Illinois Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

Are you currently in the situation the place you require files for both organization or specific reasons virtually every day? There are plenty of legal file web templates available online, but getting versions you can depend on is not effortless. US Legal Forms gives a large number of develop web templates, like the Illinois Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, that happen to be composed to fulfill federal and state needs.

When you are already acquainted with US Legal Forms web site and get a merchant account, basically log in. Following that, you can acquire the Illinois Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest web template.

Should you not offer an account and would like to begin using US Legal Forms, follow these steps:

- Get the develop you want and ensure it is for that correct area/area.

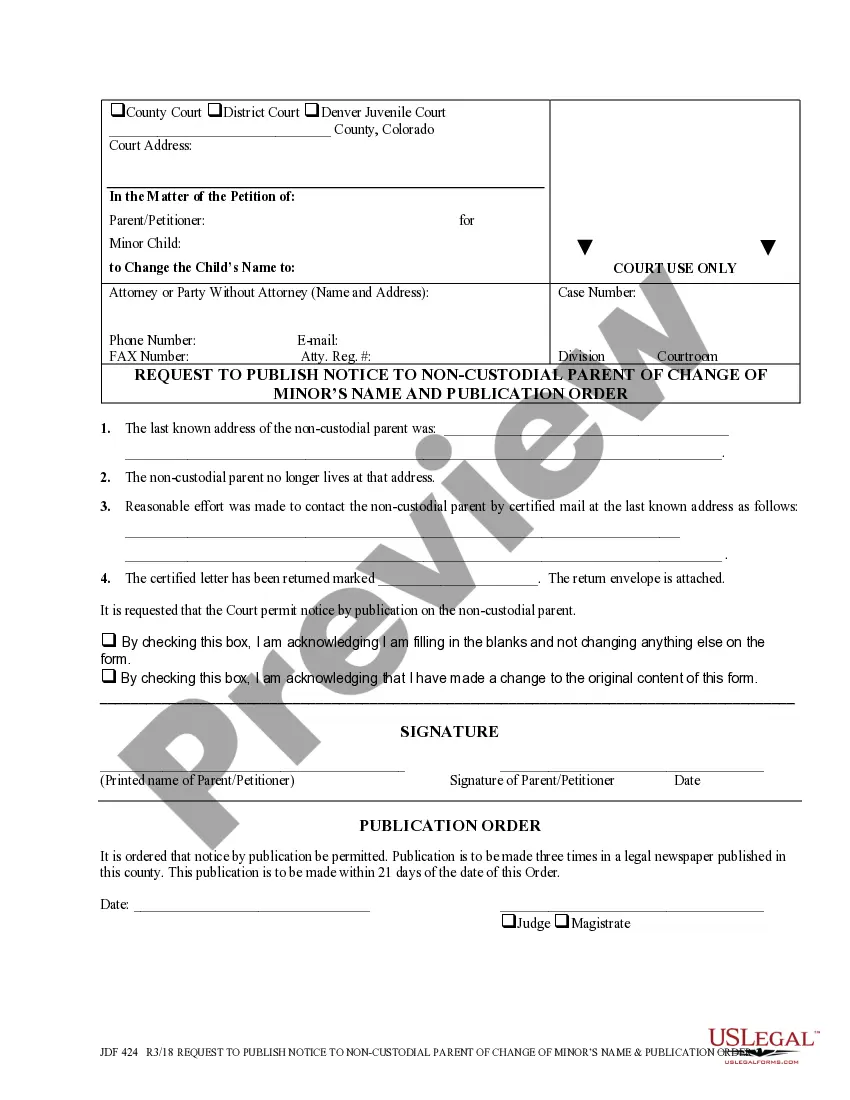

- Use the Review key to review the shape.

- Look at the description to actually have chosen the appropriate develop.

- In the event the develop is not what you are trying to find, utilize the Research area to obtain the develop that meets your needs and needs.

- When you obtain the correct develop, just click Get now.

- Choose the pricing strategy you would like, fill out the specified info to produce your account, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free file format and acquire your duplicate.

Discover all the file web templates you may have purchased in the My Forms food list. You can obtain a extra duplicate of Illinois Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest any time, if necessary. Just click the essential develop to acquire or print out the file web template.

Use US Legal Forms, by far the most substantial selection of legal kinds, to conserve some time and stay away from mistakes. The support gives expertly manufactured legal file web templates which you can use for a range of reasons. Produce a merchant account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

(a) Surface owners may gain title to severed mineral interests owned by unknown or missing owners under the theory of adverse possession in the following manner and under the following conditions: If the title to any severed mineral interest is vested in an unknown owner or missing owner and the surface owner overlying ...

The Illinois legislature responded by enacting the Dormant Mineral Interests Act in 1969. The Act was intended to facilitate development of dormant oil and gas interests by permitting consolidation of ownership into one person where it had formerly been diffused amongst many unknown or missing persons.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

Royalty income from oil, gas, and mineral properties is the amount you receive when natural resources are extracted from your property. The royalties are generally based on production or revenue and are paid to you by a person or company who leases the property from you.

Owning mineral rights (often referred to as a "mineral interest" or a "mineral estate") gives the owner the right to exploit, mine, and/or produce any or all minerals they own. Minerals can refer to oil, gas, coal, metal ores, stones, sands, or salts.