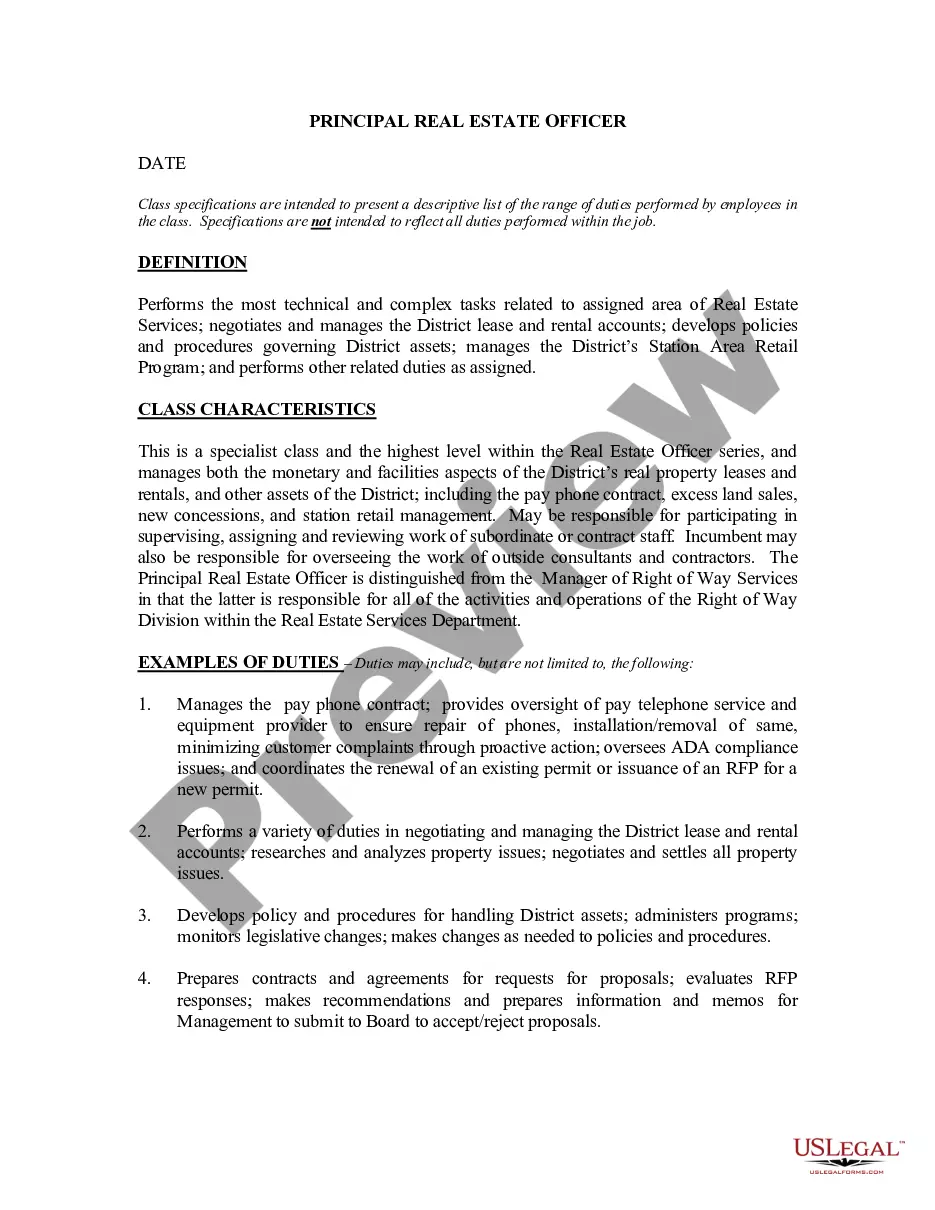

Kansas Job Opportunity Notice

Description

How to fill out Job Opportunity Notice?

If you want to acquire, download, or create authentic document templates, utilize US Legal Forms, the largest repository of valid documents, accessible online.

Take advantage of the site's simple and efficient search feature to find the forms you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Leverage US Legal Forms to locate the Kansas Job Opportunity Notice in just a few clicks.

Every legal document format you purchase is yours indefinitely. You have access to all forms you've acquired in your account. Navigate to the My documents section and select a form to print or download again.

Participate and download, and print the Kansas Job Opportunity Notice with US Legal Forms. There are thousands of professional and state-specific templates available for your personal or business needs.

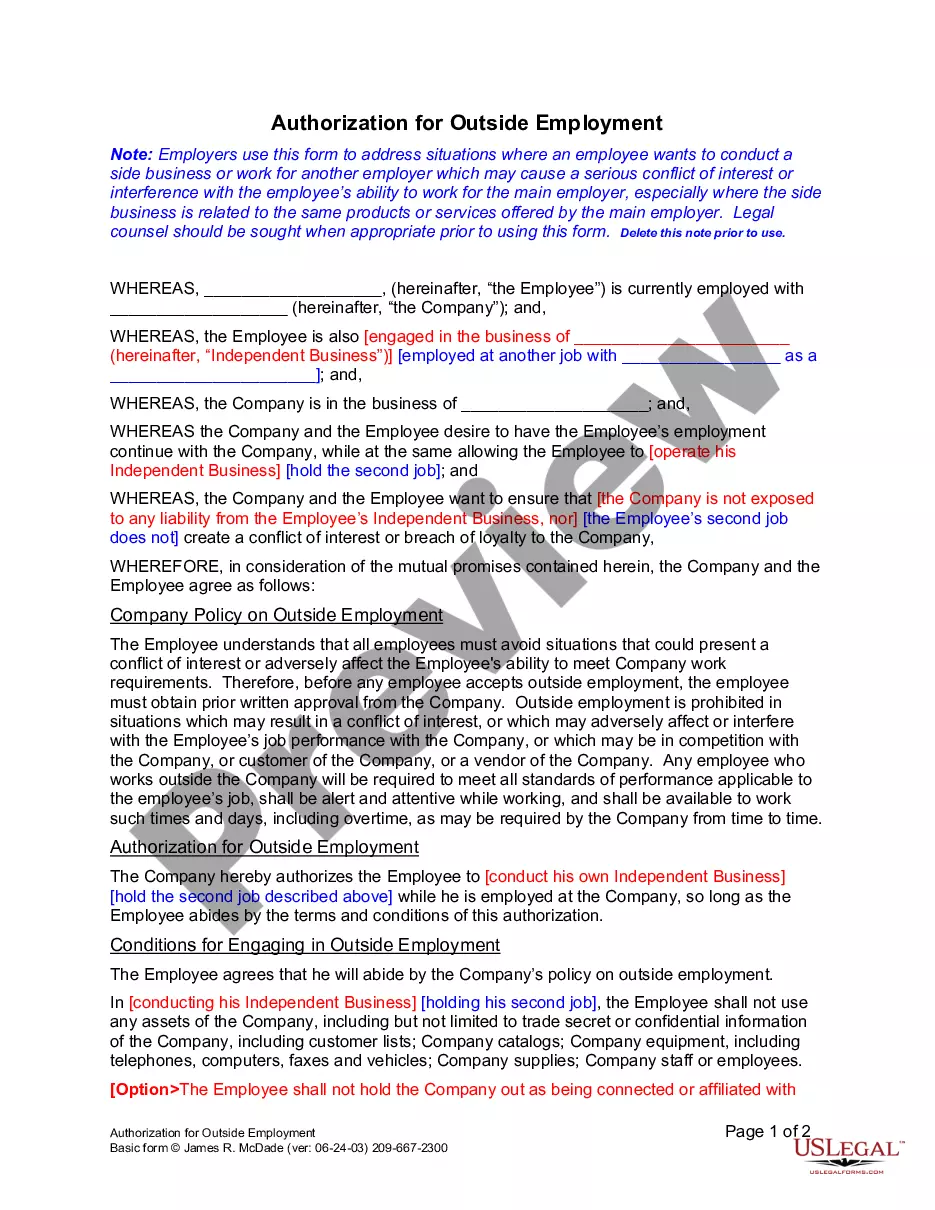

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Kansas Job Opportunity Notice.

- You can also reach forms you've previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form's details. Be sure to check the overview.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form format.

- Step 4. Once you've identified the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kansas Job Opportunity Notice.

Form popularity

FAQ

If you need a job opportunity template, you can visit the US Legal Forms website. Here, you will find a variety of templates tailored for different job-related needs, including a Kansas Job Opportunity Notice template. Simply select the template you require, complete the necessary fields, and request the document. This process streamlines your job application efforts.

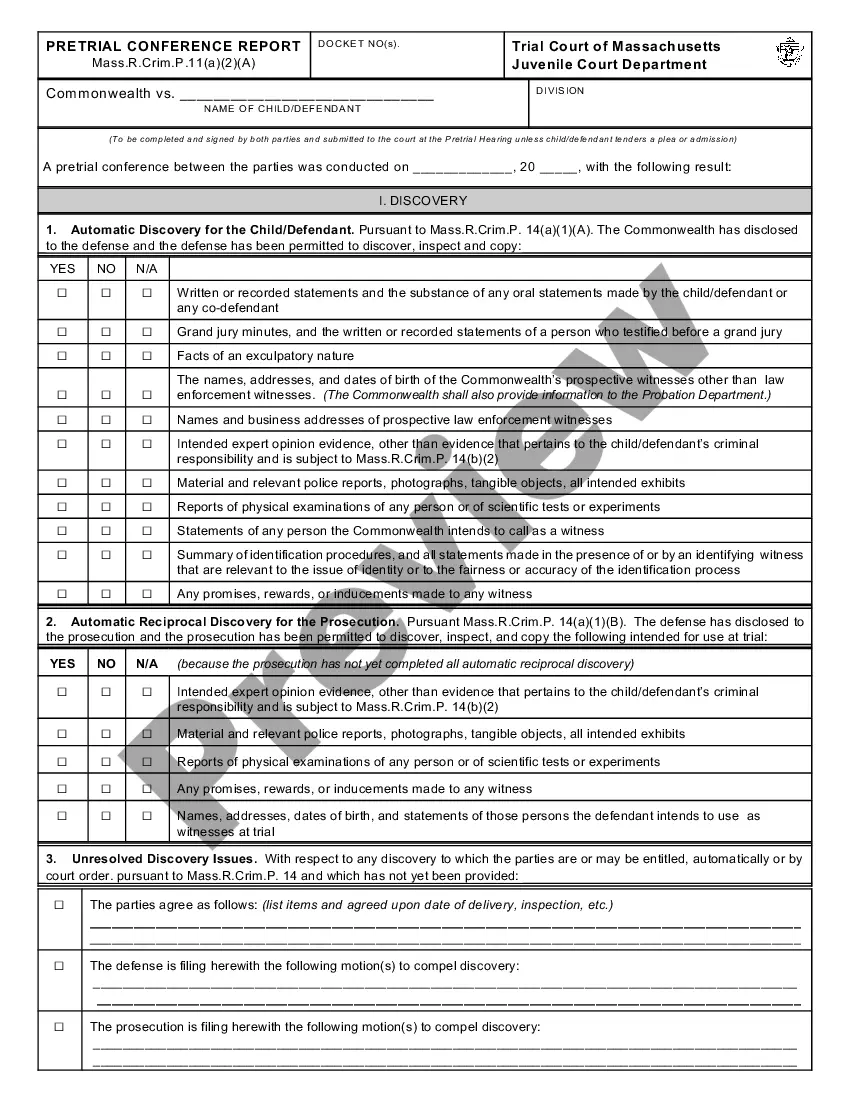

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Work Search Requirement All claimants are required to seek work unless having been specifically instructed by the Department of Labor that no work search is required. In Kansas there are two requirements. You must meet both requirements in order to be eligible for unemployment benefits.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

Those who are eligible should receive payments Thursday or Friday via direct deposit. Claimants who selected to receive their benefits on a debit card that they did not previously have they should receive it within seven to 10 days.

Steps to Hiring your First Employee in KansasStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services.

Pandemic Unemployment Assistance (PUA) expanded access to unemployment by including those who are affected by COVID-19 and not eligible for UI or PEUC (such as self-employed, independent contractors, gig workers, employees of religious organizations and those who lack sufficient work history or have been disqualified

Please send your completed forms to KDOL.UICC@ks.gov. You may also send by mail or fax. All required forms should be completed and returned to the Kansas Unemployment Contact Center as indicated on the form.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.