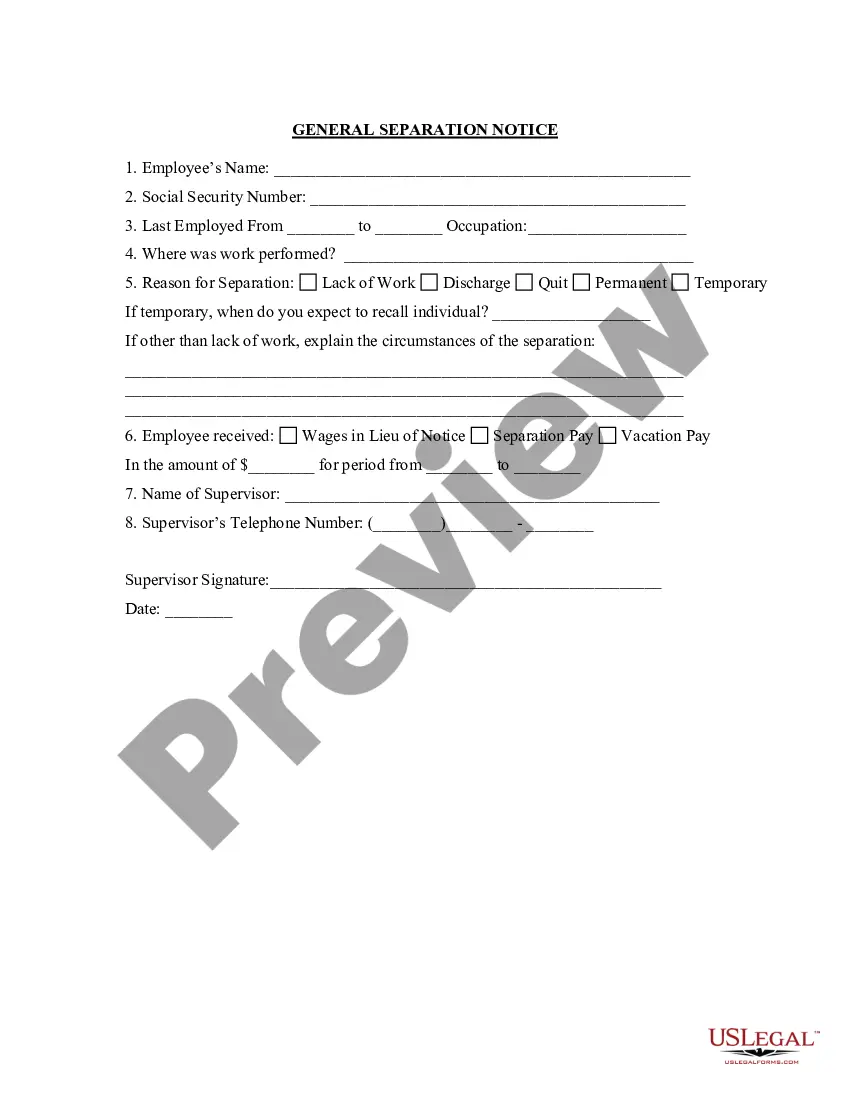

Kansas Separation Notice for 1099 Employee

Description

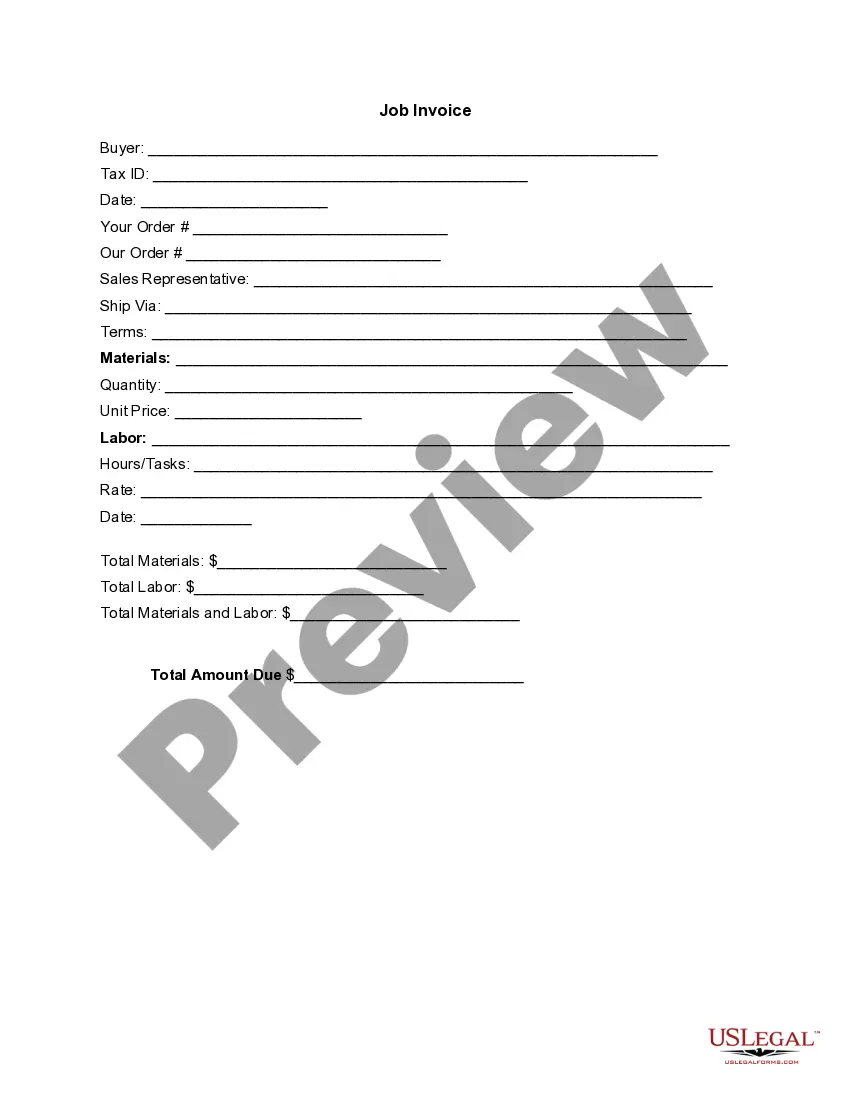

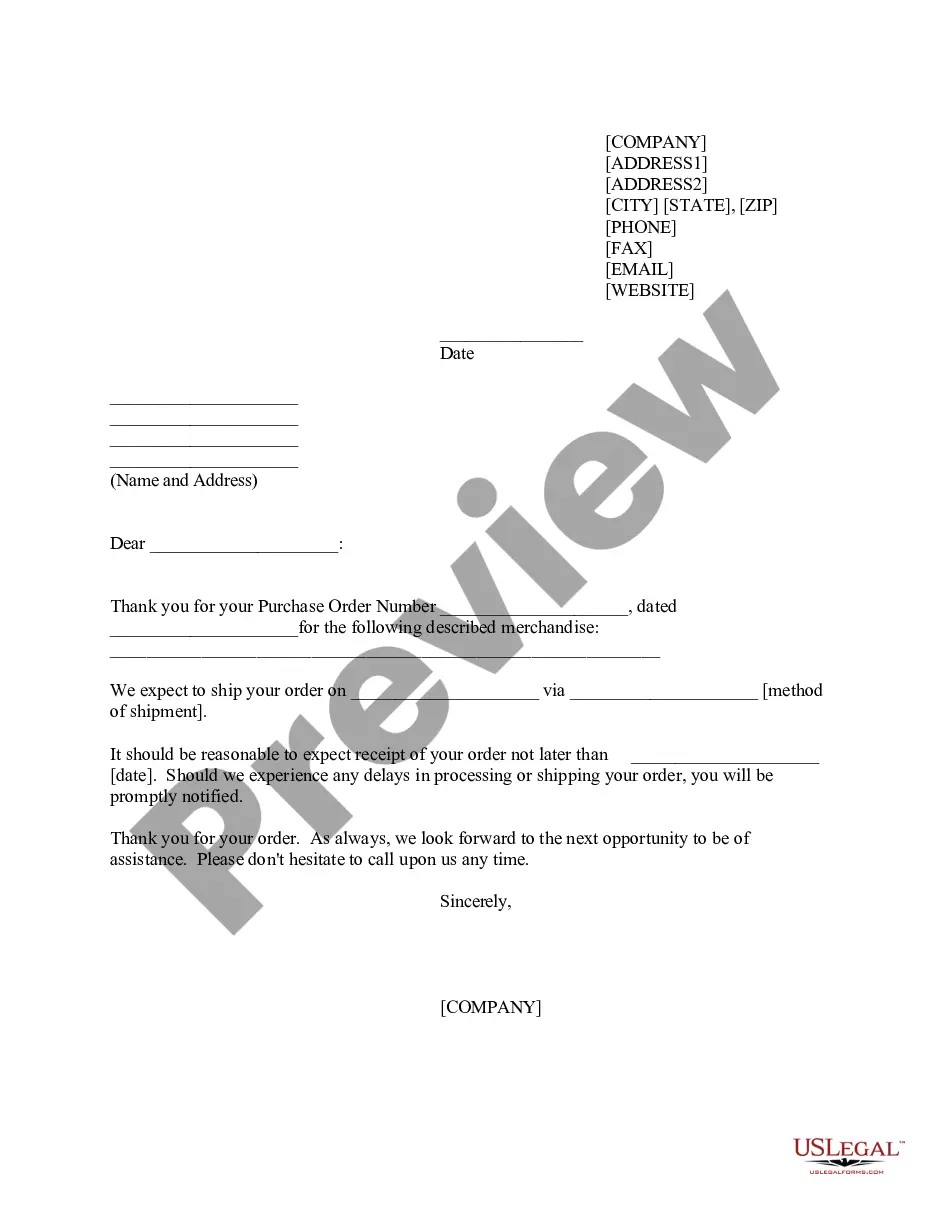

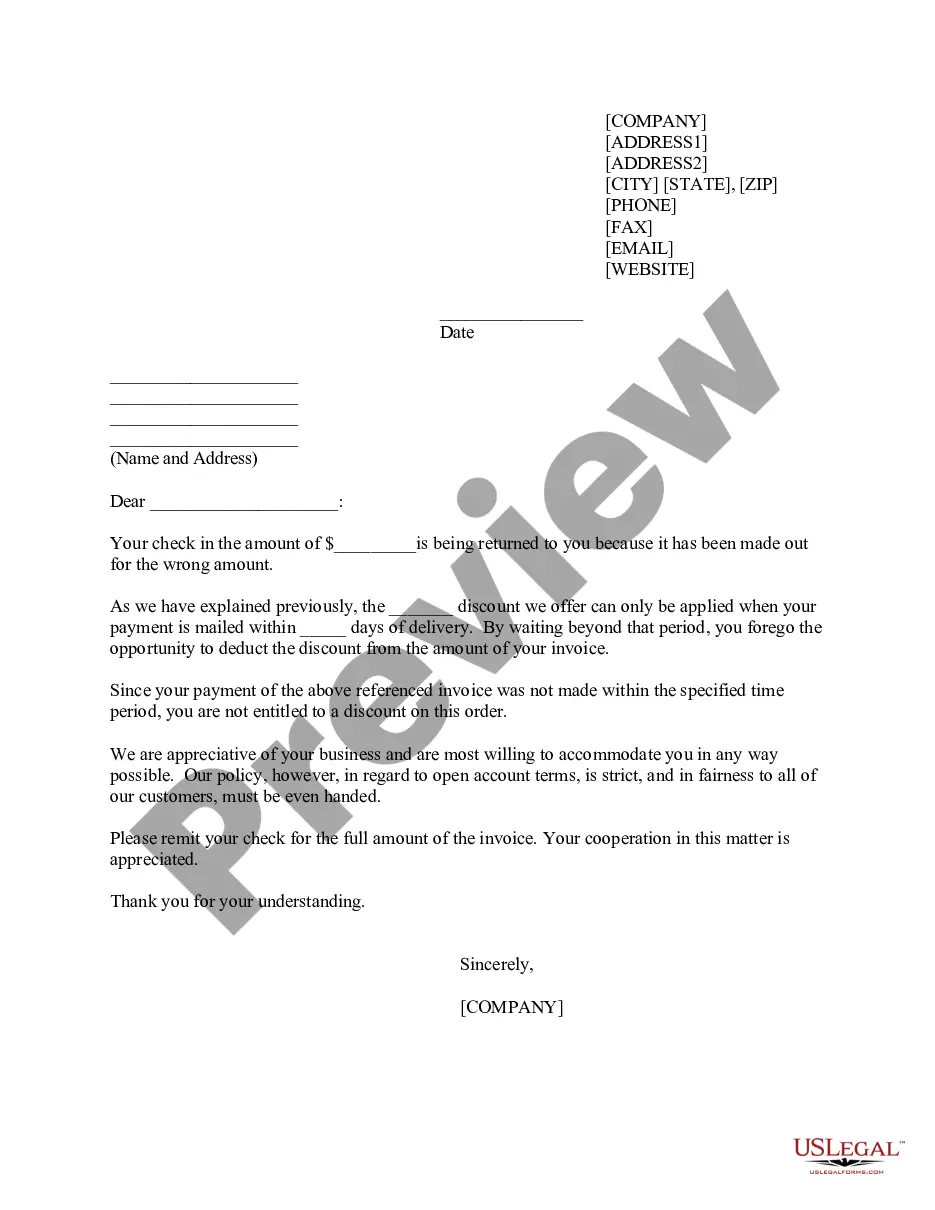

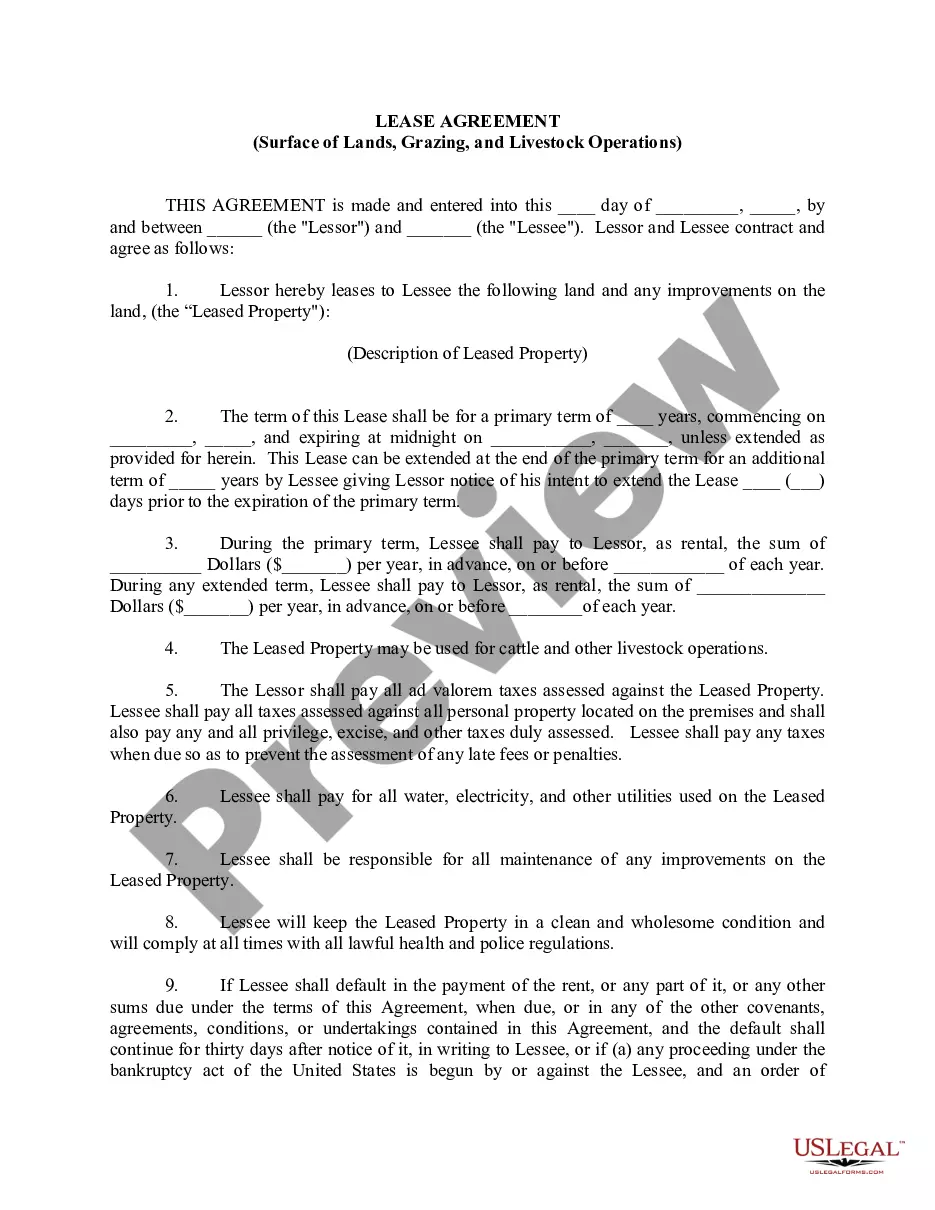

How to fill out Separation Notice For 1099 Employee?

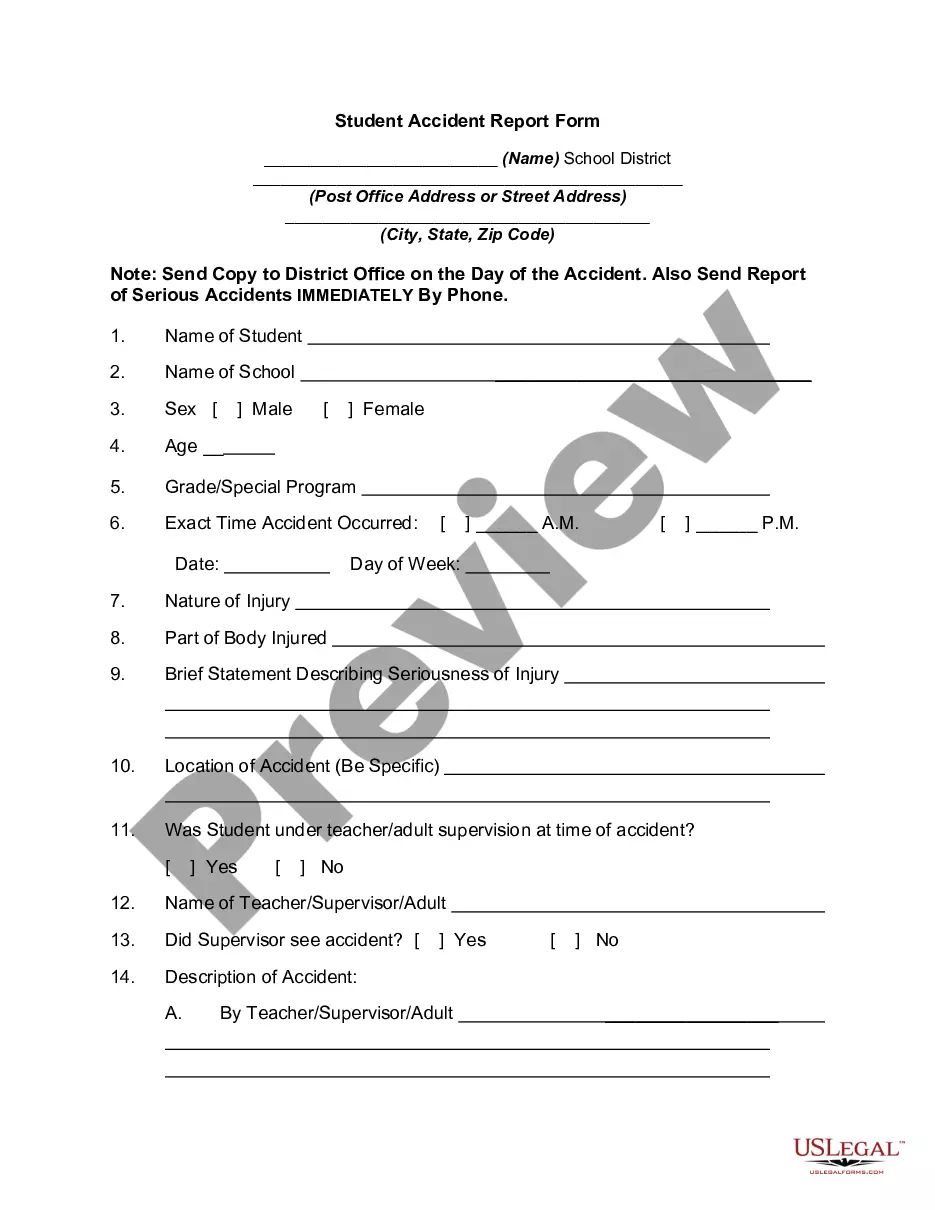

If you need to compile, retrieve, or print sanctioned document formats, utilize US Legal Forms, the primary collection of legal documents accessible online.

Take advantage of the website's straightforward and convenient search function to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

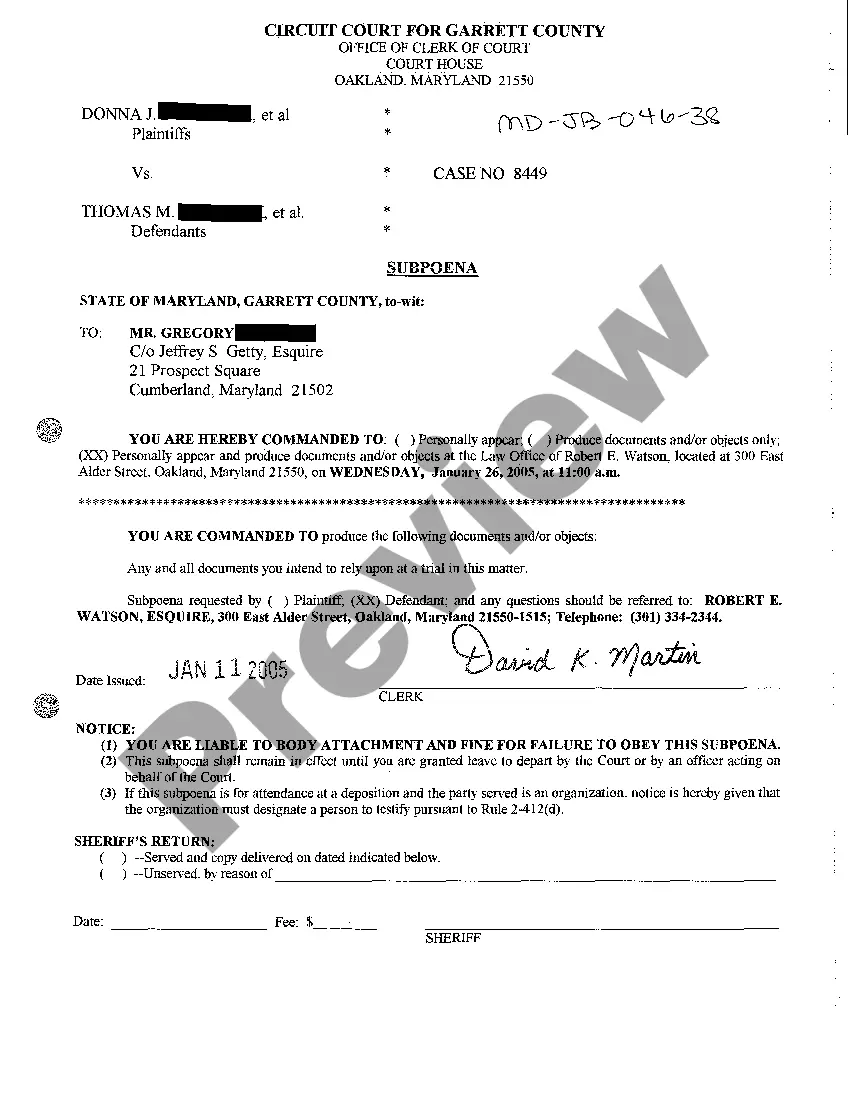

Step 3. If you're unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document style.

Step 4. Once you've found the form you need, click on the Purchase now button. Select the pricing plan you prefer and input your details to sign up for the account.

- Utilize US Legal Forms to obtain the Kansas Separation Notice for 1099 Employee in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to retrieve the Kansas Separation Notice for 1099 Employee.

- You can also access documents you previously retrieved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Ensure you've chosen the form for the appropriate city/state.

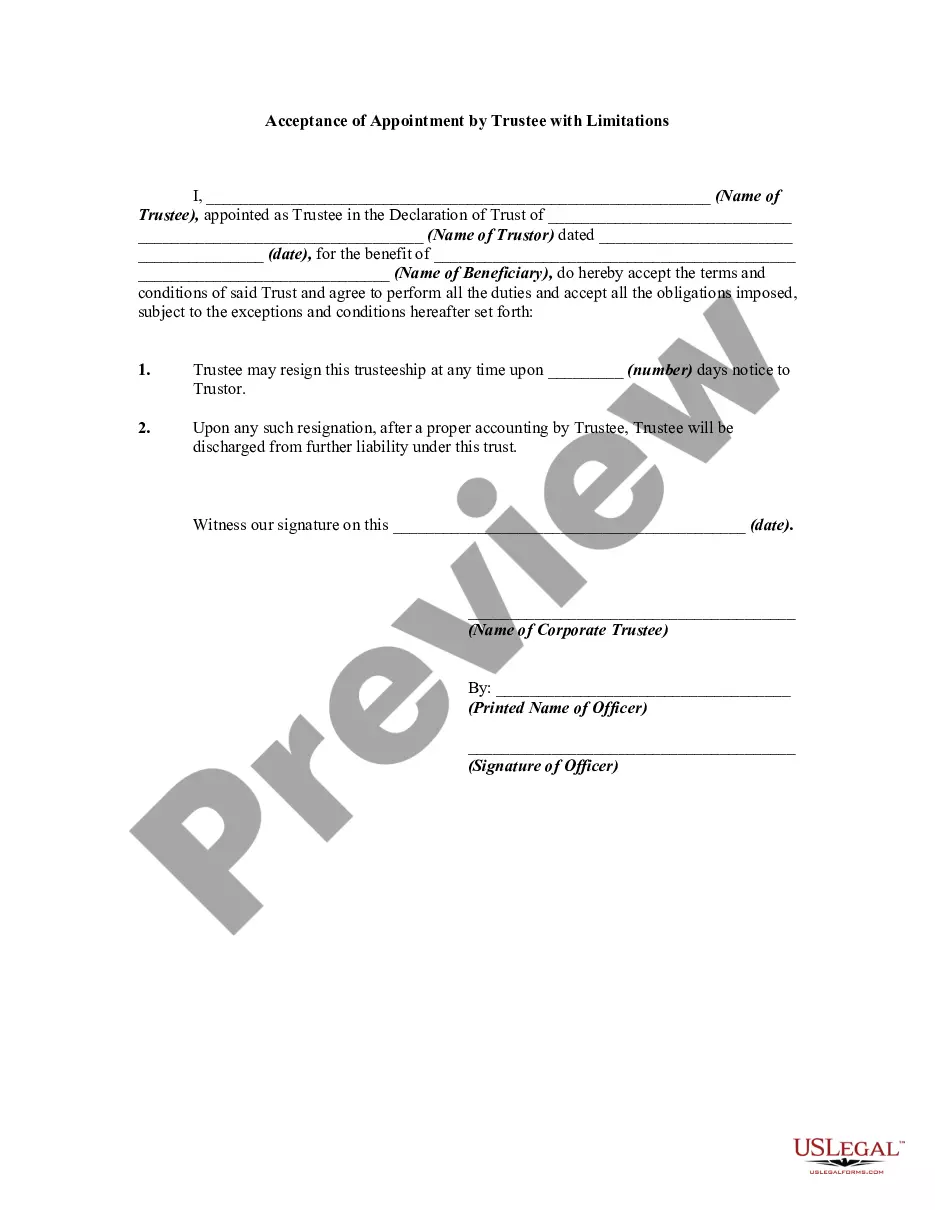

- Step 2. Use the Preview option to review the document's content. Don't forget to read the instructions.

Form popularity

FAQ

Pandemic Unemployment Assistance (PUA) expanded access to unemployment by including those who are affected by COVID-19 and not eligible for UI or PEUC (such as self-employed, independent contractors, gig workers, employees of religious organizations and those who lack sufficient work history or have been disqualified

"Good cause" exists for leaving work, when a substantial motivating factor in causing the claimant to leave work, at the time of leaving, whether or not work connected, is real, substantial, and compelling and would cause a reasonable person genuinely desirous of retaining employment to leave work under the same

If personal circumstances force one to resign, it does not make you entitled to unemployment insurance.

If you quit your job, you will be disqualified from receiving unemployment benefits unless you had good cause relating to your work. In general, good cause means that your reason for leaving the position was job-related and was so compelling that you had no other choice than to leave.

PUA is a broad program that expands access to unemployment, in addition to what state and federal law already pay. This includes those who traditionally are not able to get unemployment such as: Self-employed. Independent contractors.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Unemployment FAQs To request a new 1099-G for a previous year to be mailed to you, log into GetKansasBenefits.gov and click Request 1099-G Reprint.

Collecting Unemployment After Quitting You may also be eligible for benefits if you quit for certain compelling personal reasons, including to relocate with a military spouse, to escape domestic violence, due to your own illness or injury (on the advice of your doctor), or due to a personal emergency.

Contact the Kansas Department of LaborKansas City (913) 596-3500.Topeka (785) 575-1460.Wichita (316) 383-9947.Toll-Free (800) 292-6333.

Those who are eligible should receive payments Thursday or Friday via direct deposit. Claimants who selected to receive their benefits on a debit card that they did not previously have they should receive it within seven to 10 days.