Indiana Direction For Payment of Royalty to Trustee by Royalty Owners

Description

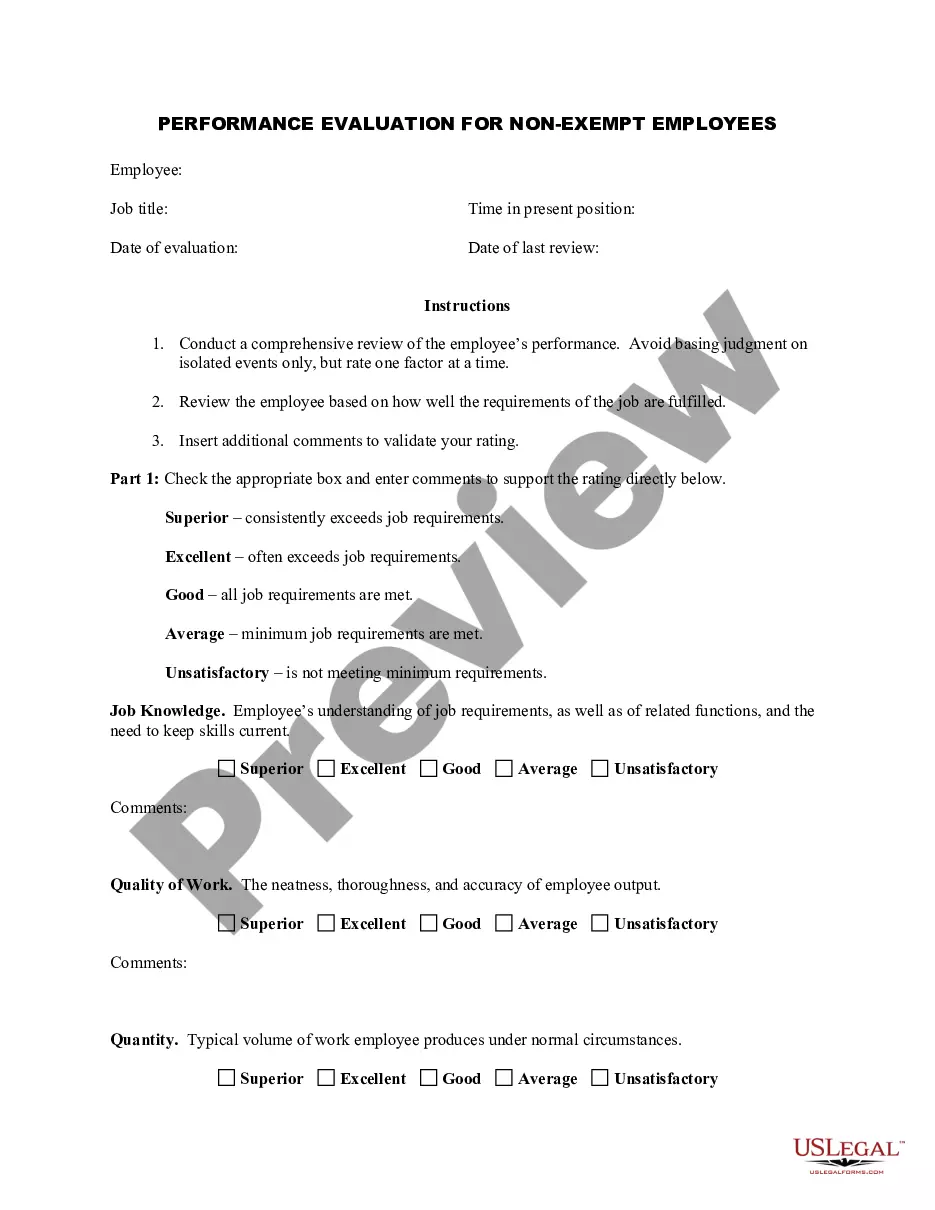

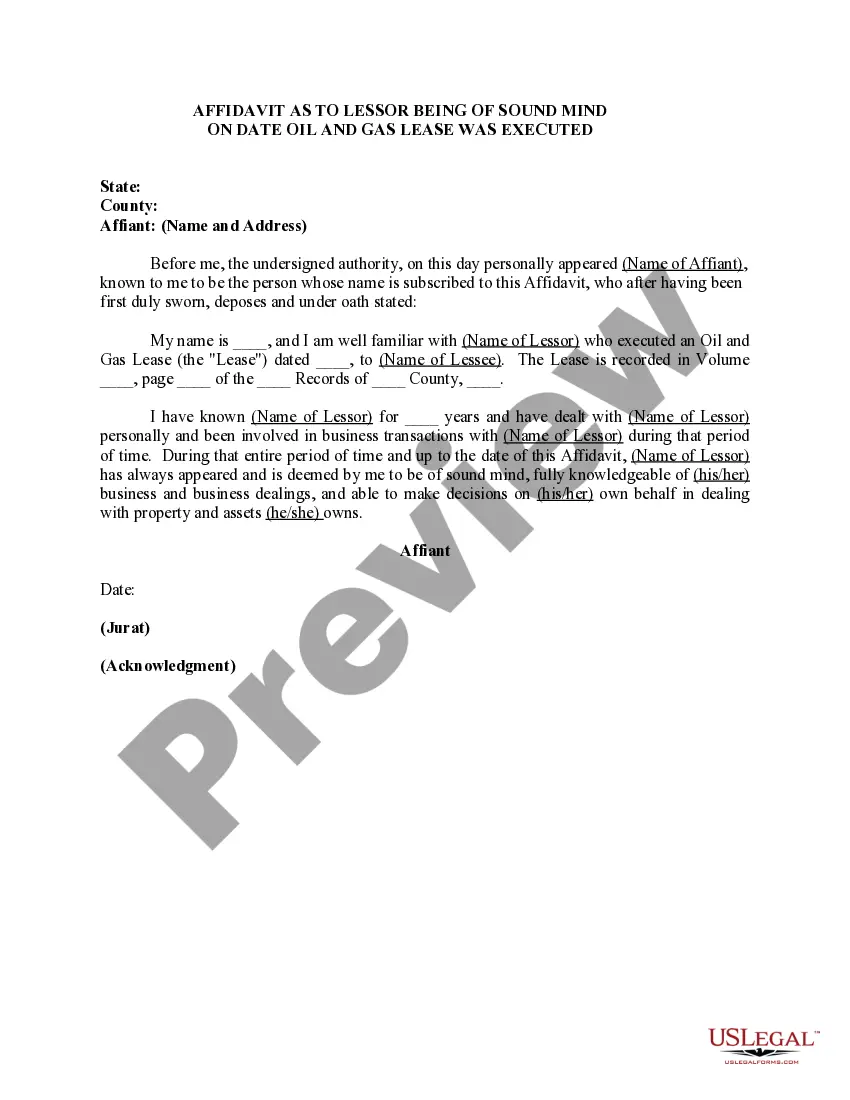

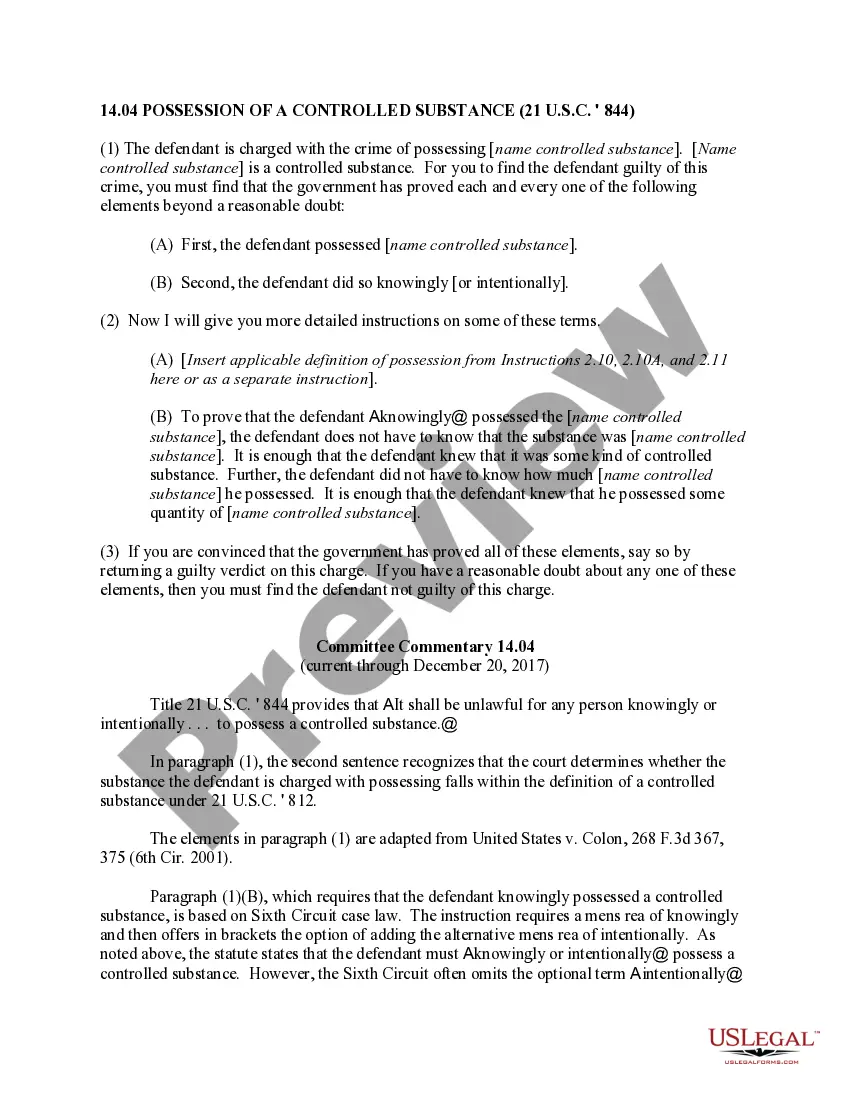

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

US Legal Forms - one of many biggest libraries of lawful types in the States - provides a wide range of lawful papers layouts you can down load or print. Utilizing the site, you will get 1000s of types for enterprise and individual uses, sorted by classes, claims, or keywords and phrases.You can get the newest models of types much like the Indiana Direction For Payment of Royalty to Trustee by Royalty Owners in seconds.

If you already have a monthly subscription, log in and down load Indiana Direction For Payment of Royalty to Trustee by Royalty Owners in the US Legal Forms library. The Download key will appear on every develop you look at. You get access to all formerly delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, here are simple instructions to get you started off:

- Ensure you have picked out the best develop for your personal town/county. Click the Review key to analyze the form`s articles. Browse the develop information to ensure that you have chosen the right develop.

- In case the develop doesn`t satisfy your demands, make use of the Lookup area at the top of the screen to find the one which does.

- When you are satisfied with the shape, affirm your option by clicking the Acquire now key. Then, opt for the prices prepare you like and offer your qualifications to register for an account.

- Approach the transaction. Make use of Visa or Mastercard or PayPal account to accomplish the transaction.

- Pick the structure and down load the shape on the device.

- Make adjustments. Fill up, edit and print and indication the delivered electronically Indiana Direction For Payment of Royalty to Trustee by Royalty Owners.

Each and every template you included with your account lacks an expiration date and it is yours eternally. So, if you would like down load or print one more version, just go to the My Forms section and click on in the develop you will need.

Get access to the Indiana Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms, the most substantial library of lawful papers layouts. Use 1000s of specialist and state-specific layouts that meet your company or individual demands and demands.

Form popularity

FAQ

These deductions include interest, taxes, depreciation, repairs, etc. To be attributable to rent or royalty income, an expense must be directly incurred, in an accounting sense, in the rental of property or for the production of royalties (S. Rep.

In most cases, you'll report your royalties in Part I of Schedule E on your Form 1040 or Form 1040-SR, identified as Supplemental Income and Loss.

Completing your tax return If your royalties are from a work or invention and there are no associated expenses, report the income on line 10400 of your return. If there were associated expenses, report the income on line 13500 of your return. Report all other royalties on line 12100 of your return.

Royalties, active or passive, are subject to regular income tax. Items of passive income from abroad are subject to final tax.

Royalty tax reporting Royalty payments are tax reportable and are reported ing to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.

Royalty Payment Income royalty contract, agreement, or statement confirming amount, frequency, and duration of the income; and. borrower's most recent signed federal income tax return, including the related IRS Form 1040, Schedule E.

Royalties are both taxable as income and deductible as a business expense. These payments must be reported to the IRS and are usually recorded on Schedule E: Supplemental Income and Loss. However, this depends on whether you own a business, the type of property in question, and who retains ownership of the property.