Indiana Salaried Employee Appraisal Guidelines - General

Description

How to fill out Salaried Employee Appraisal Guidelines - General?

If you want to compile, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and convenient search feature to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to acquire the Indiana Salaried Employee Evaluation Guidelines - General in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you obtained in your account.

Select the My documents section and choose a form to print or download again. Fill out and download, and print the Indiana Salaried Employee Evaluation Guidelines - General with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to get the Indiana Salaried Employee Evaluation Guidelines - General.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

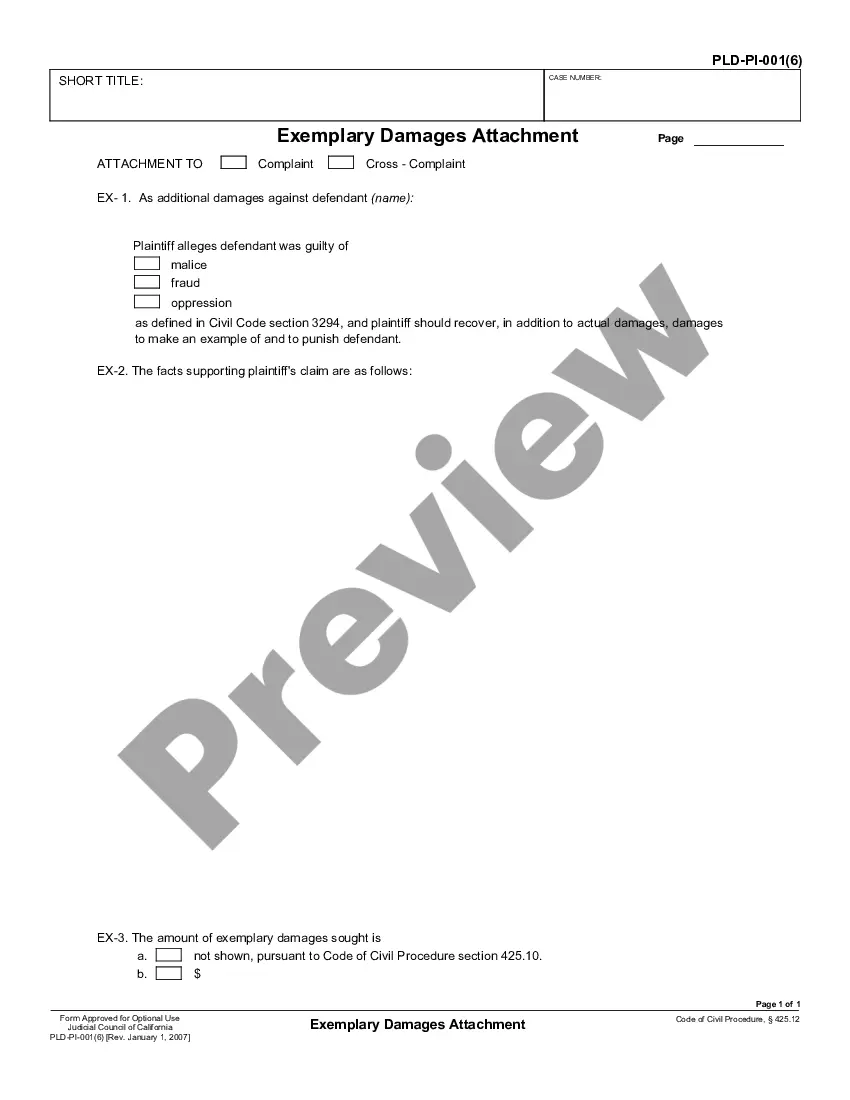

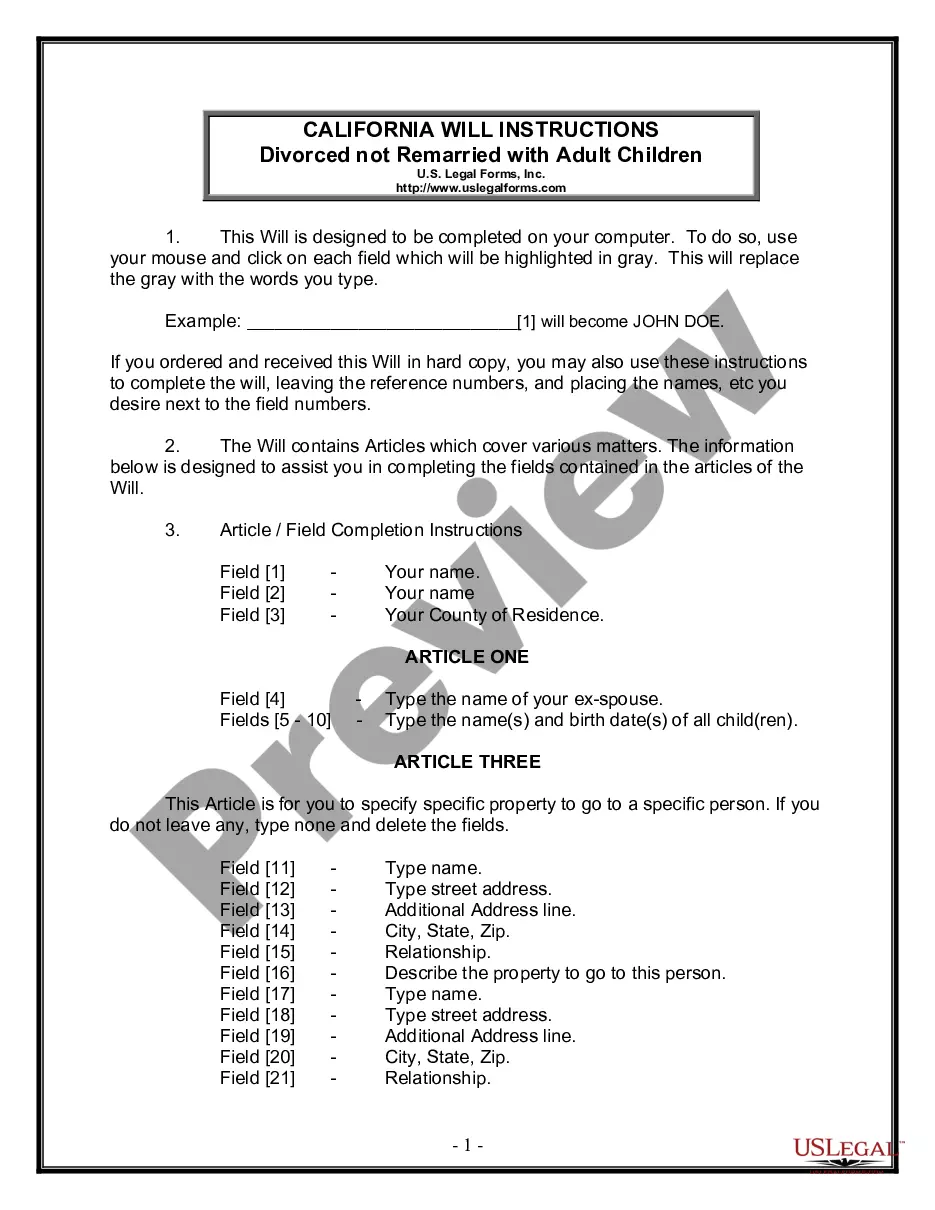

- Step 2. Utilize the Preview feature to review the form’s details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other versions in the legal form library.

- Step 4. After locating the form you require, click the Purchase now option. Choose your preferred pricing plan and provide your information to create an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the payment.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Indiana Salaried Employee Evaluation Guidelines - General.

Form popularity

FAQ

The laws governing salaried employees cover various aspects including wage requirements, classification, and rights regarding overtime. According to the Indiana Salaried Employee Appraisal Guidelines - General, employees classified as exempt are not entitled to overtime but must meet specific criteria. Understanding these laws is crucial for both employers and employees to ensure compliance and fair treatment in the workplace.

Currently, there is one state, Oregon, with full state predictive scheduling regulations that apply to every city. Additionally, Vermont and New Hampshire have specific regulations in place around flexible working hours for employees.

The Indiana Overtime law also referred to as the Indiana Minimum Wage Law, echoes the Federal Fair Labor Standards Act (FLSA) in multiple ways. The two require employees to receive 1½ times their regular hourly pay rate as overtime from their employers, for all hours they work above forty hours during a workweek.

The current minimum wage law in Indiana is $7.25, according to Indiana minimum wage laws. The minimum wage for tipped employees is $2.13. Illinois law requires employers to pay non-exempt employees 1.5 times their regular rate of pay for all hours worked over 40 in a workweek.

To be considered "exempt," these employees must generally satisfy three tests: Salary-level test. Effective January 1, 2020, employers must pay employees a salary of at least $684 per week.

Predictive scheduling is when employers provide employees with their work schedules in advance.

Currently, there is one state, Oregon, with full state predictive scheduling regulations that apply to every city. Additionally, Vermont and New Hampshire have specific regulations in place around flexible working hours for employees. Click through the drop-down menu to learn more about each state.

Fair Labor Standards Act (FLSA) laws mandate that salaried employees working in Indiana who are classified as administrative, executive or professional workers receive at least $455 a week in standard wages.

Technically, California doesn't have any predictive scheduling laws. While a number of bills have been introduced to the California legislature (like most recently, SB 850, better known as the Fair Scheduling Act of 2020), to date, none have officially been signed into law.

Indiana is not one of them, however. According to IRS rules, any portion of a mandatory service charge that the employer pays out to employees must be treated as wages, not tips.