Indiana Expense Reimbursement Form for an Employee

Description

How to fill out Expense Reimbursement Form For An Employee?

If you wish to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site’s user-friendly and efficient search to locate the documents you need.

Various templates for business and personal purposes are classified by type and category, or by keywords. Utilize US Legal Forms to find the Indiana Expense Reimbursement Form for an Employee in just a few clicks.

Every legal document template you download is yours permanently. You can access every form you acquired in your account. Go to the My documents section and select a form to print or download again.

Complete the download and print the Indiana Expense Reimbursement Form for an Employee using US Legal Forms. There are numerous professional and state-specific forms you may utilize for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to obtain the Indiana Expense Reimbursement Form for an Employee.

- You can also access forms you previously obtained within the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

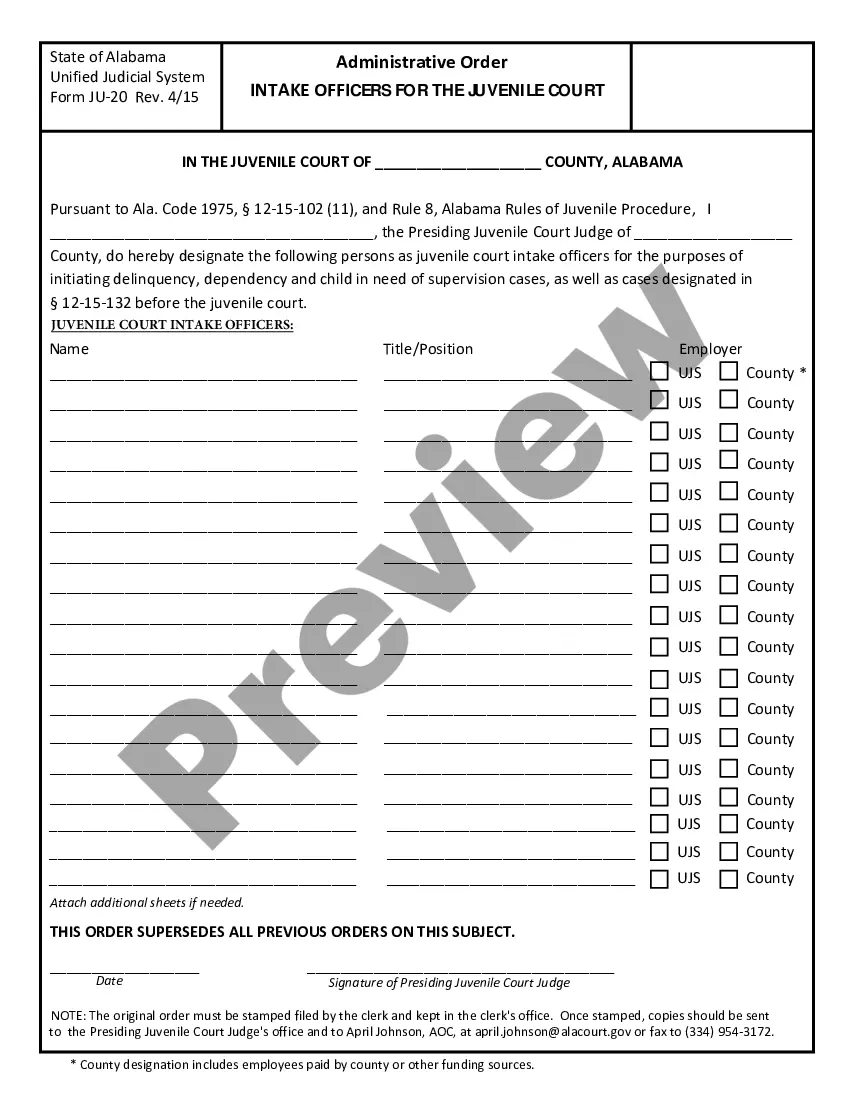

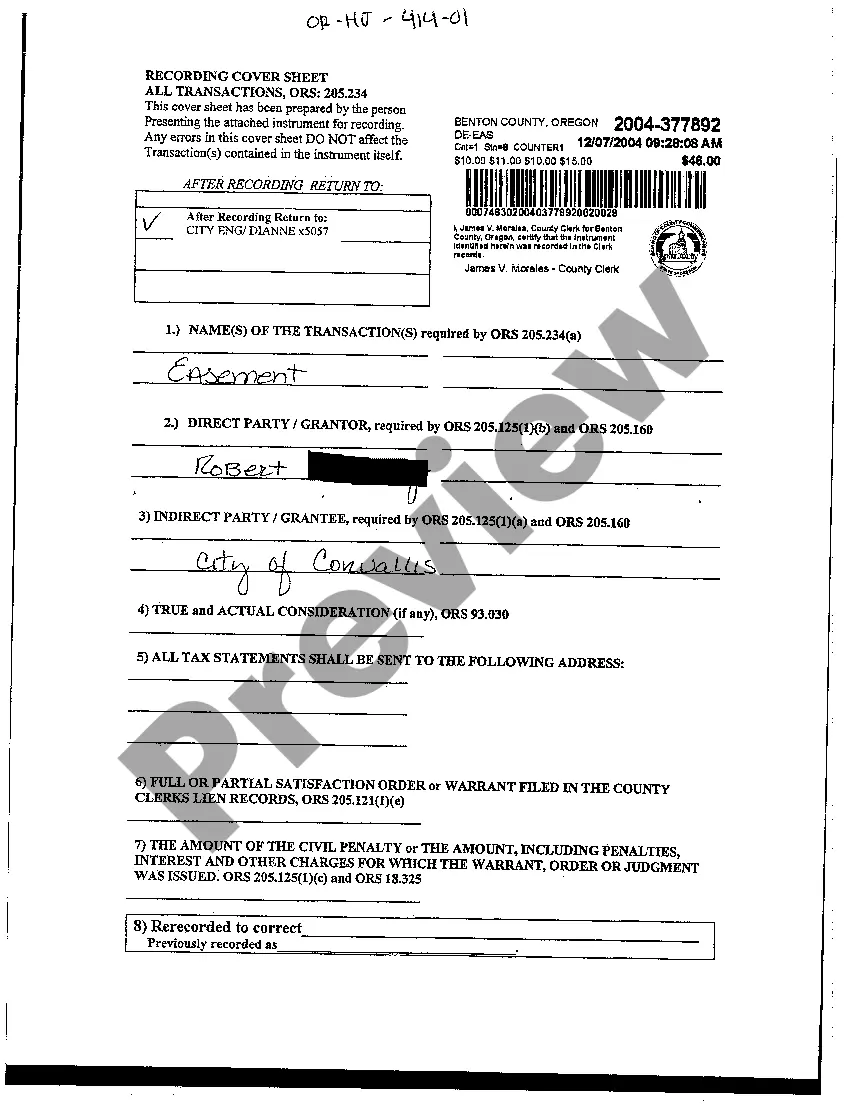

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now option. Choose your preferred payment method and input your credentials to set up an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Expense Reimbursement Form for an Employee.

Form popularity

FAQ

Accountable Plans there must be a business condition for the expenses; the expense must be in connection with performance of services as an employee. the reimbursement must be for an expense the employee could deduct on his/her tax return.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Accountable Plans An accountable plan is a reimbursement arrangement that requires employees to substantiate their business-related expenses to the company within a reasonable timeframe (no more than 60 days from the date of the expense).

An employee expense reimbursement policy is the process an employee must follow in order to be paid back by their employer when incurring business-related expenses. Typically, a reimbursement policy is related to an employee traveling for work, engaging in business dinners, or purchasing work-related supplies or tools.

How to Complete an Expense Reimbursement Form:Add personal information.Enter purchase details.Sign the form.Attach receipts.Submit to the management or accounting department.

To offer an accountable plan, an employer must comply with three standards: The expenses must have a business connection; The expenses must be substantiated within a reasonable period; and. The employee must return any money not spent to the employer, also within a reasonable period.

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

What Expenses Should a Business Cover?Business-related travel. Airfare, train, and/or other transportation expenses should be reimbursed to employees.Meals. Employees should also be reimbursed for meals as part of travel or business-related activities.Smartphones.Accommodations for travel.Training.

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.