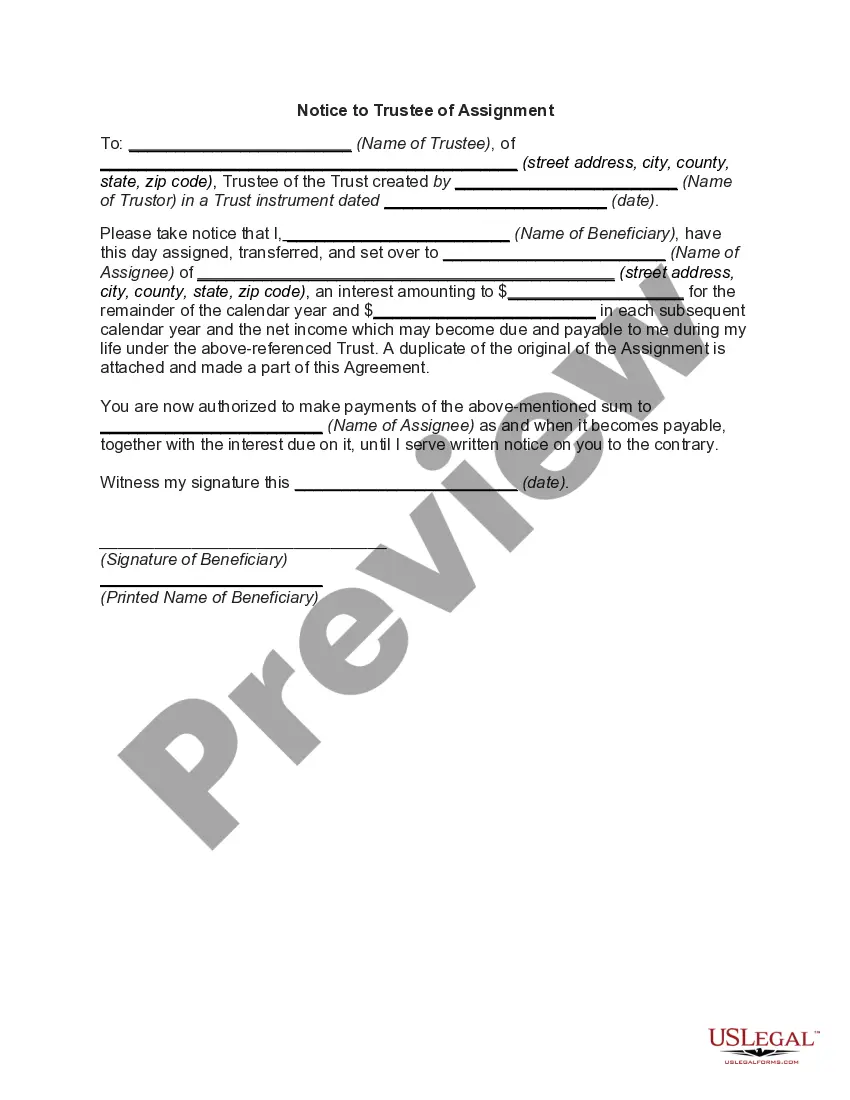

This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Locating the proper legal document template can be a challenge. Naturally, there is a plethora of templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which you can employ for personal and business needs. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust. Use your account to search for the legal forms you have previously ordered. Proceed to the My documents section of your account to retrieve another copy of the documents you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust. US Legal Forms is the largest repository of legal documents where you can find various paper templates. Use this service to download professionally crafted documents that meet state requirements.

- First, ensure you have selected the correct form for your locality/region.

- You can review the form using the Preview button and read the form description to verify this is indeed the one you need.

- If the form does not fulfill your needs, use the Search box to find the appropriate form.

- Once you are confident that the form is suitable, click the Get Now button to obtain the form.

- Choose the pricing plan you prefer and input the required information.

- Create your account and complete the payment through your PayPal account or by using a Visa or Mastercard.

Form popularity

FAQ

Indeed, a trustee and the sole beneficiary can be the same person. This setup allows individuals to manage their assets while enjoying the benefits of the trust. However, it is important to uphold fiduciary responsibilities and act in the best interests of the trust. Being informed about the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust will bolster your understanding of these roles.

Trustees generally cannot add beneficiaries unless explicitly allowed by the trust document. The authority to add beneficiaries relies on the terms set forth in the trust agreement. Maintaining compliance with the trust's guidelines ensures adherence to the wishes of the creator. Understanding the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust can illuminate the legal framework governing this process.

A trustee can be an individual or an institution, such as a bank or a trust company. As long as the appointed trustee is capable and trustworthy, their background must be suitable for managing the trust assets. It is crucial to evaluate qualifications and understand the responsibilities that come with this role. Referencing the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust can provide guidance in selecting the right trustee.

Yes, a beneficiary may assign their interest in a trust to another individual. This process typically requires formal notification and may involve following specific legal guidelines. Using the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust can ensure that the assignment is executed according to legal standards. It is advisable to consult legal expertise to navigate this process smoothly.

A beneficiary can also serve as a trustee for the trust. This dual role allows the beneficiary to have a say in the management of the trust’s assets, potentially aligning their interests with the trust’s goals. However, transparent communication and adherence to fiduciary duties are crucial in this situation. Understanding the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust provides additional insights into maintaining proper governance.

Yes, you can be both the trustee and the beneficiary of a trust. This arrangement can offer certain advantages, such as greater control over the management of the trust assets. However, it's essential to remain impartial and act in the best interest of all beneficiaries. Familiarizing yourself with the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust will guide you in fulfilling both roles effectively.

The duty to keep beneficiaries informed pertains to a trustee's responsibility to communicate important information about the trust. This includes providing updates on the trust's assets, financial performance, and any actions taken concerning the trust. Being aware of these details allows beneficiaries to understand their interests better and ensures transparency. For further clarity on your rights, consider exploring the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

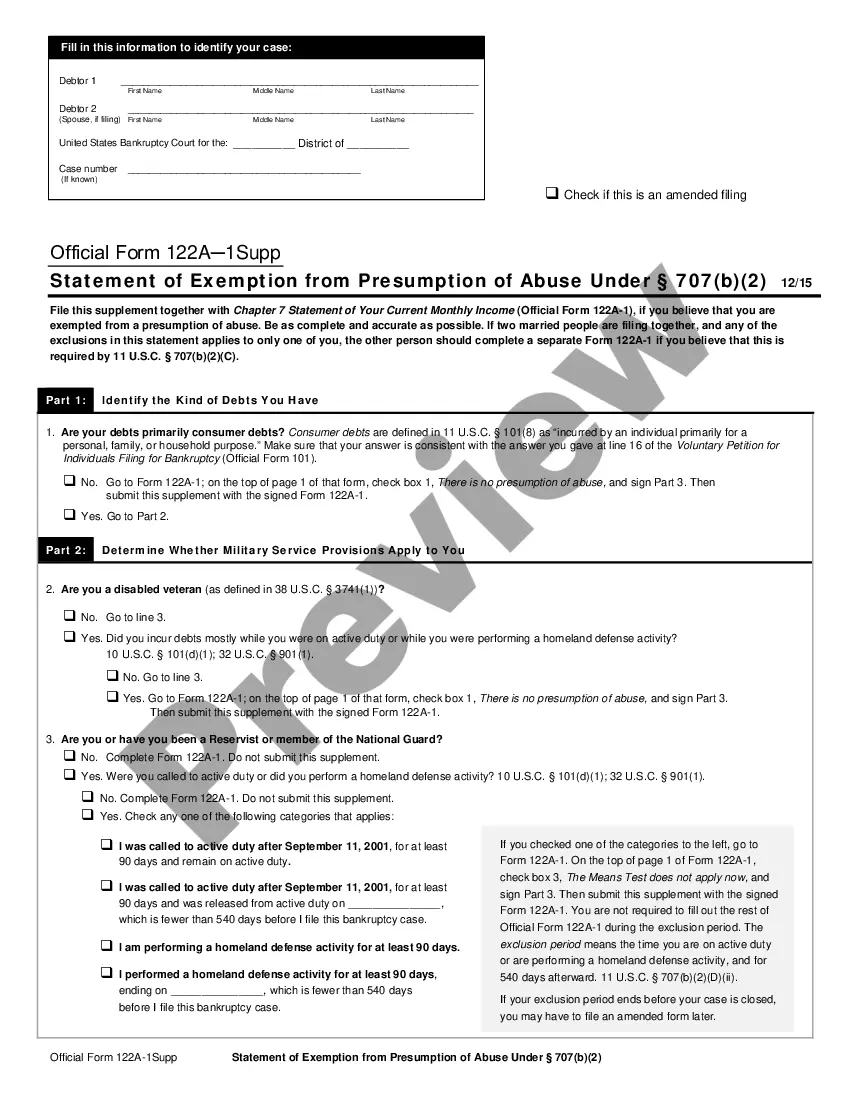

Indiana Code 30-5-5-19 addresses the trustee's obligation to provide information to beneficiaries. This code mandates that trustees keep beneficiaries informed about significant changes or issues related to the trust. Leveraging the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust is a strategic way to ensure trustees meet these obligations. Being proactive about your rights can significantly enhance trust management effectiveness.

Indiana Code 30-5-5-16 pertains to the rights of a beneficiary to request an accounting from the trustee. This right ensures that beneficiaries can review the trust's financial activities, making it a vital aspect of trust management. Utilizing the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust can facilitate this request effectively and maintain transparency in trust operations. Understanding this code empowers you as a beneficiary.

Indiana Code 29-3-5-5 discusses the powers and duties granted to a trustee under Indiana law. This code clarifies what actions a trustee can legally take and their obligations toward the beneficiaries. For those involved in trusts, grasping these duties is crucial, particularly when dealing with the Indiana Notice to Trustee of Assignment by Beneficiary of Interest in Trust. This awareness can foster better communication between trustees and beneficiaries.