is considered fair. When negotiating, ensure clarity in your Kentucky Contract for Sale of Goods on Consignment regarding commission rates to avoid disputes.

Contract law in Kentucky governs the formation, execution, and enforcement of contracts, including those for consignment sales. The law emphasizes mutual consent, lawful purpose, and sufficient consideration. Understanding these principles is essential when drafting a Kentucky Contract for Sale of Goods on Consignment to ensure compliance with state laws.

The three types of consignments include those for resale, where goods are sold by a retailer, those for sample purposes, which allow potential buyers to examine products, and those for sale at auction. Each type serves a specific market need and involves different contractual terms. When using a Kentucky Contract for Sale of Goods on Consignment, knowing these categories helps streamline the process.

The consignment sale policy allows a seller to provide goods to a retailer without transferring ownership until the goods are sold. This agreement benefits both parties, as the retailer can offer products without upfront costs, while the seller retains ownership until sale completion. Understanding the Kentucky Contract for Sale of Goods on Consignment is crucial for anyone involved in such arrangements.

To terminate a consignment agreement, refer to the specific terms outlined in your Kentucky contract for sale of goods on consignment. Typically, you need to provide written notice to the other party. Follow the guidelines to ensure a smooth termination process, preserving the relationship for potential future agreements.