Illinois Declaration of Trust

Description

How to fill out Declaration Of Trust?

Are you in a position the place you will need papers for either business or individual uses just about every working day? There are a lot of lawful file templates available on the net, but finding versions you can rely on is not straightforward. US Legal Forms delivers thousands of develop templates, like the Illinois Declaration of Trust, which can be created to satisfy federal and state needs.

In case you are previously informed about US Legal Forms web site and get your account, just log in. After that, you can download the Illinois Declaration of Trust template.

Unless you come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Find the develop you require and ensure it is to the proper area/area.

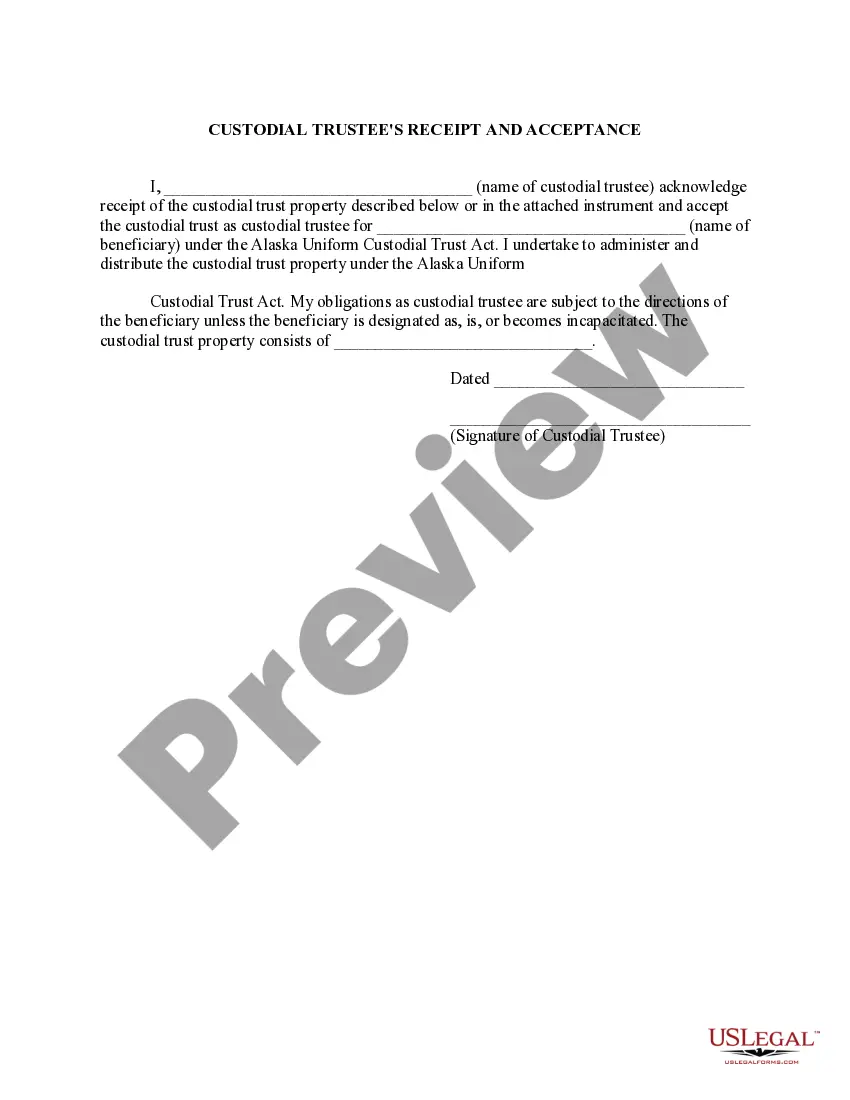

- Use the Preview button to examine the form.

- Look at the outline to actually have chosen the right develop.

- In case the develop is not what you`re searching for, make use of the Research area to get the develop that meets your requirements and needs.

- Once you obtain the proper develop, just click Purchase now.

- Pick the prices prepare you need, complete the specified details to generate your account, and purchase your order with your PayPal or charge card.

- Decide on a practical paper file format and download your copy.

Find every one of the file templates you have bought in the My Forms food selection. You can get a further copy of Illinois Declaration of Trust whenever, if required. Just select the required develop to download or printing the file template.

Use US Legal Forms, by far the most comprehensive collection of lawful forms, in order to save efforts and avoid mistakes. The service delivers professionally manufactured lawful file templates which you can use for an array of uses. Make your account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

A revocable living trust has a huge benefit over a will in that you will prepare your estate if you become mentally incapacitated, not only when you die. If you become mentally unstable to the extent that you can no longer manage your affairs, your successor trustee can step in.

When the decedent is the beneficiary of a trust, the decedent's death will cause the property to pass pursuant to the terms of the trust document. This is true whether or not the decedent was also the trustee. Typically, the trust document will name the people that inherit a house, much like in a will.

By placing assets in a trust, court intervention may be avoided; instead, property will be distributed ing to the instructions contained in the trust agreement. Consequently, money and other possessions can transfer faster and costly court expenses will be avoided.

A living trust might be especially useful in Illinois because the state does not use the Uniform Probate Code. This means that a living trust has the potential to save time and money for your family. When it comes to creating a living trust, you can do it yourself or work with an attorney.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

A Will and Power of Attorney for Property need to be notarized. A Revocable Trust and Power of Attorney for Healthcare do not require a notary.

Do I need to file or record my trust anywhere? Not in Illinois. Some other states may have different requirements, but one of the principal advantages of a living trust is privacy. Unlike a Will, which must be made public record after you die, a trust remains private and is not filed or recorded.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.