Indiana Space, Net, Net, Net - Triple Net Lease

Description

How to fill out Space, Net, Net, Net - Triple Net Lease?

If you wish to complete, obtain, or generate official document templates, utilize US Legal Forms, the largest collection of legal documents accessible online.

Take advantage of the website's straightforward and convenient search functionality to locate the documents you require.

Various templates for business and personal purposes are categorized by types and regions, or keywords. Employ US Legal Forms to find the Indiana Space, Net, Net, Net - Triple Net Lease with just a few clicks.

Each legal document template you acquire is yours indefinitely. You have access to every document you downloaded in your account. Select the My documents section and choose a document to print or download again.

Stay competitive and download and print the Indiana Space, Net, Net, Net - Triple Net Lease with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms client, Log In to your account and click on the Acquire button to obtain the Indiana Space, Net, Net, Net - Triple Net Lease.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

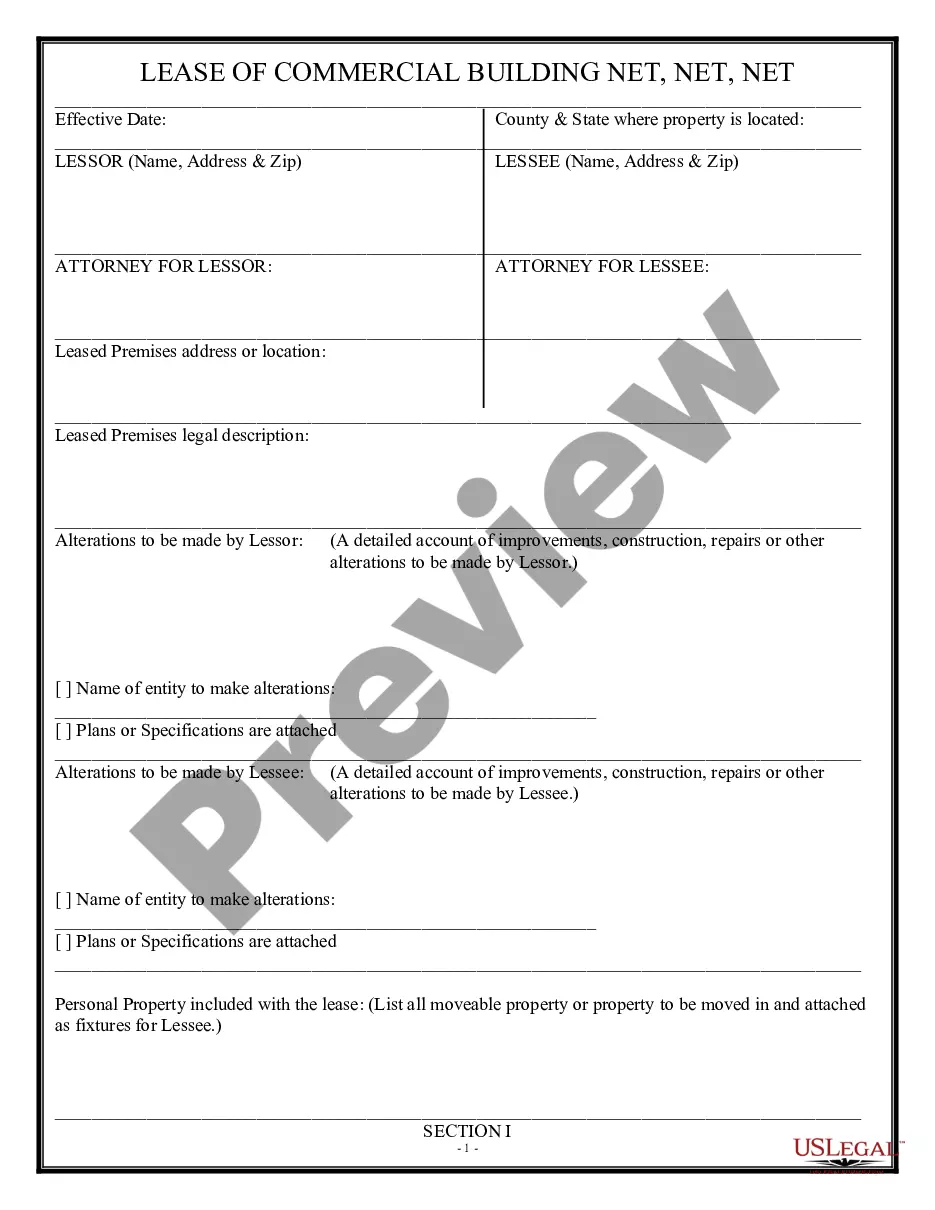

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to review the form’s content. Remember to read the information carefully.

- Step 3. If you are not satisfied with the template, use the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose your preferred pricing plan and provide your details to create an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Space, Net, Net, Net - Triple Net Lease.

Form popularity

FAQ

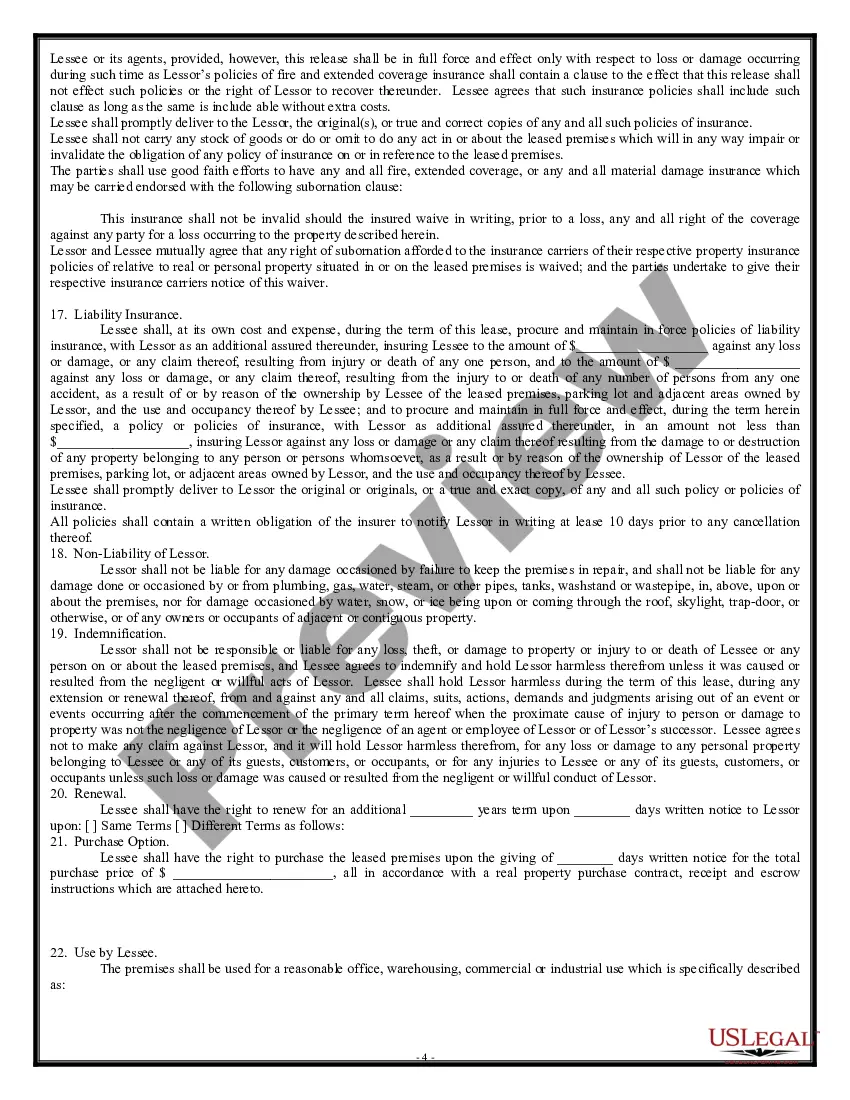

Accounting for a triple net lease requires tracking not only the rent but also additional costs such as property taxes, insurance, and maintenance. Ensure you have a system in place to monitor these expenses, as they can impact your overall financial performance. Utilizing accounting software can simplify this process and provide a clear view of your investments, especially in the context of Indiana space, net, net, net - triple net lease.

Qualifying for a triple net lease generally requires demonstrating financial stability and creditworthiness. Landlords often review your credit score, financial statements, and previous leasing experiences to ensure you can handle the lease's responsibilities. If you are serious about investing in Indiana space, net, net, net - triple net lease options, prepare your documentation and consult with a real estate professional for guidance.

Valuing a triple net lease in Indiana involves assessing the property’s location, condition, and rental income. Key factors include analyzing the tenant's creditworthiness and understanding the lease terms, including duration and renewal options. A reliable way to determine value is by calculating the net operating income (NOI) and applying a capitalization rate specific to Indiana space, net, net, net - triple net lease investments.

To find a triple net lease, start by researching commercial properties in Indiana that fit your investment goals. Use online real estate platforms, local listings, and consult with real estate agents specializing in Indiana space, net, net, net - triple net lease properties. By exploring different neighborhoods and property types, you can discover promising opportunities that align with your strategy.

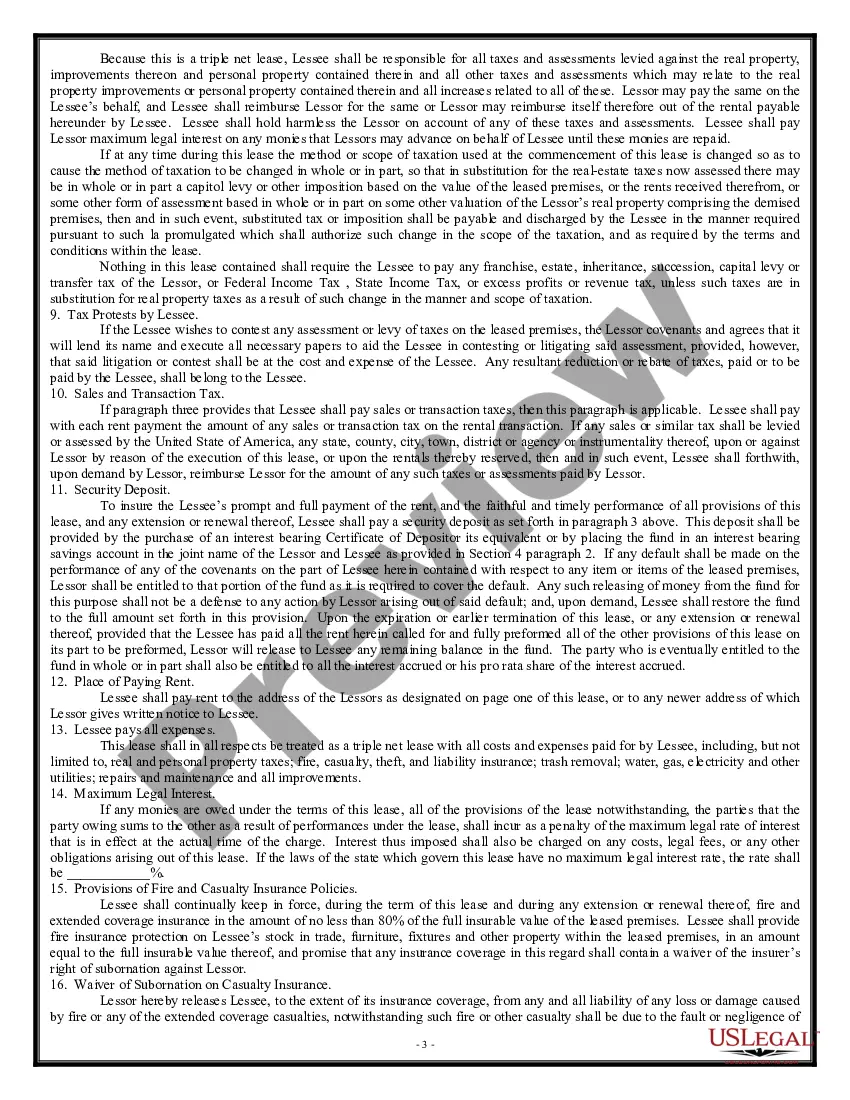

$12 NNN means that the lease costs $12 per square foot according to a triple net lease agreement. This figure indicates that the tenant is responsible for the base rent, plus additional costs such as property taxes, insurance, and maintenance fees. This clarity in financial commitments makes the Indiana Space, Net, Net, Net - Triple Net Lease an attractive option for many investors.

The primary difference between a net net lease and a triple net lease lies in the responsibilities for operating expenses. In a net net lease, the tenant covers property taxes and insurance, while in a triple net lease, the tenant also pays for maintenance and repair costs. If you are considering an Indiana Space, Net, Net, Net - Triple Net Lease, knowing this distinction can help you make informed decisions regarding your obligations as a tenant.

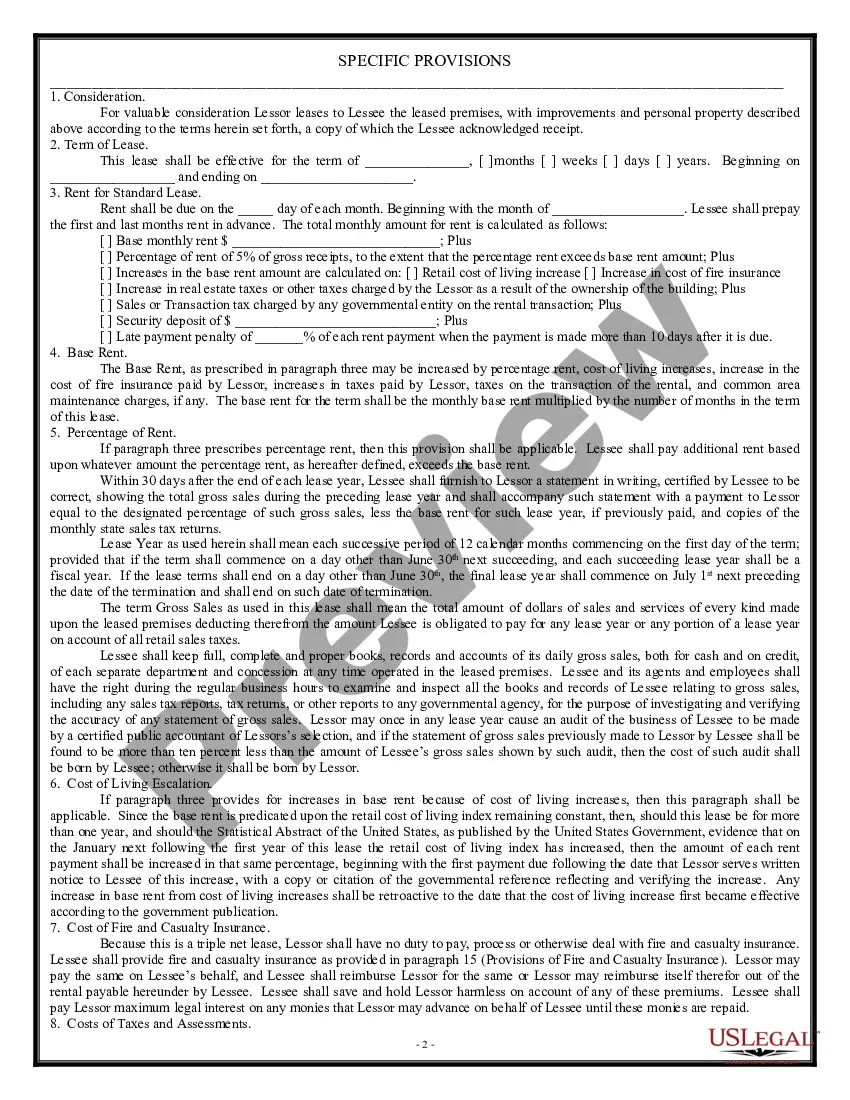

Structuring a triple net lease requires clear agreement on the responsibilities of both landlord and tenant. A typical Indiana Space, Net, Net, Net - Triple Net Lease outlines that the tenant pays base rent plus all operational expenses. It is crucial to define what these expenses include, such as property taxes, insurance, and maintenance costs. You can rely on uslegalforms to create a well-structured lease that protects both parties and clarifies obligations.

To calculate a triple net lease, first determine the base rent, then estimate additional costs for property taxes, insurance, and maintenance. In Indiana Space, Net, Net, Net - Triple Net Lease context, you multiply the total square footage by the yearly rent rate and add estimated expenses. This gives you a clear picture of your financial obligations. For detailed guidance, you might find resources at uslegalforms helpful.

A triple net lease impacts your taxes in several ways. For tenants, the additional expenses of property taxes, insurance, and maintenance can be deductible business expenses. This can lead to a favorable tax outcome, as these deductions reduce taxable income. If you're investing in Indiana Space, Net, Net, Net - Triple Net Lease properties, understanding tax implications is vital for financial planning.

Accounting for a triple net lease involves specific financial procedures that reflect both the rental income and the additional expenses. Tenants should track all related costs such as taxes, insurance, and maintenance expenses separately. This thorough accounting ensures transparency in financial records and helps a tenant understand their total expenditure in properties related to Indiana Space, Net, Net, Net - Triple Net Lease. Using tools from USLegalForms can simplify this process.