Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

How to fill out Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

Finding the appropriate legal document format may be challenging. Clearly, there are numerous web templates available online, but how can you acquire the legal form you require? Make use of the US Legal Forms website.

The service offers a vast selection of templates, including the Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, which you can utilize for both business and personal purposes. Each of the forms is reviewed by experts and complies with federal and state regulations.

If you are already a registered user, Log In to your account and click on the Obtain button to access the Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Use your account to browse through the legal forms you’ve purchased previously. Navigate to the My documents section of your account to obtain another copy of the document you require.

Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally crafted documents that meet state requirements.

- First, ensure you have selected the correct form for your specific city/state.

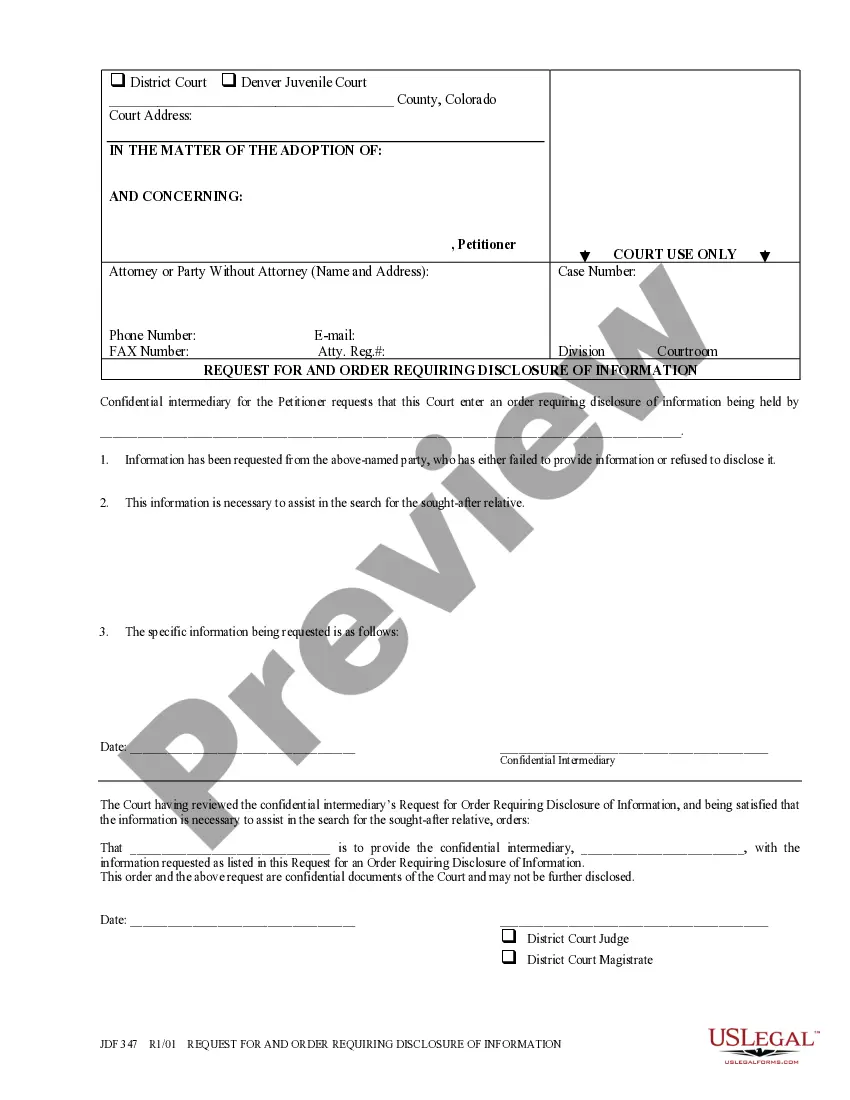

- You can preview the form using the Review button and inspect the form description to confirm it meets your needs.

- If the form does not satisfy your criteria, utilize the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click on the Get now button to obtain the document.

- Select the pricing plan you wish and enter the necessary details.

- Create your account and complete the order using your PayPal account or credit card.

Form popularity

FAQ

Yes, you can have multiple trustees in a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Having more than one trustee can enhance the trust's management and ensure checks and balances in decision-making. It is essential, however, to outline the roles and responsibilities of each trustee clearly to avoid potential conflicts. US Legal Forms provides guidance on structuring your trust for multiple trustees effectively.

To write a living trust in Kansas, you begin by identifying your assets and deciding how to distribute them among your beneficiaries. Next, you will create a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries document, ensuring that it reflects your wishes accurately. It is essential to include the names of all trustees and beneficiaries to eliminate any confusion later. Utilizing platforms like US Legal Forms can streamline this process, offering resources and templates tailored to Kansas law.

Trust funds can pose certain dangers, primarily relating to mismanagement or lack of clarity in the Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Poor communication among trustees and beneficiaries can lead to conflicts and disputes, eroding trust in the process. Additionally, inadequate oversight could potentially result in misuse of funds. It's vital to implement stringent governance practices to navigate these risks effectively.

A potential negative aspect of a trust is the complexity and ongoing costs associated with its administration. Trusts, particularly a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, require careful record-keeping and compliance with legal guidelines. These responsibilities can become burdensome for trustees, especially without proper guidance. Working with a legal service can simplify this process and enhance overall efficiency.

Absolutely, having two trustees is not only possible but often advantageous under a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This arrangement allows for shared responsibility, facilitates collaboration, and can enhance accountability in managing the trust. However, it is vital to establish clear roles and responsibilities to ensure effective governance and prevent misunderstandings.

While this primarily concerns UK parents, a common mistake often parallels that of U.S. parents: not addressing tax implications within the trust. Failure to consider the tax consequences can lead to unexpected liabilities, which may diminish the trust's overall value. Establishing a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries can help parents in the U.S. avoid similar pitfalls by ensuring all relevant financial factors are addressed thoroughly.

One disadvantage of a family trust is the complexity that may arise in trust management, especially with a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Trusts require careful maintenance and compliance with legal requirements, which can sometimes be cumbersome. Additionally, family dynamics can complicate trust administration, leading to emotional conflicts among beneficiaries. Seeking professional guidance can mitigate these issues.

Yes, two family members can serve as trustees under a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Having multiple trustees can enhance decision-making and provide diverse perspectives on managing the trust. However, it is essential to establish clear communication and delineate responsibilities to avoid potential conflicts. This can create a more balanced and effective trust management process.

One of the most significant mistakes parents often encounter when establishing a trust fund is failing to clearly outline the terms and goals of the trust. Without a well-defined Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, conflicts can arise among trustees and beneficiaries. This lack of clarity can lead to misunderstandings regarding asset distribution and management, ultimately undermining the trust's purpose. To avoid this, parents should consult with legal experts to ensure everything is explicitly stated.

To form a Kansas Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, you need to start by deciding on the type of trust that best meets your needs. First, draft the trust document, outlining the trust terms, trustees, and beneficiaries. Then, sign the document in front of a notary to make it legally binding. Finally, transfer the intended assets into the trust to ensure it operates as you planned.