Kansas Subcontract for Construction of Portion of or Materials to go into Building

Description

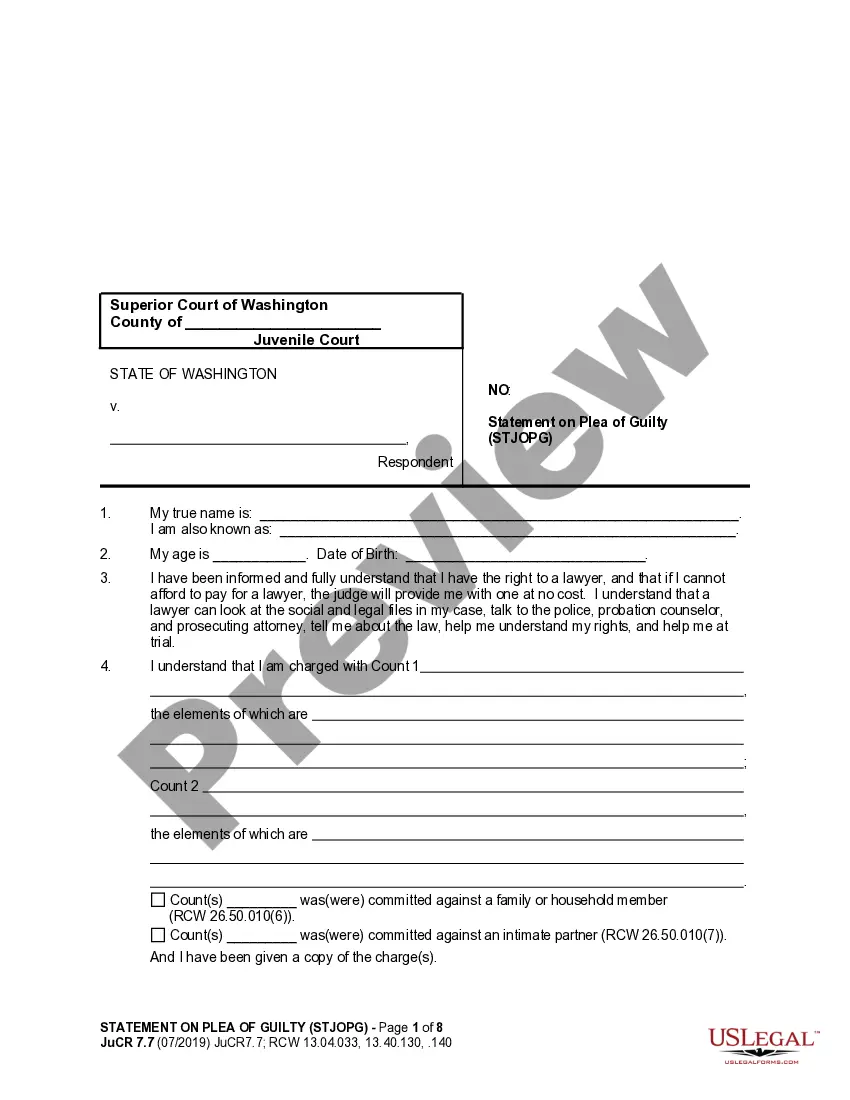

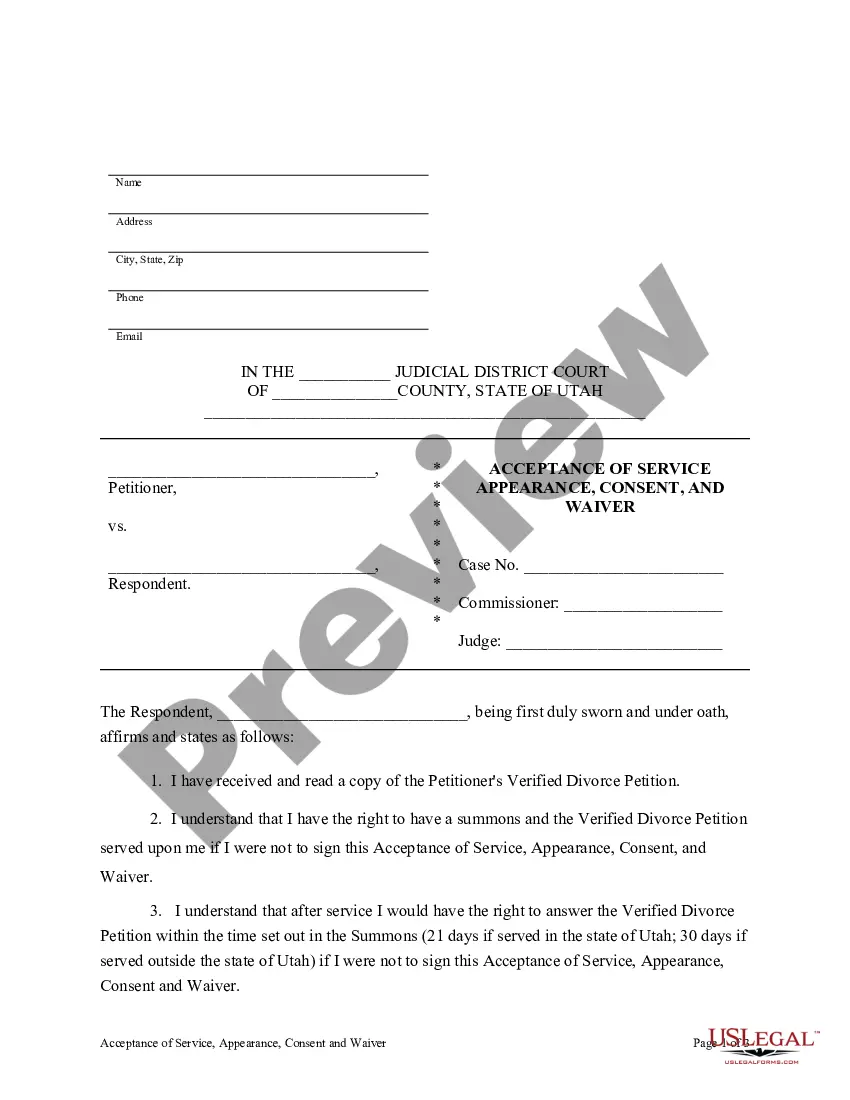

How to fill out Subcontract For Construction Of Portion Of Or Materials To Go Into Building?

US Legal Forms, one of the largest collections of legal documents in the United States, provides a diverse selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for both business and personal needs, organized by type, state, or keywords. You can quickly locate the latest versions of forms, such as the Kansas Subcontract for Construction of Part of or Materials to be Used in Building.

If you already have an account, Log In to access Kansas Subcontract for Construction of Part of or Materials to be Used in Building from the US Legal Forms library.

If the form does not meet your needs, use the Search box at the top of the screen to find the appropriate one.

If you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then select your preferred payment plan and provide your details to register for an account.

- The Download button will appear on every form you view.

- You will have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the details of the form.

- Read the form description to confirm you have the correct document.

Form popularity

FAQ

Sales Tax Exemptions in KansasAll construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.

WHAT PURCHASES ARE EXEMPT? Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

Nontaxable types of labor repair Repair labor is work performed on a product to repair or restore it to its intended use. Examples include: Replacing a broken water pump on a customer's used car. Replacing a hard drive in a used computer. Restoring a damaged painting.

Rental income is subject to the earnings tax to the extent that the rental, ownership, management, or operation of the property from which the income is derived constitutes a business activity of the taxpayer in whole or in part.

Kansas imposes a 6.5 percent (effective July 1, 2015) percent state retailers' sales tax, plus applicable local taxes on the: Retail sale, rental or lease of tangible personal property; Labor services to install, apply, repair, service, alter, or maintain tangible personal property, and.

As a general rule, all of these items are subject to sales tax when purchased by contractors and subcontractors. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).

ORIGINAL CONSTRUCTION. Labor services involving the installation or application of tangible personal property performed in connection with the original constructionof a building, facility are exempt from sales tax.

Lease or rental of equipment with an operator, is providing a service and therefore is taxable if the service being performed by the equipment operator is taxable.

Whether labor is subject to sales tax depends upon the circumstances under which the labor is performed: If tangible personal property is not transferred, labor is not taxable. If custom-made items are sold at retail, labor is taxable.

Equipment renting payments are considered external expenses and are therefore deductible from the company's taxable profit under common law provisions. This taxable profit determines the taxable portion of earnings for corporation tax, or income tax.