Kansas Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

Are you presently in a role where you require documentation for either business or particular operations almost every day.

There are numerous legal document templates accessible online, but finding reliable forms can be challenging.

US Legal Forms offers a wide array of form templates, including the Kansas Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity, which is designed to meet state and federal requirements.

Access all the document templates you have purchased in the My documents menu.

You can obtain another copy of the Kansas Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity at any time, if needed. Just choose the needed form to download or print the format.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Kansas Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

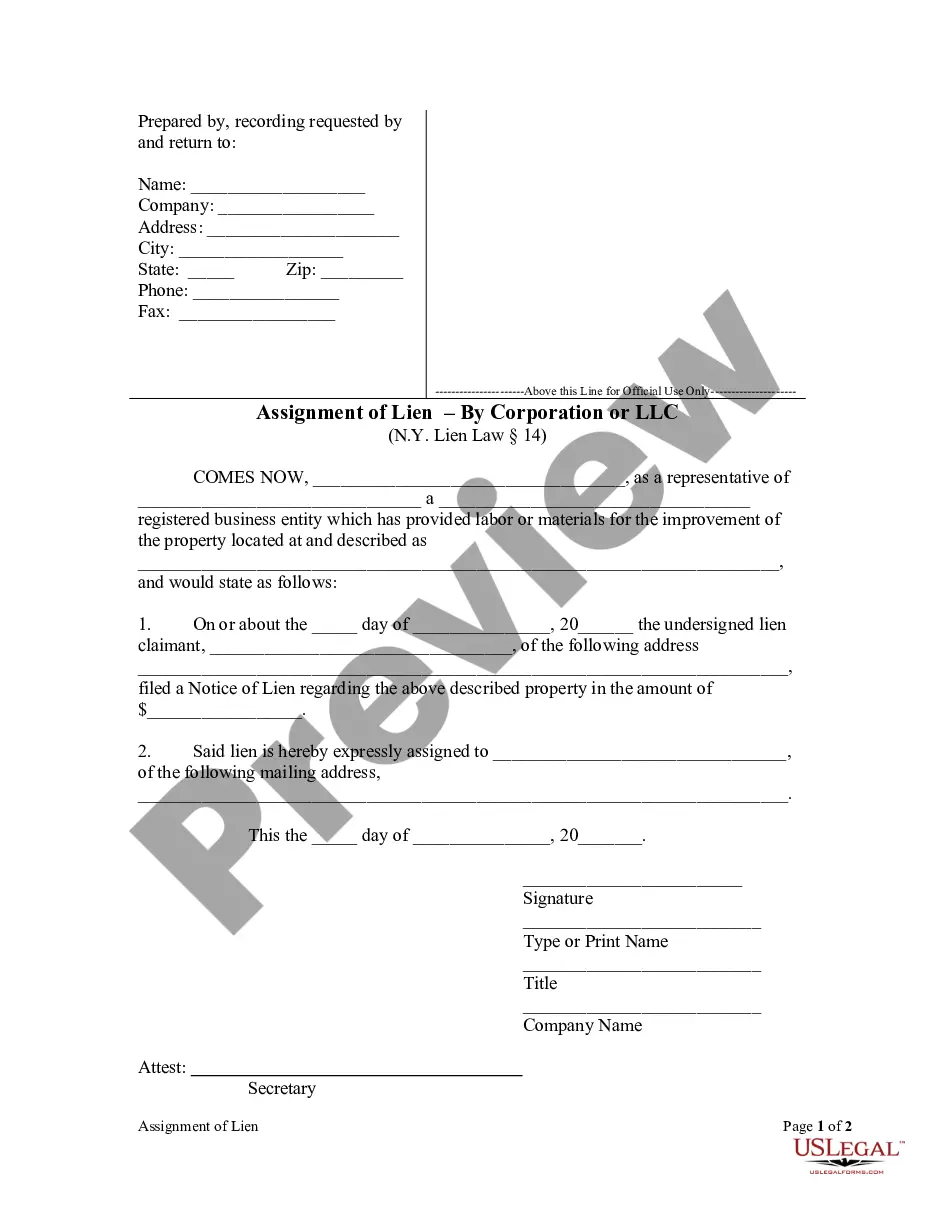

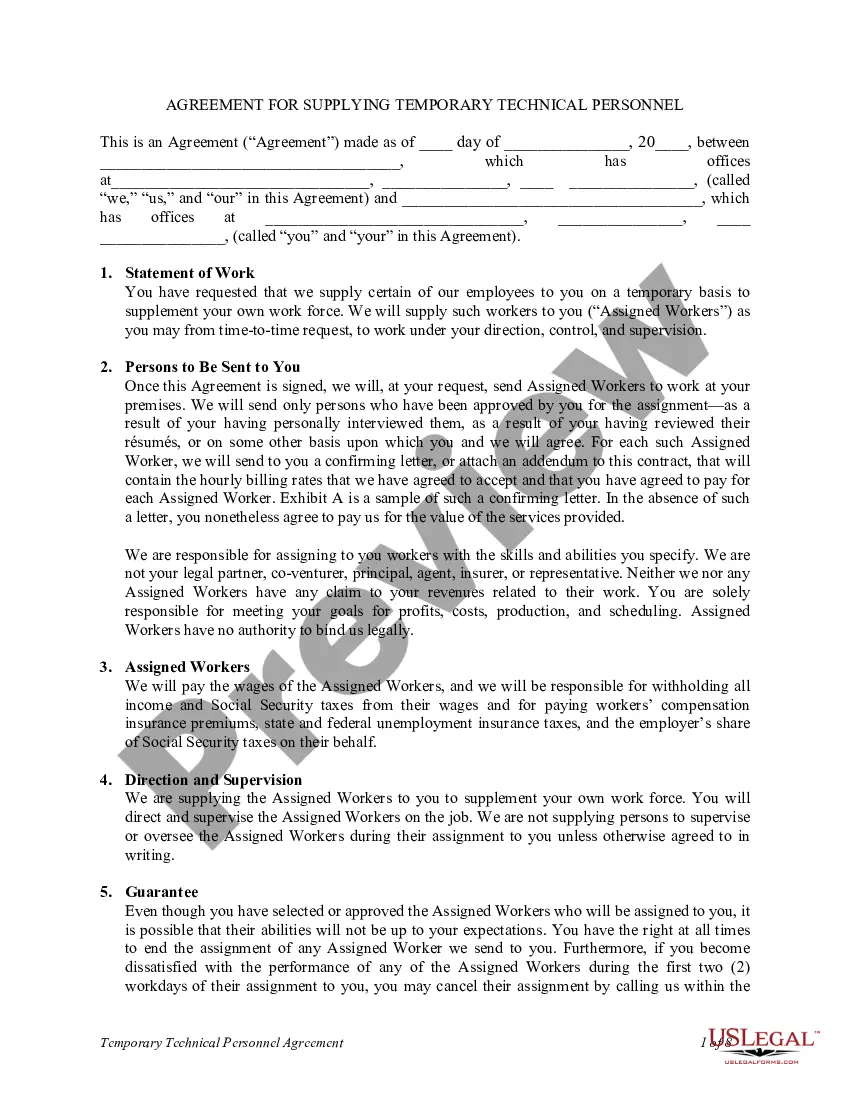

- Acquire the form you need and ensure it is for the correct city/state.

- Use the Review button to scrutinize the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form isn’t what you require, utilize the Lookup field to find the form that meets your needs and specifications.

- Once you identify the correct form, click on Buy now.

- Choose the payment plan you prefer, enter the necessary information to create your account, and process the order using your PayPal or credit card.

- Select a convenient document format and download your version.

Form popularity

FAQ

A spousal lifetime access trust (SLAT) is an irrevocable trust where one spouse (the donor spouse) gifts assets to the other spouse (the beneficiary spouse) in a trust. The trust authorizes the trustee to make distributions to the beneficiary spouse if a need arises.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

A SLAT allows the donor spouse to transfer up to the donor spouse's available exemption amount without a gift tax. When the donor spouse dies, the value of the assets in the SLAT is excluded from the donor spouse's gross estate and are not subjected to the federal estate tax.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

The Spousal Lifetime Access Trust (SLAT) As the name suggests, a SLAT is an irrevocable trust where one spouse makes a gift into a trust to benefit the other spouse (and potentially other family members) while removing the assets from their combined estates.

SLAT Tax Implications During the beneficiary-spouse's lifetime, the SLAT is taxed as a grantor trust, meaning the settlor-spouse is responsible for paying tax on the trust's income, because the SLAT is held for the beneficiary-spouse's benefit. IRC §677(a).

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

The main disadvantage of SLATs is that in the event of death of the non-donor spouse, the original donor spouse loses access to trust assets as the trust would then terminate with assets going to children or contingent beneficiaries of trust.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.