Indiana Proposal to authorize and issue subordinated convertible debentures

Description

How to fill out Proposal To Authorize And Issue Subordinated Convertible Debentures?

If you have to comprehensive, down load, or printing legitimate file layouts, use US Legal Forms, the biggest variety of legitimate forms, which can be found on the Internet. Make use of the site`s easy and handy lookup to obtain the documents you need. Numerous layouts for business and specific functions are sorted by types and says, or keywords and phrases. Use US Legal Forms to obtain the Indiana Proposal to authorize and issue subordinated convertible debentures with a handful of clicks.

Should you be presently a US Legal Forms customer, log in for your bank account and click on the Download option to get the Indiana Proposal to authorize and issue subordinated convertible debentures. You can even gain access to forms you earlier downloaded inside the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the right town/country.

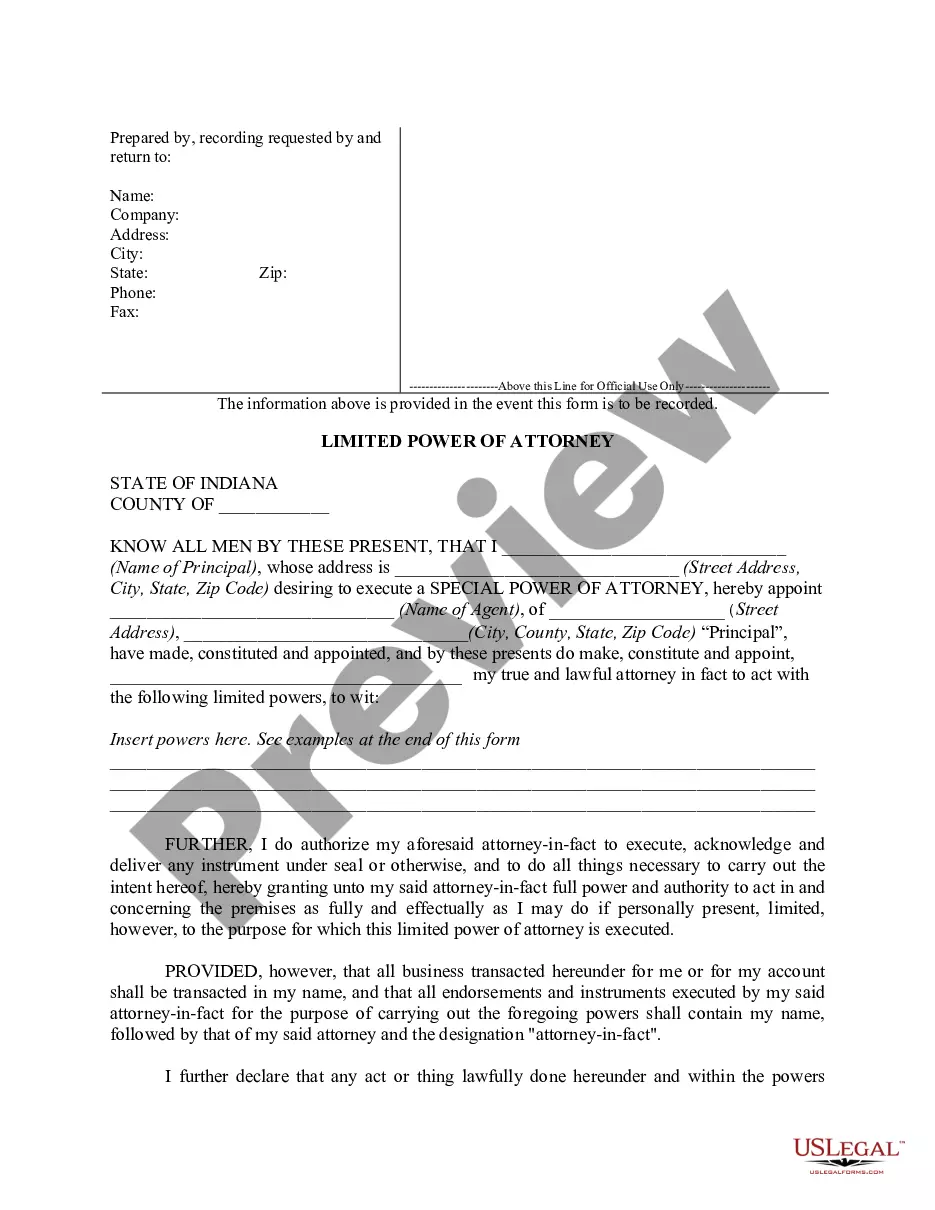

- Step 2. Utilize the Preview solution to look over the form`s information. Do not forget about to see the outline.

- Step 3. Should you be unhappy together with the develop, use the Look for discipline on top of the monitor to get other types from the legitimate develop design.

- Step 4. Once you have located the shape you need, click on the Get now option. Select the prices strategy you prefer and add your credentials to sign up on an bank account.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal bank account to finish the transaction.

- Step 6. Pick the file format from the legitimate develop and down load it on your own product.

- Step 7. Total, revise and printing or signal the Indiana Proposal to authorize and issue subordinated convertible debentures.

Each legitimate file design you get is your own property for a long time. You have acces to every single develop you downloaded within your acccount. Go through the My Forms portion and choose a develop to printing or down load again.

Remain competitive and down load, and printing the Indiana Proposal to authorize and issue subordinated convertible debentures with US Legal Forms. There are many specialist and status-certain forms you can utilize to your business or specific needs.

Form popularity

FAQ

A convertible debenture is a hybrid financial instrument that has both fixed income and equity characteristics. In its simplest terms, it is a bond that gives the holder the option to convert into an underlying equity instrument at a predetermined price.

Convertible securities are generally issued by companies to raise funds for their functioning, who usually reserve the right to determine the time of conversion of these securities. Furthermore, these securities also help in enhancing the outreach of a company with a direct positive impact on their market reputation.

A convertible subordinated debenture is a type of debt instrument that can be converted into another security, such as stock. It is subordinate to other debts, meaning it is paid off after other debts are paid. For example, a company may issue a convertible subordinated debenture to raise funds.

Yes, you can issue convertible notes for LLCs, but this approach is rare. Transferring equity to the issuer of a convertible note once the convertible note matures is more complex in such cases, and the process must be laid out in the LLC's operating agreement.

Definition: Optionally convertible debentures are debt securities which allow an issuer to raise capital and in return the issuer pays interest to the investor till the maturity.

The valuation report is not required if issued to domestic investors. Required if raised from foreign investors. If issuing to foreign investors then Convertible notes should be preferred. If issuing to domestic investors then CCD is the only option.

Convertible bonds offer lower interest rates than comparable conventional bonds, so they're a cost-effective way for the company to raise money. Their conversion to shares also saves the company cash, although it risks diluting the share price.

Fully Convertible Debenture: These are debentures in which the whole value of debentures can be converted into equity shares of the company. Partly Convertible Debenture: In this kind of debentures, only a part of the debentures will be eligible for conversion into equity shares.