Kentucky Asset Purchase Agreement - More Complex

Description

How to fill out Asset Purchase Agreement - More Complex?

Are you presently in a circumstance where you require documents for both commercial or personal purposes nearly all the time.

There are many authentic document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of form templates, such as the Kentucky Asset Purchase Agreement - More Complex, which are designed to meet state and federal requirements.

Once you find the appropriate form, simply click Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for your order with your PayPal or credit card. Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can download an additional copy of the Kentucky Asset Purchase Agreement - More Complex at any time if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of authentic forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Kentucky Asset Purchase Agreement - More Complex template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Utilize the Preview button to review the form.

- Check the outline to confirm that you have selected the right form.

- If the form is not what you are seeking, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

There are several potential issues with a Kentucky Asset Purchase Agreement - More Complex that buyers and sellers should be aware of. Common problems include unclear terms, which can lead to disputes over what is included in the sale. Additionally, liabilities associated with the assets may not be fully disclosed, causing unexpected financial burdens. Utilizing platforms like USLegalForms can help you create a more effective and comprehensive agreement, minimizing these risks.

Kentucky does not have a specific buyer's remorse law that applies to asset purchase agreements. However, consumers have certain rights under general contract law, which may provide some recourse if a transaction was made under duress or misrepresentation. When entering into a Kentucky Asset Purchase Agreement - More Complex, it's wise to conduct thorough due diligence to protect yourself from potential regret after the deal is finalized. Always consider seeking legal advice for clarity on your rights.

Yes, a Kentucky Asset Purchase Agreement - More Complex is legally binding once both parties sign it. This means that the terms outlined in the agreement must be followed, and failure to do so can result in legal consequences. It is essential to ensure that the agreement is clear and comprehensive to avoid disputes later. Consulting with a legal professional can help you understand your rights and obligations under the agreement.

Creating a higher purchase agreement requires a comprehensive approach. Start by detailing the buyer and seller's information, as well as the asset being financed. It's important to outline the payment structure, including the interest rate and repayment schedule. For those looking to draft a Kentucky Asset Purchase Agreement - More Complex, utilizing resources from USLegalForms can simplify the process, offering templates and expert guidance tailored to your needs.

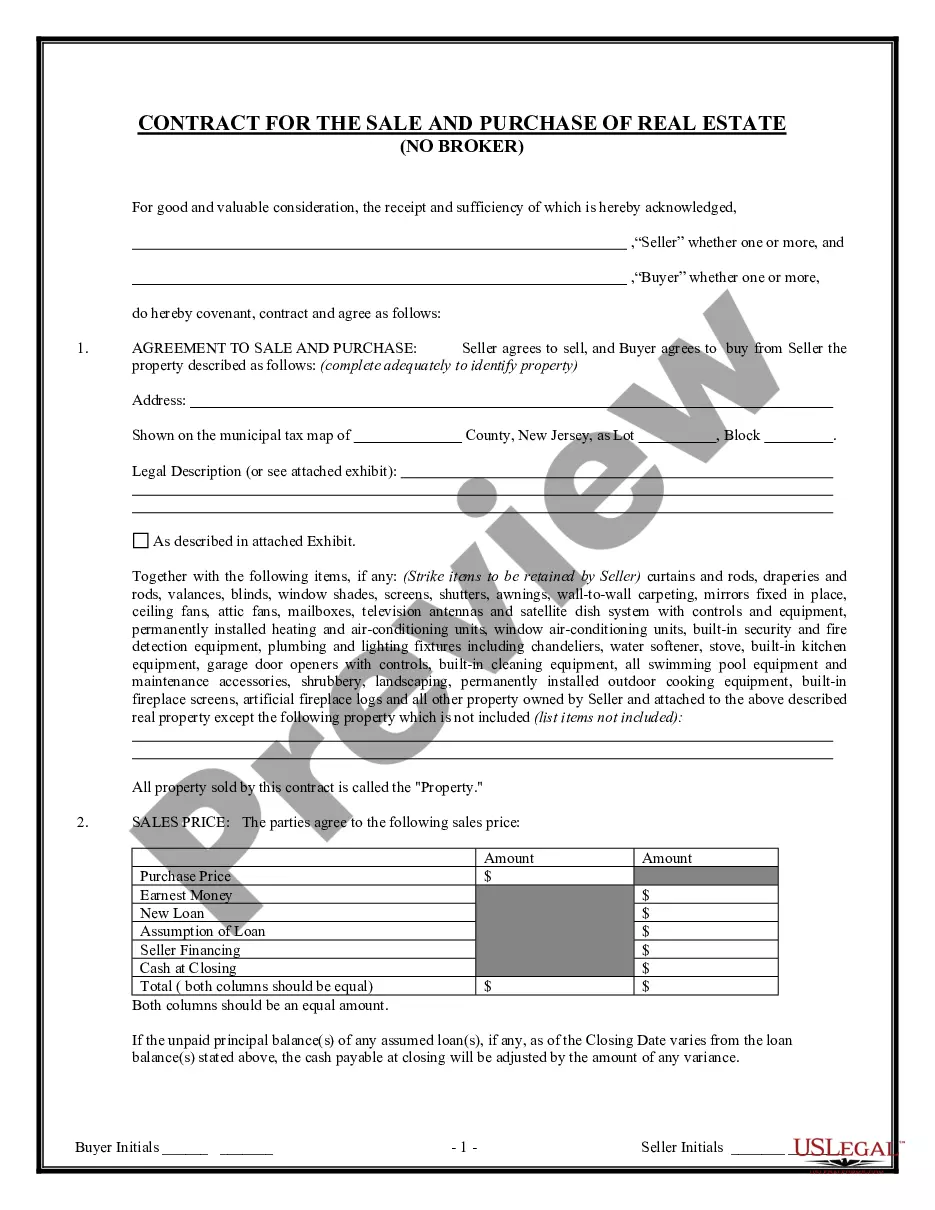

Writing an Asset Purchase Agreement involves several key elements. Begin by outlining the parties involved and the effective date of the agreement. Clearly define the assets being sold, including any liabilities that may transfer. Additionally, include warranties, representations, and any conditions for closing the sale. For a Kentucky Asset Purchase Agreement - More Complex, you can rely on USLegalForms to provide templates and legal insights to ensure your document meets all necessary requirements.

Yes, you can write your own purchase agreement, but it is crucial to ensure that it meets legal requirements. A Kentucky Asset Purchase Agreement - More Complex must include essential elements, such as a detailed description of the assets and the terms of sale. However, writing such an agreement can be intricate, so using a resource like USLegalForms can provide you with templates and expert advice to create a compliant and effective document.

An asset purchase agreement operates by outlining the terms under which one party purchases specific assets from another. In a Kentucky Asset Purchase Agreement - More Complex, the buyer and seller agree on a clear framework that details the assets included and the obligations of each party. This agreement ensures that all aspects of the transaction are understood and legally binding. Platforms like USLegalForms can assist in drafting these agreements, ensuring that they meet legal standards.