Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Are you presently in a situation where you must have documentation for either business or personal reasons nearly every workday.

There are numerous legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers thousands of document templates, such as the Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which are designed to meet federal and state requirements.

Once you find the correct document, click Purchase now.

Select a convenient file format and download your version.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the document you need and ensure it is for the correct city/region.

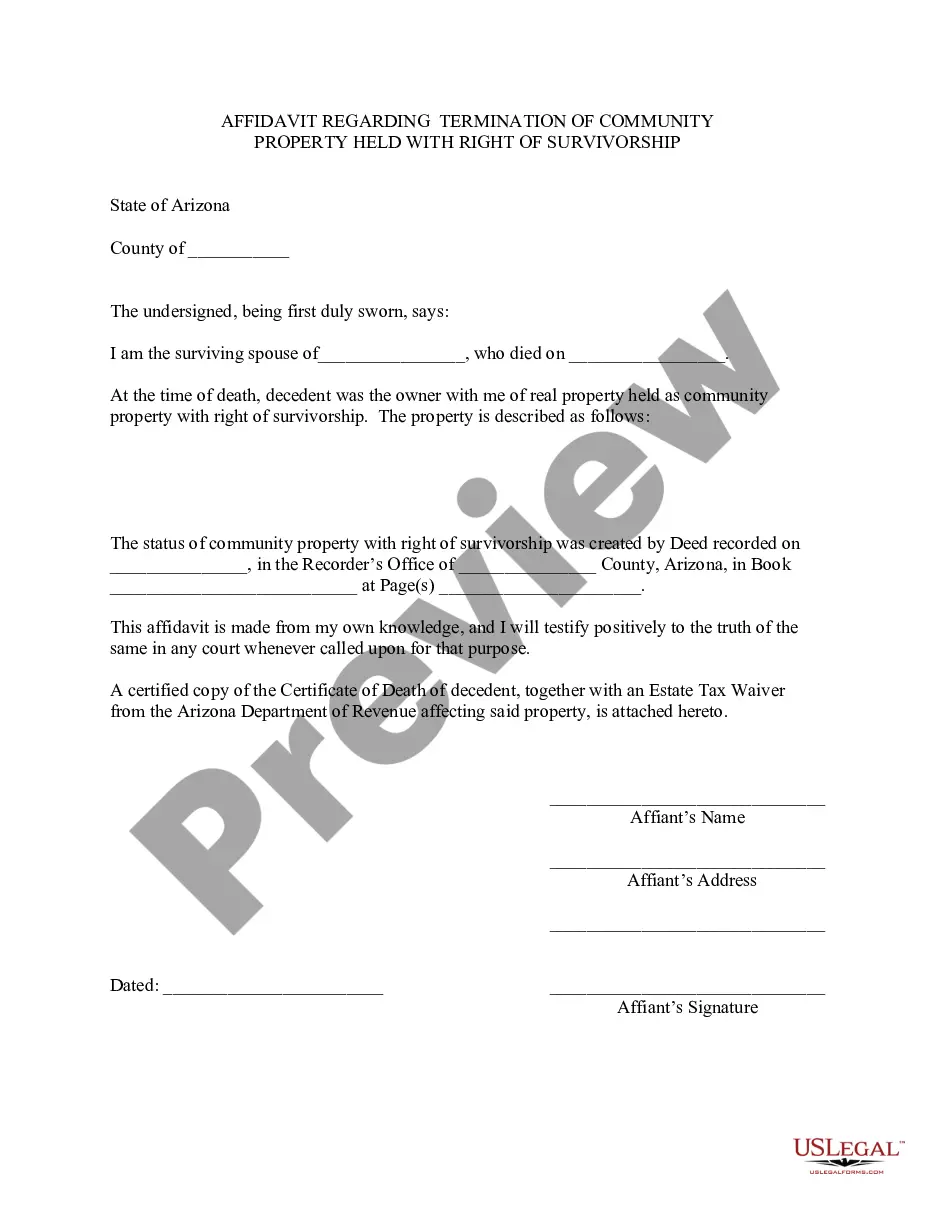

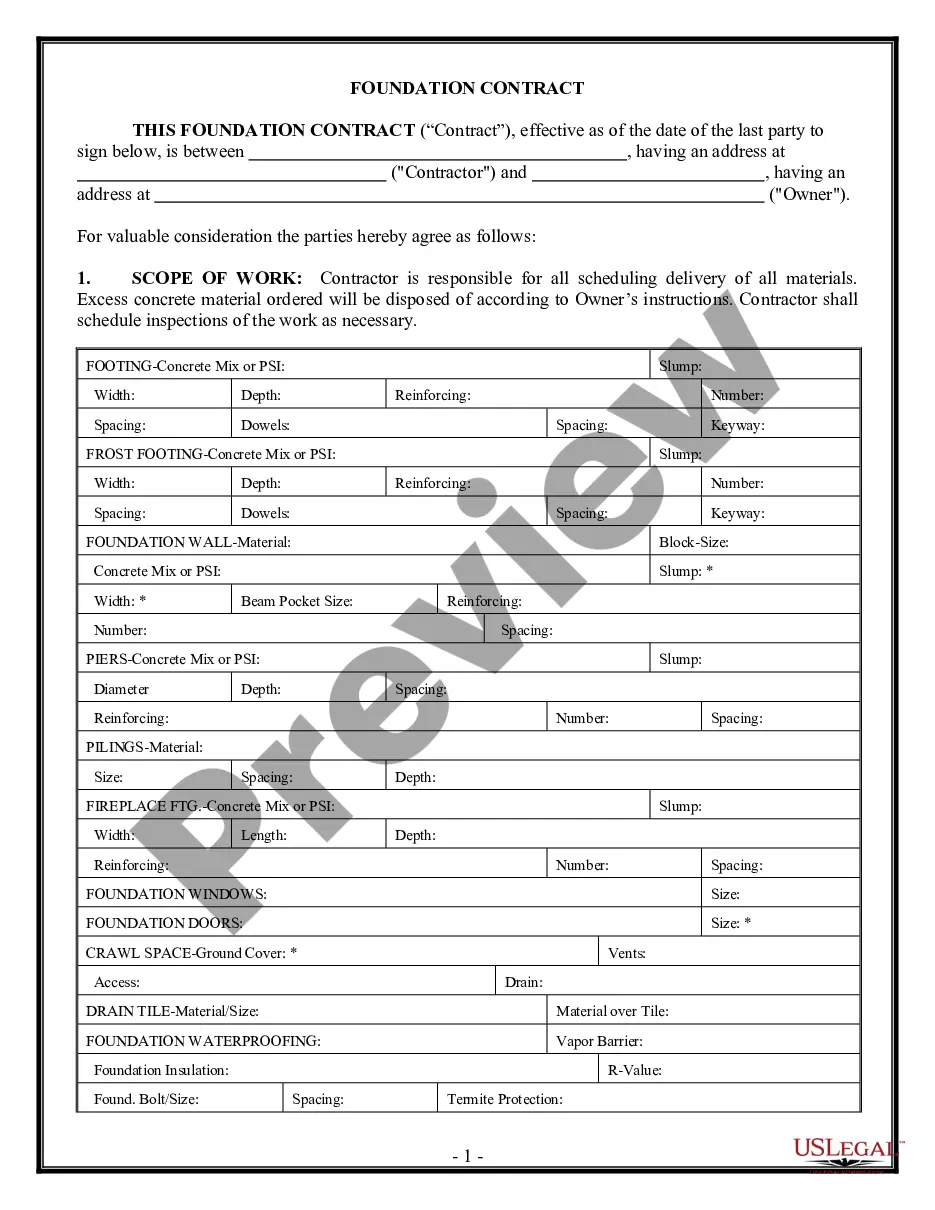

- Utilize the Review button to assess the form.

- Check the details to confirm that you have chosen the appropriate document.

- If the document is not what you are seeking, use the Search field to find the form that meets your needs.

Form popularity

FAQ

: a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Most special meetings involve director elections, which typically work pursuant to a less-restrictive plurality standard, rather than a majority standard.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meetings of the Board for any purpose or purposes may be called at any time by the chairman of the Board, the chief executive officer, the secretary or any two directors. The person(s) authorized to call special meetings of the Board may fix the place and time of the meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.