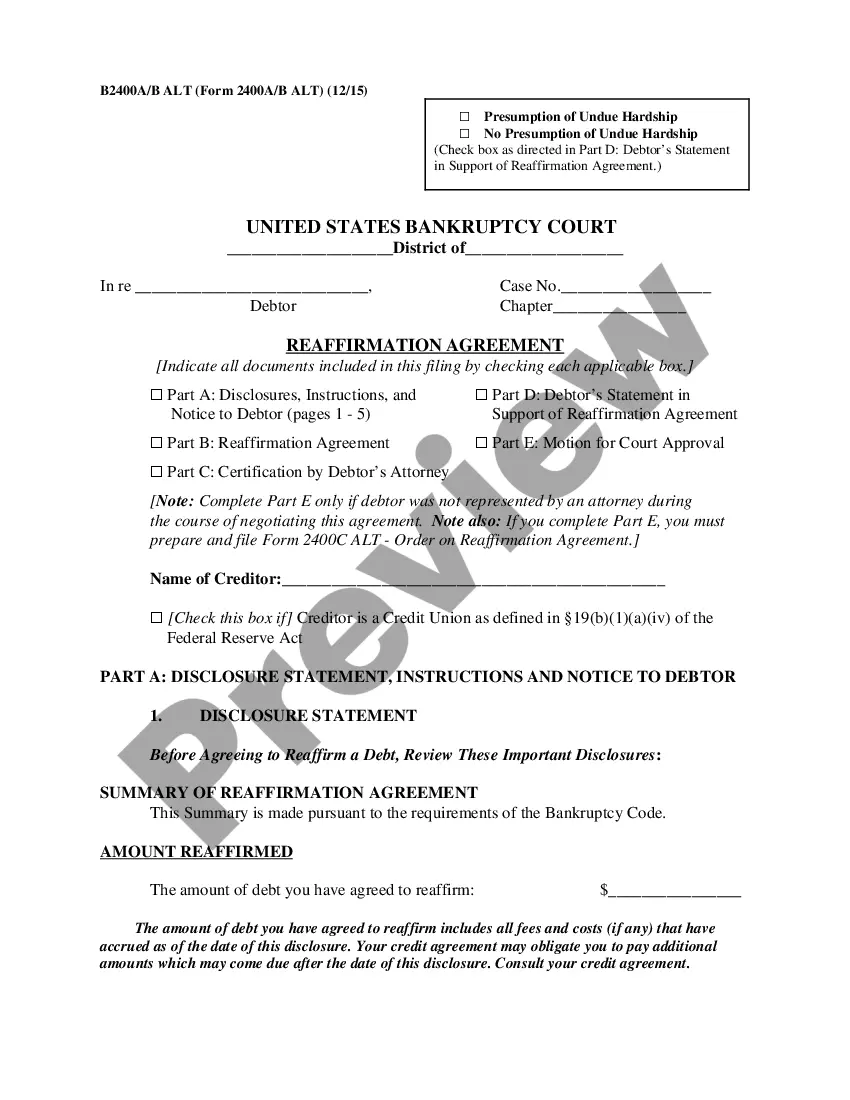

Illinois Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

Are you presently in a placement where you will need files for possibly company or specific purposes just about every day? There are plenty of legitimate file templates available on the net, but finding ones you can rely on isn`t straightforward. US Legal Forms offers a huge number of form templates, like the Illinois Reaffirmation Agreement, Motion and Order, which are created to satisfy state and federal demands.

When you are already familiar with US Legal Forms website and also have an account, merely log in. Next, it is possible to download the Illinois Reaffirmation Agreement, Motion and Order design.

Should you not have an bank account and want to start using US Legal Forms, abide by these steps:

- Find the form you will need and make sure it is to the appropriate metropolis/state.

- Make use of the Review key to check the form.

- Read the outline to ensure that you have chosen the right form.

- When the form isn`t what you are searching for, make use of the Look for field to obtain the form that suits you and demands.

- Whenever you find the appropriate form, click on Get now.

- Select the prices prepare you need, fill in the necessary information and facts to make your money, and pay for an order with your PayPal or bank card.

- Select a hassle-free paper structure and download your copy.

Find each of the file templates you may have bought in the My Forms food list. You can aquire a more copy of Illinois Reaffirmation Agreement, Motion and Order at any time, if necessary. Just click the required form to download or printing the file design.

Use US Legal Forms, by far the most considerable collection of legitimate kinds, to conserve efforts and stay away from faults. The support offers professionally produced legitimate file templates that can be used for an array of purposes. Make an account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

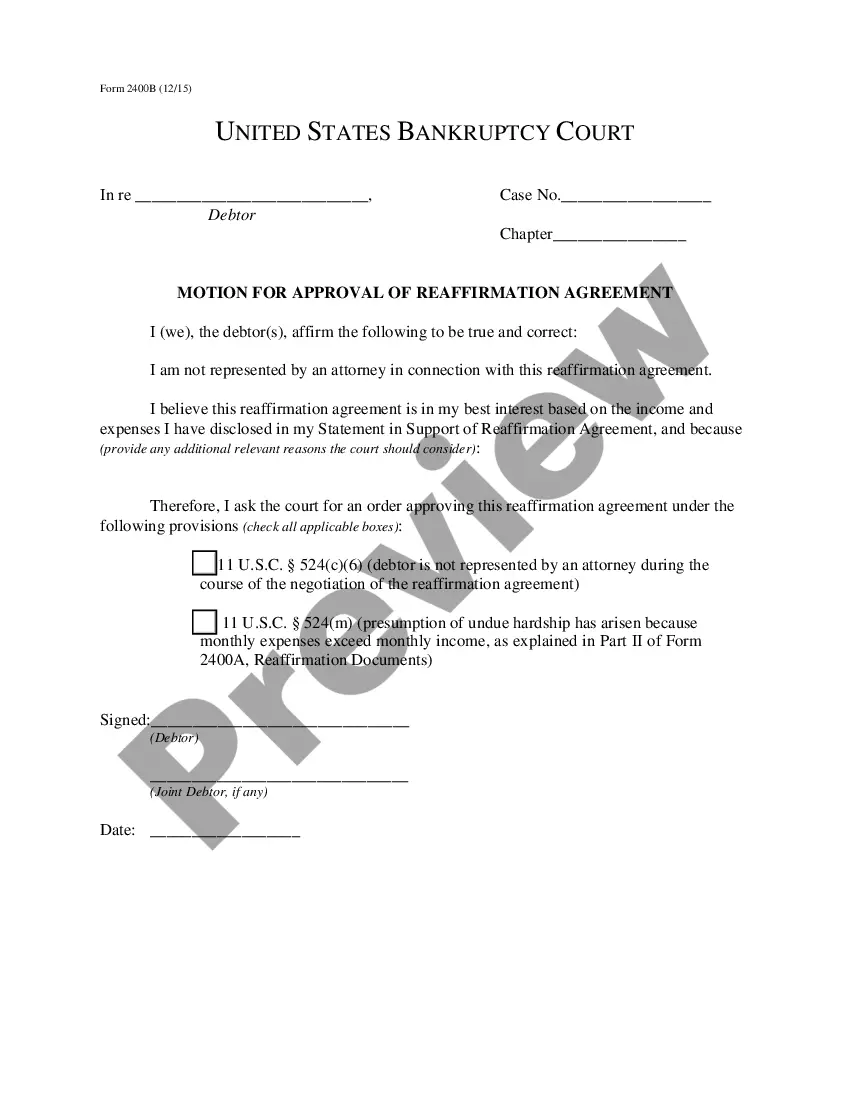

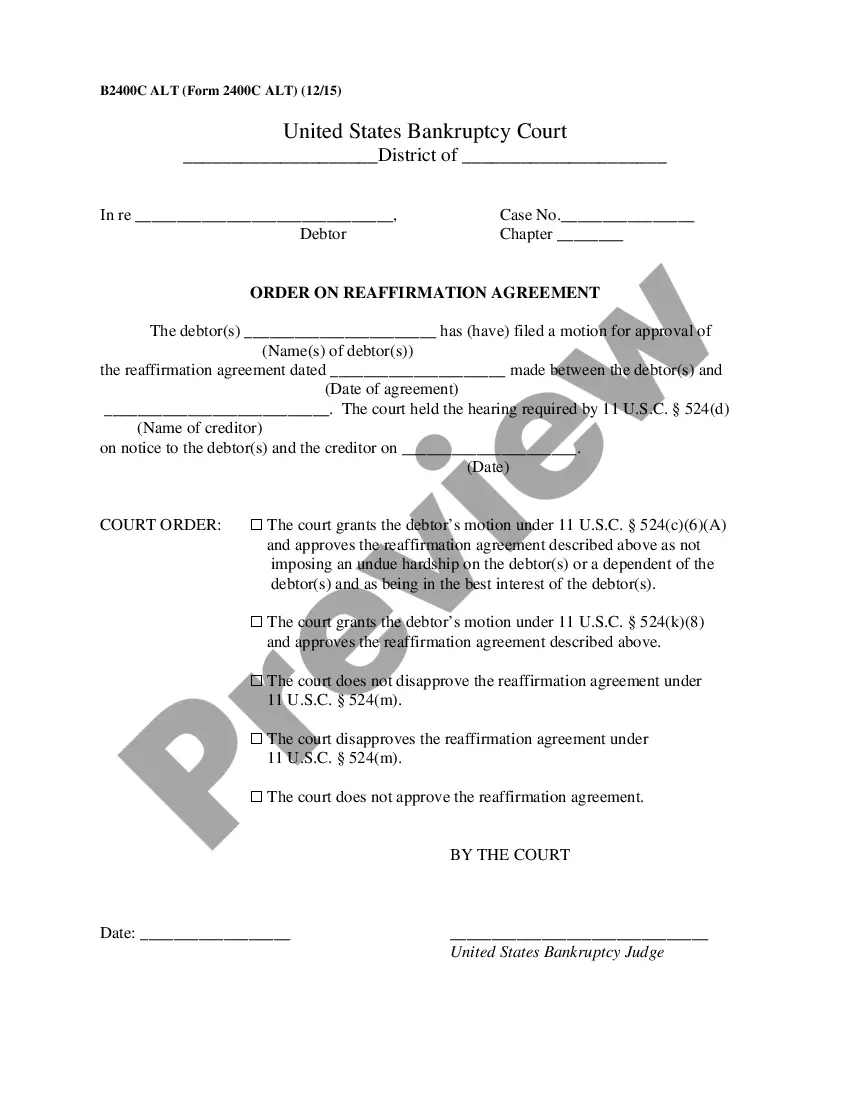

If I deny the motion to reaffirm the debt, you are under no legal responsibility to pay the creditor, but the creditor can seek to repossess the collateral (if there is any). However the creditor cannot obtain a judgment against you for the amount you owe on this debt.

Reaffirmation agreements can be rescinded any time before the Court issues the discharge, or within 60 days after the agreement is filed with the Court, whichever is the later. Notice of the rescission must be given to the creditor.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

A reaffirmation agreement allows you to agree with a lender to keep your collateral after filing for bankruptcy. Common types of loans you may make a reaffirmation agreement for include home loans, auto loans or any other loan that is attached to significant collateral that you use regularly.

Example of Reaffirmation He has depleted his savings and is unable to make his mortgage payments. John arranges with his mortgage company a reaffirmation that is approved in court. He reaffirms the debt he owes on the home mortgage, with a chance to renegotiate payments with the lender.

The Chapter 13 Trustee is required to report to the Bankruptcy Court if you fail to make payments on time or in full. The Court may then enter an order dismissing your case and withdrawing the protection of the Bankruptcy Court. If that occurs, you then could be subject to creditor collection efforts and other actions.

A reaffirmed debt remains your personal legal obligation to pay. Your reaffirmed debt is not discharged in your bankruptcy case. That means that if you default on your reaffirmed debt after your bankruptcy case is over, your creditor may be able to take your property or your wages.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

In bankruptcy, a reaffirmation is an agreement that a debtor and a creditor enter into after a debtor has filed for bankruptcy, in which the debtor agrees to repay all or part of an existing debt after the bankruptcy proceedings are over and the property subject to the reaffirmation is not subject to partition in the ...