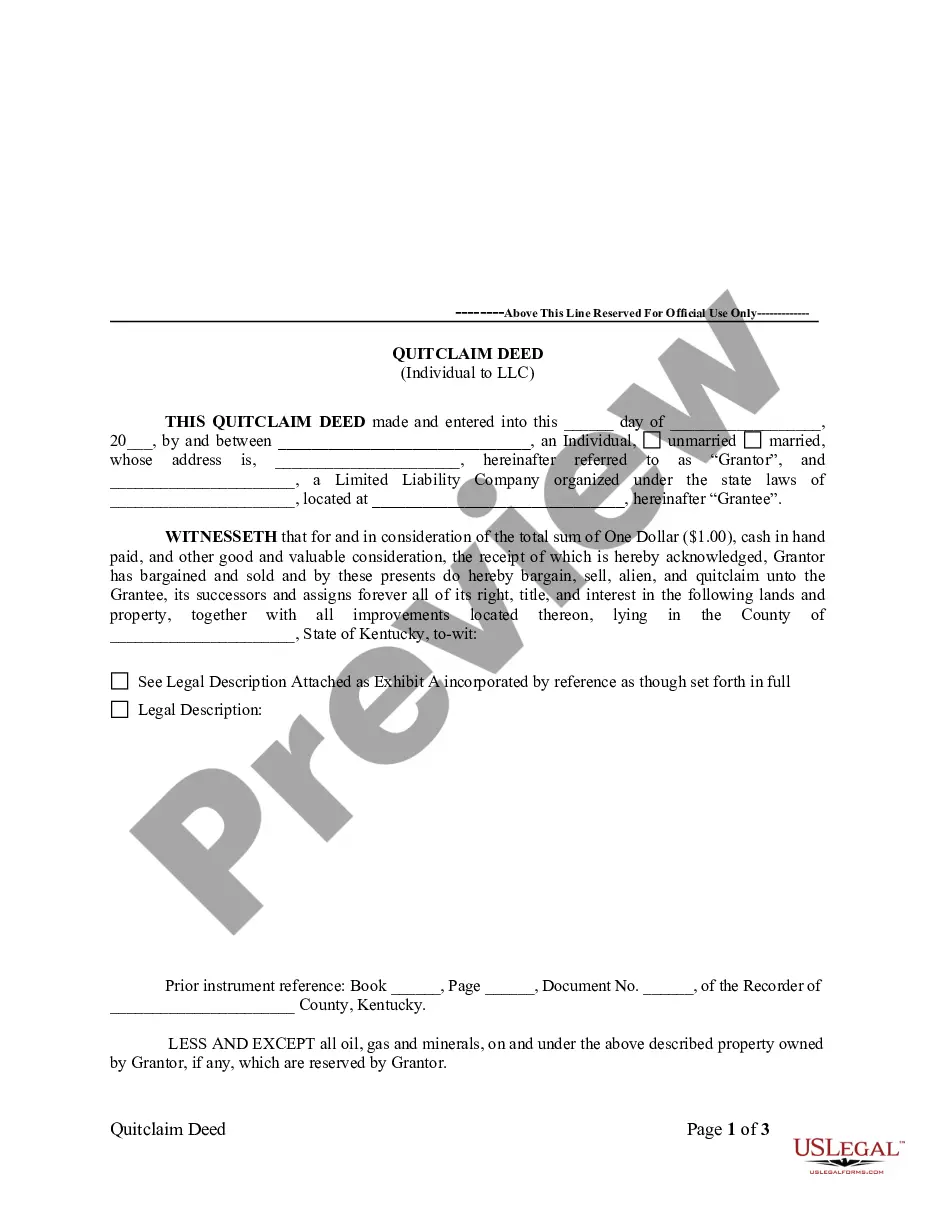

Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals) is a form used in bankruptcy proceedings to disclose information about creditors who have a security interest in any of the debtor's property. The information provided on the form includes the name and address of the creditor, the type of claim, the amount of the claim, and the type of collateral that secures the claim. There are two types of Schedule D forms: one for secured creditors and one for unsecured creditors. Secured creditors are those who have a lien on a debtor’s property, while unsecured creditors are those who do not have a lien on the property. The debtor must list all creditors who have a security interest in the property on Schedule D, regardless of whether they are secured or unsecured.

Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals)

Description

How to fill out Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals)?

Drafting legal documents can be quite a hassle unless you have accessible fillable templates on hand. With the US Legal Forms digital library of formal paperwork, you can be assured that the forms you discover align with federal and state regulations and have been validated by our experts.

Thus, if you need to create Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals), our service is the ideal destination to acquire it.

Document compliance verification. You should carefully examine the content of the form you desire and ensure it meets your requirements and adheres to your state law specifications. Reviewing your document and browsing its general description will assist you in achieving this.

- Acquiring your Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals) from our library is as easy as 1-2-3.

- Previously registered users with an active subscription merely need to Log In and click the Download button once they locate the appropriate template.

- If required, users can retrieve the same document from the My documents section of their account.

- However, even if you are new to our service, signing up with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Form popularity

FAQ

In Indiana, certain properties are exempt from a judgment, meaning creditors cannot seize these assets to satisfy debts. Exemptions may include your home, personal property up to a specified value, and necessary tools for your profession. Understanding the Indiana Schedule D: Creditors Who Hold Claims Secured By Property (individuals) can help you determine which assets may be protected. If you're facing legal claims, using platforms like uslegalforms can guide you through your rights and help you find solutions.

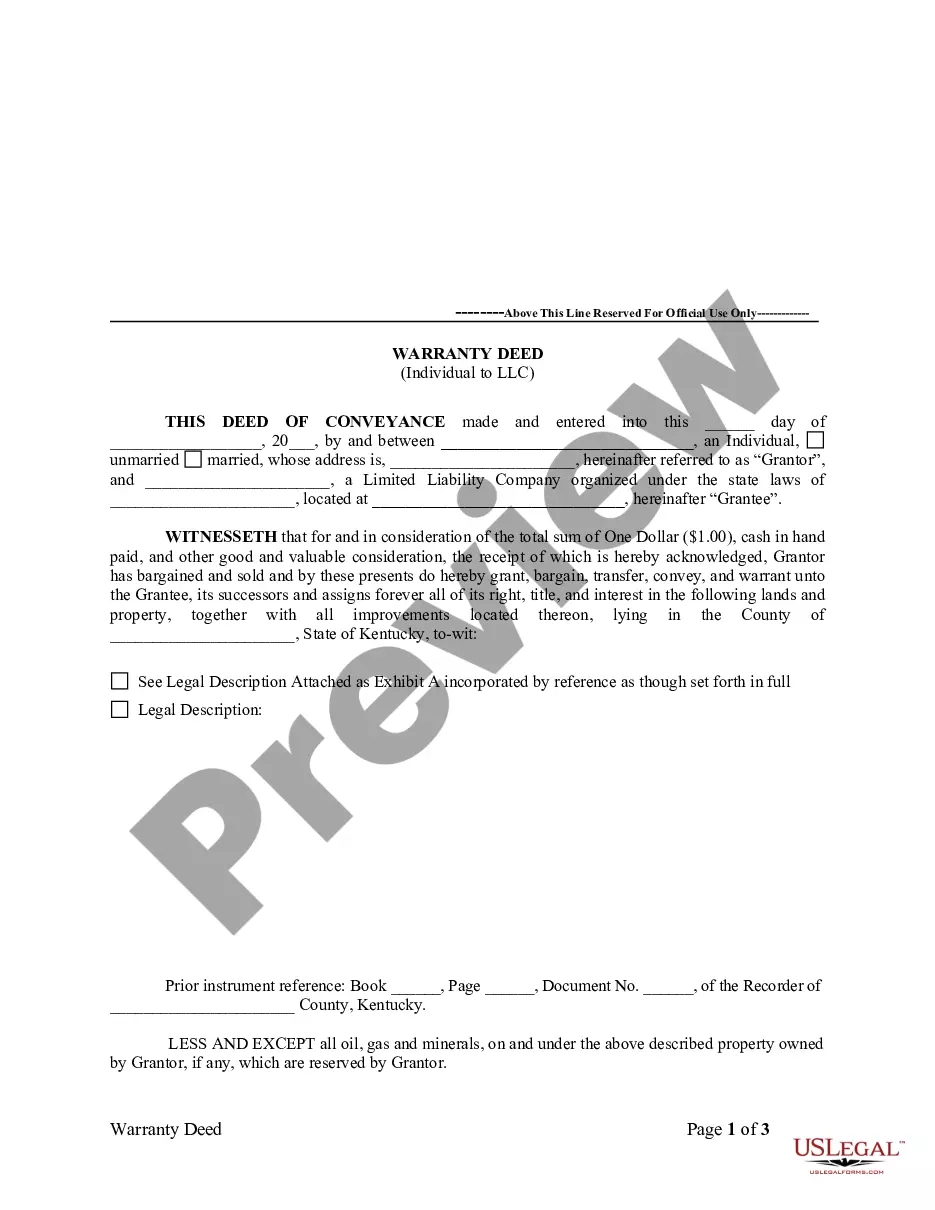

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

The secured creditor holds priority on debt collection from the property on which it holds a lien. The unsecured creditor gets no such protection; its best method of repayment from its debtor is voluntary repayment.

What Is a Secured Creditor? A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

A claim held by a creditor who has a perfected lien or a right of set-off against the debtor's property. A claim is secured to the extent of the creditor's interest in the debtor's property or to the extent of the amount subject to set-off.

Example of a Secured Creditor For example, a mortgage lender is a secured creditor, because it has a lien on the property for which it is providing a mortgage. If the mortgage holder does not pay on a timely basis, the lender takes back the property.

Secured debt - A debt that is backed by real or personal property is a ?secured? debt. A creditor whose debt is ?secured? has a legal right to take the property as full or partial satisfaction of the debt.

In a secured claim contract, if the debtor defaults, or is unable to payback the debt, the creditor can take ownership of the collateral and sell it to pay off what the debtor owes. For example, if a consumer defaults on a mortgage, the bank can claim the house and sell it to pay off the consumer's debt.

A lender must check the "secured claim" box if the borrower agreed to guarantee the debt with property, called "collateral." In other words, the borrower put up an asset that the creditor could sell if the borrower defaulted on (broke the terms of) the contract.