Illinois Series Seed Preferred Stock Purchase Agreement

Description

Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

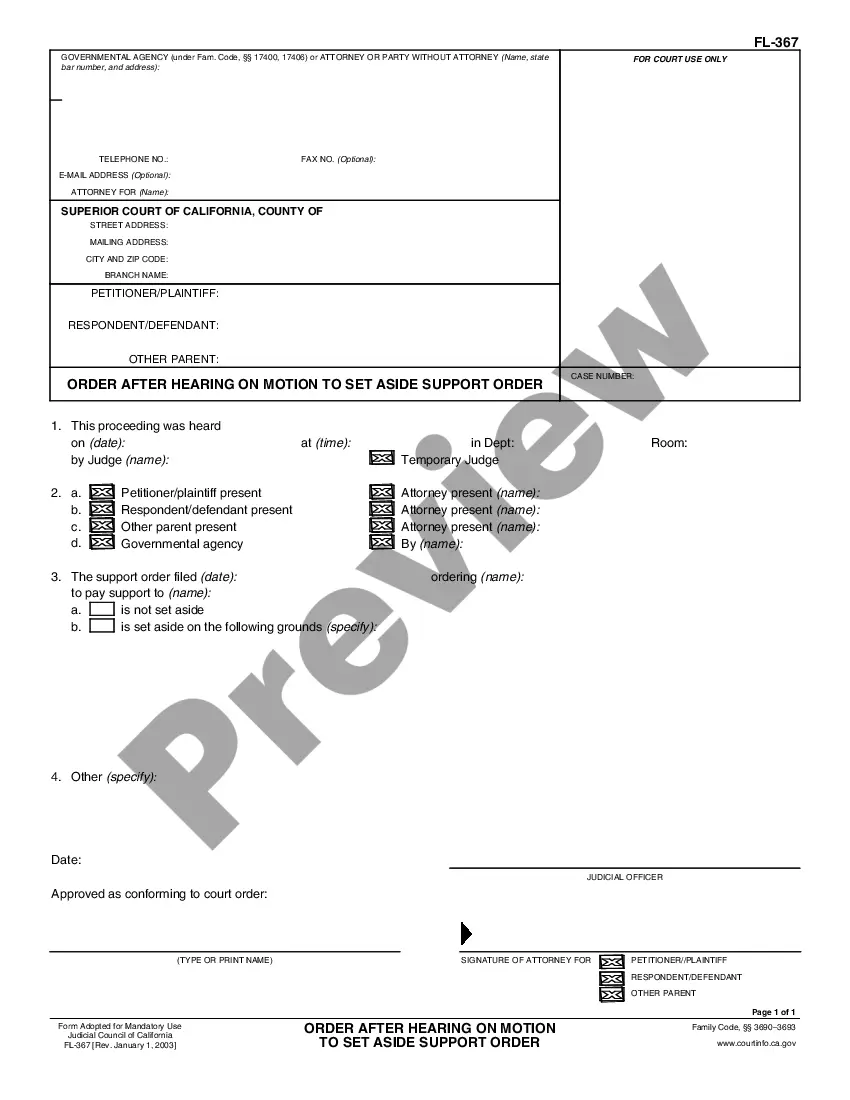

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

How to fill out Series Seed Preferred Stock Purchase Agreement?

Have you been in a placement in which you require papers for either company or specific uses just about every day? There are a lot of lawful papers themes accessible on the Internet, but locating versions you can depend on is not easy. US Legal Forms offers a large number of develop themes, much like the Illinois Series Seed Preferred Stock Purchase Agreement, that happen to be published to satisfy federal and state needs.

If you are currently acquainted with US Legal Forms web site and possess your account, simply log in. After that, you can obtain the Illinois Series Seed Preferred Stock Purchase Agreement format.

Should you not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you will need and make sure it is to the correct town/region.

- Use the Preview key to examine the form.

- Browse the explanation to actually have selected the proper develop.

- When the develop is not what you are looking for, take advantage of the Search area to obtain the develop that meets your requirements and needs.

- If you discover the correct develop, click on Purchase now.

- Choose the pricing prepare you need, fill out the desired info to create your account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file format and obtain your version.

Get all of the papers themes you possess bought in the My Forms menus. You can aquire a more version of Illinois Series Seed Preferred Stock Purchase Agreement whenever, if needed. Just go through the necessary develop to obtain or print the papers format.

Use US Legal Forms, one of the most considerable collection of lawful types, in order to save some time and stay away from mistakes. The assistance offers professionally manufactured lawful papers themes which can be used for an array of uses. Create your account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

It details specific information about the stock transfer, including warranties, dispute resolution measures, allocation of costs, etc. It is a binding agreement that ensures the stock transfer will proceed. The buyer and seller can review the agreement and get a clear understanding of the transaction in advance.

Series Seed Preferred Shares means the Series Seed Preferred Shares of the Company, par value US$0.001 per share, with the rights, preferences, and privileges as set forth in the Memorandum and Articles. Series Seed Preferred Shares means the Company's Series Seed Preferred Shares, par value US$0.000005 per share.

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

Redeemable preferred stock is a type of preferred stock that includes a provision allowing the issuer to buy it back at a specific price and retire it. Also known as callable preferred stock, redeemable preferred stock can be advantageous for issuers because it gives them more financial flexibility.

A purchase agreement is the final document used to transfer a property from the seller to the buyer, while a purchase and sale agreement specifies the terms of the transaction. Parties will sign a purchase agreement after both parties have complied with the terms of the purchase and sale agreement.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.