Indiana Letter to limited partners

Description

How to fill out Letter To Limited Partners?

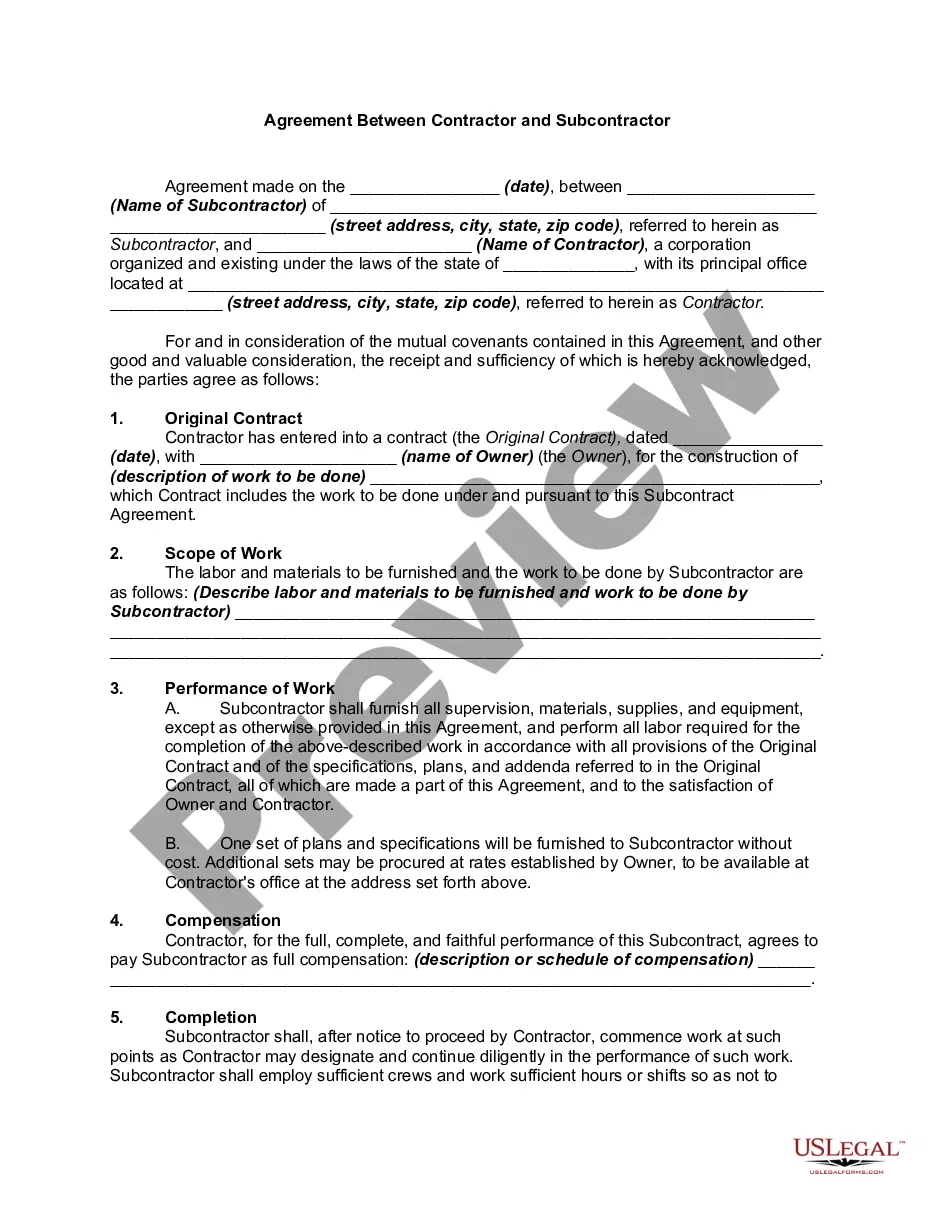

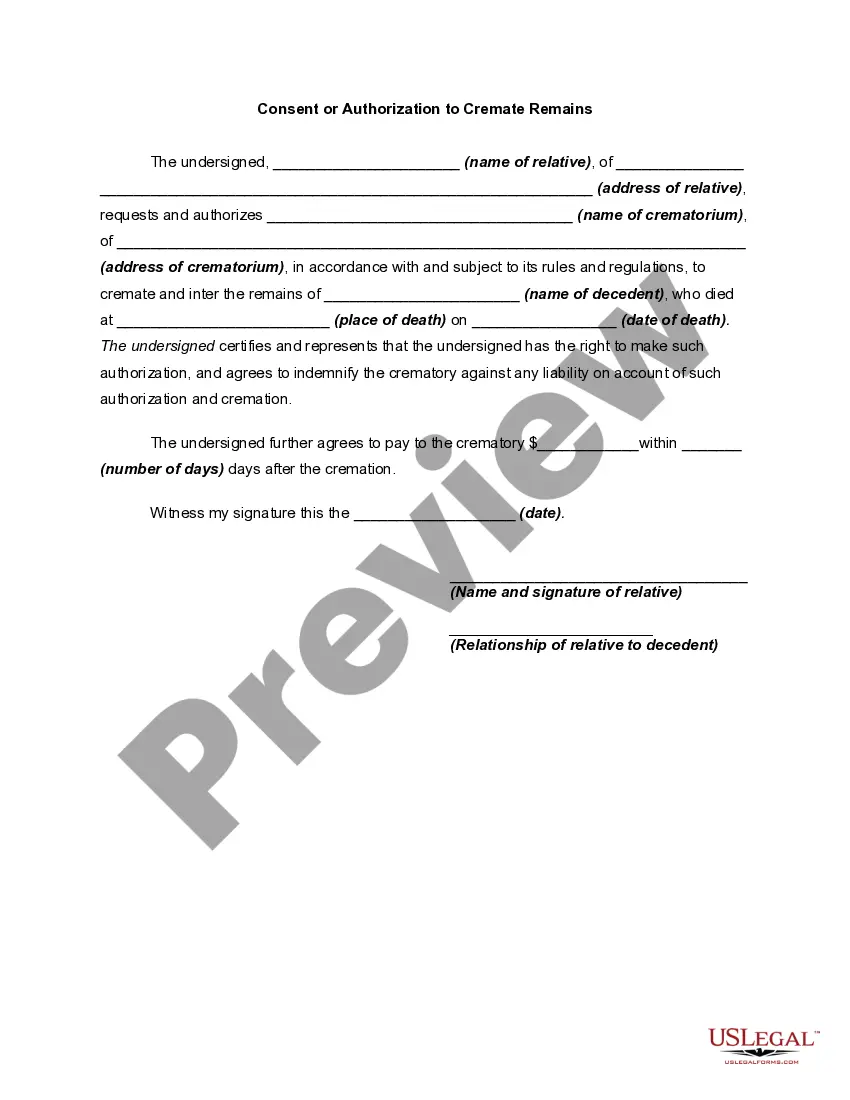

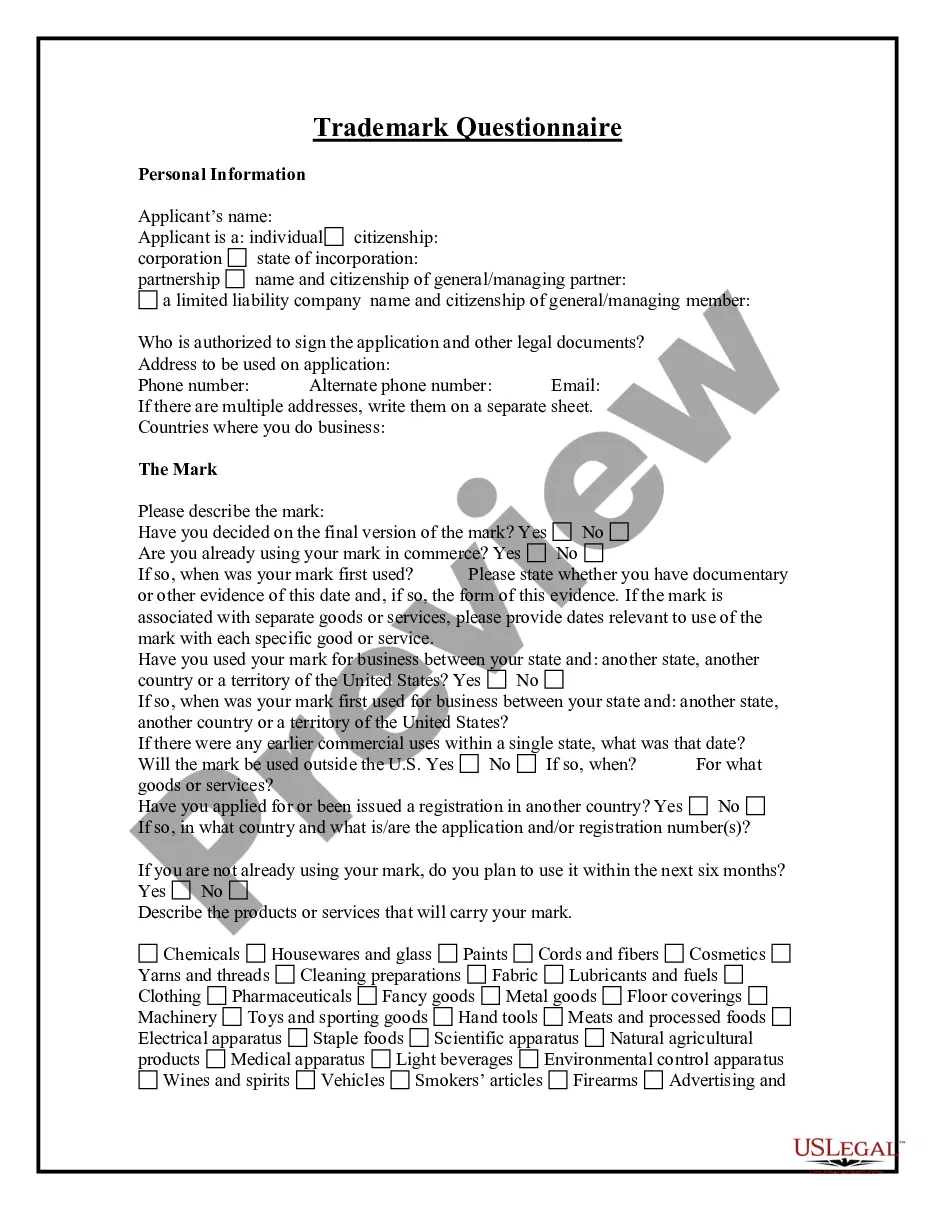

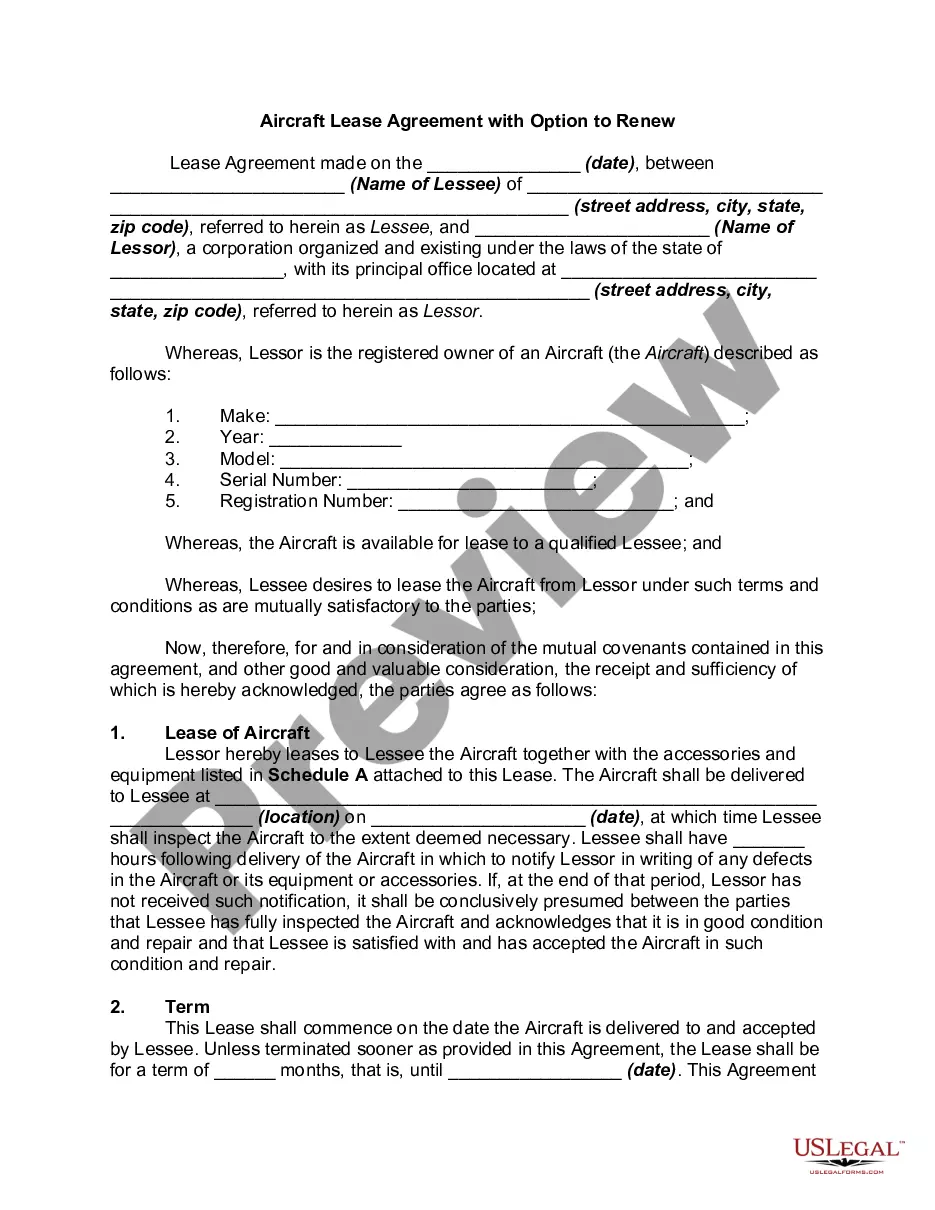

Choosing the best legal document design could be a battle. Of course, there are tons of themes available on the Internet, but how can you obtain the legal type you require? Make use of the US Legal Forms website. The service offers a huge number of themes, such as the Indiana Letter to limited partners, which can be used for company and private needs. All of the forms are examined by pros and meet state and federal demands.

In case you are currently listed, log in to the account and click on the Down load option to obtain the Indiana Letter to limited partners. Make use of account to appear with the legal forms you may have ordered earlier. Visit the My Forms tab of your respective account and obtain one more copy of your document you require.

In case you are a fresh end user of US Legal Forms, listed below are simple recommendations that you should adhere to:

- First, make sure you have chosen the correct type for your metropolis/region. You can examine the shape using the Review option and study the shape information to ensure this is basically the right one for you.

- When the type fails to meet your needs, make use of the Seach area to find the correct type.

- When you are sure that the shape is suitable, select the Acquire now option to obtain the type.

- Pick the prices prepare you need and type in the needed info. Create your account and buy your order using your PayPal account or credit card.

- Select the document file format and down load the legal document design to the gadget.

- Complete, edit and produce and indicator the received Indiana Letter to limited partners.

US Legal Forms will be the biggest local library of legal forms for which you can discover various document themes. Make use of the service to down load skillfully-produced files that adhere to state demands.

Form popularity

FAQ

In basic terms, the owners of an LLP are considered partners in an organization, while the owners of an LLC are members. As a result, there are key differences between how the limited liability protection is recognized, how an LLC and LLP are managed and how each structure is taxed.

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.

A Limited Liability Partnership (LLP) is formed and governed based on the Indiana Uniform Partnership Act. An LLP is considered a blend of a corporation and a partnership. Beyond the assets that were invested in the partnership, none of the partners may be held personally responsible for the actions of other parties.

The general partners bear 100% of the risk of liability for the debts of the business, the limited partners risk only their capital contributions, and nothing more. Limited partners may not take a role in the management of the business.

Ing to the Indiana Secretary of State, All Corporations, Limited Liability Companies, Limited Partnerships, and Limited Liability Partnerships must maintain a Registered Agent and Registered Address within the State of Indiana. The Registered Agent is the legal representative and contact for the business.

Limited partnerships (LP): LPs need to file a Certificate of Limited Partnership to do business within Indiana. Like a general partnership, they too may create a partnership agreement. Limited liability partnerships (LLP): LLPs must turn in an Application for Registration of an LLP with the state.

Ing to the Indiana Secretary of State, All Corporations, Limited Liability Companies, Limited Partnerships, and Limited Liability Partnerships must maintain a Registered Agent and Registered Address within the State of Indiana. The Registered Agent is the legal representative and contact for the business.

Limited liability partnership (LLP) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Partners will not be liable for the tortious damages of other partners but potentially for the contractual debts depending on the state.