Kansas UCC-1 for Personal Credit

Description

How to fill out UCC-1 For Personal Credit?

In case you need to gather, retrieve, or reproduce legally binding document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you need.

Numerous templates for commercial and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, select the Purchase now option. Choose the payment plan you prefer and input your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Kansas UCC-1 for Personal Credit with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to locate the Kansas UCC-1 for Personal Credit.

- You can also reach the forms you previously downloaded within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

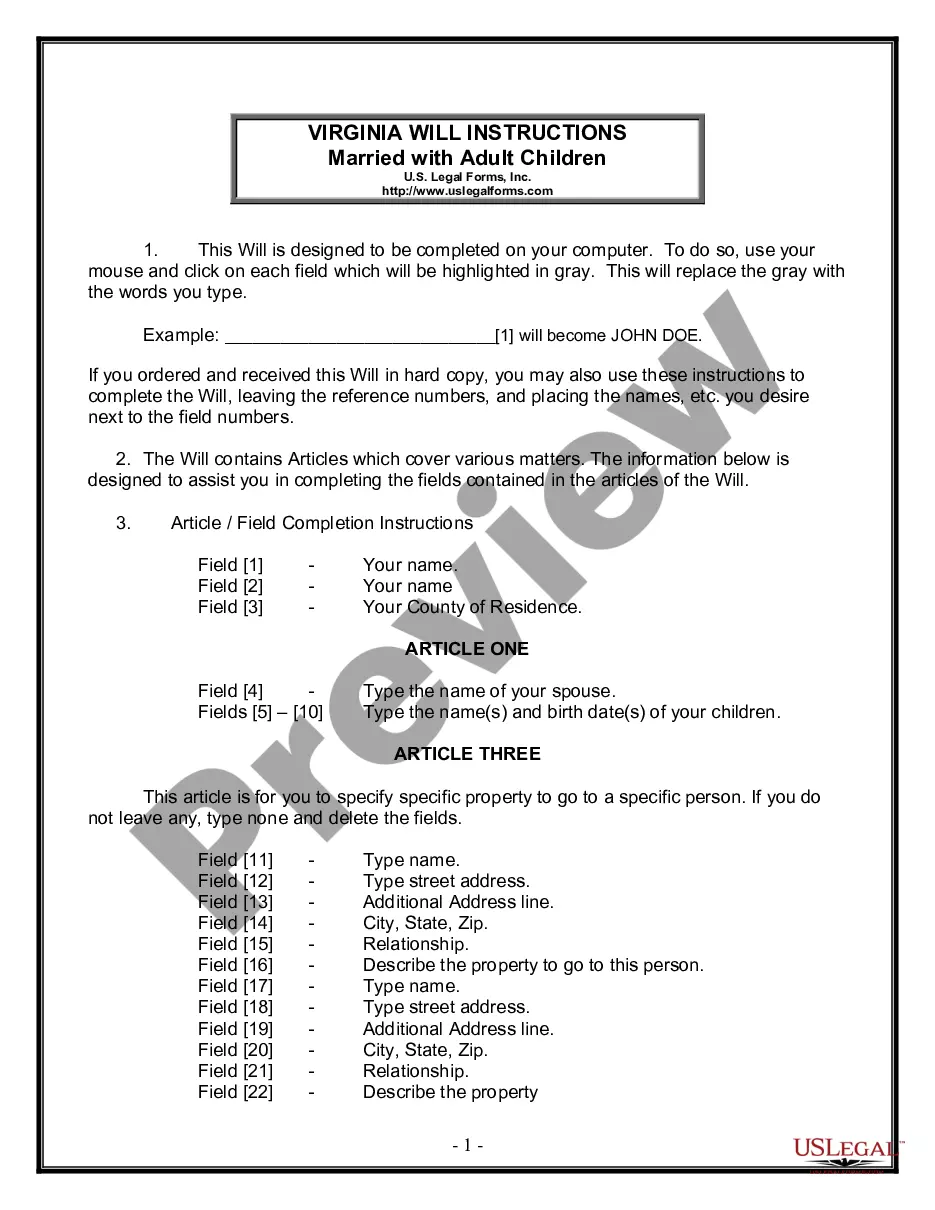

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

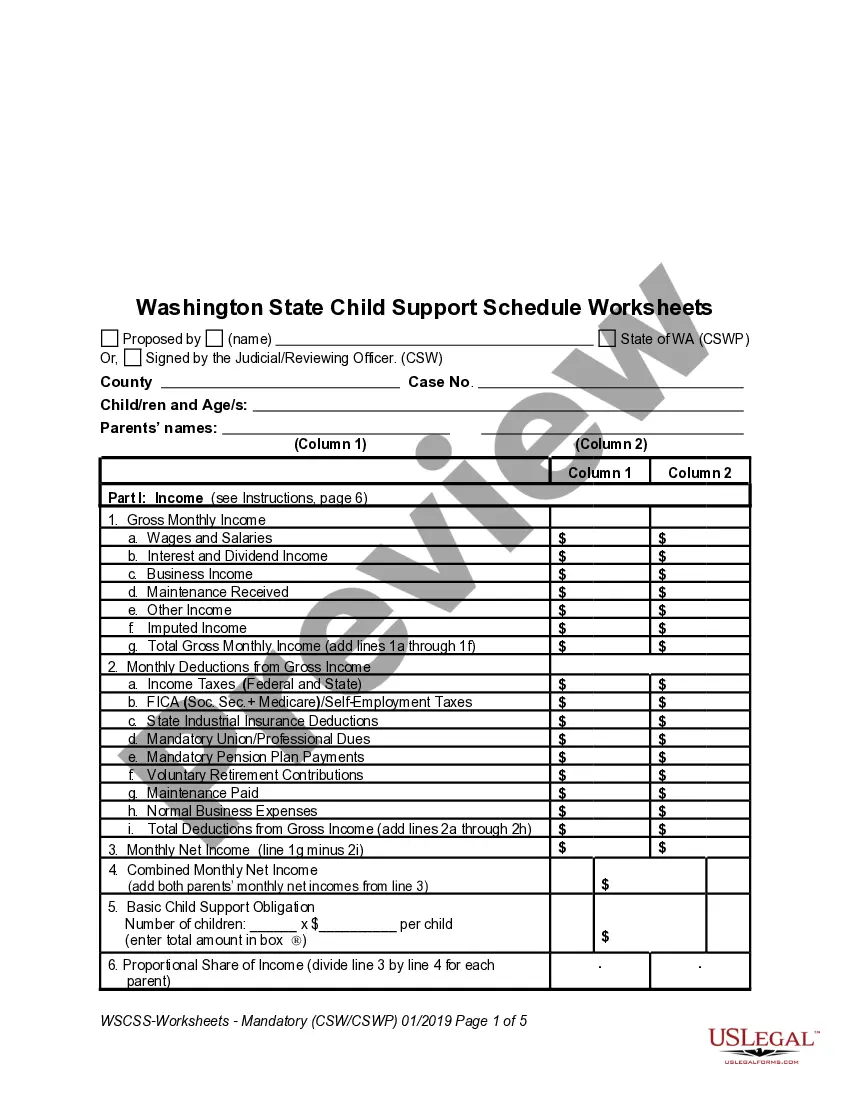

To fill out a Kansas UCC-1 for personal credit, start with the debtor's name and address, followed by the secured party's details. Describe the collateral you are securing, ensuring it is specific and comprehensive. Complete the form with your signature and the filing date, then check for accuracy before submitting it to the appropriate state office. Follow each step closely to avoid complications.

The UCC, or Uniform Commercial Code, simplifies legal transactions regarding personal and business assets across the United States. In the context of the Kansas UCC-1 for personal credit, it specifically pertains to securing interests in personal property as collateral for loans. Understanding the UCC helps you navigate financial agreements confidently. It’s essential to know these basic principles to protect your assets effectively.

To fill out a Kansas UCC-1 for personal credit, start by entering your name and address accurately. Next, provide the name and address of the secured party, which might be a lender or yourself if filing for personal purposes. Include a detailed description of the collateral to ensure clarity and protect your interests. Finally, review the information carefully before submitting to avoid delays in processing.

Filing a Kansas UCC-1 for personal credit helps establish your security interest in your own assets. This filing protects your rights in the event of financial disputes or claims against your property. Additionally, it can enhance your credibility with lenders, improving your chances of securing favorable borrowing terms. By taking this step, you demonstrate proactive management of your financial affairs.

Yes, a UCC filing can affect your personal credit significantly. A Kansas UCC-1 for Personal Credit indicates that you have secured debts, which can make you seem riskier to lenders. This may impact your ability to obtain new credit or loans. To navigate these implications, consider using platforms like uslegalforms to manage your filings and understand their effects better.

On a credit report, UCC refers to 'Uniform Commercial Code' filings. When a Kansas UCC-1 for Personal Credit appears, it indicates a legal claim against your assets. This can impact your creditworthiness as it shows creditors that your assets are already pledged as collateral. It's essential to review this information for a complete understanding of your credit status.

UCC filings provide crucial information about secured transactions. Specifically, a Kansas UCC-1 for Personal Credit shows the creditors' claims against personal and business assets. This enables potential lenders to evaluate risks before extending credit. Understanding these filings can help you make informed financial decisions.

Yes, you can file a UCC against an individual in Kansas, provided that there is a valid debt that justifies it. This process allows creditors to secure their interests in personal property owned by the individual. To navigate this procedure confidently, consider using US Legal Forms, which offers resources and templates tailored for UCC filings.

The UCC certainly applies to personal property. It provides a framework for establishing security interests in items such as vehicles, equipment, and inventory. If you're considering a UCC-1 to protect your personal credit, understanding how it relates to personal property is crucial for making informed decisions.

Yes, a UCC filing can affect your personal credit. When a UCC-1 is filed against you, it indicates to potential lenders that there is a lien on your personal property. This information is accessible to credit reporting agencies, which can impact your creditworthiness in the context of future lending opportunities.