Illinois I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Are you in the situation in which you require papers for sometimes company or specific reasons just about every time? There are a variety of lawful papers themes available online, but finding kinds you can depend on isn`t simple. US Legal Forms gives a huge number of kind themes, like the Illinois I.R.S. Form SS-4 (to obtain your federal identification number), which can be created to fulfill state and federal requirements.

If you are presently informed about US Legal Forms web site and also have a free account, just log in. Afterward, you can download the Illinois I.R.S. Form SS-4 (to obtain your federal identification number) web template.

Unless you offer an account and need to start using US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is to the right area/state.

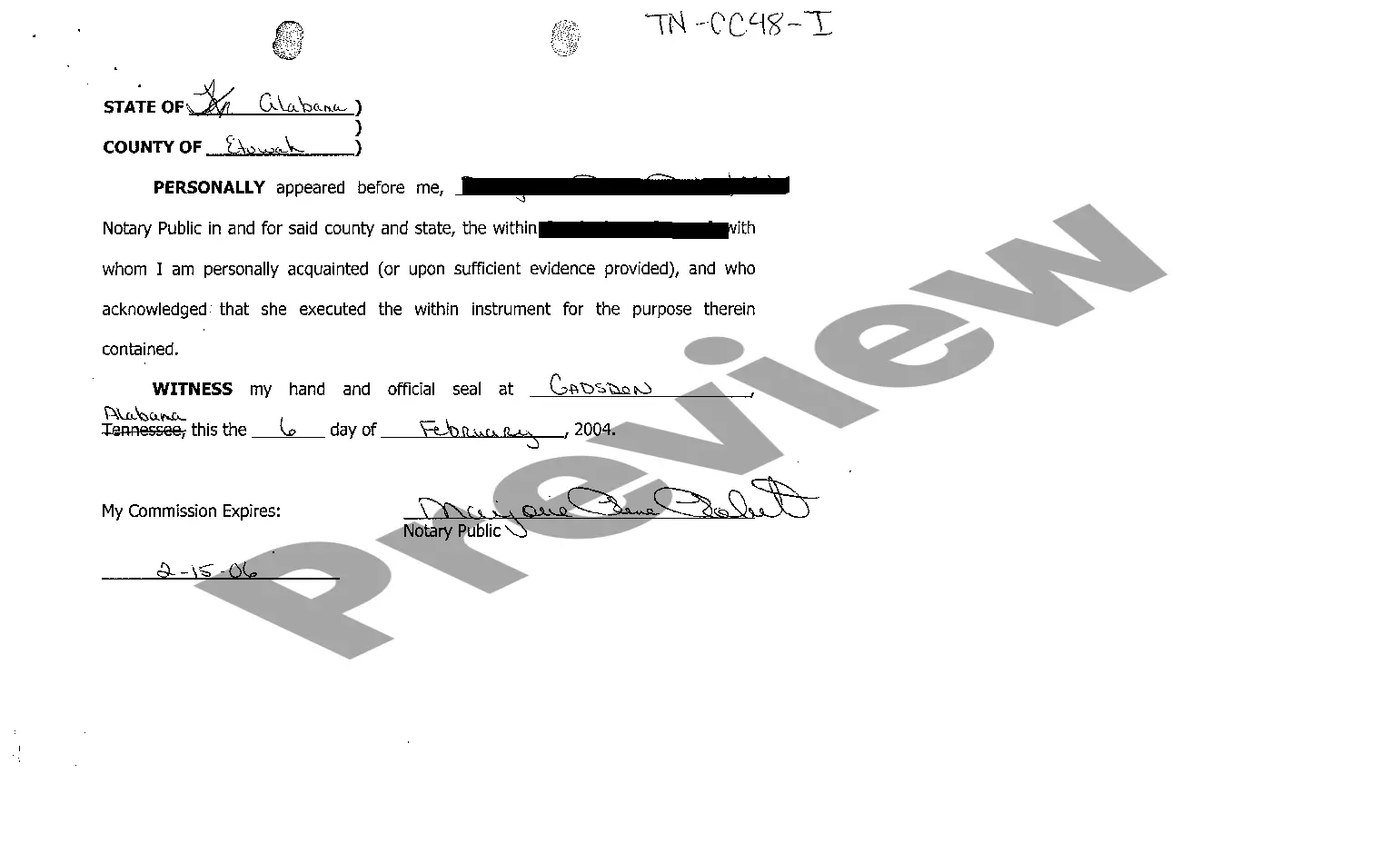

- Utilize the Preview key to analyze the form.

- Browse the explanation to ensure that you have chosen the proper kind.

- If the kind isn`t what you are trying to find, utilize the Lookup area to get the kind that suits you and requirements.

- When you discover the right kind, click Purchase now.

- Choose the costs program you want, fill out the required info to make your account, and purchase an order utilizing your PayPal or bank card.

- Decide on a practical document structure and download your version.

Locate all the papers themes you may have bought in the My Forms menu. You can aquire a further version of Illinois I.R.S. Form SS-4 (to obtain your federal identification number) anytime, if needed. Just click the necessary kind to download or print the papers web template.

Use US Legal Forms, one of the most considerable selection of lawful types, to save efforts and avoid mistakes. The assistance gives expertly made lawful papers themes that you can use for a selection of reasons. Produce a free account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

If you want to get a state tax ID in the state of Illinois, you'll first need to have your federal tax ID number in place. Applying online is the fastest and most efficient way to get this number. Once you have your federal tax ID, you can apply for your IDOR number in one of several different methods.

You can start a business in minutes. COVID-19 has impacted organizations around the world and the IRS is no exception. Due to COVID-19 the IRS has relaxed some ?wet signature? requirements which means you are able to digitally sign Form SS-4 (Application for an EIN)!

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

6 Steps to Complete SS-4 Gather the Information Necessary To Complete Form SS-4. You'll want to gather information on the business. ... Complete the General Information Section. ... Complete the Business Type Information Section. ... Complete the Other Business Information Section. ... Sign the Form. ... Submit Your Form SS-4.

SS-4 Confirmation Letter: This letter acts as an official statement from the IRS, confirming your authorized EIN. It outlines your entity's legal name, address, EIN, and the date of issuance.

You can apply for an EIN by filing an Application For Employer Identification Number (Form SS-4) with the Internal Revenue Service (IRS). The form can be submitted online, by mail, telephone, or fax. There is no filing fee.

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

You can use Form SS-4 to request an Employer Identification Number (EIN) from the IRS. An EIN is assigned to a business for business activities such as tax filing and reporting purposes. The following types of entities can apply for an EIN: Employers (including corporations, partnerships, and sole proprietors)