Kansas Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Are you currently in the place in which you need papers for possibly organization or specific purposes just about every day? There are tons of lawful document web templates available on the net, but discovering ones you can depend on isn`t simple. US Legal Forms gives a large number of develop web templates, like the Kansas Clauses Relating to Dividends, Distributions, which can be published to meet state and federal requirements.

If you are already acquainted with US Legal Forms website and get a merchant account, simply log in. After that, you can acquire the Kansas Clauses Relating to Dividends, Distributions design.

If you do not offer an accounts and need to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is for that correct area/state.

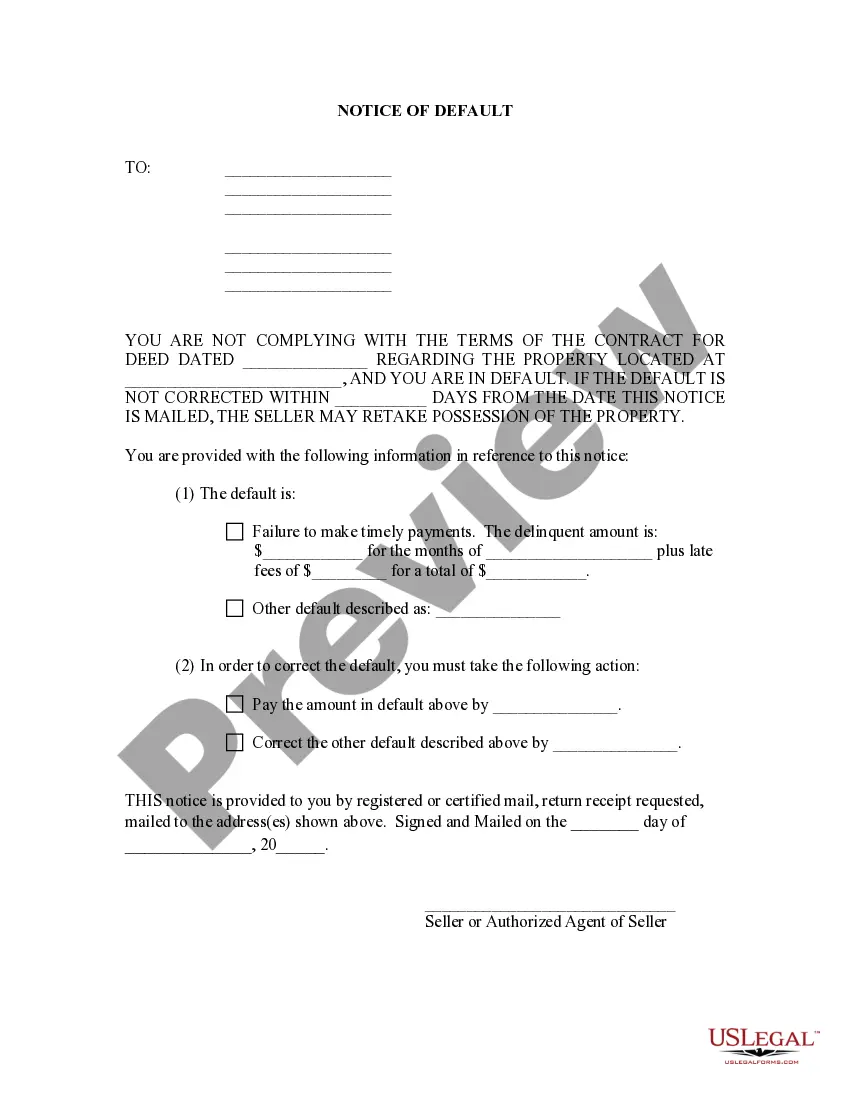

- Make use of the Preview switch to review the form.

- Look at the information to ensure that you have selected the correct develop.

- When the develop isn`t what you are searching for, take advantage of the Search area to discover the develop that fits your needs and requirements.

- Whenever you get the correct develop, simply click Buy now.

- Select the prices prepare you need, submit the required details to generate your account, and pay for the order using your PayPal or bank card.

- Choose a hassle-free document formatting and acquire your backup.

Find every one of the document web templates you have bought in the My Forms menu. You can get a more backup of Kansas Clauses Relating to Dividends, Distributions anytime, if needed. Just click the required develop to acquire or print the document design.

Use US Legal Forms, the most considerable collection of lawful forms, to save some time and steer clear of blunders. The services gives appropriately manufactured lawful document web templates which you can use for a range of purposes. Create a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Corporations which elect under subchapter S of the Internal Revenue Code not to be taxed as a corporation must file a Kansas Partnership or S Corporation Return (Form K-120S). All other corporations must file a Form K-120.

COMPLETING FORM K-120EL This business income election is binding on all members of a unitary group. An officer of the business listed at the top of the form must sign this election.

Retirement income from a 401(k), pension or IRA is fully taxable at the regular Kansas income tax rates of 3.1% to 5.7%. One exception is public pension income, whether from federal, state or local government pension. Public pension income is fully exempt from the Kansas income tax.

Business income is apportioned to Kansas generally using the average of the three factors of property, payroll, and sales.

When you withdraw money from your IRA or employer-sponsored retirement plan, your state may require you to have income tax withheld from your distribution. Your withholding is a pre-payment of your state income tax that serves as a credit toward your current-year state income tax liability.