A nominee trust is a trust in which the trustee holds legal title to the trust property for the trust's beneficiaries, but the beneficiaries exercise the controlling powers, and the actions that the trustees may take on their own are very limited. Such trusts are a common device for holding title to real estate, and afford certain tax advantages. A nominee trust is not a trust in the strict classical sense, because of the trustee-beneficiary relationship. Despite a nominee trust's nontraditional relationship between trustee and beneficiary, such a trust must still adhere to the rule that no trust exists when the same individual is the sole settlor, sole trustee, and sole beneficiary. The trustees of a nominee trust act at the direction of the beneficiaries.

Kansas Nominee Trust

Description

How to fill out Nominee Trust?

If you need to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Use the site's straightforward and user-friendly search feature to find the documents you need. Numerous templates for business and personal purposes are categorized by types and states, or by keywords. Use US Legal Forms to locate the Kansas Nominee Trust in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Kansas Nominee Trust. You can also access forms you previously saved from the My documents section of your account.

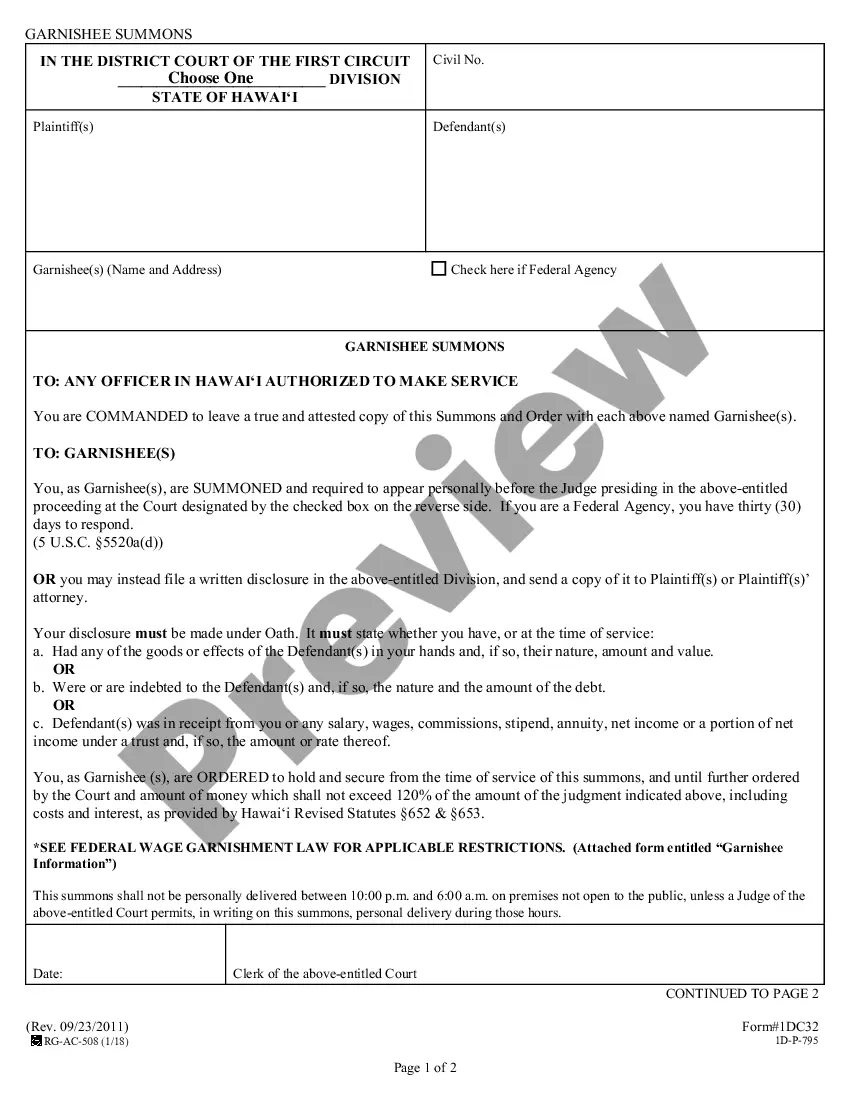

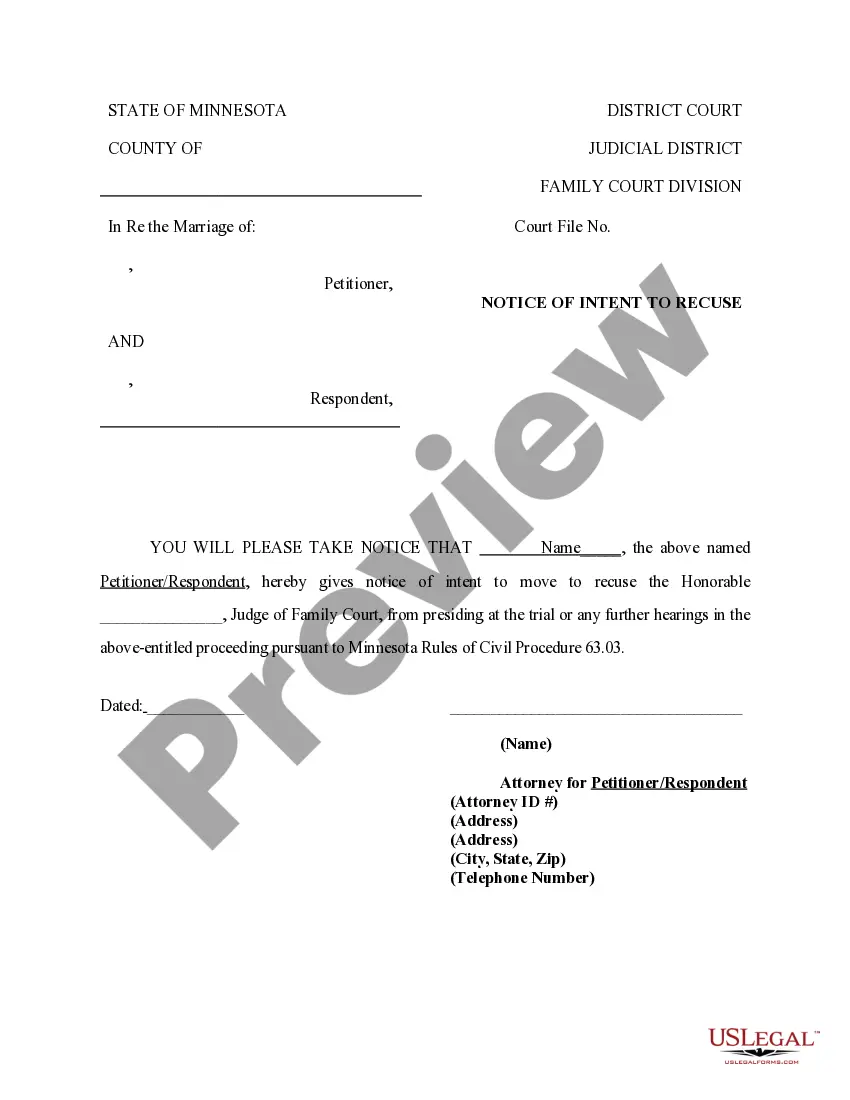

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Make sure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form directory. Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Kansas Nominee Trust.

- Every legal document template you acquire is yours permanently.

- You will have access to all forms you saved in your account.

- Click the My documents section and select a form to print or download again.

- Complete and download, and print the Kansas Nominee Trust with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

- Enjoy the convenience of having legal forms at your fingertips.

- Utilize the platform to streamline your legal documentation process.

Form popularity

FAQ

Complexity and Cost Establishing and maintaining a trust can be complex and expensive. Trusts require legal expertise to draft, and ongoing management by a trustee may involve administrative fees. Additionally, some trusts require regular tax filings, adding to the overall cost.

Typically, a will must go through probate, a legal process that administers a person's estate after their death. This process can be lengthy, costly, and public. However, if you choose a trust, you can bypass this process, thereby keeping your estate private ? a useful strategy to avoid probate hassles.

You can create a living trust through two different ways: you can hire an attorney or you can use an online program. Hiring an attorney will cost you more than $1,000. If you choose to use the DIY approach, you'll spend a few hundred dollars.

Your assets, beneficiaries, or trust terms do not become public record. In contrast, a will must be probated and becomes public. Control is another primary benefit of a revocable living trust. During your lifetime, you remain in control of your assets.

Will: a legal document that directs who will receive your assets and property at the time of your death. Trust: a legal arrangement where a ?trustee? (someone you select) manages and holds title to your assets and property and distributes income to the beneficiaries that you select.

DISADVANTAGES OF A TRUST Most importantly, a trust will cost more than a last will at the initial stage of planning and you have to provide more information up front.

A declaration of trust, or nominee declaration, appoints a trustee to oversee assets for the benefit of another person or people. The declaration also describes the assets that are to be held in the trust and how they are to be managed. State laws have different requirements for the creation of a declaration of trust.

With a will you can do certain things that you can't with a trust. A trust lets you determine how certain assets are distributed after your death. A will allows you to account for property not included in your trust.