Indiana Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

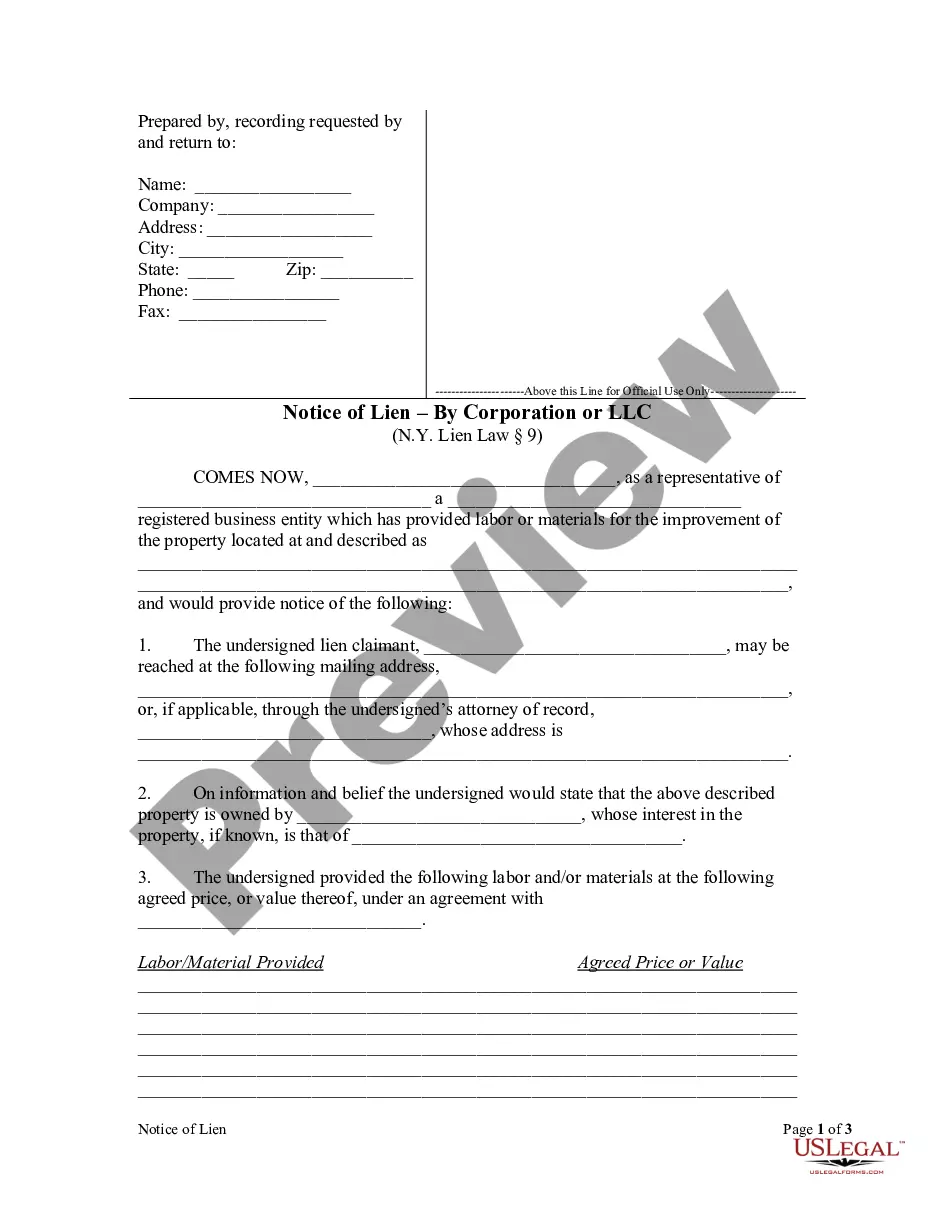

How to fill out Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

US Legal Forms - one of the biggest libraries of authorized types in America - offers a wide range of authorized file themes you are able to obtain or print. While using internet site, you may get a large number of types for organization and individual purposes, sorted by categories, claims, or keywords.You can get the newest models of types such as the Indiana Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption within minutes.

If you currently have a monthly subscription, log in and obtain Indiana Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption in the US Legal Forms collection. The Acquire option will show up on every single form you look at. You have access to all in the past saved types in the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, allow me to share simple guidelines to obtain started out:

- Be sure you have picked the right form for your town/region. Select the Preview option to analyze the form`s articles. Look at the form explanation to actually have selected the appropriate form.

- In the event the form does not suit your requirements, make use of the Search area near the top of the screen to discover the one that does.

- When you are pleased with the form, validate your option by clicking the Buy now option. Then, opt for the costs prepare you like and offer your references to sign up to have an profile.

- Process the transaction. Make use of your Visa or Mastercard or PayPal profile to complete the transaction.

- Choose the structure and obtain the form on your system.

- Make alterations. Fill up, edit and print and indication the saved Indiana Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption.

Each web template you included in your bank account lacks an expiry time which is yours for a long time. So, if you want to obtain or print an additional duplicate, just go to the My Forms portion and click around the form you want.

Obtain access to the Indiana Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption with US Legal Forms, by far the most considerable collection of authorized file themes. Use a large number of expert and state-certain themes that meet up with your business or individual requirements and requirements.

Form popularity

FAQ

Any individual filing an Indiana tax return may claim a $1,000 exemption for themselves. This exemption is available even if the individual can be claimed as a dependent on another taxpayer's return.

To register for nonprofit status with the state of Indiana, submit a Nonprofit Application for Sales Tax Exemption (Form NP-20A) through DOR's e-services portal at INTIME.dor.in.gov. For more information, call 317-232-0129.

Indiana law does provide exemptions for transactions involving manufacturing equipment, but only if that equipment has an ?immediate effect? on what is being produced and are ?an essential part of an integrated process? to produce tangible personal property.

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

What is the Indiana personal exemption? Individuals are allowed a $1,000 exemption on their adjusted gross income tax return. In addition, an individual can claim a second $1,000 exemption for the individual's spouse, if filing a joint return.

You are generally allowed one exemption for yourself if you cannot be claimed as a dependent on any other taxpayer's return ? whether or not the other taxpayer chooses to claim you.

Tax exemptions reduce the amount of income you owe tax on. Instead of having to pay taxes on your gross earnings, you're allowed to subtract certain figures from this amount to arrive at your AGI.

Tax-exempt customers Some customers are exempt from paying sales tax under Indiana law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.