Illinois Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al.

Description

How to fill out Grantor Trust Agreement Between Cumberland Mountain Bancshares, James J. Shoffner, Et Al.?

Have you been in a position in which you will need documents for sometimes enterprise or personal purposes nearly every working day? There are a lot of authorized document layouts available on the Internet, but getting kinds you can rely isn`t straightforward. US Legal Forms gives 1000s of develop layouts, such as the Illinois Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al., that happen to be composed in order to meet state and federal demands.

When you are previously knowledgeable about US Legal Forms site and get an account, simply log in. Afterward, you are able to down load the Illinois Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. format.

If you do not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the develop you will need and ensure it is for the appropriate town/area.

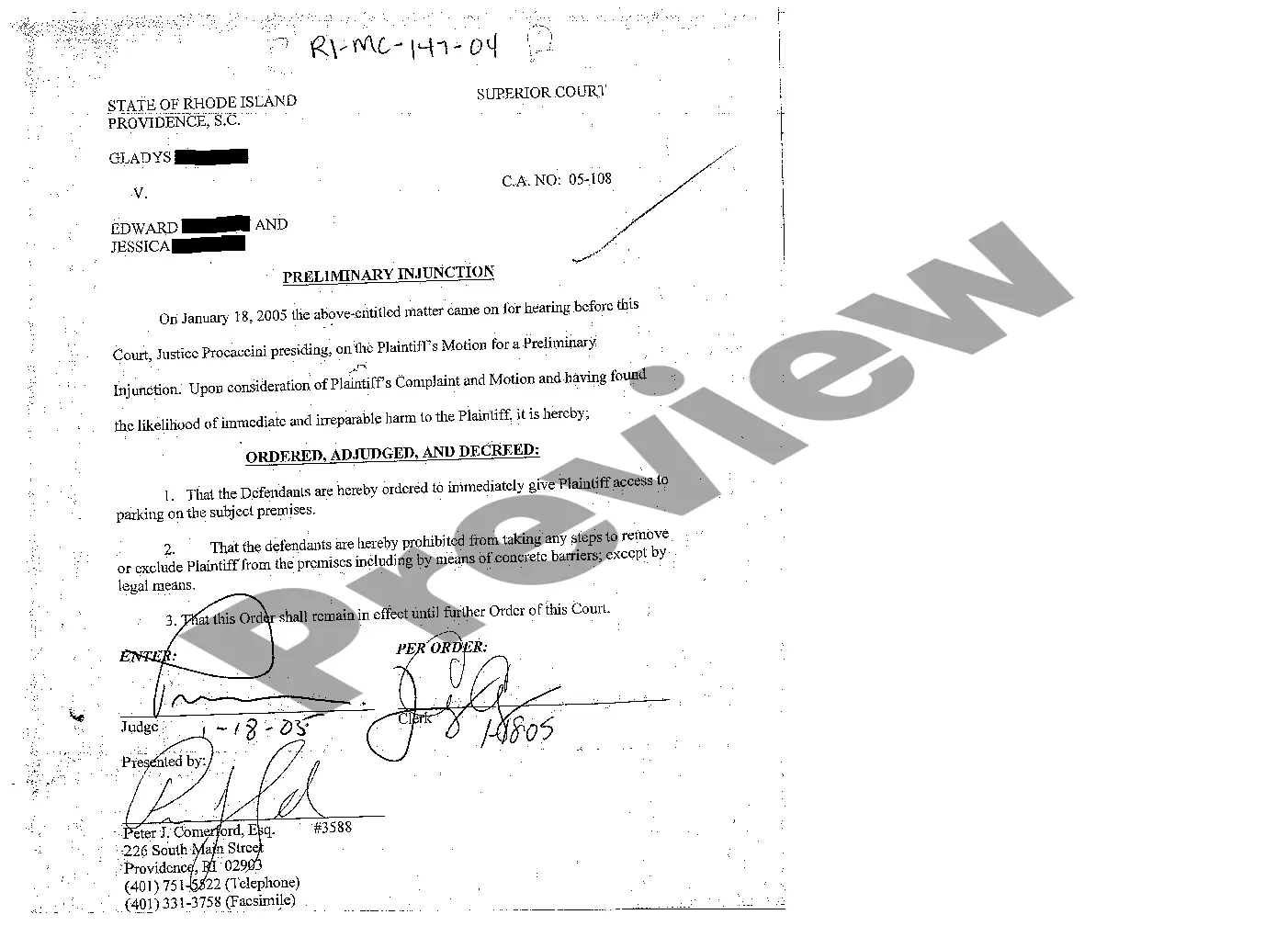

- Take advantage of the Review option to review the form.

- See the description to ensure that you have chosen the right develop.

- When the develop isn`t what you are seeking, use the Search field to get the develop that suits you and demands.

- Whenever you discover the appropriate develop, simply click Get now.

- Opt for the rates strategy you would like, fill out the required info to produce your money, and purchase the transaction making use of your PayPal or bank card.

- Choose a convenient file structure and down load your copy.

Locate each of the document layouts you possess bought in the My Forms food list. You can aquire a further copy of Illinois Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. anytime, if necessary. Just go through the needed develop to down load or print out the document format.

Use US Legal Forms, probably the most comprehensive collection of authorized types, to conserve efforts and prevent faults. The assistance gives appropriately made authorized document layouts which can be used for a range of purposes. Make an account on US Legal Forms and initiate creating your daily life easier.