Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

If you require to complete, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor. Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Browse the My documents section and choose a form to print or download again. Stay efficient and download, and print the Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- You can also view forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

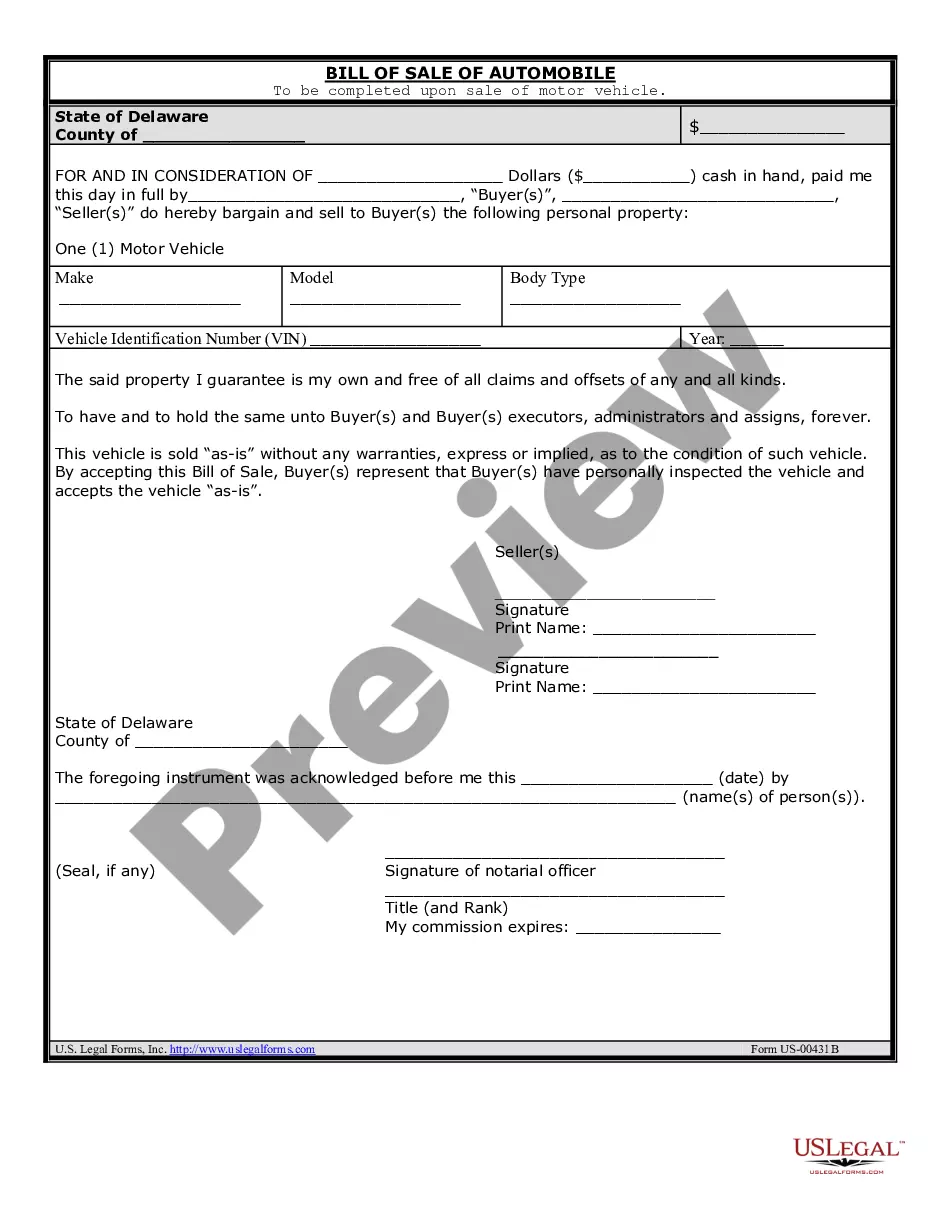

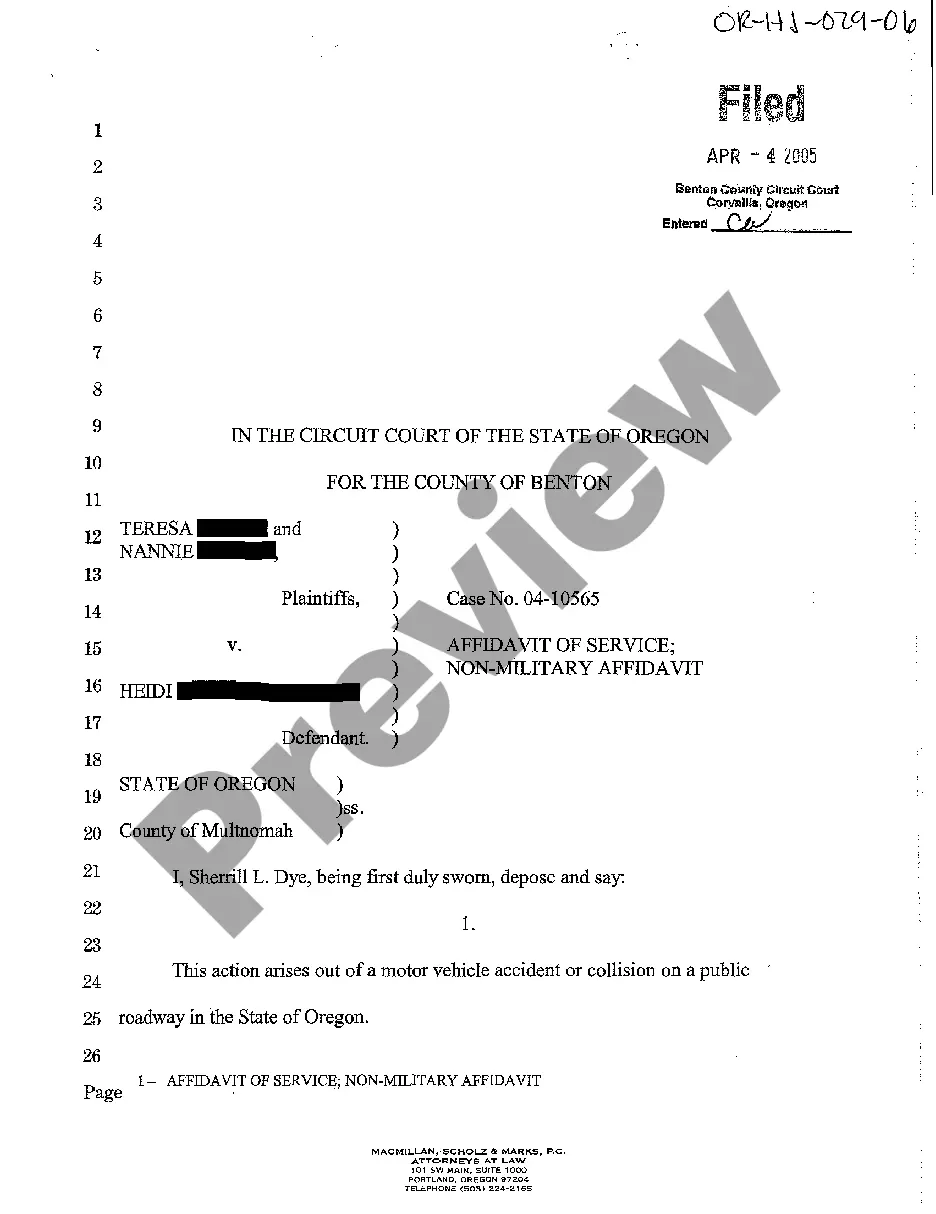

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, interpreters can work as independent contractors depending on their agreements and job assignments. In many cases, an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor outlines the terms and responsibilities of the interpreter, establishing them as an independent entity. Understanding the nature of your contract is essential for compliance and to maintain your independent status.

The Illinois Freedom to Work Act mainly targets non-compete agreements for employees; however, it does not cover independent contractors. Therefore, independent contractors, including those engaged in an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor, have different legal considerations. If you have questions regarding your specific situation, consulting a legal professional can provide clarity on how this act may or may not affect your agreements.

Writing a contract as an independent contractor begins with outlining your services and payment terms clearly. Include essential details such as deadlines, responsibilities, and provisions for changes or cancellations. An Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor should reflect mutual agreement and understanding. Consider using uslegalforms for expert guidance and templates that meet legal standards.

Freelance law in Illinois focuses on the rights and responsibilities of independent contractors. It encompasses various aspects, including payment terms and contract regulations. When entering into an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor, it's crucial to familiarize yourself with these laws to ensure compliance and protect your interests.

To write an effective independent contractor agreement, start by defining the scope of work and payment arrangements. Incorporate components like deadlines, confidentiality clauses, and dispute resolution methods. For an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor, ensure that all parties understand their roles clearly. Utilizing resources from uslegalforms can simplify this process.

The 7-day rule in Illinois refers to a specific guideline related to freelance agreements, which allows freelancers to cancel their contract within seven days if they have not started work. Knowing this rule is crucial for anyone operating under an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor. This rule promotes fairness and gives freelancers a chance to reconsider their contracts without penalty.

You can write your own legally binding contract, as long as it meets the legal requirements in your jurisdiction. When crafting an Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor, ensure it includes key elements like scope of work, payment terms, and dispute resolution procedures. However, for added assurance, consider using templates or services from uslegalforms to guide you.

Yes, having a contract as an independent contractor is essential. It clarifies the expectations and obligations of both parties involved in the Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor. A well-drafted contract minimizes misunderstandings and potential disputes, providing a solid foundation for your freelance work.

An independent contractor agreement is a written document that outlines the terms of the working relationship between a contractor and a client. This Illinois Translator And Interpreter Agreement - Self-Employed Independent Contractor specifies the services to be provided, payment details, and the responsibilities of each party. Having a clear contract helps protect both the contractor and the client, ensuring everyone understands their commitments.