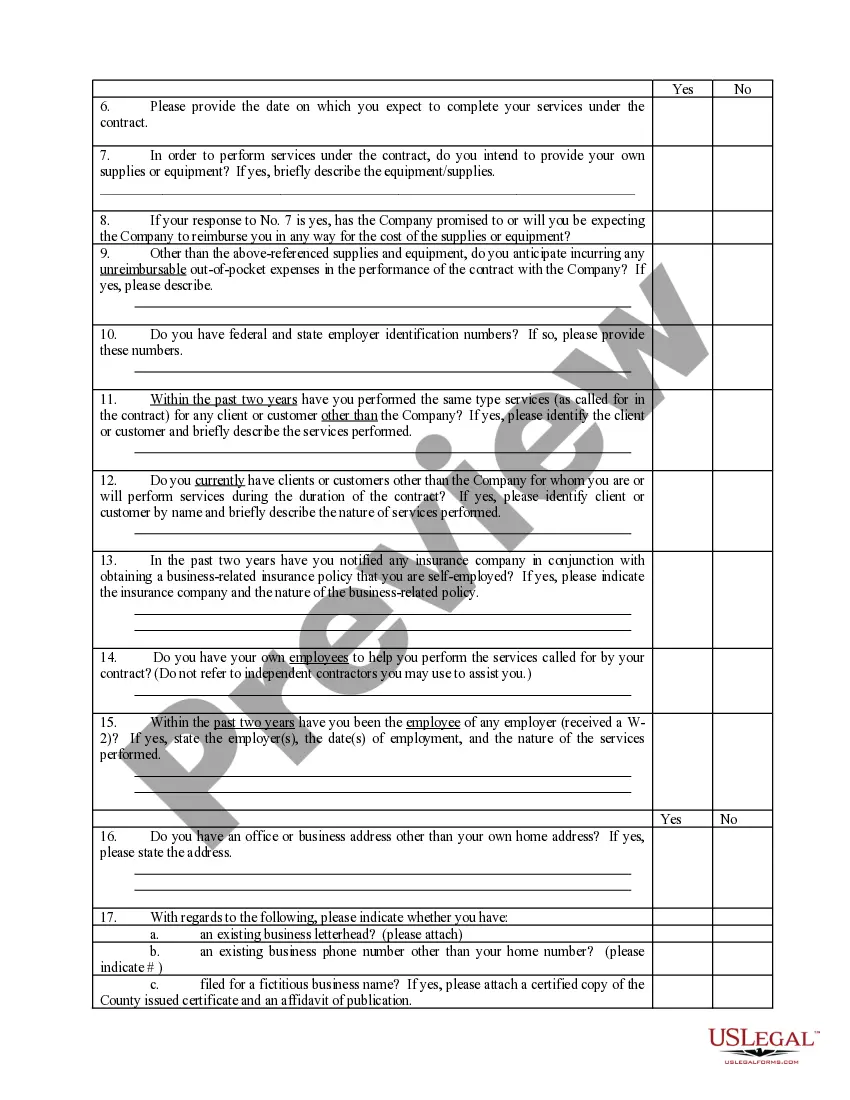

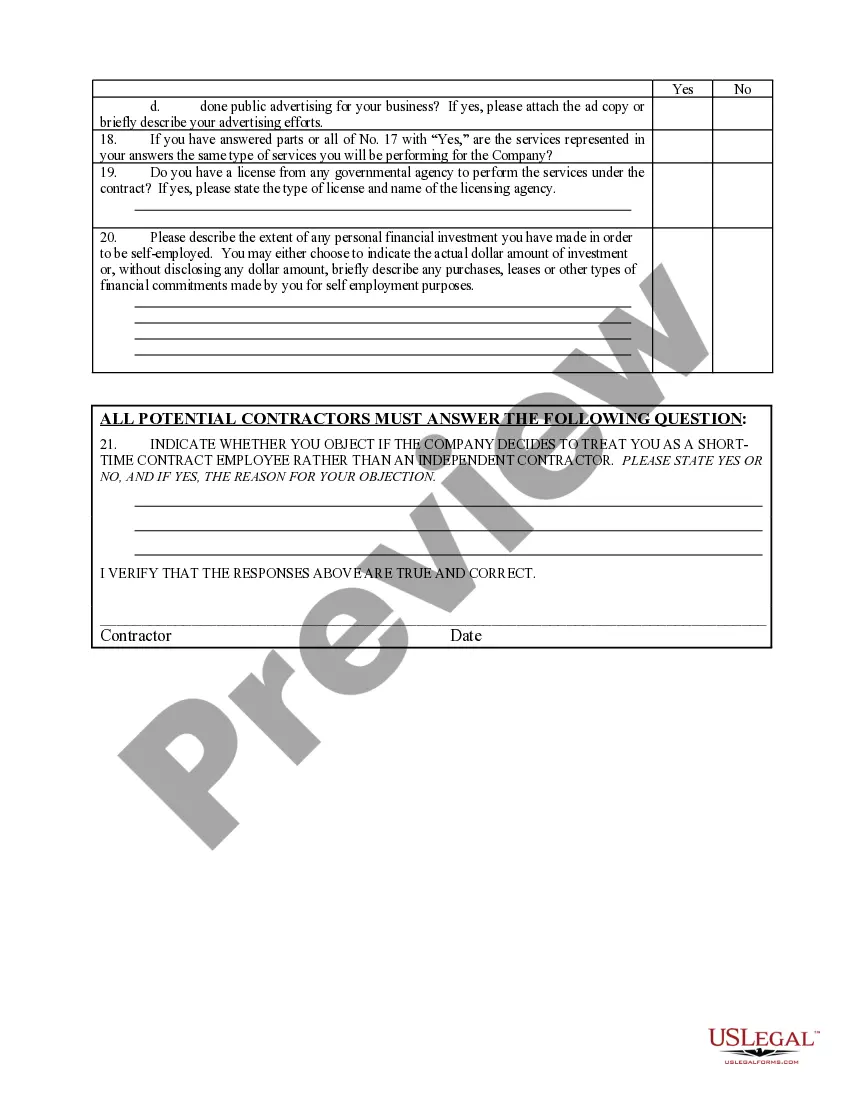

Kansas Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

If you want to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of legitimate forms that are accessible online.

Employ the website's straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and provide your details to register for an account.

- Utilize US Legal Forms to obtain the Kansas Self-Employed Independent Contractor Questionnaire with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Kansas Self-Employed Independent Contractor Questionnaire.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Ensure you have selected the correct form for the respective city/state.

- Step 2. Use the Preview option to review the form's details. Do not forget to read the description.

Form popularity

FAQ

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Independent Contractor Interview Questions:Why did you choose to become an independent contractor?Can you tell me about the project that you are proudest of?Have you ever had difficulty meeting deadlines?How do you track your performance?What would you do if you encountered unexpected difficulties on a project?

Because of the limited scope of the time commitment, an independent contractor is considered to be self-employed. Business owners are responsible for providing Independent contractors with a 1099-MISC form instead of a W-2, showing the total income paid to the independent contractor.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.