Illinois Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

If you wish to be thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s simple and user-friendly search to find the documents you require.

Various templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to get the Illinois Tutoring Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, modify and print or sign the Illinois Tutoring Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Complete and acquire, and print the Illinois Tutoring Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Illinois Tutoring Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

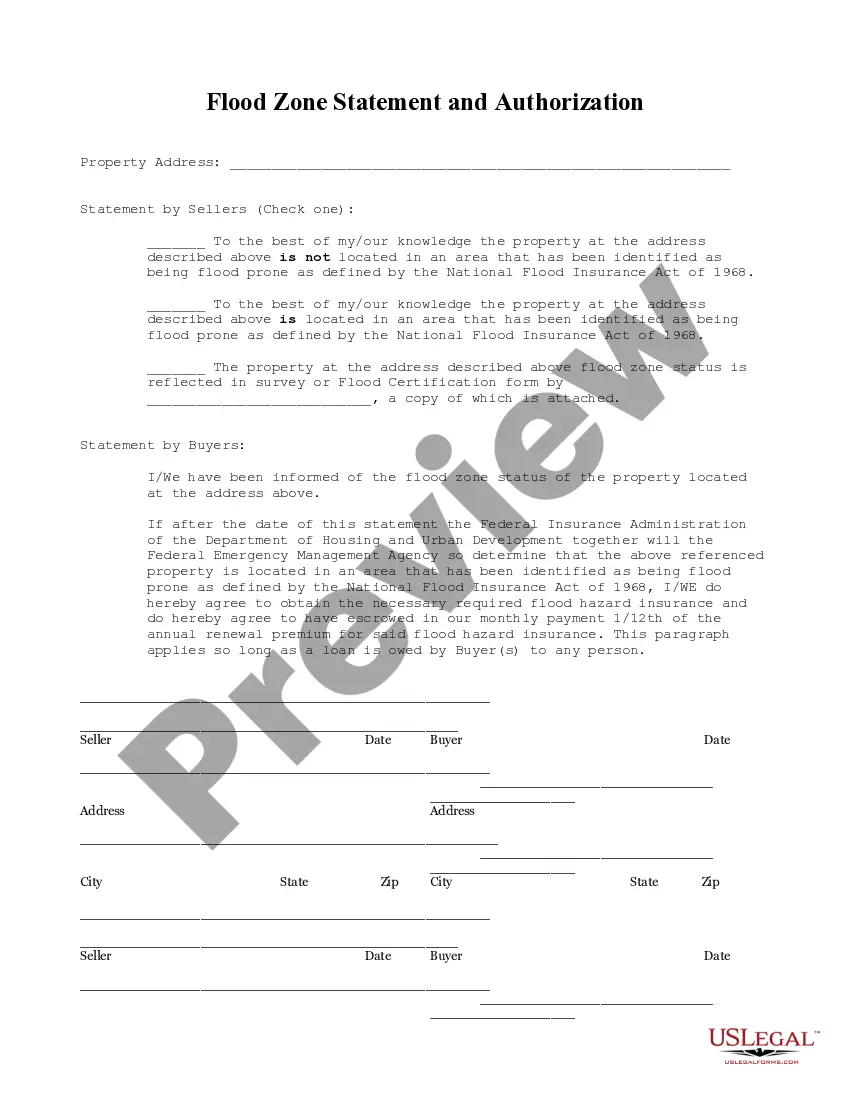

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

You do not need to issue a 1099 to individuals who are not classified as independent contractors. Specifically, if you hire employees under a traditional employment agreement, a 1099 is unnecessary. Additionally, if you engage services from a corporation, you typically do not issue a 1099. Understanding the Illinois Tutoring Agreement - Self-Employed Independent Contractor is crucial, as it helps clarify who qualifies for 1099 reporting and ensures you remain compliant with tax regulations.

To fill out an independent contractor agreement, start by entering the names and addresses of both parties involved. Next, specify the work to be performed, payment amounts, and deadlines for completion. Double-check for any necessary legal clauses regarding confidentiality or termination. Using a reliable Illinois Tutoring Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this task and ensure you cover all bases.

Filling out an independent contractor form requires entering personal information, work specifics, and payment details. Make sure you accurately describe the services you will provide and the terms of payment. It's essential to review the document for clarity to avoid misunderstandings. An Illinois Tutoring Agreement - Self-Employed Independent Contractor template can guide you through this process effectively.

Writing a tutoring contract involves stating the tutoring services provided, payment terms, and scheduling details. You should also clarify the responsibilities of both the tutor and the student or parent. Including a cancellation policy and a confidentiality agreement can safeguard both parties. Consider using the Illinois Tutoring Agreement - Self-Employed Independent Contractor template from uslegalforms for a solid foundation.

To create an independent contractor agreement, start with basic details such as the names and addresses of both parties. Next, outline the scope of work, payment terms, and deadlines. Additionally, include clauses on confidentiality, termination, and dispute resolution. Utilizing a template like the Illinois Tutoring Agreement - Self-Employed Independent Contractor from uslegalforms can streamline this process.

In Illinois, independent contractors are defined as individuals who provide services based on their own terms and manage their own business operations. This law often applies to tutors operating without an employer's oversight. To ensure compliance and protect your interests, it is wise to draft an Illinois Tutoring Agreement - Self-Employed Independent Contractor.

Indeed, tutoring is generally regarded as self-employment if you are managing your own client base and finances. This means you are not dependent on an employer and can establish your unique business model. Utilizing an Illinois Tutoring Agreement - Self-Employed Independent Contractor can further solidify your status as a self-employed tutor.

If you are self-employed as a tutor, you may be eligible to write off certain expenses on your taxes. This could include materials, advertising, or any costs directly related to your tutoring business. Ensuring you have an Illinois Tutoring Agreement - Self-Employed Independent Contractor may also aid in documenting your services and related expenses for tax purposes.

Being self-employed means operating your own business and earning income directly from your services. You are responsible for your business expenses and taxes. If you are a tutor who manages clients and sets your own fees, you likely qualify as a self-employed individual. Having an Illinois Tutoring Agreement - Self-Employed Independent Contractor can provide vital structure for your self-employment.

A tutor can be classified as an independent contractor if they provide services on a flexible basis without direct supervision. This type of employment allows you the freedom to choose clients and rates, making it a popular option for many. By securing an Illinois Tutoring Agreement - Self-Employed Independent Contractor, you establish clear terms with your clients.