Indiana Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

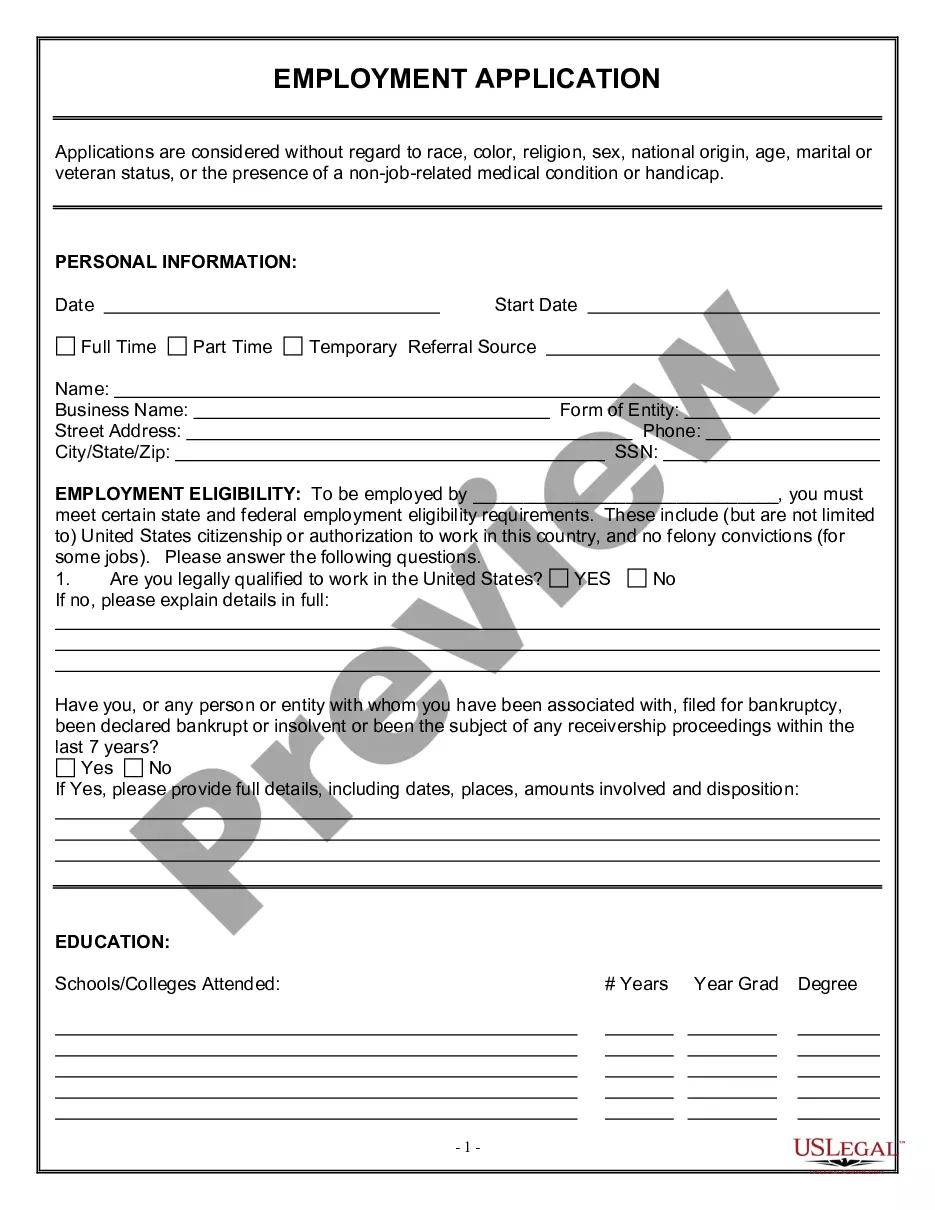

How to fill out Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

US Legal Forms - one of several biggest libraries of authorized forms in the United States - offers a variety of authorized file layouts you may acquire or printing. While using site, you can get a huge number of forms for enterprise and specific functions, sorted by groups, suggests, or key phrases.You can get the newest variations of forms like the Indiana Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC within minutes.

If you already have a registration, log in and acquire Indiana Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC in the US Legal Forms collection. The Acquire key can look on every single form you view. You have access to all previously downloaded forms in the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, here are straightforward directions to help you get started:

- Be sure to have picked the proper form for your personal metropolis/region. Go through the Preview key to examine the form`s content material. Browse the form outline to ensure that you have chosen the proper form.

- In the event the form does not fit your demands, use the Research area towards the top of the monitor to obtain the the one that does.

- In case you are satisfied with the form, validate your choice by visiting the Get now key. Then, choose the pricing plan you favor and give your qualifications to sign up on an bank account.

- Approach the transaction. Make use of bank card or PayPal bank account to finish the transaction.

- Pick the file format and acquire the form in your device.

- Make modifications. Fill out, revise and printing and sign the downloaded Indiana Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC.

Each format you included with your money lacks an expiry particular date which is your own property for a long time. So, if you wish to acquire or printing an additional copy, just go to the My Forms section and click on the form you want.

Obtain access to the Indiana Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC with US Legal Forms, probably the most comprehensive collection of authorized file layouts. Use a huge number of specialist and status-certain layouts that meet your business or specific needs and demands.

Form popularity

FAQ

You have to contact your 401(k) plan's administrator to withdraw funds. Consumers can reach out to human resources from their companies to get more details.

Acquisition expands Empower's reach across retirement services market to more than 17 million individuals and $1.4 trillion in AUA. GREENWOOD VILLAGE, Colo. April 4, 2022?Empower today announced it has completed the previously announced acquisition of Prudential Financial, Inc.'s full-service retirement business.

PGIM is the investment management business of Prudential Financial, Inc.

Generally, you'll need to complete some paperwork, and describe why you need early access to your retirement funds. Unless you're 59 1/2 or older, the IRS will tax your traditional 401(k) withdrawal at your ordinary income rate (based on your tax bracket) plus a 10 percent penalty.

Based on former employees' testimony, investors alleged that Prudential already knew in February that there had recently been an unexpected number of deaths among holders of 700,000 policies the company purchased from another insurer.

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

All distribution requests are sent for approval -- this action is typically completed by your Employer. Once the distribution is reviewed and approved, the payment will be processed. Payments are generally received within 7-10 business days for a check; 5-7 business days for direct deposit (if available).

If you are eligible, you may have the option to request a withdrawal online by logging in Opens in new window to your account and navigating to the Withdrawals page for a display of your options. Depending on your plan, you may be required to complete forms.