Indiana Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

Are you presently in a location where you frequently require documents for either business or personal purposes.

There are numerous legal document templates accessible online, but locating reliable forms is challenging.

US Legal Forms offers thousands of document templates, such as the Indiana Revocable Trust Agreement - Grantor as Beneficiary, designed to comply with federal and state regulations.

Once you find the suitable form, click Buy now.

Select your desired payment plan, complete the necessary details to create your account, and pay for the order with your PayPal or credit card. Choose a convenient file format and download your copy. You can find all the file templates you have purchased in the My documents menu. You can obtain an additional copy of the Indiana Revocable Trust Agreement - Grantor as Beneficiary anytime, if needed. Just click the specific form to download or print the template. Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and begin to simplify your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Indiana Revocable Trust Agreement - Grantor as Beneficiary template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

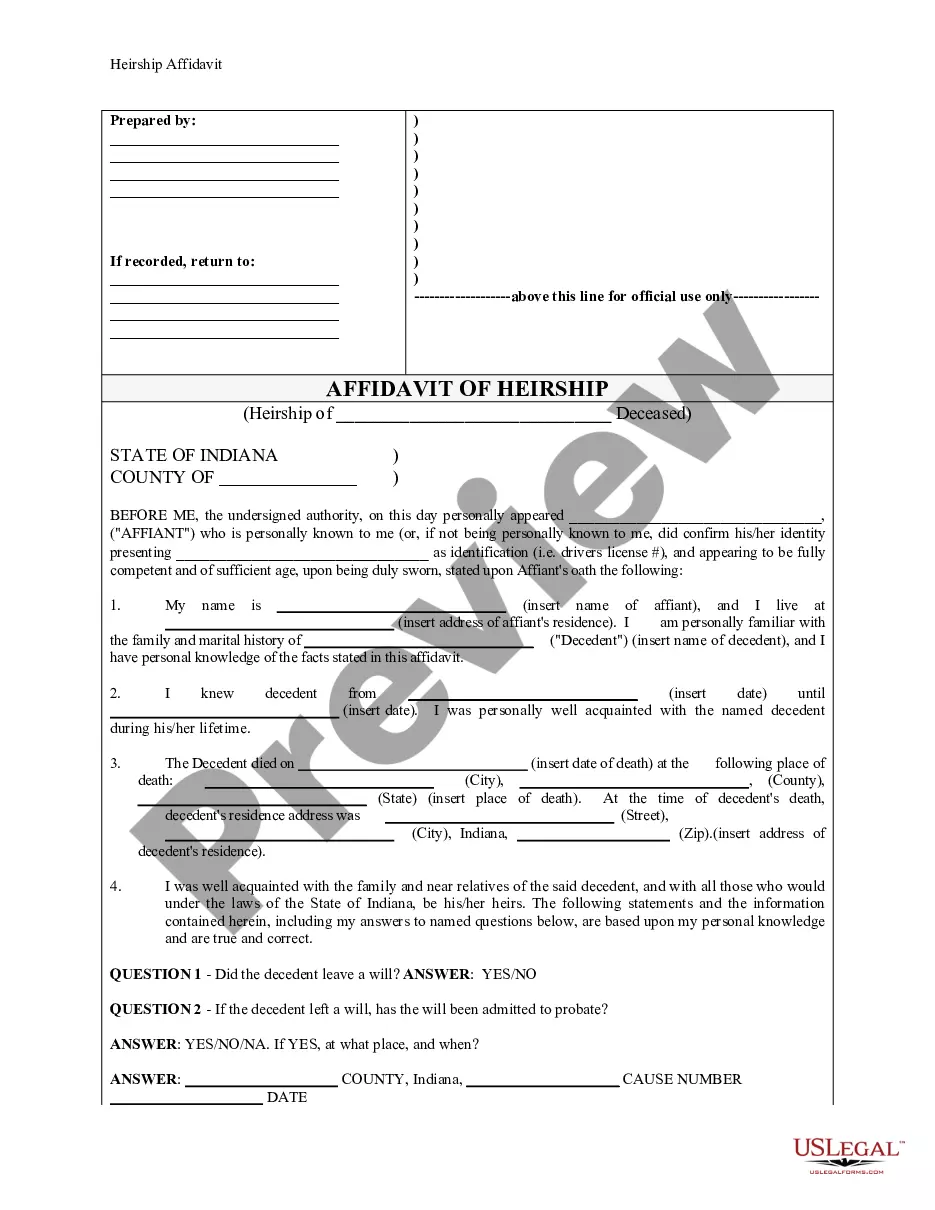

- Use the Preview feature to check the form.

- Read the description to ensure you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Yes, under the Indiana Revocable Trust Agreement - Grantor as Beneficiary, a grantor trust can indeed make distributions to beneficiaries. This type of trust allows the grantor to retain control over the assets and manage how and when distributions occur. By establishing the Indiana Revocable Trust Agreement, you can ensure that beneficiaries receive their share according to your wishes. Always consider consulting uslegalforms for guidance on structuring these distributions effectively.

Yes, a beneficiary can also be a grantor in an Indiana Revocable Trust Agreement - Grantor as Beneficiary. This arrangement allows the grantor to maintain control over the assets while still benefiting from them during their lifetime. Having this dual role provides flexibility in estate planning, enabling individuals to dictate how their assets will be managed and distributed. If you're looking to create this type of trust, consider using US Legal Forms for reliable templates and guidance.

When a trust is named as a beneficiary, the assets will be redirected to the trust upon the owner's death, rather than going directly to individuals. This allows for orderly and controlled distribution according to the trust's terms. It's important to realize that this can also introduce complexities like probate and tax considerations. An Indiana Revocable Trust Agreement - Grantor as Beneficiary effectively manages these scenarios.

A significant mistake parents often make is failing to clearly communicate their intentions with their trust fund. Without open dialogue, beneficiaries may not understand the trust's terms or the reasons behind decisions. This lack of clarity can lead to conflicts. Using an Indiana Revocable Trust Agreement - Grantor as Beneficiary can provide clarity and structure to your estate planning.

Naming a trust as a beneficiary of an IRA can lead to unfavorable tax consequences, as trusts are often taxed at higher rates. Additionally, the required minimum distributions might be more complex and less favorable than those for individual beneficiaries. It is beneficial to consult a tax advisor when considering this option, especially in the context of an Indiana Revocable Trust Agreement - Grantor as Beneficiary.

Yes, a grantor can be a beneficiary of their own trust. This setup allows the grantor to retain control over the trust assets while enjoying the benefits during their lifetime. However, it is vital to structure the trust correctly to avoid unintended consequences in estate planning. An Indiana Revocable Trust Agreement - Grantor as Beneficiary supports such structures.

One disadvantage of being a beneficiary is potential family disputes over inheritance. Beneficiaries may also find themselves responsible for tax liabilities or debts linked to the inheritance. The terms of a trust can also restrict immediate access to funds, complicating financial situations. Understanding the implications of an Indiana Revocable Trust Agreement - Grantor as Beneficiary helps prepare for these issues.

When you name a trust as the beneficiary of an IRA, the IRA funds will be distributed according to the terms of the trust. This can provide control over how the assets are managed and distributed. However, it is essential to understand the associated tax implications, as trusts may face different tax treatments. Consider how an Indiana Revocable Trust Agreement - Grantor as Beneficiary fits your estate planning goals.

To add a beneficiary to a revocable trust, you need to review the trust document and make any necessary amendments. This typically involves drafting an amendment to include additional beneficiaries. Be sure to execute this amendment in accordance with your state's laws. Using an Indiana Revocable Trust Agreement - Grantor as Beneficiary can make this process clearer and more straightforward.

One disadvantage of naming a trust as a beneficiary is the potential for complex taxation. Trusts can be subject to higher tax rates than individuals. Additionally, the trust may have specific terms that limit access to funds, impacting beneficiaries. It’s crucial to consult a legal professional to navigate this, especially with an Indiana Revocable Trust Agreement - Grantor as Beneficiary.