Indiana Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

Are you in a situation where you need documentation for both business or personal reasons almost every day.

There are numerous valid document templates accessible online, but finding ones that you can trust isn't simple.

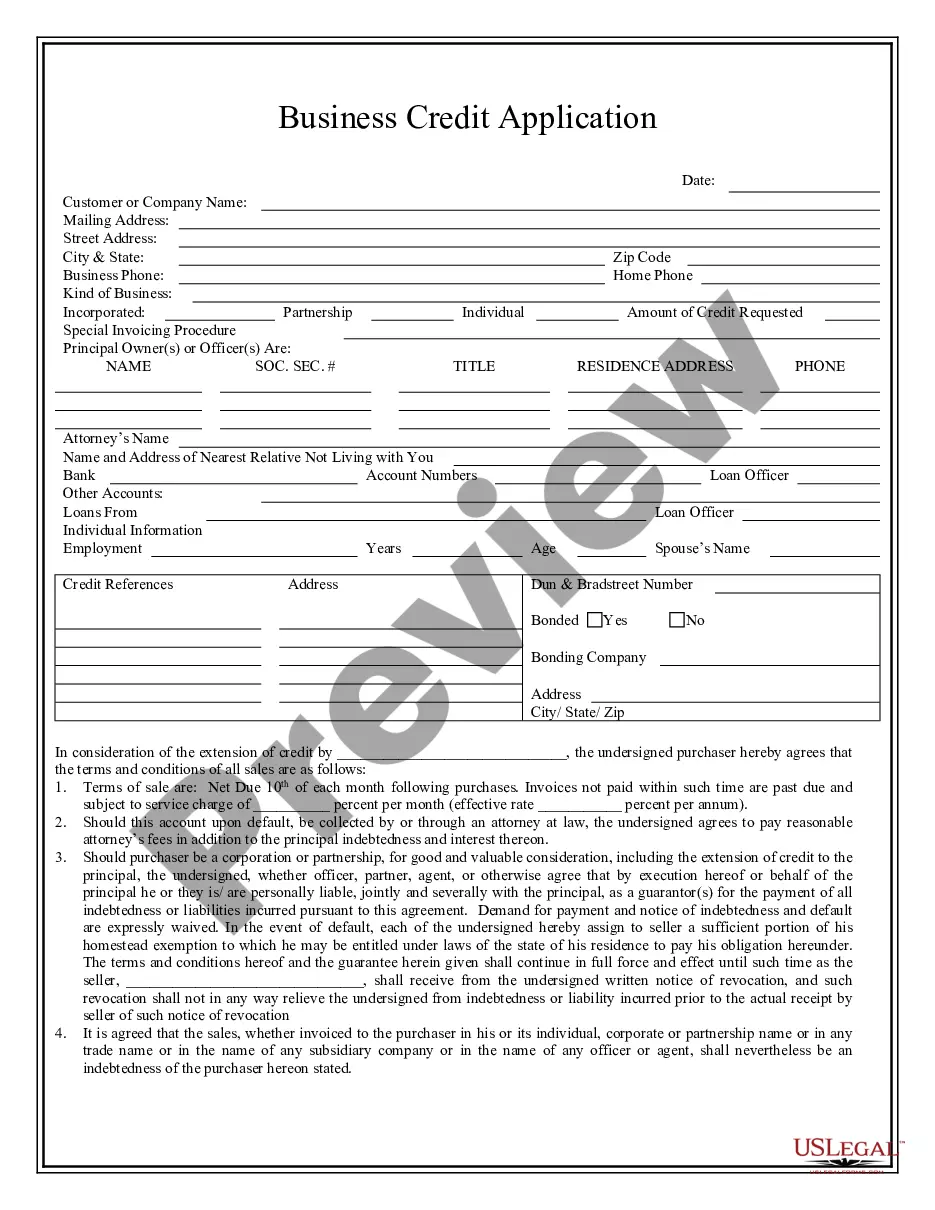

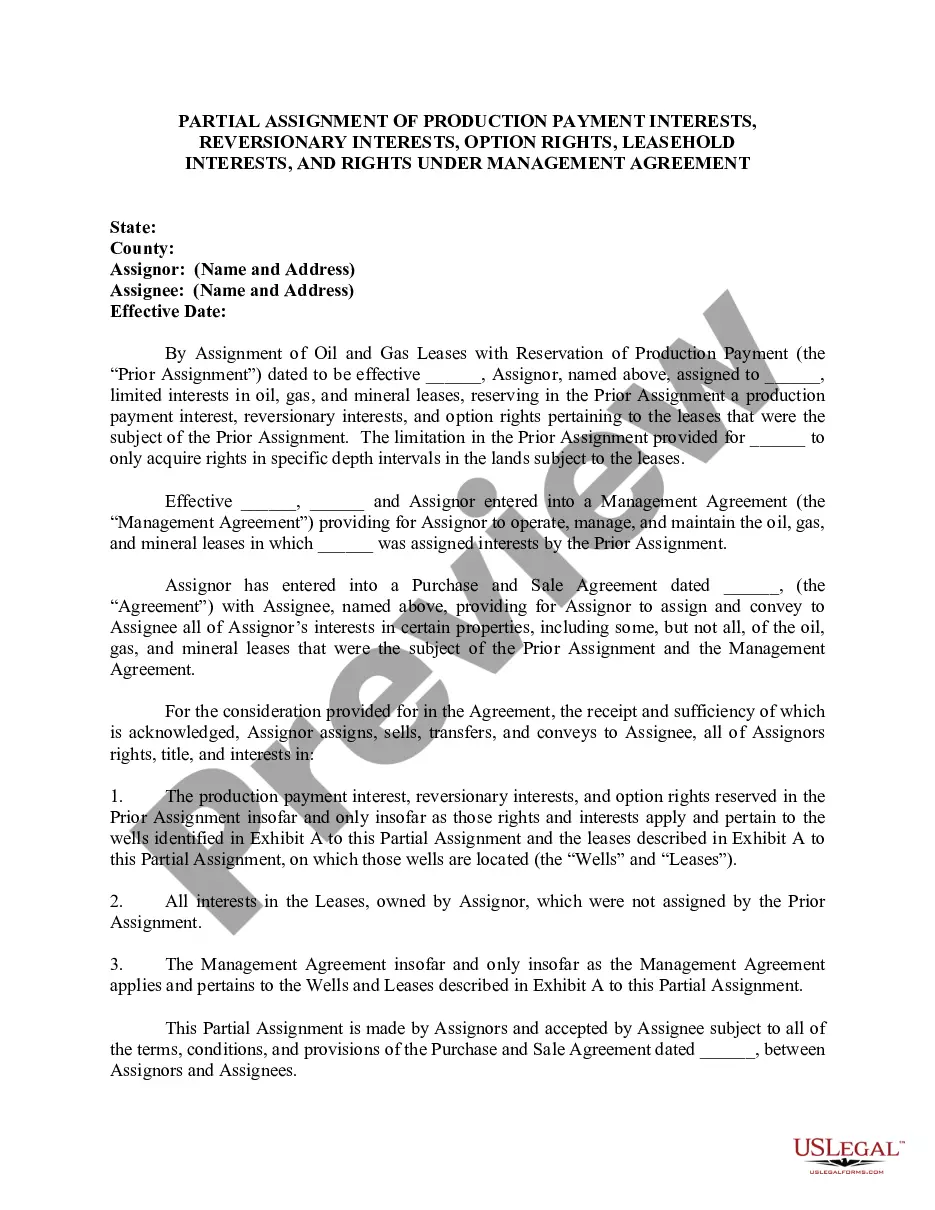

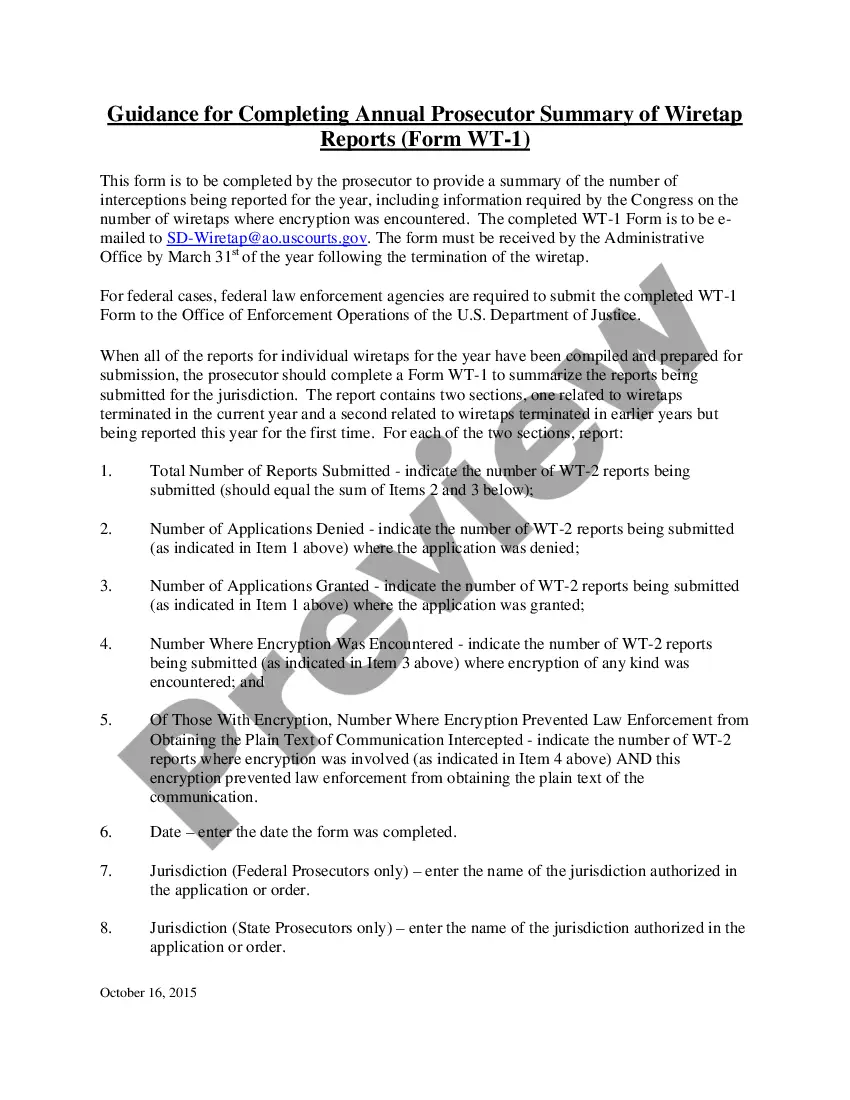

US Legal Forms offers an extensive collection of document templates, including the Indiana Memo - Utilizing Self-Employed Independent Contractors, that are designed to meet federal and state requirements.

Once you find the correct document, click Acquire now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Memo - Utilizing Self-Employed Independent Contractors template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Check the overview to confirm that you have selected the appropriate document.

- If the document isn’t what you’re searching for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

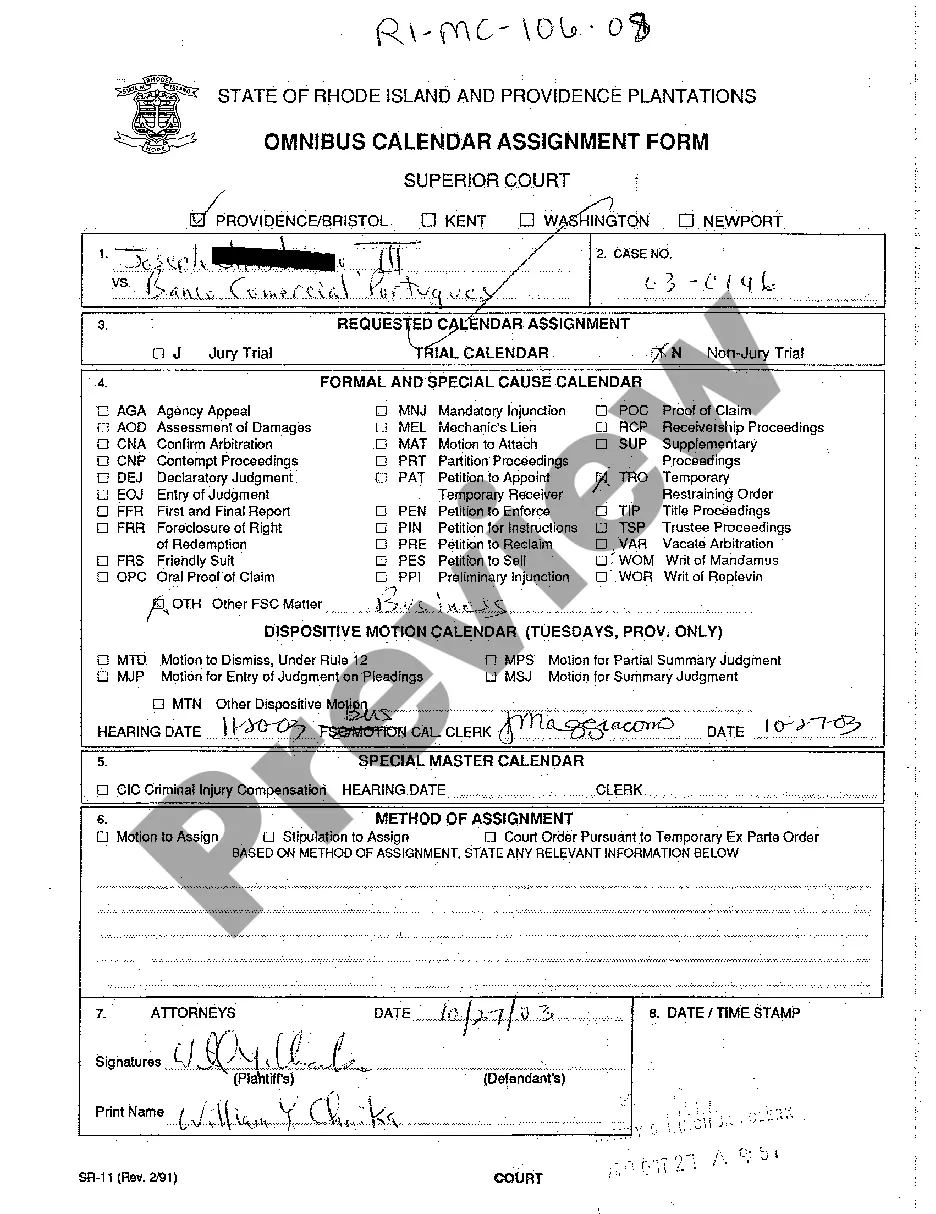

The law defines a worker as an independent contractor if he/she meets the guidelines of the IRS (See statute quote above in section 2). Senate Enrolled Act 576, (Public Law 168), provides that all independent contractors, not just those in the construction trades, may now obtain a clearance certificate.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Independent contractors doing business in the State of Indiana are required to file a statement and documentation with the Indiana Department of Revenue (DOR) stating independent contractor status. There is a five dollar filing fee and the certificate is valid for one year.

As a contractor, this is most likely you. This means that you run your own business as an individual and you are self-employed. Being a sole trader gives you both complete control and responsibility. Your business assets and liabilities are not separate from your personal ones.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

How To Become a Licensed Contractor in Indiana. Unlike plumbers, in Indiana contractor licensing is not regulated at the state level. Instead, contractors are required to register or obtain a license through the various municipal governments throughout the state.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.