Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(16) The false representation or implication that a debt collector operates or is employed by a consumer reporting agency . . . ."

Illinois Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing or Implying that a Debt Collector Operates or is Employed by a Consumer Reporting Agency

Description

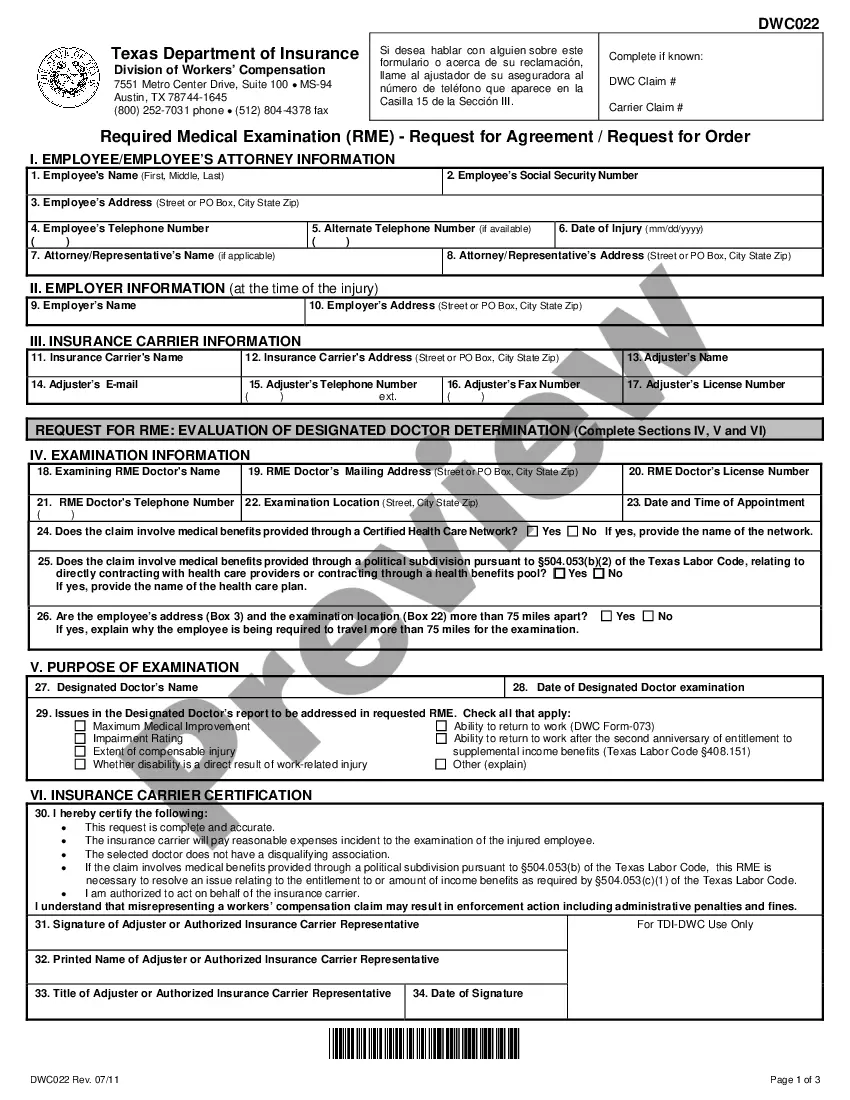

How to fill out Letter Informing Debt Collector Of False Or Misleading Misrepresentations In Collection Activities - Falsely Representing Or Implying That A Debt Collector Operates Or Is Employed By A Consumer Reporting Agency?

Locating the correct sanctioned document template may present a challenge. Certainly, there are numerous templates accessible online, but how do you locate the sanctioned type you require.

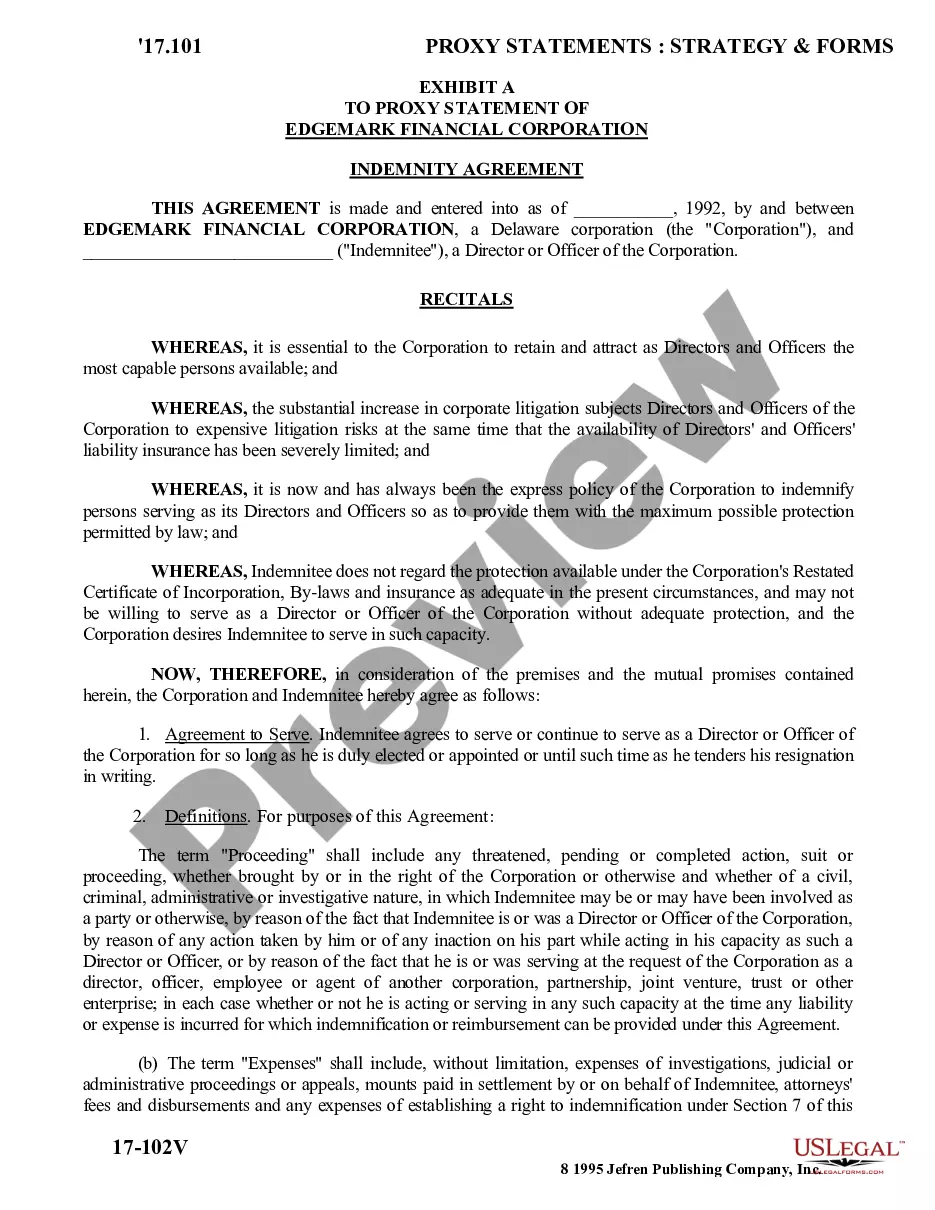

Utilize the US Legal Forms website. The platform offers a multitude of templates, including the Illinois Letter Notifying Debt Collector of Incorrect or Deceptive Misrepresentations in Collection Activities - Incorrectly Indicating or Suggesting that a Debt Collector Functions or is Employed by a Consumer Reporting Agency, which you can utilize for business and personal purposes.

All of the documents are reviewed by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the correct template.

- If you are already registered, Log In to your account and click on the Download button to acquire the Illinois Letter Notifying Debt Collector of Incorrect or Deceptive Misrepresentations in Collection Activities - Incorrectly Indicating or Suggesting that a Debt Collector Functions or is Employed by a Consumer Reporting Agency.

- Use your account to access the legal documents you may have obtained previously.

- Navigate to the My documents tab of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct template for your region/county.

- You can view the document using the Preview button and read the document summary to confirm it is suitable for you.

Form popularity

FAQ

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Your letter should: Ask the credit bureau to remove or correct the inaccurate or incomplete information. Include: your complete name and address....The credit bureaus also accept disputes online or by phone:Experian (888) 397-3742.Transunion (800) 916-8800.Equifax (866) 349-5191.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof. (2) The false representation of -- (A) the character, amount, or legal status of any debt; or.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.