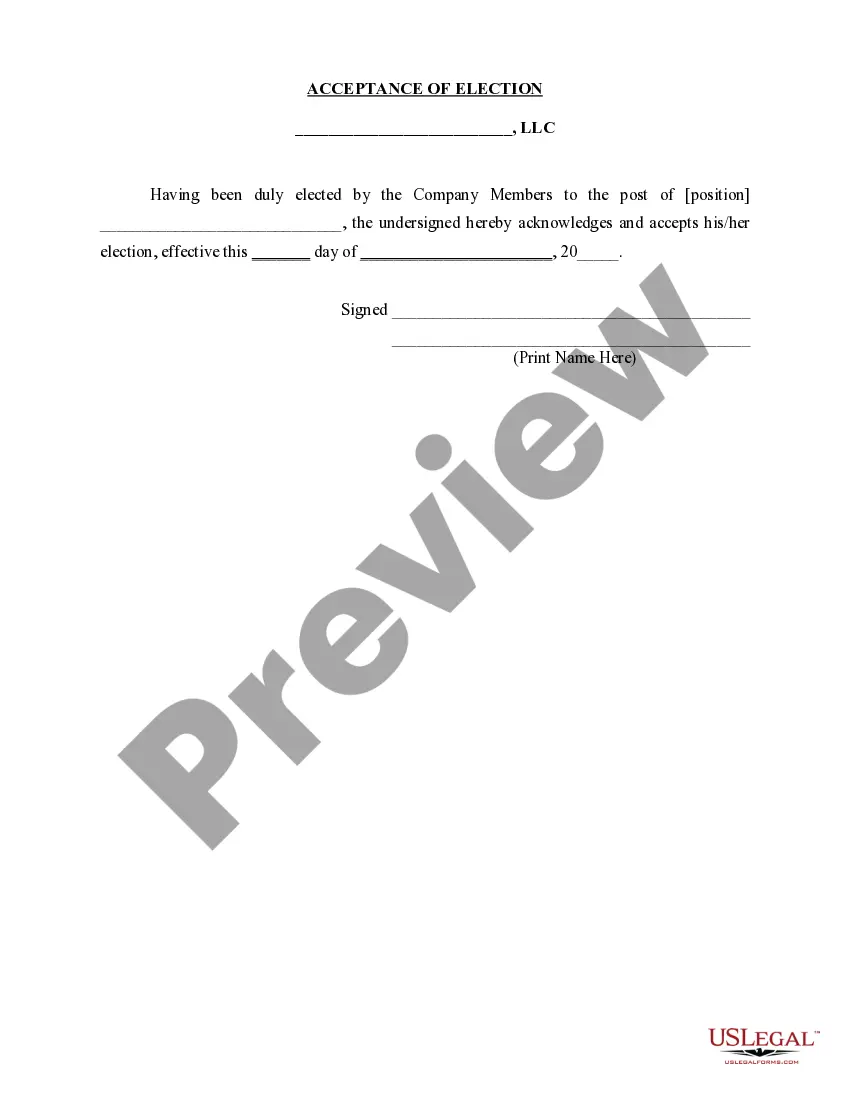

Kansas Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

US Legal Forms - one of several largest libraries of legitimate forms in America - provides a variety of legitimate document templates you may acquire or produce. Using the internet site, you may get thousands of forms for organization and individual uses, categorized by classes, suggests, or search phrases.You will discover the most up-to-date versions of forms such as the Kansas Acceptance of Election in a Limited Liability Company LLC in seconds.

If you already have a membership, log in and acquire Kansas Acceptance of Election in a Limited Liability Company LLC from the US Legal Forms catalogue. The Download option will appear on each kind you view. You gain access to all formerly acquired forms in the My Forms tab of your own accounts.

If you would like use US Legal Forms the very first time, listed below are straightforward recommendations to obtain started:

- Be sure you have picked the best kind for your personal town/area. Go through the Review option to review the form`s information. Browse the kind outline to ensure that you have selected the correct kind.

- When the kind does not satisfy your demands, utilize the Research field near the top of the display to find the one which does.

- Should you be content with the shape, confirm your option by simply clicking the Acquire now option. Then, select the rates prepare you favor and supply your references to register to have an accounts.

- Process the deal. Make use of your bank card or PayPal accounts to accomplish the deal.

- Select the structure and acquire the shape in your system.

- Make adjustments. Complete, edit and produce and indication the acquired Kansas Acceptance of Election in a Limited Liability Company LLC.

Each design you included with your bank account lacks an expiry date and is yours forever. So, if you wish to acquire or produce yet another copy, just visit the My Forms section and click on on the kind you need.

Get access to the Kansas Acceptance of Election in a Limited Liability Company LLC with US Legal Forms, the most substantial catalogue of legitimate document templates. Use thousands of expert and express-distinct templates that meet your small business or individual demands and demands.

Form popularity

FAQ

Kansas LLC Processing Times Normal LLC processing time:Expedited LLC:Kansas LLC by mail:2-3 business days (plus mail time)Not availableKansas LLC online:immediatelyNot available

Q: What is a registered office? A: A registered office is the physical, Kansas address where the resident agent is located for service of process (lawsuits). The registered office may not be a PO BOX (or other variation), it may only be a street address, rural route or highway address in Kansas.

For service on any corporation, limited liability company, limited partnership, and limited liability partnership: An original and two copies of the process. Two copies of the petition, notice or demand. $50.00 processing fee. If condition 1 above was met, evidence that an attempt was made to serve the resident agent.

Kansas Form K-40 Instructions A Kansas resident must file if he or she is:And gross income is at least:SINGLEUnder 65$ 5,25065 or older or blind$ 6,10065 or older and blind$ 6,950MARRIED FILING JOINTUnder 65 (both spouses)$12,00011 more rows

Kansas's corporation tax rate is a flat 4% of federal taxable income (with state-specific adjustments) plus a 3% surtax on taxable income above $50,000. The tax is payable to the state's Department of Revenue (DOR). Use the state's corporation income tax return (Form K-120) to pay the tax.

An individual person may also act as registered agent for your business. This can either be someone you appoint or yourself.

Your LLC must file a IRS Form 1065 and a Kansas Partnership Return (Form K-120S). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Kansas Department of Revenue to pay your Kansas income tax. Check with your accountant to make sure you file all the correct documents.

How Are Kansas LLCs Taxed? If your LLC is a single-member LLC (SMLLC), you'll file taxes as a sole proprietorship, while multi-member LLCs are taxed as partnerships by default. Here are the federal tax forms that LLCs need to file: Single-member LLC?Form 1040 (usually Schedule C, but some SMLLCsfile C-EZ, E, or F)

(b) Who serves process. The sheriff of the county in which the action is filed must serve any process by any method authorized by this section, or as otherwise provided by law, unless a party, either personally or through an attorney, notifies the clerk that the party elects to undertake responsibility for service.

Service of a subpoena may be made anywhere within this state, must be made in ance with K.S.A. 60-303, and amendments thereto, and must, if the subpoena requires a person's attendance, be accompanied by the fees for one day's attendance and the mileage allowed by law.