Indiana Worksheet - New Product or Service

Description

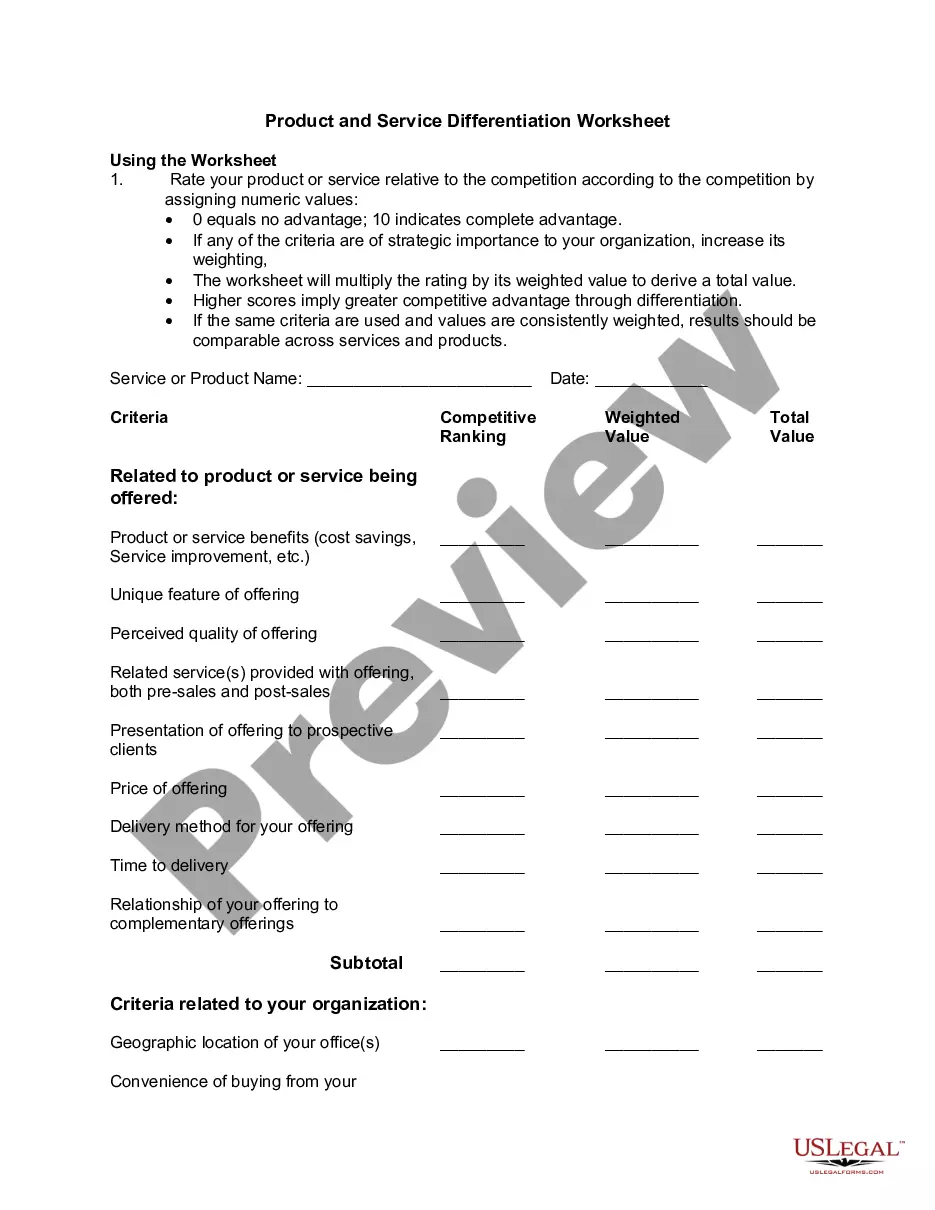

How to fill out Worksheet - New Product Or Service?

It is feasible to spend time on the web trying to locate the legal document template that complies with the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

You can download or create the Indiana Worksheet - New Product or Service from our platform.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Next, you can complete, modify, produce, or sign the Indiana Worksheet - New Product or Service.

- Each legal document template you obtain is yours permanently.

- To get another copy of the purchased form, visit the My documents tab and select the relevant option.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, make sure that you have chosen the right document template for the area/city of your preference.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Qualifying for sales tax exemption requires the completion and filing of an application form prescribed by the Indiana Department of Revenue. The taxpayer Identification Number (TID) above must be provided to the retailer if purchases are to be exempt from sales tax.

Whatever number is reported on line H is the number of allowances you can claim. However, if you want to have the maximum withheld from your paycheck, simply enter a 0 for lines A G, and line H.

Although the Indiana sales tax is not aimed at services, certain services are specifically subject to the tax (See below). The rate of the Indiana sales tax is 7%, tying it with Mississippi, New Jersey, Rhode Island, and Tennessee for second highest rate in the U. S., behind California at 7.25%.

Generally, purchases of tangible personal property, accommodations, or utilities made directly by Indiana state and local government entities are exempt from sales tax.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Goods that are subject to sales tax in Indiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries and prescription medicine are tax-exempt.

Are services subject to sales tax in Indiana? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Indiana, services are generally not taxable.

2713 Taxpayer Identification Number (TID).

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.22-Sept-2021