Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

How to fill out Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Have you been within a situation that you will need papers for possibly organization or individual uses nearly every working day? There are a lot of authorized record themes available on the net, but finding ones you can trust is not straightforward. US Legal Forms provides 1000s of develop themes, much like the Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, that are written to fulfill state and federal needs.

When you are presently knowledgeable about US Legal Forms web site and get your account, simply log in. Afterward, it is possible to acquire the Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit template.

Unless you offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for the right area/state.

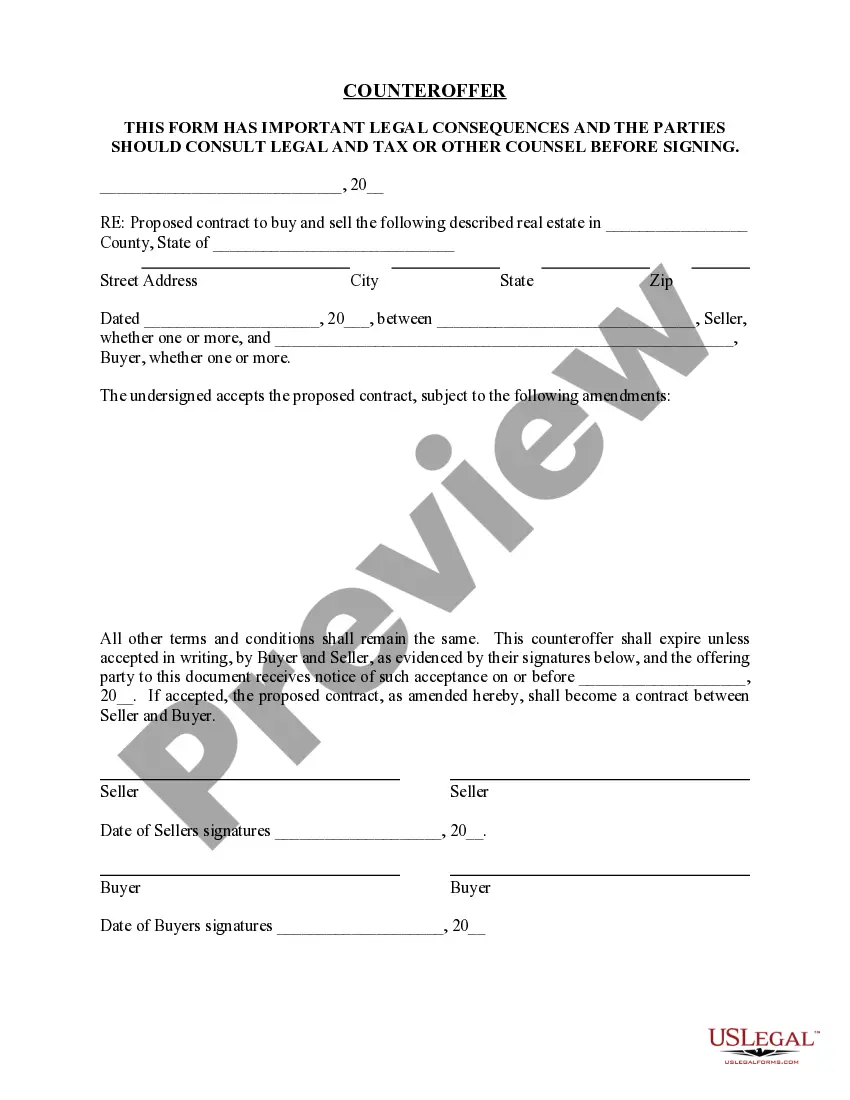

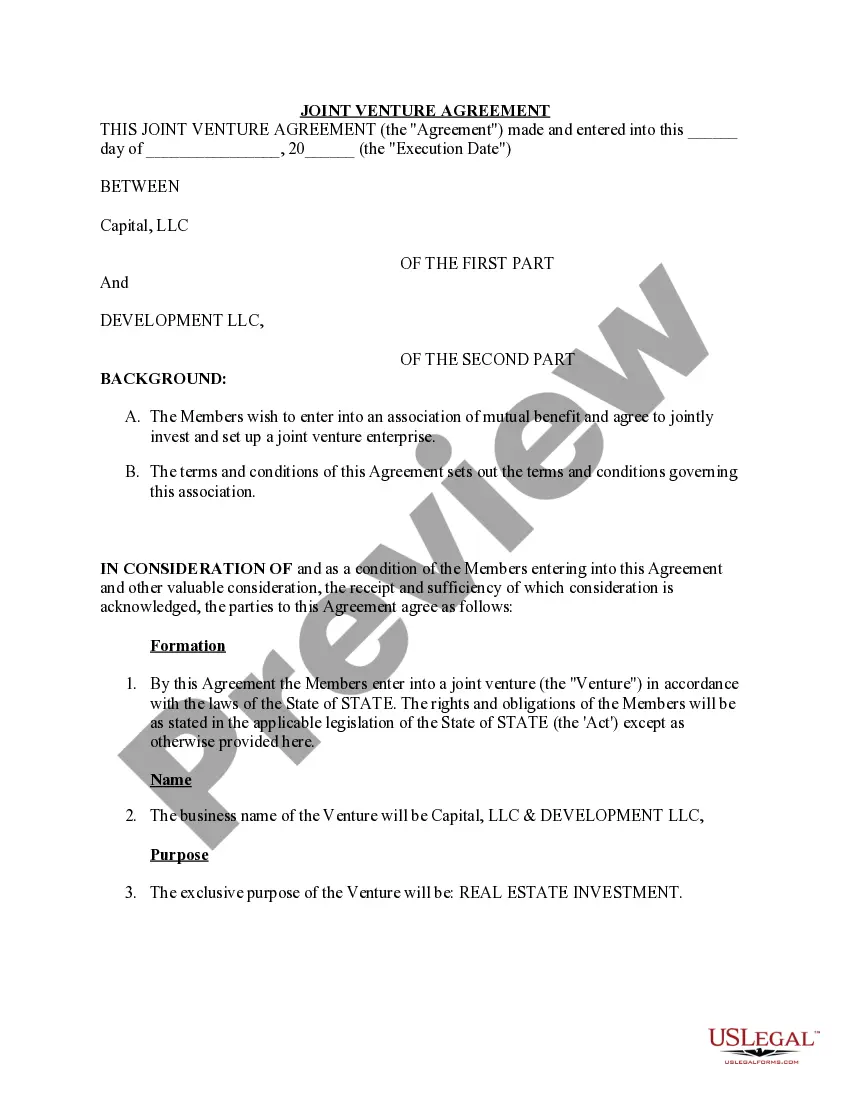

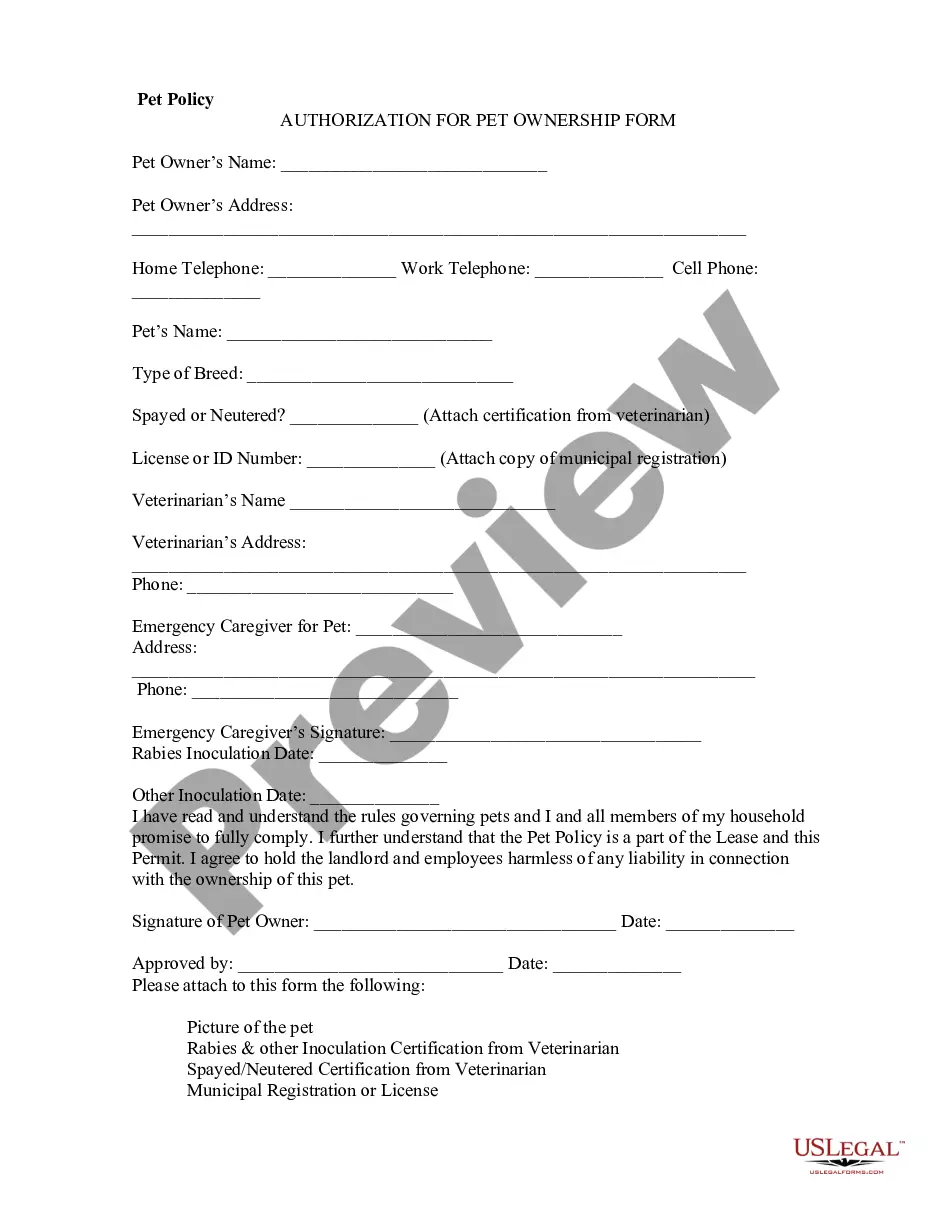

- Take advantage of the Review option to examine the shape.

- Read the explanation to actually have chosen the appropriate develop.

- In the event the develop is not what you are seeking, make use of the Research field to get the develop that fits your needs and needs.

- When you discover the right develop, simply click Get now.

- Choose the rates prepare you desire, fill in the desired information to generate your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a practical paper structure and acquire your copy.

Get all of the record themes you have bought in the My Forms menu. You can get a more copy of Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit whenever, if needed. Just click the required develop to acquire or printing the record template.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save time and stay away from faults. The support provides professionally produced authorized record themes which you can use for a selection of uses. Produce your account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment. Family Loans: How to Borrow From and Lend to Family - NerdWallet nerdwallet.com ? loans ? personal-loans ? fa... nerdwallet.com ? loans ? personal-loans ? fa...

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. What Is a Credit Agreement? Definition, How It Works, Example investopedia.com ? terms ? creditagreement investopedia.com ? terms ? creditagreement

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

10 essential loan agreement provisions Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability. 10 things you need to have in your loan agreement - .com ? articles ? 10-things-you... .com ? articles ? 10-things-you...

The Lender agrees to lend to the Borrower and the Borrower agrees to borrow from the Lender for the purposes specified in Article 2 hereof and on the terms and conditions contained herein, a sum not exceeding Rs. _____/-_ (Rupees __________________________ only). The said sum is hereinafter referred to as ?the Loan?.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Loan Agreement Terms & How to Write a Loan Contract debt.org ? Credit ? Loans debt.org ? Credit ? Loans