Kansas General Partnership for Business

Description

How to fill out General Partnership For Business?

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous designs accessible online, but how do you obtain the legal form you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Kansas General Partnership for Business, which you can utilize for both business and personal needs. All forms are reviewed by professionals and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Obtain button to get the Kansas General Partnership for Business. Use your account to search through the legal forms you have previously acquired. Visit the My documents tab of your account and obtain another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Kansas General Partnership for Business. US Legal Forms is the premier repository of legal forms where you can find a variety of document templates. Use the service to download professionally-crafted documents that meet state requirements.

- First, ensure you have selected the correct form for your city/county.

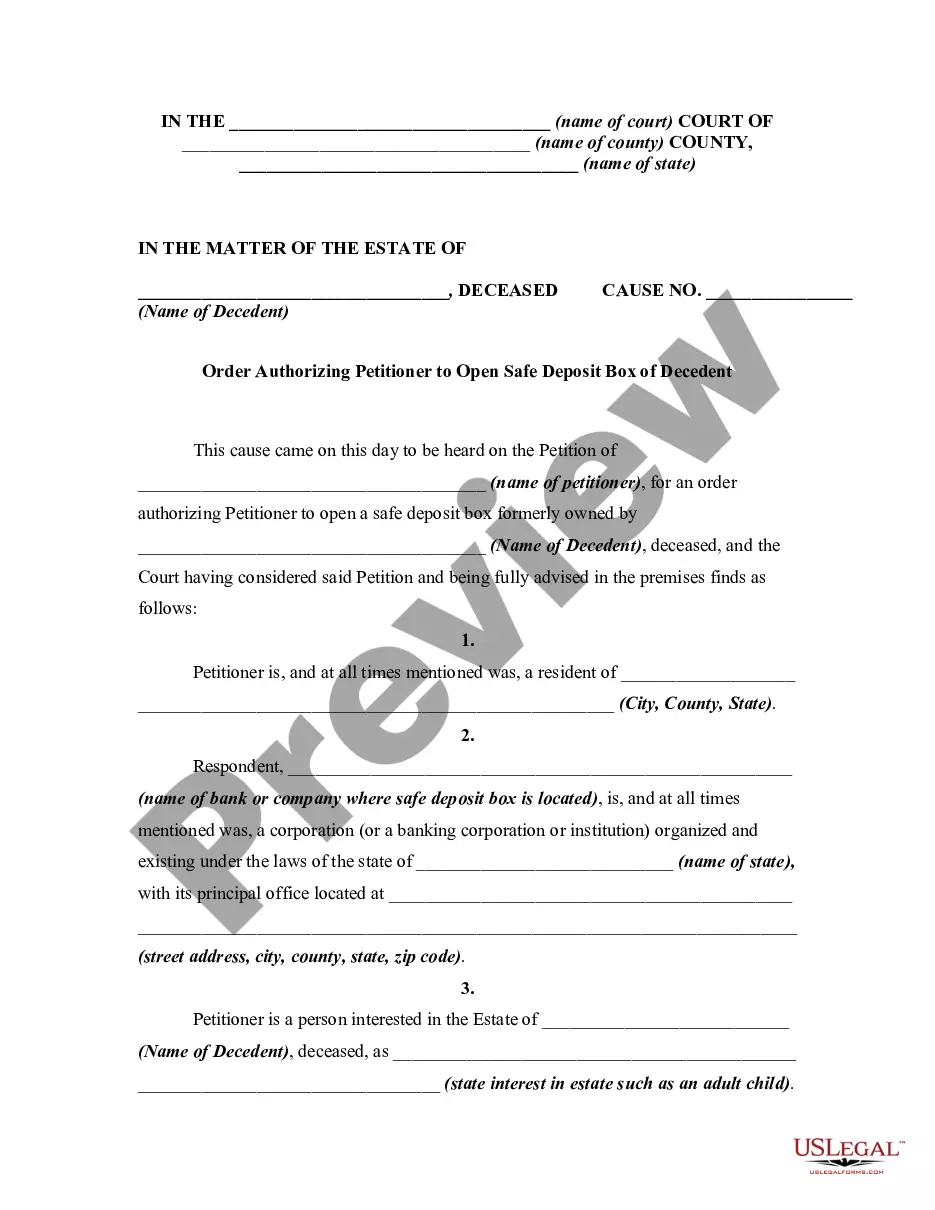

- You may preview the form using the Preview option and review the form description to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search area to find the appropriate form.

- Once you are sure that the form is correct, click the Purchase now button to acquire the form.

- Select the pricing plan you prefer and input the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

Partnerships have specific attributes, which are defined by Kansas Statutes. All partners share equally in the right and responsibility to manage the business. of State. The filings are optional and not mandatory.

Once the decision to form a Kansas partnership has been made, the partners must work with state agencies to properly create the business.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

However, where it is the penultimate partner who dies or withdraws, courts have held that the buyout provision does not apply because a partnership cannot exist with only one partner. Furthermore, courts have reasoned that, insofar as a partnership cannot continue with a single partner, the dissociation of a partner

Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership -- meaning that creditors of the partnership can go after the partners' personal assets -- while members (owners) of an LLC are not personally liable

General partnership disadvantages include:General Partners are Responsible for Other Partners' Actions. In a general partnership, each partner is liable for what the other does.You'll Have to Split the Profits.Disagreements Could Arise.Your Personal Assets are Vulnerable.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

A partnership must have two or more owners who share in the profits and losses of a business. Partnerships can form automatically without the submission of formation documents. All partnerships should have a written partnership agreement that spells out the rules and regulations of the business.