Kansas Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose

Description

How to fill out Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement Of Purpose?

Finding the correct legal document template can be a challenge. Clearly, there are numerous templates available online, but how do you obtain the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Kansas Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose, which you can use for business and personal purposes. All of the forms are reviewed by professionals and meet state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to retrieve the Kansas Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose. Use your account to browse through the legal forms you have previously ordered. Navigate to the My documents section of your account and obtain another copy of the document you need.

Complete, modify, and print and sign the acquired Kansas Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to obtain properly crafted documents that adhere to state standards.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

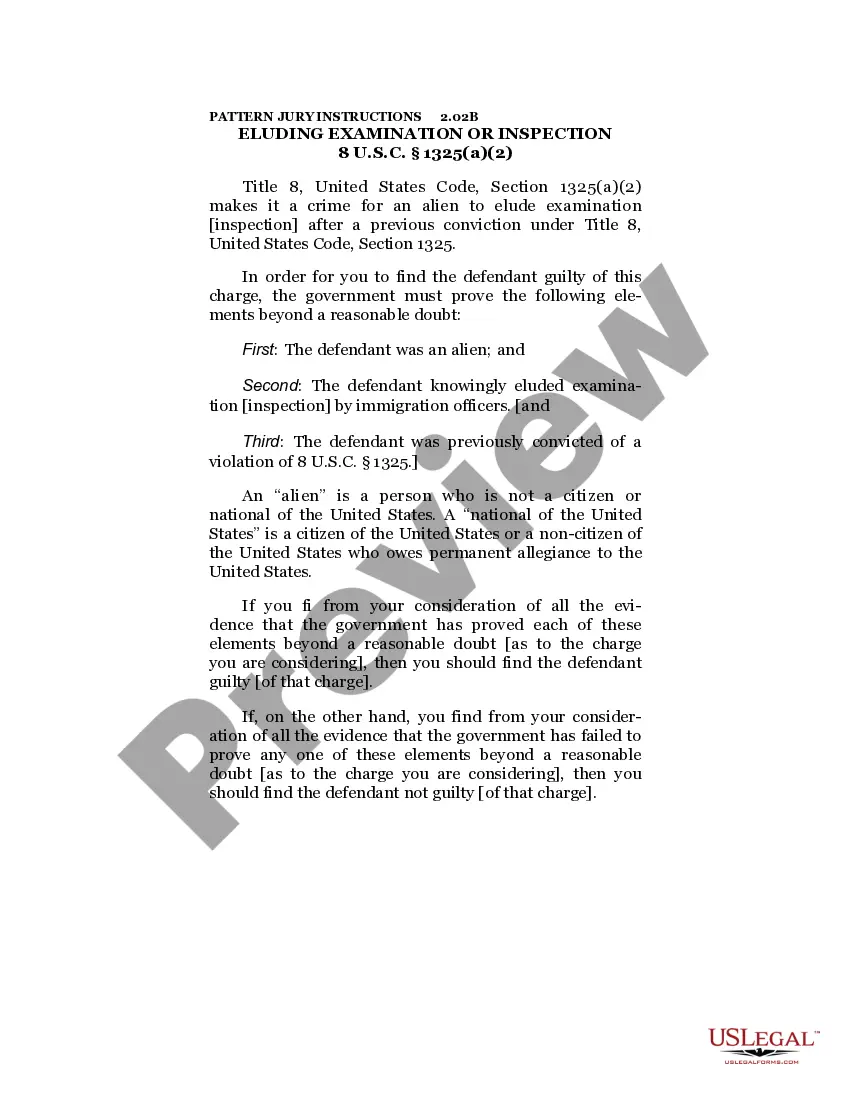

- Firstly, ensure you have selected the correct form for your state/region. You can review the form using the Review button and check the form details to confirm that it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase Now button to obtain the form.

- Select the pricing plan you need and enter the required information. Create your account and finalize the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Typically, the articles of incorporation consist of general details about your nonprofit. Your bylaws outline the detailed rules and procedures for managing your nonprofit. All nonprofits must file their articles of incorporation with the proper state agency.

The primary corporate document for every nonprofit corporation is its articles of incorporation. A corporation comes into existence on the date its articles of incorporation are filed with the state corporate filing office.

What to include in nonprofit bylawsGeneral information. This section should outline some basic information about your nonprofit, including your nonprofit's name and your location.Statements of purpose.Leadership.Membership.Meeting and voting procedures.Conflict of interest policy.Committees.The dissolution process.More items...?

Bylaws should include, at a minimum, the following:Governance Structure.Control provisions.Director's terms.Officers.Voting procedures.Committees.Conflicts of Interest.Amendments.More items...?

What should your 501c3 Nonprofit Articles of Incorporation include?Legal Name of the Organization (Not taken by other companies in your State)Address of the Organization (Should be in the Incorporating State)Incorporator of the Nonprofit Organization (Every State asks for this)More items...

It registers your organization's name. It limits the personal liability of the directors and members. It adds credibility to the organization. It paves the way to applying for 501(c) federal tax exemption.

Write a first draft of your bylawsArticle I. Name and purpose of the organization.Article II. Membership.Article III. Officers and decision-making.Article IV. General, special, and annual meetings.Article V. Board of Directors.

When you incorporate, your name is registered with the state you operate in and is therefore secured. It limits any personal liability. Members, board members, and director's liability are limited within the clauses of the articles. It adds credibility to your nonprofit.

Should your organization decide to legally incorporate in order to apply for tax-exemption status through the IRS, you must file your organization's bylaws with your state government. The IRS examines all the legal requirements of a corporation, including bylaws, when determining whether to grant tax-exemption.

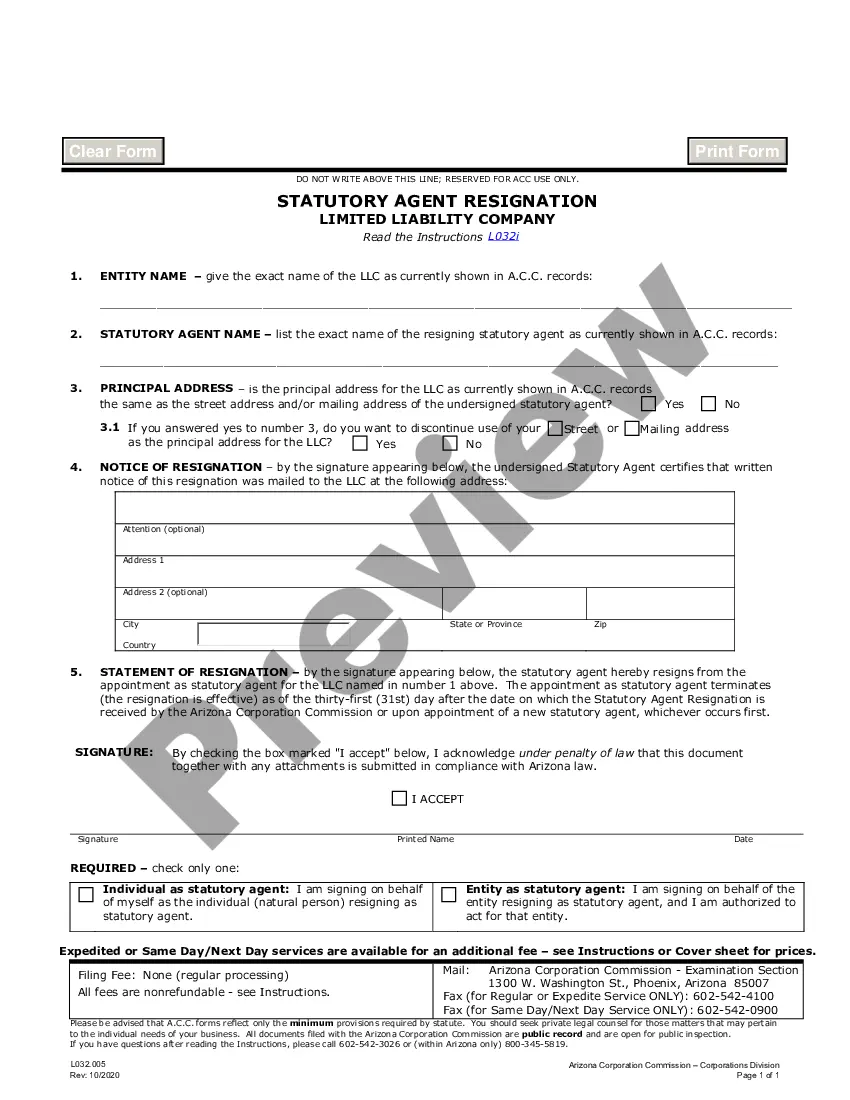

You must be able to provide the following to file your Articles of Incorporation:Corporation name and mailing address.Registered agent name and address.Duration of incorporation.Nature of the business.Number of shares and type issued.Powers of Incorporation designations.Signature and date lines.