Kansas General Form of Agreement to Incorporate

Description

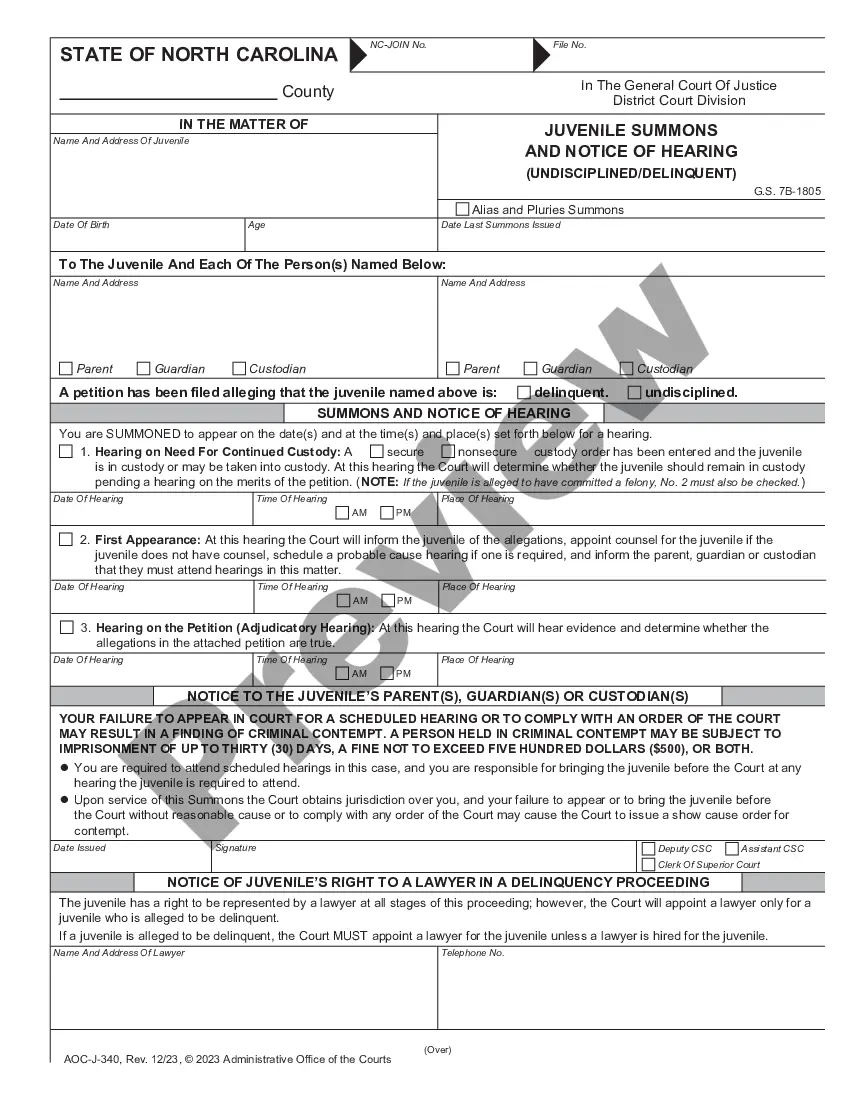

How to fill out General Form Of Agreement To Incorporate?

It is feasible to dedicate time online striving to discover the sanctioned document template that aligns with the federal and state regulations you seek.

US Legal Forms offers thousands of legal templates that are evaluated by experts.

You can easily acquire or print the Kansas General Form of Agreement to Incorporate from my service.

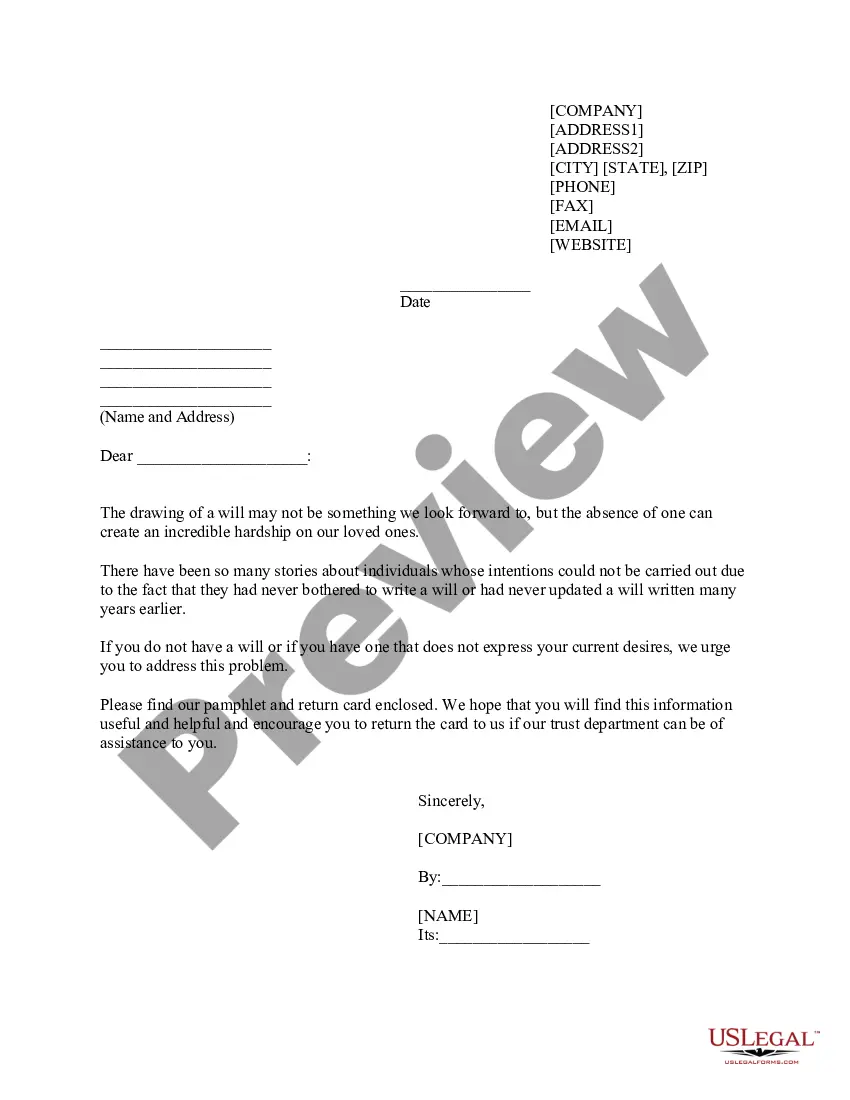

Utilize the Preview button to review the document template as well, if available. If you wish to get an additional version of your form, utilize the Search field to find the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can sign in and click on the Get button.

- Subsequently, you can complete, modify, print, or sign the Kansas General Form of Agreement to Incorporate.

- Every legal document template you obtain is yours indefinitely.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the essential instructions outlined below.

- First, ensure you have selected the appropriate document template for your locality/city of choice.

- Review the form details to confirm you have chosen the correct template.

Form popularity

FAQ

Kansas does not legally require an LLC to have an operating agreement, but it is highly recommended. Having an operating agreement helps define the roles and responsibilities of members, which can prevent misunderstandings. Moreover, using the Kansas General Form of Agreement to Incorporate can help you create a solid and effective operational framework for your LLC.

Yes, an operating agreement is often referred to as an LLC agreement. This document details the structure and operating procedures of the LLC. It provides essential guidelines for members on how the business will be run. Utilizing the Kansas General Form of Agreement to Incorporate can ensure your LLC agreement is thorough and tailored to your business.

If your LLC has no operating agreement, it may encounter challenges in decision-making and management. Additionally, any disputes among members could be more complicated without a written agreement. To avoid potential issues, drafting an operating agreement is advisable, and the Kansas General Form of Agreement to Incorporate is a useful resource to create it.

To determine if your LLC has an operating agreement, check your business records. Typically, this document is created at the formation stage and should be stored alongside your other legal documents. If you can't find one, consider drafting a new operating agreement using the Kansas General Form of Agreement to Incorporate for your LLC's specific requirements.

If an LLC does not have an operating agreement, it may face difficulties in managing internal operations. This document lays out the roles, responsibilities, and decision-making procedures for members, ensuring smooth operation. Without it, state laws will dictate management structure, which may not reflect your business needs. Using the Kansas General Form of Agreement to Incorporate can help establish a clear framework for your LLC.

In Kansas, an operating agreement is not legally required for an LLC, but it is highly encouraged. This document serves as a guide to outline procedures, responsibilities, and financial distribution among members. By utilizing a Kansas General Form of Agreement to Incorporate, you codify these important aspects, making them clear and enforceable. Consequently, having an operating agreement helps reduce ambiguity and strengthens your business structure.

Yes, an LLC can technically operate without an operating agreement, but this is not advisable. Without this document, the business may face challenges in resolving disputes among members and in clarifying responsibilities. Utilizing a Kansas General Form of Agreement to Incorporate helps ensure smooth operations and clear guidelines, which can prevent future conflicts. Thus, having an operating agreement is a beneficial practice for a well-run LLC.

While not all states mandate an LLC operating agreement, many experts recommend having one regardless of state laws. This document clarifies the operations and management of your LLC. Specifically, states like Kansas benefit from having a Kansas General Form of Agreement to Incorporate, as it enhances credibility and outlines the roles of members. Therefore, while it may not be legally required, it's wise to have an agreement in place.

Yes, you can write your own operating agreement for your LLC. Customizing the agreement allows you to include specific details relevant to your business. However, it's crucial to ensure that it complies with state laws and clearly reflects the structure of your business. The Kansas General Form of Agreement to Incorporate can provide helpful insights as you draft your document.

While not every corporation has an operating agreement, it is highly recommended. This document outlines the policies and regulations that govern corporate operations. Having an operating agreement minimizes misunderstandings and conflicts among shareholders. If you're incorporating in Kansas, the Kansas General Form of Agreement to Incorporate can serve as a valuable template.