Kentucky Sample Letter for Preferred Customer Sale

Description

How to fill out Sample Letter For Preferred Customer Sale?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Kentucky Sample Letter for Preferred Customer Sale in moments.

If you already possess a subscription, Log In and download the Kentucky Sample Letter for Preferred Customer Sale from the US Legal Forms database. The Download button will appear on each form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the purchase. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the retrieved Kentucky Sample Letter for Preferred Customer Sale. Every template you have added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Make sure you have selected the correct form for your jurisdiction.

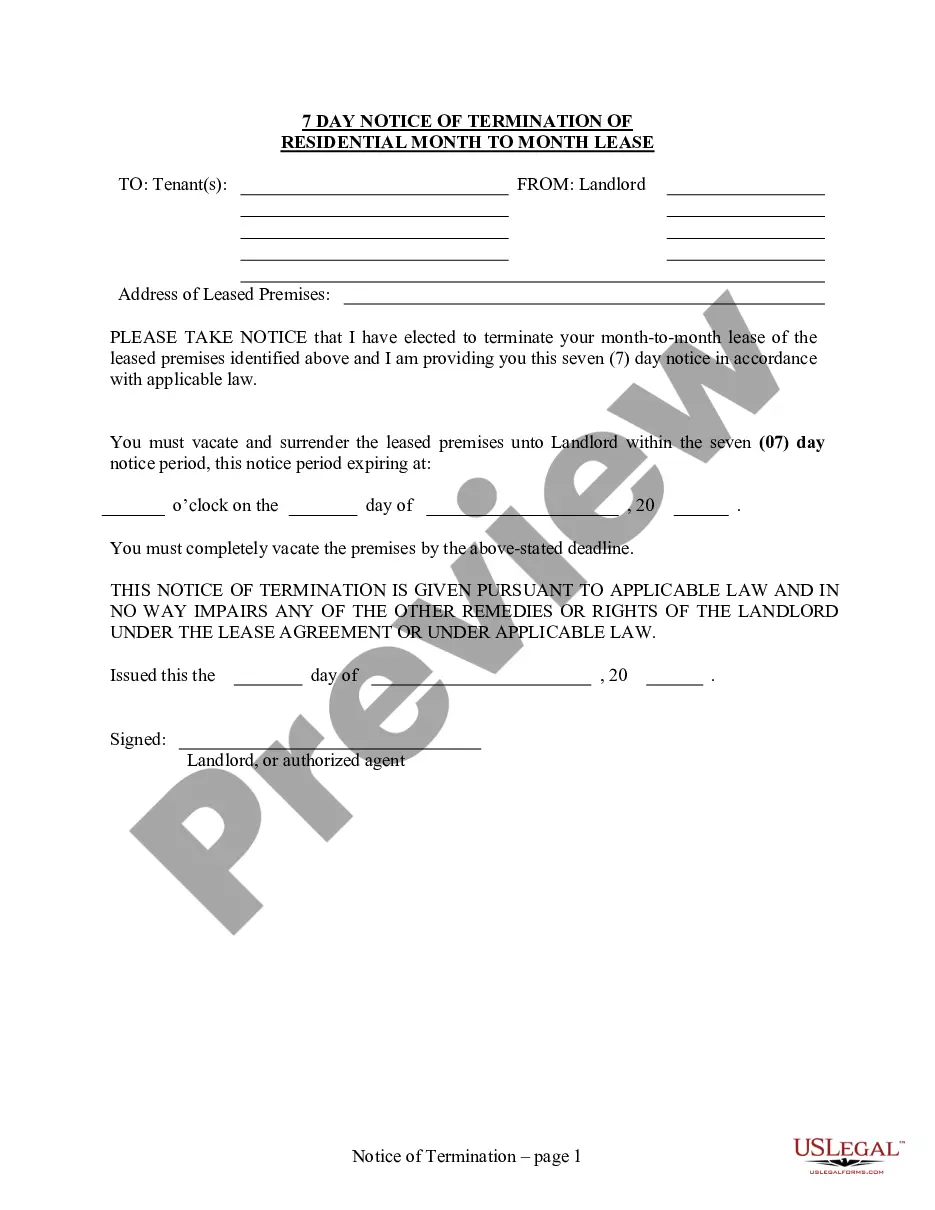

- Click on the Preview button to review the content of the form.

- Check the form description to ensure that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your credentials to create an account.

Form popularity

FAQ

The Kentucky form 740 is an individual income tax return used by residents to report their income and calculate taxes owed. This form is essential for taxpayers looking to achieve compliance with state tax regulations. Incorporating the Kentucky Sample Letter for Preferred Customer Sale can help streamline communications regarding tax matters with your valued customers.

A letter from the Kentucky Department of Revenue may relate to various issues such as a tax return inquiry, overdue payments, or needed documentation for your accounts. It is important to respond promptly to avoid further complications. If you received this letter alongside a Kentucky Sample Letter for Preferred Customer Sale, it’s wise to address both matters without delay.

In 2024, Kentucky allows a pension exclusion of up to $41,110 for retirees under specific conditions. This exclusion is intended to provide tax relief for those living on retirement income. When discussing this in relation to the Kentucky Sample Letter for Preferred Customer Sale, it’s helpful for businesses to inform customers about the potential tax advantages.

In Kentucky, several items are exempt from sales tax, including a range of food products, certain medical equipment, and non-profit sales. Understanding these exemptions can benefit your business strategy, especially when discussing the Kentucky Sample Letter for Preferred Customer Sale with your audience.

Yes, if you earned income in Kentucky as a non-resident, you are required to file a non-resident tax return. This allows you to report income earned within the state, which is crucial for tax compliance. Utilize the Kentucky Sample Letter for Preferred Customer Sale as a tool to inform your customers about their tax responsibilities.

You can request a Kentucky withholding number by completing an application on the Kentucky Department of Revenue's website. This process usually involves submitting basic business information and tax-related details. If you are sending out a Kentucky Sample Letter for Preferred Customer Sale, having this number will be essential for tax compliance.

To close a sales tax account in Kentucky, you must complete the necessary paperwork from the Kentucky Department of Revenue. Typically, you will need to file a final sales tax return and indicate that you are closing the account. Ensure to review your obligations related to the Kentucky Sample Letter for Preferred Customer Sale to avoid any issues.

You can obtain the form 740 Kentucky PDF directly from the Kentucky Department of Revenue's website. Simply navigate to their forms section, and you will find the downloadable PDF version. This form is essential for taxpayers who want to understand how to utilize the Kentucky Sample Letter for Preferred Customer Sale.