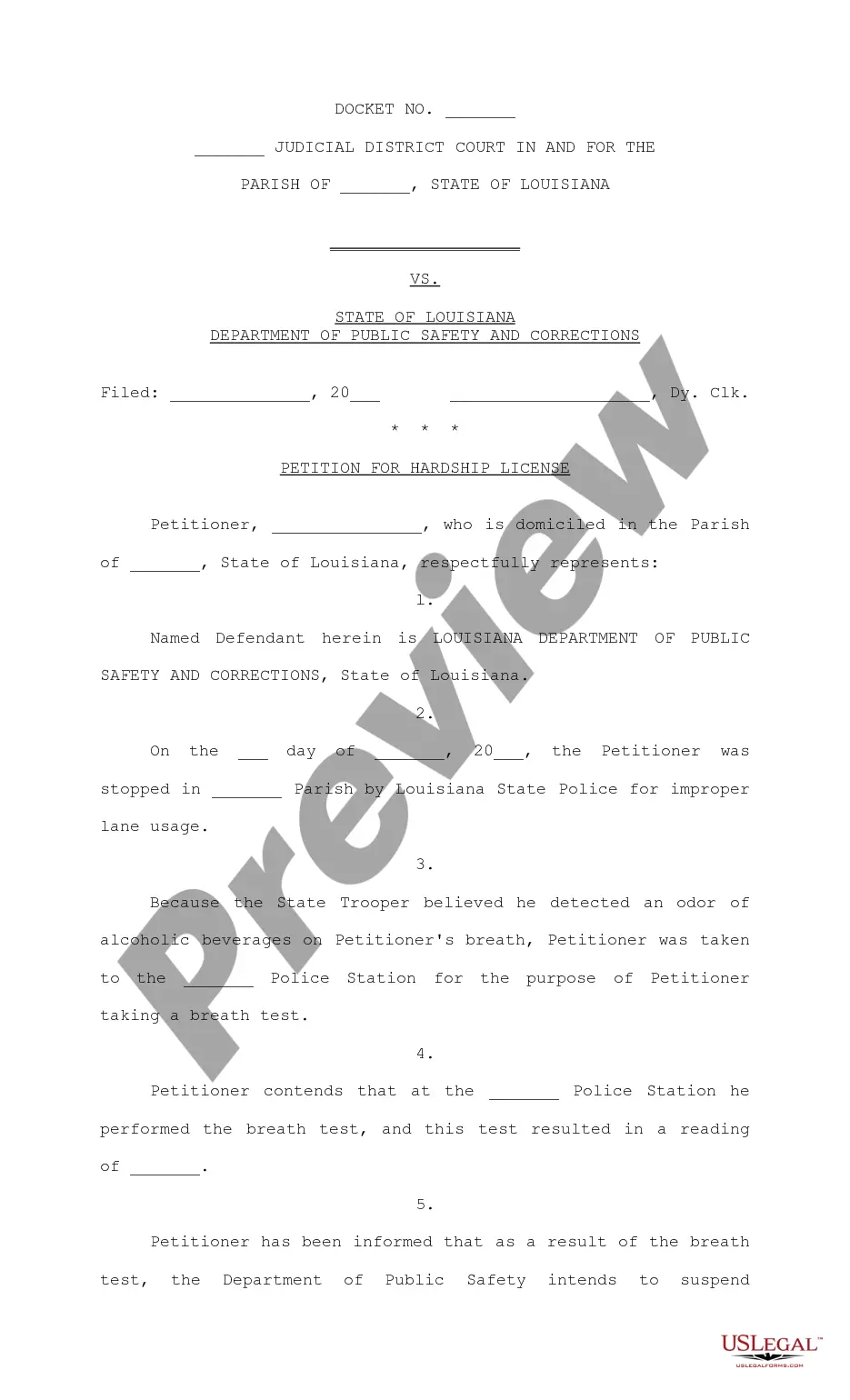

A reverse mortgage is a loan from the U.S. Government for 50% to 75% of the value of a home owned by a homeowner aged 62 and older. Instead of making monthly payments to a lender, as with a regular mortgage, a lender makes payments to the homeowner. The funds from a reverse mortgage are tax-free. The loan doesn't have to be repaid in the homeowner's lifetime, however, when the homeowner dies, the money received plus approximately 4% interest is repaid by their estate. The loan is repaid when the homeowner ceases to occupy the home as a principal residence, due to the homeowner (the last remaining spouse, in cases of couples) passing away, selling the home, or permanently moving out.

Indiana Home Equity Conversion Mortgage - Reverse Mortgage

Description

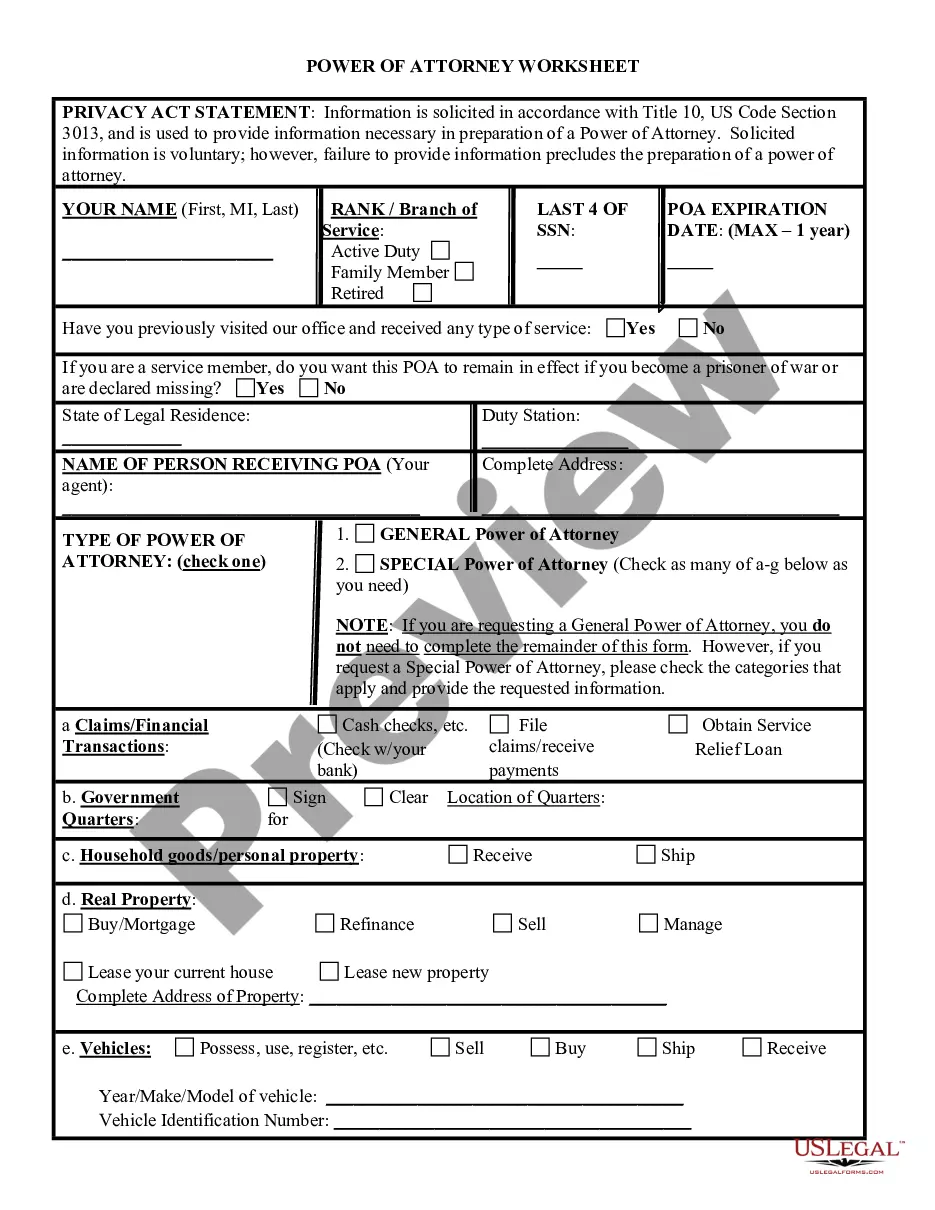

How to fill out Home Equity Conversion Mortgage - Reverse Mortgage?

Choosing the best lawful file web template might be a have a problem. Naturally, there are a variety of themes accessible on the Internet, but how would you get the lawful form you want? Utilize the US Legal Forms internet site. The assistance delivers 1000s of themes, such as the Indiana Home Equity Conversion Mortgage - Reverse Mortgage, which you can use for enterprise and private requires. All of the varieties are inspected by specialists and satisfy federal and state needs.

Should you be previously listed, log in to the profile and then click the Obtain key to obtain the Indiana Home Equity Conversion Mortgage - Reverse Mortgage. Make use of profile to appear through the lawful varieties you possess acquired earlier. Visit the My Forms tab of your own profile and have one more version of the file you want.

Should you be a brand new consumer of US Legal Forms, here are easy directions for you to follow:

- Initial, make sure you have chosen the appropriate form for the area/area. You are able to examine the shape making use of the Review key and read the shape information to guarantee this is the right one for you.

- In case the form will not satisfy your requirements, utilize the Seach area to get the appropriate form.

- Once you are sure that the shape would work, click on the Get now key to obtain the form.

- Opt for the costs strategy you would like and enter the essential information and facts. Create your profile and purchase an order with your PayPal profile or Visa or Mastercard.

- Pick the data file formatting and download the lawful file web template to the product.

- Full, revise and printing and signal the received Indiana Home Equity Conversion Mortgage - Reverse Mortgage.

US Legal Forms is the largest catalogue of lawful varieties where you can see different file themes. Utilize the company to download appropriately-created papers that follow state needs.

Form popularity

FAQ

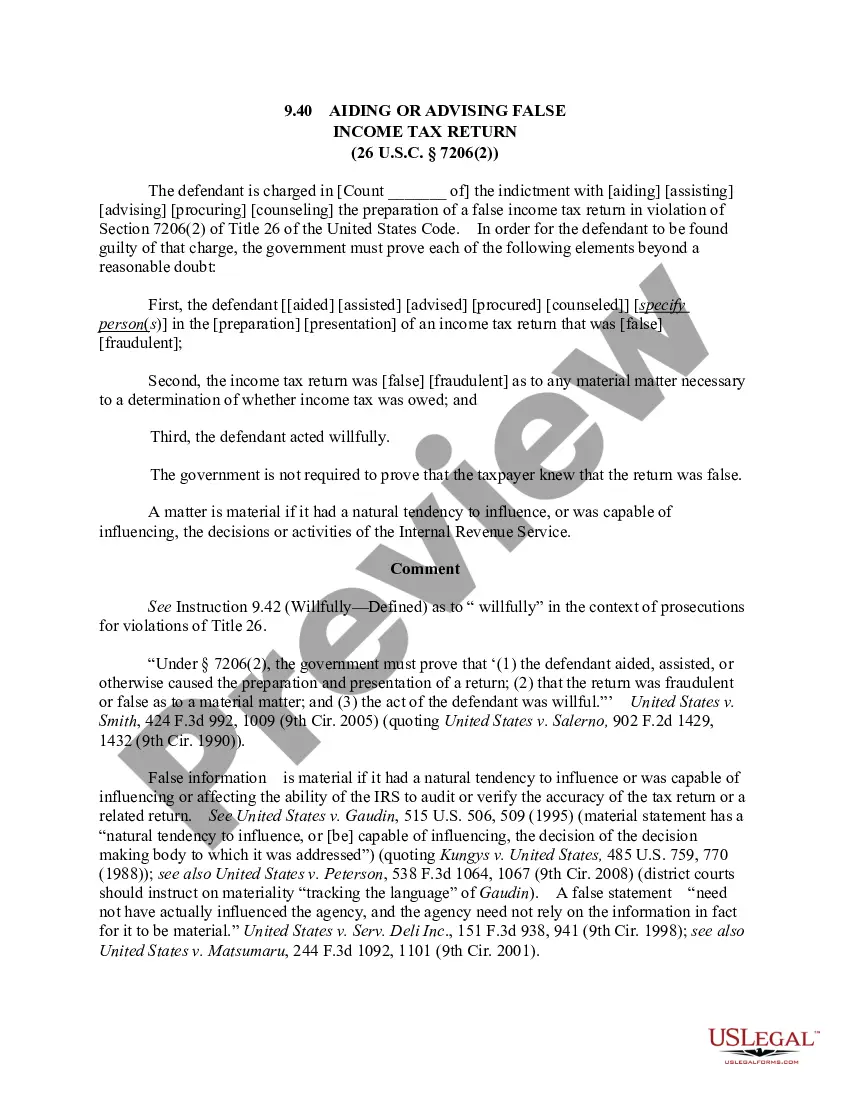

A traditional private reverse mortgage is not necessarily backed by the federal government, whereas an HECM is not only underwritten by HUD, it is also regulated to consumer safety by the federal government as well. This allows interest rates charged to be far lower.

The benefit is that HECM loans are nonrecourse, which means the homeowner or the estate (if the homeowner dies) won't have to pay more at the end of the loan than what the home is worth ? no matter whether the home value at the time of sale is less than the loan amount. Everything You Need to Know About HECM Loans | Mortgages and Advice usnews.com ? loans ? mortgages ? articles usnews.com ? loans ? mortgages ? articles

A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older. This information only applies to Home Equity Conversion Mortgages (HECMs), which are the most common type of reverse mortgage loans.

Cons of HECM You have to live in your home: When you get a HECM, your property must be your principal residence for much of the year. You'll have to pay back the HECM if you sell the home or want to move.

Reverse mortgages represent one way to get the equity out of your home, but they aren't the only way. If you don't qualify for a reverse mortgage but still want to turn your equity to cash, there are options that you can consider.

A reverse mortgage increases your debt and can use up your equity. While the amount is based on your equity, you're still borrowing the money and paying the lender a fee and interest. Your debt keeps going up (and your equity keeps going down) because interest is added to your balance every month. Reverse Mortgages | Consumer Advice - Federal Trade Commission ftc.gov ? articles ? reverse-mortgages ftc.gov ? articles ? reverse-mortgages

The downside of a reverse mortgage can be that the closing costs can be higher than a traditional loan, the property must be your primary residence, the loan is not assumable, and there may be less equity to leave to your heir as an inheritance. Here's the Truth About Reverse Mortgages (No BS) reverse.mortgage ? truth-about-reverse-mortgages reverse.mortgage ? truth-about-reverse-mortgages

Reverse mortgage cons Reverse mortgages have costs that include lender fees (origination fees are capped at $6,000 and depend on the amount of your loan), FHA insurance charges and closing costs. These costs can be added to the loan balance; however, that means the borrower would have more debt and less equity. Reverse Mortgage Pros And Cons - Bankrate bankrate.com ? mortgages ? reverse-mortga... bankrate.com ? mortgages ? reverse-mortga...