The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

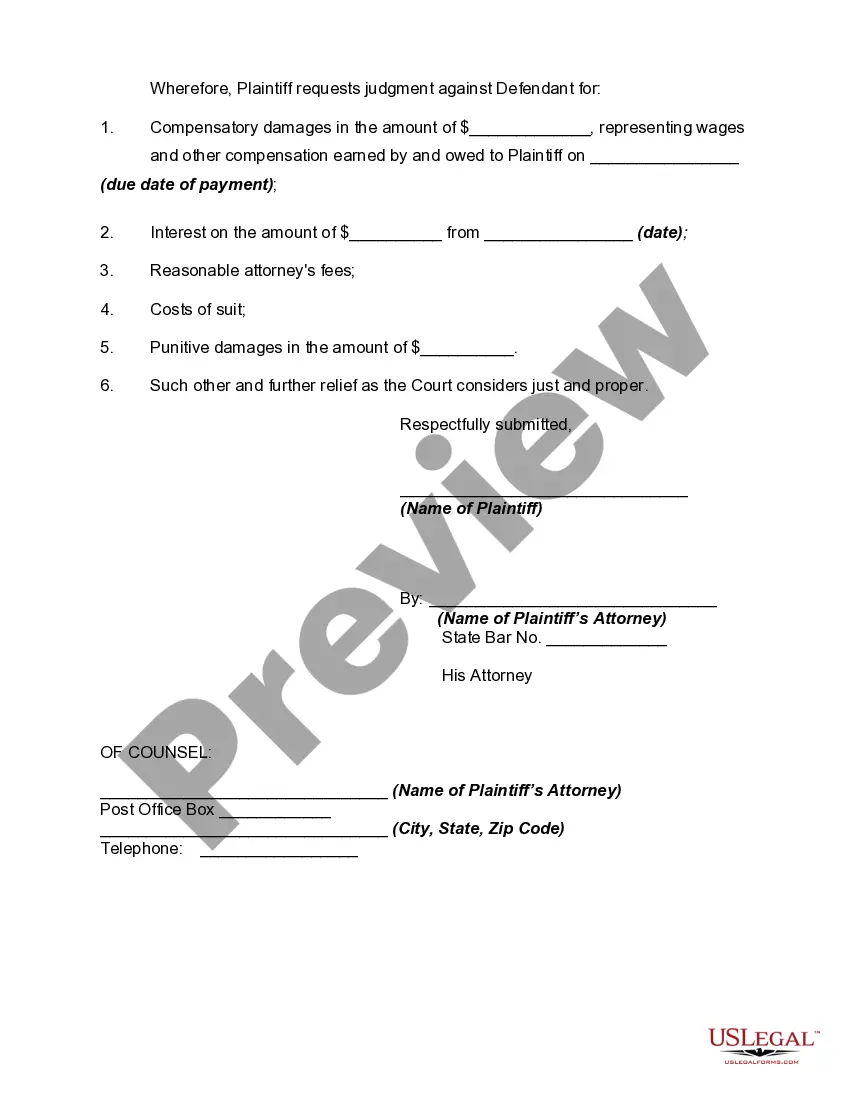

Kansas Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

US Legal Forms - one of several most significant libraries of legitimate forms in America - provides a wide range of legitimate document web templates you can down load or print out. Making use of the site, you will get 1000s of forms for enterprise and individual purposes, categorized by groups, states, or keywords.You will discover the latest versions of forms such as the Kansas Complaint for Recovery of Unpaid Wages in seconds.

If you currently have a monthly subscription, log in and down load Kansas Complaint for Recovery of Unpaid Wages through the US Legal Forms library. The Obtain key will show up on each form you see. You gain access to all formerly delivered electronically forms in the My Forms tab of the account.

If you want to use US Legal Forms the first time, allow me to share easy instructions to get you started out:

- Be sure you have picked the best form for your metropolis/county. Click the Review key to analyze the form`s content material. Look at the form explanation to actually have chosen the right form.

- In case the form does not suit your requirements, utilize the Look for field near the top of the monitor to discover the one that does.

- When you are satisfied with the shape, affirm your decision by visiting the Get now key. Then, opt for the costs prepare you want and give your accreditations to register for an account.

- Approach the transaction. Make use of bank card or PayPal account to finish the transaction.

- Choose the file format and down load the shape on your gadget.

- Make alterations. Complete, modify and print out and indication the delivered electronically Kansas Complaint for Recovery of Unpaid Wages.

Each and every web template you added to your account does not have an expiry date and is also your own property forever. So, if you wish to down load or print out yet another copy, just check out the My Forms section and then click around the form you need.

Gain access to the Kansas Complaint for Recovery of Unpaid Wages with US Legal Forms, the most substantial library of legitimate document web templates. Use 1000s of professional and condition-certain web templates that satisfy your organization or individual requirements and requirements.

Form popularity

FAQ

The Kansas Wage Payment Act (KWPA) is a state law that governs how employers must pay their employees. The KWPA sets forth rules for when and how employers must pay their employees, and the amount of money they must pay. It applies to all employers in Kansas, regardless of the number of employees.

Submit a wage claim with the Texas Workforce Commission within 180 days of the date the claimed wages originally became due for payment. File a complaint with the U.S. Department of Labor's Wage and Hour Division within two years of the date the claimed wages originally became due for payment.

Dear [employer name]: This is a demand for my final wages. My last day of work was [last day of work]. I have worked and not been paid for [number of hours] hours and I am owed [dollar-amount owed] at this time.

Title 5, United States Code, authorizes the payment of back pay, interest, and reasonable attorney fees for the purpose of making an employee financially whole (to the extent possible), when, on the basis of a timely appeal or an administrative determination (including a decision relating to an unfair labor practice or ...

(a) Except as provided in subsections (b) and (c), no employer may withhold, deduct or divert any portion of an employee's wages unless: (1) The employer is required or empowered to do so by state or federal law; (2) the deductions are for medical, surgical or hospital care or service, without financial benefit to the ...

You could claim compensation if your employer has breached your contract, for example if they: haven't paid your wages. haven't paid other money your contract says you should get - like holiday or sick pay. have dismissed you and haven't paid you during your notice period.

If your employer has not paid your wages or benefits owed, file the Wage Claim form with the Kansas Department of Labor (KDOL) for wages under the provisions of the Kansas Wage payment Law, K.S.S 44-313 et.

Federal overtime rules, as outlined by the Fair Labor and Standards Act (FLSA), state that employees may pursue retro pay for unpaid minimum wages, overtime and wage increases. It doesn't provide much of a framework beyond that.