Kentucky Schedule A-B: Property (Individuals) is a form used by the Kentucky Department of Revenue to report property owned by individuals. It is used to determine and report the value of the property for taxation purposes. The form includes two schedules: Schedule A and Schedule B. Schedule A is used to report real property, which includes land, buildings, and any improvements to the land. It also includes personal property such as furniture, vehicles, equipment, and other tangible items. Schedule B is used to report intangible property, such as stocks, bonds, bank accounts, and other investments. Both schedules must be completed and submitted to the Kentucky Department of Revenue in order to calculate the taxable amount of property owned by an individual.

Kentucky Schedule A-B: Property (individuals)

Description

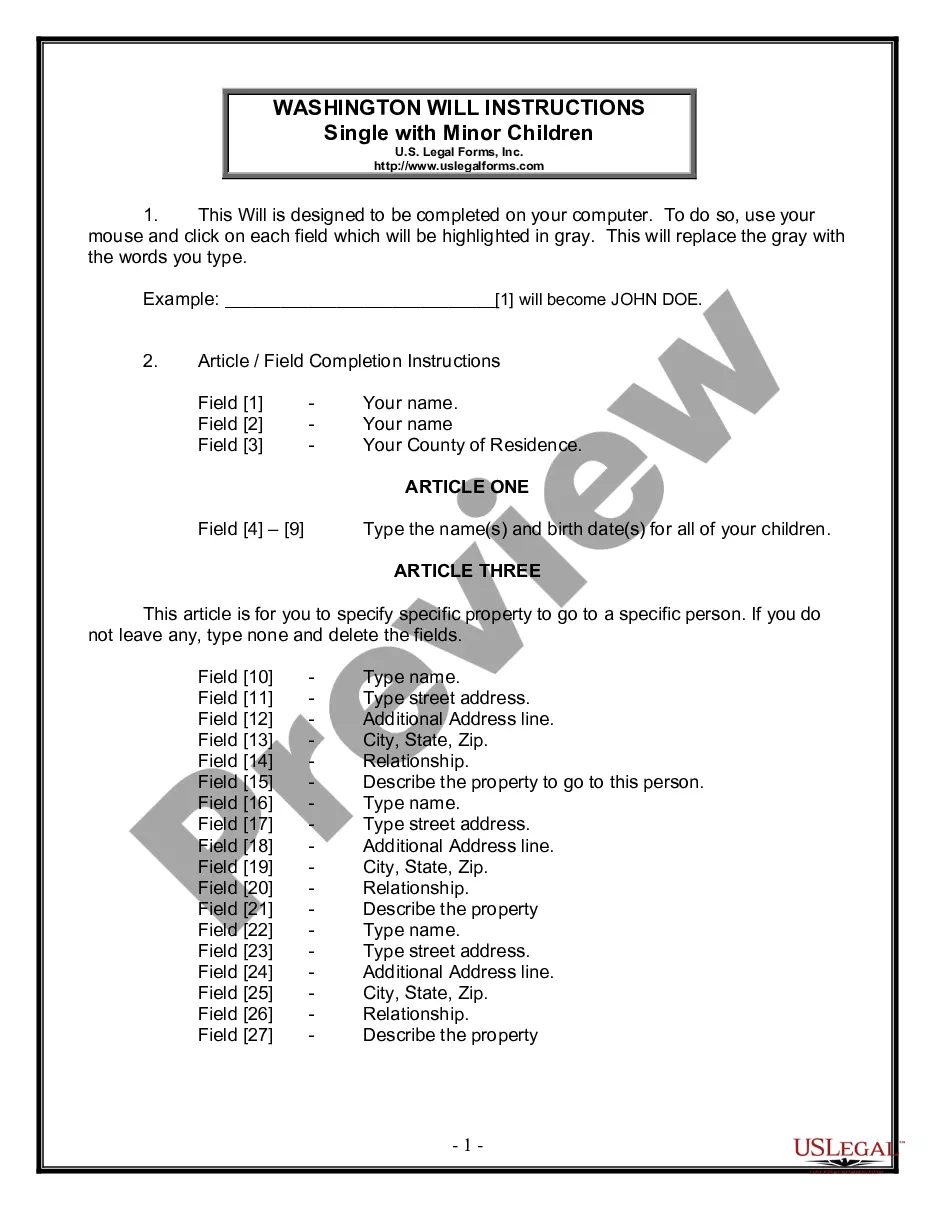

How to fill out Kentucky Schedule A-B: Property (individuals)?

Drafting legal documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online repository of official documents, you can trust the forms you find, as they all conform to federal and state regulations and have been verified by our experts.

Acquiring your Kentucky Schedule A-B: Property (individuals) from our platform is as simple as 1-2-3. Existing users with an active subscription only need to Log In and click the Download button after locating the correct template. Later, if necessary, users can also retrieve the same document from the My documents section of their account.

Haven't you explored US Legal Forms yet? Subscribe to our service now to obtain any official document swiftly and effortlessly whenever you need to, and keep your paperwork organized!

- Document compliance review. Ensure you scrutinize the content of the form you wish to use and verify that it meets your needs and adheres to your state law requirements. Viewing your document and examining its general description will assist you in this.

- Alternative search (optional). If you encounter any discrepancies, navigate the library using the Search tab at the top of the page until you find a fitting template, then click Buy Now when you find the one that suits your needs.

- Account creation and document purchase. Register for an account with US Legal Forms. After your account is verified, Log In and select your desired subscription plan. Proceed with payment (PayPal and credit card options are available).

- Template download and additional usage. Choose the file format for your Kentucky Schedule A-B: Property (individuals) and click Download to store it on your device. You can print it to manually complete your paperwork or utilize a feature-rich online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

Kentucky does not require you to use the same filing status as your federal return. Generally, all income of Kentucky residents, regardless of where it was earned, is subject to Kentucky income tax.

Tangible personal property is every physical item subject to ownership, except real and intangible property. Lessors and Lessees of Tangible Personal Property?Leased property must be listed by the owner on Revenue Form 62A500, regardless of the lease agreement's terms regarding tax liability.

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

??Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

The taxable situs of tangible personal property in Kentucky are the Counties where the property is physically located. Another way to define tangible personal property is that it is every physical item subject to ownership except real and intangible property.

Overview of Kentucky Taxes Property taxes in in Kentucky are relatively low. The typical homeowner in Kentucky pays just $1,382 annually in property taxes, around half the national median. The state's average effective property tax rate is 0.80%.

What is a KY Form 740? Kentucky Income Tax Return Nonresident - Reciprocal State Current, 2021 - Form 740-NP-R - Fill-in. Kentucky Itemized Deduction for Nonresidents or Part-Year Residents Current, 2021 - Form 740-NP Schedule A - Fill-in, Schedule.

A Kentucky Resident is an individual that spends at least 183 days in Kentucky during the tax year. A Nonresident of Kentucky is and individual that did not reside in Kentucky during the tax year. A Part-Year Resident is an individual that moved into or out of Kentucky during the tax year.