Kansas Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Are you presently in the situation that you require papers for either company or personal reasons nearly every working day? There are tons of authorized record layouts available online, but discovering ones you can rely on is not effortless. US Legal Forms gives a large number of kind layouts, just like the Kansas Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, which can be written in order to meet state and federal demands.

Should you be currently acquainted with US Legal Forms site and also have a merchant account, simply log in. Following that, it is possible to download the Kansas Ratification and approval of directors and officers insurance indemnity fund with copy of agreement template.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is for your correct area/state.

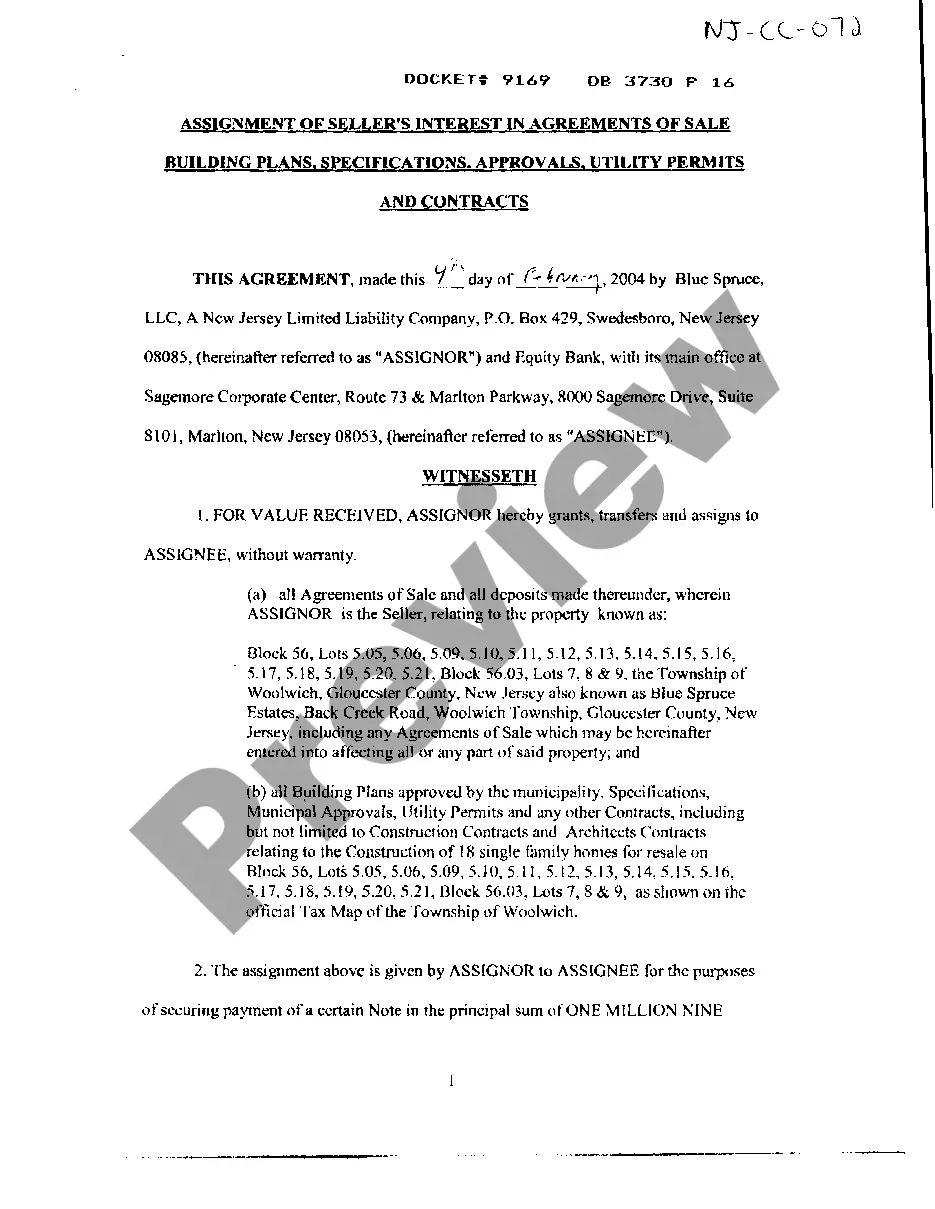

- Take advantage of the Preview key to examine the form.

- See the explanation to ensure that you have chosen the right kind.

- When the kind is not what you are searching for, make use of the Look for field to find the kind that suits you and demands.

- Whenever you get the correct kind, simply click Get now.

- Select the pricing prepare you want, fill out the required info to make your bank account, and pay for the transaction making use of your PayPal or charge card.

- Select a hassle-free file structure and download your duplicate.

Discover each of the record layouts you possess bought in the My Forms menus. You can obtain a additional duplicate of Kansas Ratification and approval of directors and officers insurance indemnity fund with copy of agreement whenever, if needed. Just select the required kind to download or produce the record template.

Use US Legal Forms, one of the most comprehensive variety of authorized types, to save lots of efforts and avoid blunders. The support gives skillfully created authorized record layouts that can be used for a range of reasons. Make a merchant account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

Indemnification refers to the right to have a company reimburse current or former directors or officers for all losses, including legal fees, incurred in connection with litigation arising from actions taken in service to the company or at the company's direction.

Indemnification Agreement to secure against loss or damage; to give security for the reimbursement of a person in case of an anticipated loss falling upon him. Also to make good; to compensate; to make reimbursement to one of a loss already incurred by him.

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

A company may, however, lend money to a director to fund the director's defence costs. Frequently, an indemnity will include a provision under which the company agrees to lend the director the amounts necessary to fund the director's defence costs.

Technically, no. Kansas state law does not require your board of directors to sign your bylaws. However, having your board sign your bylaws is common practice and makes your bylaws look more official.