Indiana LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Are you located in a situation where you need documents for either business or specialized objectives almost every workday? There are numerous legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers thousands of document templates, including the Indiana LLC Operating Agreement for S Corp, which is designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Indiana LLC Operating Agreement for S Corp template.

Choose a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Indiana LLC Operating Agreement for S Corp at any time, if needed. Simply navigate to the required document to download or print the template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/county.

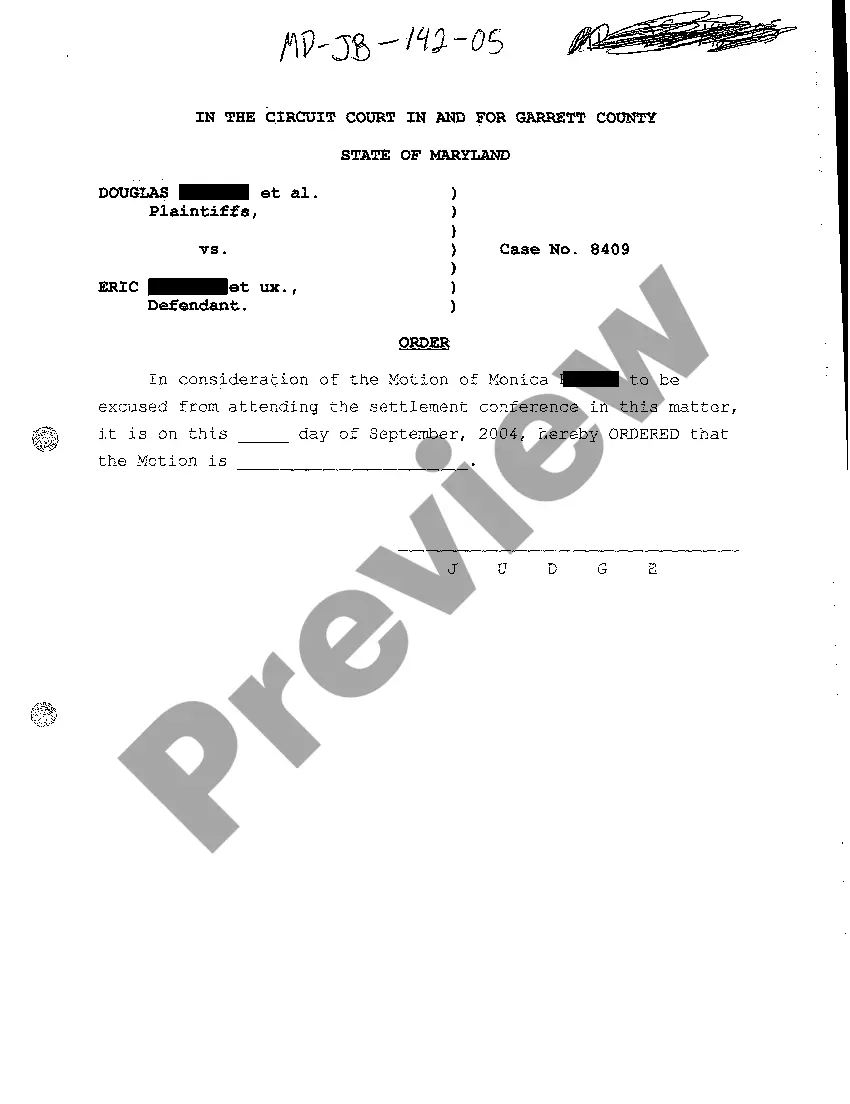

- Use the Preview button to view the form.

- Check the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs and requirements.

- Once you find the correct document, click Buy now.

- Select the pricing plan you prefer, provide the required information to set up your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Yes, Indiana allows the formation of single-member LLCs. This means you can operate your business as the sole owner while enjoying limited liability protection. A single-member LLC can also choose to be taxed as a partnership, providing flexibility in how you manage taxes. Be sure to create an Indiana LLC Operating Agreement - Taxed as a Partnership for clarity on how your business is run.

You can switch your limited liability company's (LLC) tax status to an S corporation, provided it meets the Internal Revenue Service's (IRS) requirements. You don't have to change your business structure, but you'll need to file a form with the IRS.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

For federal tax purposes, you can simply make an election for the LLC to be taxed as an S-Corporation. All you need to do is fill out a form and send it to the IRS. Once the LLC is classified for federal tax purposes as a Corporation, it can file Form 2553 to be taxed as an S-Corporation.

The reason the Indiana Business Flexibility Act does not require an operating agreement is that it contains default rules that govern the LLC if there is no operating agreement (or if there is an operating agreement but it doesn't address every issue). However, those default rules may or may not be what you want.

You can start an S corporation (S corp) in Indiana by forming a limited liability company (LLC) or a corporation, and then electing S corp status from the IRS when you apply for your EIN. An S corp is an IRS tax classification, not a business structure. The S corp status is used to reduce a business's tax burden.

Is an LLC Operating Agreement required in Indiana? No, Indiana does not require LLCs to create an Operating Agreement as a legal document to operate.

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to