Indiana Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

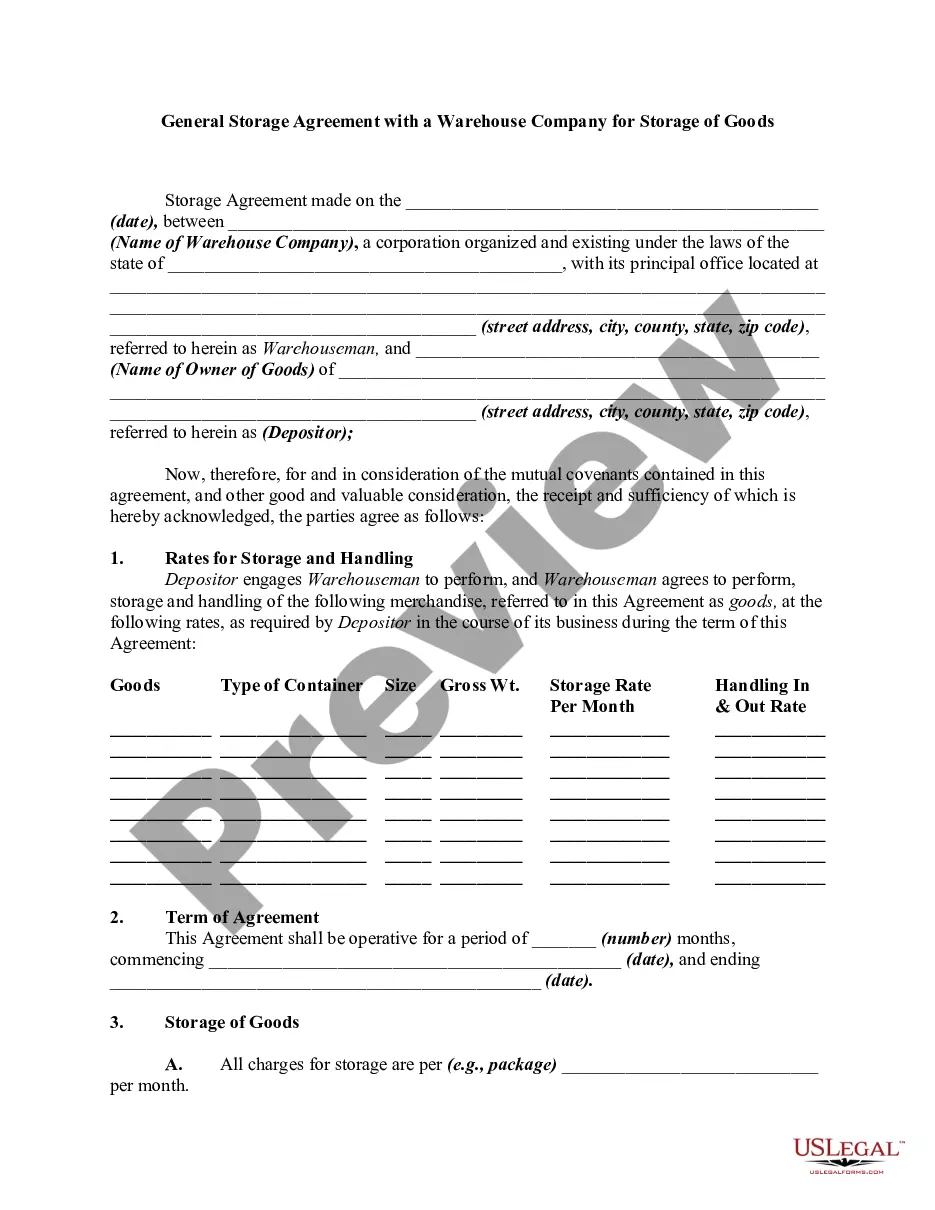

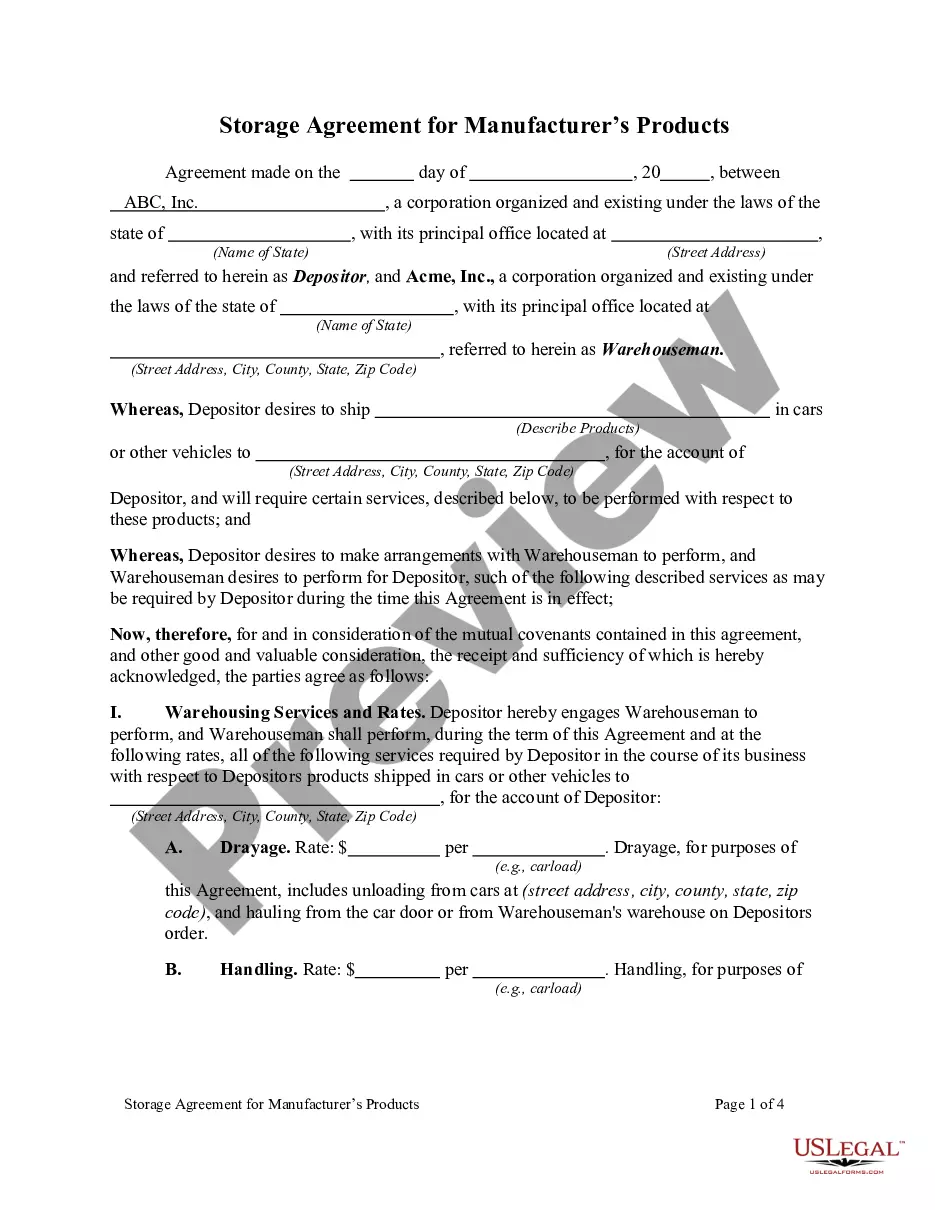

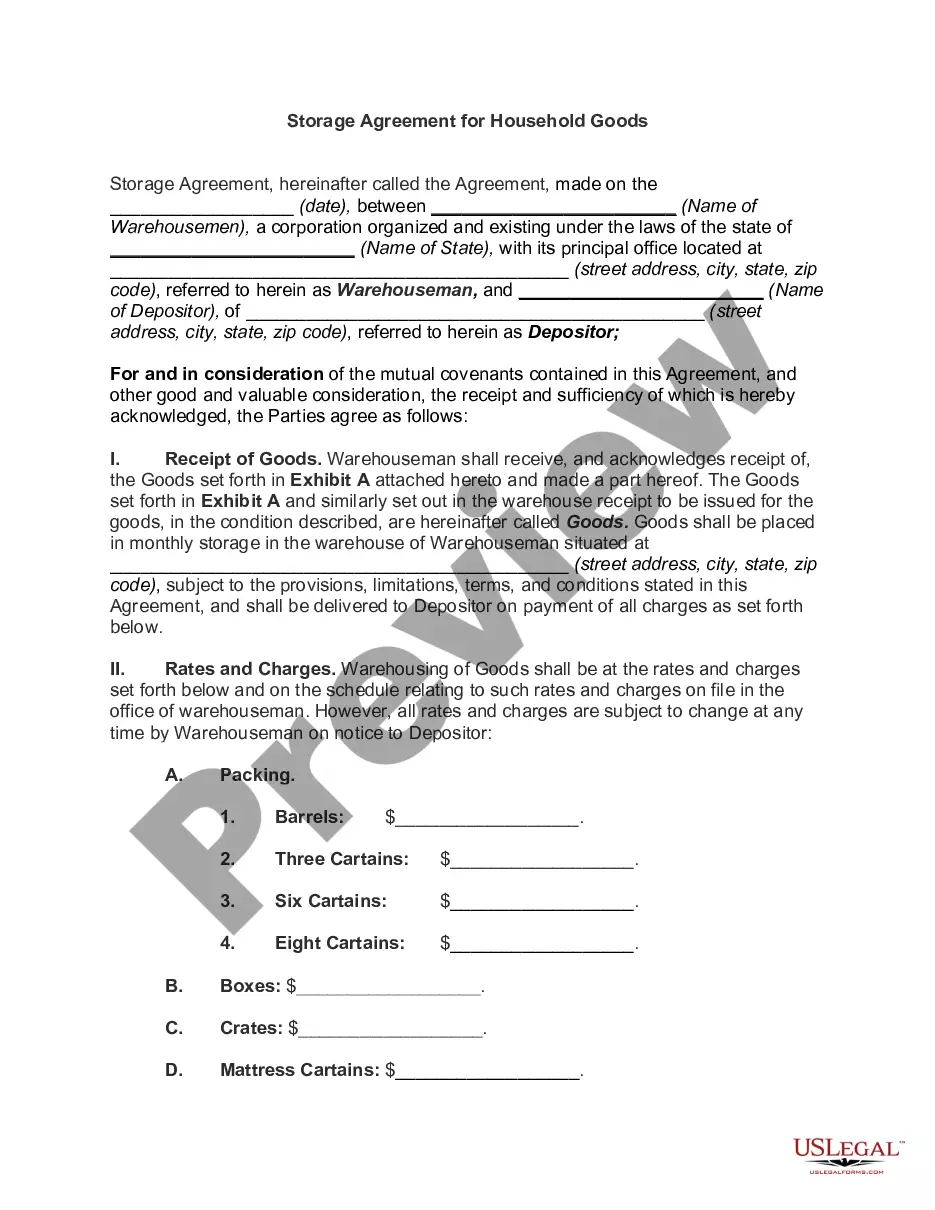

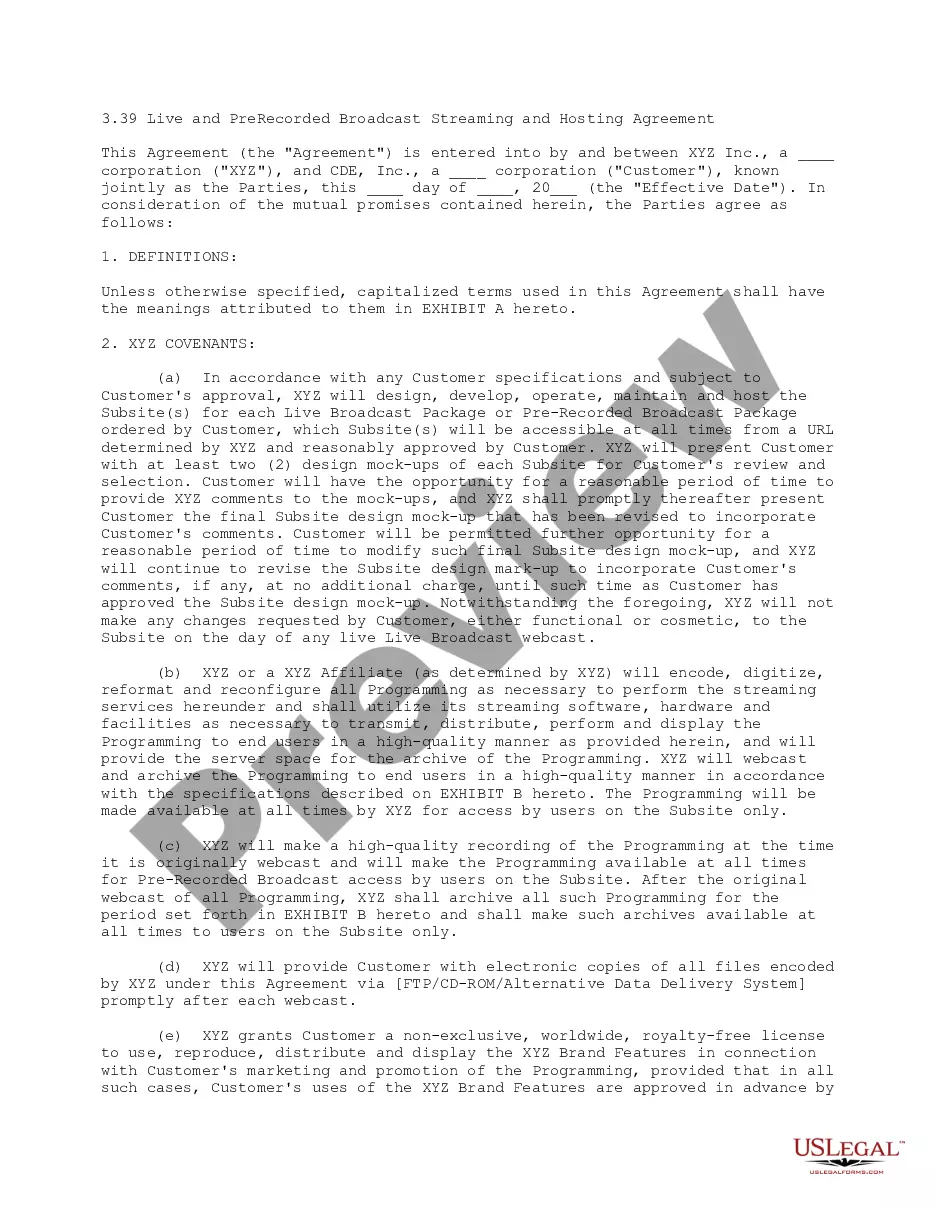

You might spend several hours online looking for the valid document format that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can acquire or print the Indiana Storage Services Contract - Self-Employed from our platform.

If available, use the Preview button to review the document format as well. If you wish to find another version of the form, utilize the Search field to locate the format that suits your needs and requirements. Once you have found the format you want, click Buy now to proceed. Select the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Modify your document if necessary. You can complete, edit, sign, and print the Indiana Storage Services Contract - Self-Employed. Download and print numerous document templates using the US Legal Forms site, which offers the most extensive collection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Indiana Storage Services Contract - Self-Employed.

- Every legal document format you purchase is yours forever.

- To obtain another copy of a purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the region/city of your choice.

- Check the form description to confirm you have selected the right document.

Form popularity

FAQ

To write a self-employed contract, begin by defining the services you'll provide, detailing payment terms, and specifying deadlines. Make sure to include clauses that address confidentiality and dispute resolution. A well-structured Indiana Storage Services Contract - Self-Employed serves as a powerful tool to protect both parties and foster a successful working relationship.

In Indiana, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operating procedures, providing clarity for all members. If your LLC engages in contracts, such as an Indiana Storage Services Contract - Self-Employed, having an operating agreement can help mitigate disputes and enhance professionalism.

To show proof that you are self-employed, gather documents like tax returns, business licenses, and contracts that verify your work arrangements. Highlighting an Indiana Storage Services Contract - Self-Employed can serve as a solid piece of evidence to confirm your self-employment status, making it easier for you to apply for loans or other services.

You can write your own legally binding contract as long as you include all necessary elements, such as the offer, acceptance, and consideration. When crafting an Indiana Storage Services Contract - Self-Employed, ensure you use clear language and cover all important aspects of the agreement. Utilizing resources like USLegalForms can simplify this process and provide templates that meet legal standards.

Yes, a service contract is legally binding as long as it meets specific requirements such as mutual consent, a lawful purpose, and defined terms. When you draft a contract, particularly an Indiana Storage Services Contract - Self-Employed, both parties must agree to the terms and sign the document for it to be enforceable. Consider using a trusted platform like USLegalForms to ensure your contract is comprehensive and compliant.

When writing a self-employment contract, focus on the services you will provide and how you will be compensated. It's important to include terms regarding duration, cancellation policies, and liability limitations. By framing this as an Indiana Storage Services Contract - Self-Employed, you clarify expectations and protect your rights in a professional relationship.

To write a contract for a 1099 employee, start by clearly defining the scope of work and payment terms. Include essential details such as project deadlines, deliverables, and any necessary confidentiality clauses. Make sure to specify that this is an Indiana Storage Services Contract - Self-Employed arrangement, outlining the responsibilities of both parties while ensuring compliance with tax regulations.

In Indiana, whether you need a license to be a contractor depends on the type of work you perform. Some contractor services do require licensing to comply with state regulations. If you engage in storage services, ensuring you understand the licensing requirements is vital, along with using the Indiana Storage Services Contract - Self-Employed to document your agreements.

Yes, independent contractors often require a business license in Indiana, depending on the nature of their services. This ensures you are authorized to operate and provides credibility to your clients. The Indiana Storage Services Contract - Self-Employed can serve as a reference when understanding the specifics of your licensing needs.

Independent contractors in Indiana must adhere to specific legal requirements such as obtaining necessary permits and licenses. You will also need to maintain proper records of your contracts, including the Indiana Storage Services Contract - Self-Employed, to ensure compliance with state laws. Familiarizing yourself with these requirements is a crucial step to operating legally and successfully.