Kansas Tutoring Agreement - Self-Employed Independent Contractor

Description

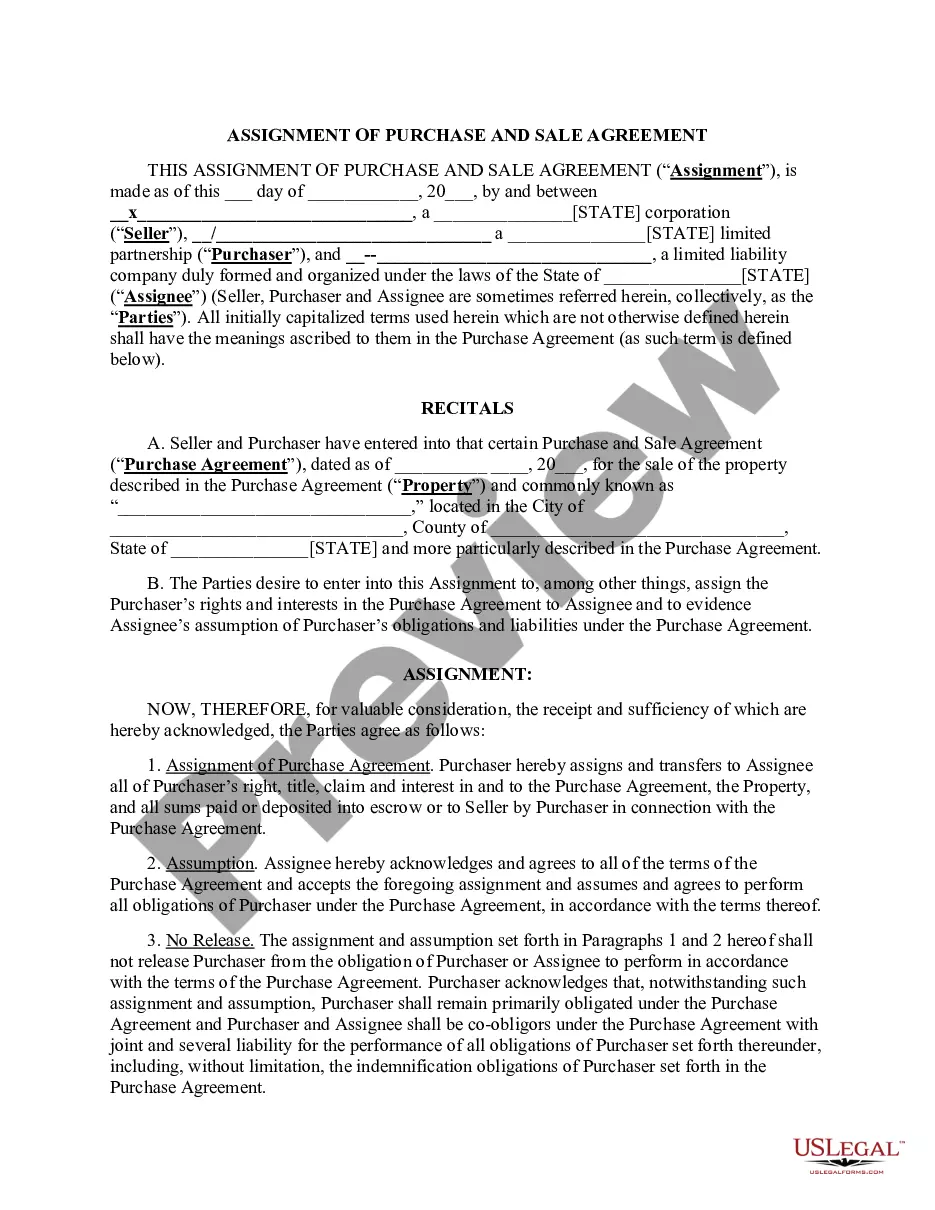

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

You may spend countless hours online looking for the legal document template that fulfills both state and federal requirements that you require.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can obtain or print the Kansas Tutoring Agreement - Self-Employed Independent Contractor from our service.

If available, use the Preview button to review the template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Kansas Tutoring Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours indefinitely.

- To get another copy of the purchased form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/city of your choice.

- Review the form description to ensure you have selected the right document.

Form popularity

FAQ

A basic tutoring contract outlines the terms between you and your student or their guardians. It usually includes details like scheduling, payment terms, and cancellation policies. This document helps protect both parties by establishing clear expectations. For your tutoring business, a Kansas Tutoring Agreement - Self-Employed Independent Contractor can serve as a solid foundational document.

Licensing requirements for private tutoring vary by state, and typically, a formal license is not required. However, specific certifications may strengthen your credibility as a tutor. It is wise to research local regulations to ensure compliance. A thorough Kansas Tutoring Agreement - Self-Employed Independent Contractor can help delineate the expectations and obligations without the need for licensing.

Indeed, tutoring is typically categorized as self-employment. When you offer your tutoring services independently, you are taking on the role of a self-employed individual. This status allows you to manage your clients and dictate your business practices. A Kansas Tutoring Agreement - Self-Employed Independent Contractor provides essential terms and conditions for your tutoring services.

Tutors are often classified as independent contractors, especially when they work privately. This means they control their services without being tied to a single employer. While some tutors might work for schools or agencies, many choose the flexibility that comes with being self-employed. A detailed Kansas Tutoring Agreement - Self-Employed Independent Contractor can clarify these working arrangements.

Yes, private tutoring is generally considered self-employed. As an independent contractor, you have the freedom to set your own rates and schedule. However, you must also handle your own taxes and business expenses. A comprehensive Kansas Tutoring Agreement - Self-Employed Independent Contractor can help formalize your working relationship with clients.

To draft an independent contractor agreement, include both parties' names, contact details, and the specific services to be delivered. Clearly define payment terms, the project timeline, and any responsibilities or expectations. Using a Kansas Tutoring Agreement - Self-Employed Independent Contractor template from US Legal Forms can simplify the process, providing you with a solid foundation for your agreement.

Writing a tutoring contract starts with outlining the purpose and scope of tutoring services being offered. Include vital details such as payment terms, cancellation policies, and confidentiality agreements. A well-structured Kansas Tutoring Agreement - Self-Employed Independent Contractor can be created easily using forms from US Legal Forms, ensuring all essential elements are professionally covered.

To complete an independent contractor form, provide your personal information, including your name, address, and social security number. Specify the services you will provide as a tutor, the payment structure, and any specific conditions agreed upon. For efficient filling, consider accessing templates like the Kansas Tutoring Agreement - Self-Employed Independent Contractor from US Legal Forms, which guide you step by step.

Yes, in most cases, a tutor operates as an independent contractor. This classification allows tutors to work independently and manage their schedules. Engaging in a Kansas Tutoring Agreement - Self-Employed Independent Contractor helps clarify the business relationship, providing the tutor with flexibility and control over their teaching approach.

To fill out an independent contractor agreement, start by entering your name and contact information along with the tutor's details. Clearly outline the scope of work, payment terms, and duration of the agreement. You can utilize resources like US Legal Forms, which offers templates specifically for a Kansas Tutoring Agreement - Self-Employed Independent Contractor, ensuring you cover all necessary elements.