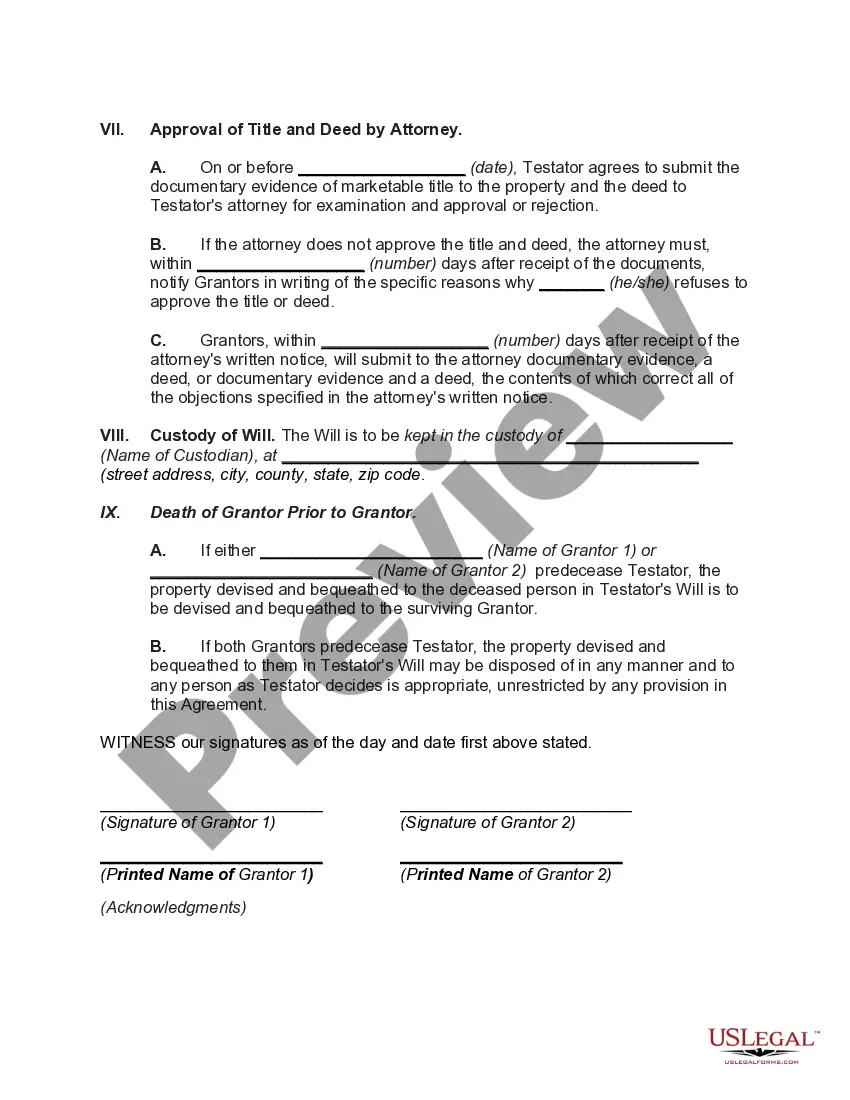

Kansas Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

Locating the appropriate authentic document template can be challenging.

Certainly, there are numerous designs accessible online, but how do you identify the correct form you need.

Utilize the US Legal Forms website. The platform provides a plethora of templates, such as the Kansas Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, which can be utilized for both business and personal purposes.

If the form does not fulfill your needs, utilize the Search field to find the appropriate form. Once you are certain the document is correct, click the Buy now button to acquire the form. Choose the pricing plan you desire and fill in the required details. Create your account and make the payment via your PayPal account or credit card. Select the file format and download the legal document template for your device. Finally, complete, modify, print, and sign the obtained Kansas Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator. US Legal Forms is the largest repository of legal documents where you can discover a variety of document templates. Use the service to download professionally crafted paperwork that adhere to state regulations.

- All of the documents are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, sign in to your account and click the Download button to obtain the Kansas Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- Use your account to review the legal documents you have previously acquired.

- Navigate to the My documents section of your account to retrieve another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your region/state. You can preview the document using the Review button and read the form summary to confirm it is suitable for you.

Form popularity

FAQ

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

A gift given by means of the will of a decedent of an interest in real property.

A bequest is the act of leaving property to a loved one through your Will. An inheritance describes the property itself, as well as the rights an individual has to property after your passing. In other words, a bequest is more about you, and the inheritance is more about your beneficiary on the receiving end.

The choices depend upon your individual circumstances. Bequests are assets given in a will or a trust. A bequest might be a specific amount of money or assets, a percentage of those assets, or what is left over after heirs and other obligations are paid from an estate.

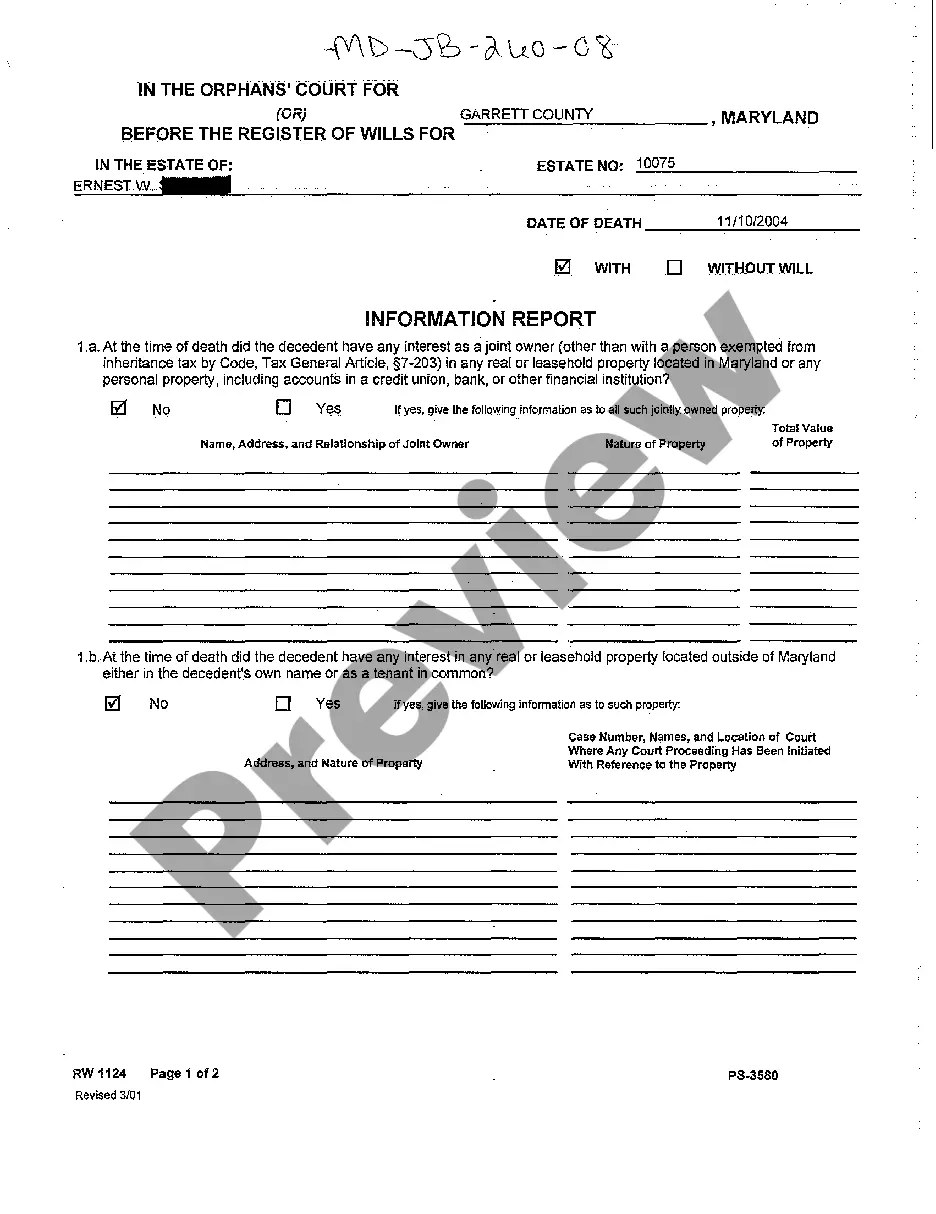

In Kansas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Make sure you enter all the essential personal details, including name, address, place and date, correctly; put in the full name and relationship of beneficiaries; mention the assets precisely; have it done in the presence of two witnesses; and sign it along with the witnesses and their details.

Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

(a) The executor or administrator appointed under the Kansas simplified estates act shall collect the decedent's assets, file an inventory and valuation, pay claims of creditors, and pay taxes owed by the decedent or the decedent's estate in the manner provided by law.

If an unmarried person passes away, the decedent's children (or lineal descendants of a deceased child) inherit the entire estate. If the decedent has no surviving children or lineal descendants of deceased children, the decedent's parents inherit the whole estate.

Ultimately, under Kansas law, if a person dies intestate, any assets owned solely in his or her name go to the closest living relatives. This is set out according to an order of priority in which a decedent's heirs will inherit the property in the estate.