Illinois Voluntary Petition for Non-Individuals Filing for Bankruptcy

Description

How to fill out Voluntary Petition For Non-Individuals Filing For Bankruptcy?

It is possible to spend hours on-line looking for the legal record format which fits the federal and state requirements you will need. US Legal Forms gives a large number of legal varieties that are examined by experts. You can easily obtain or produce the Illinois Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act from our service.

If you already have a US Legal Forms bank account, you may log in and click the Acquire option. Following that, you may complete, change, produce, or indication the Illinois Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act. Each and every legal record format you get is your own permanently. To acquire an additional duplicate for any acquired form, check out the My Forms tab and click the related option.

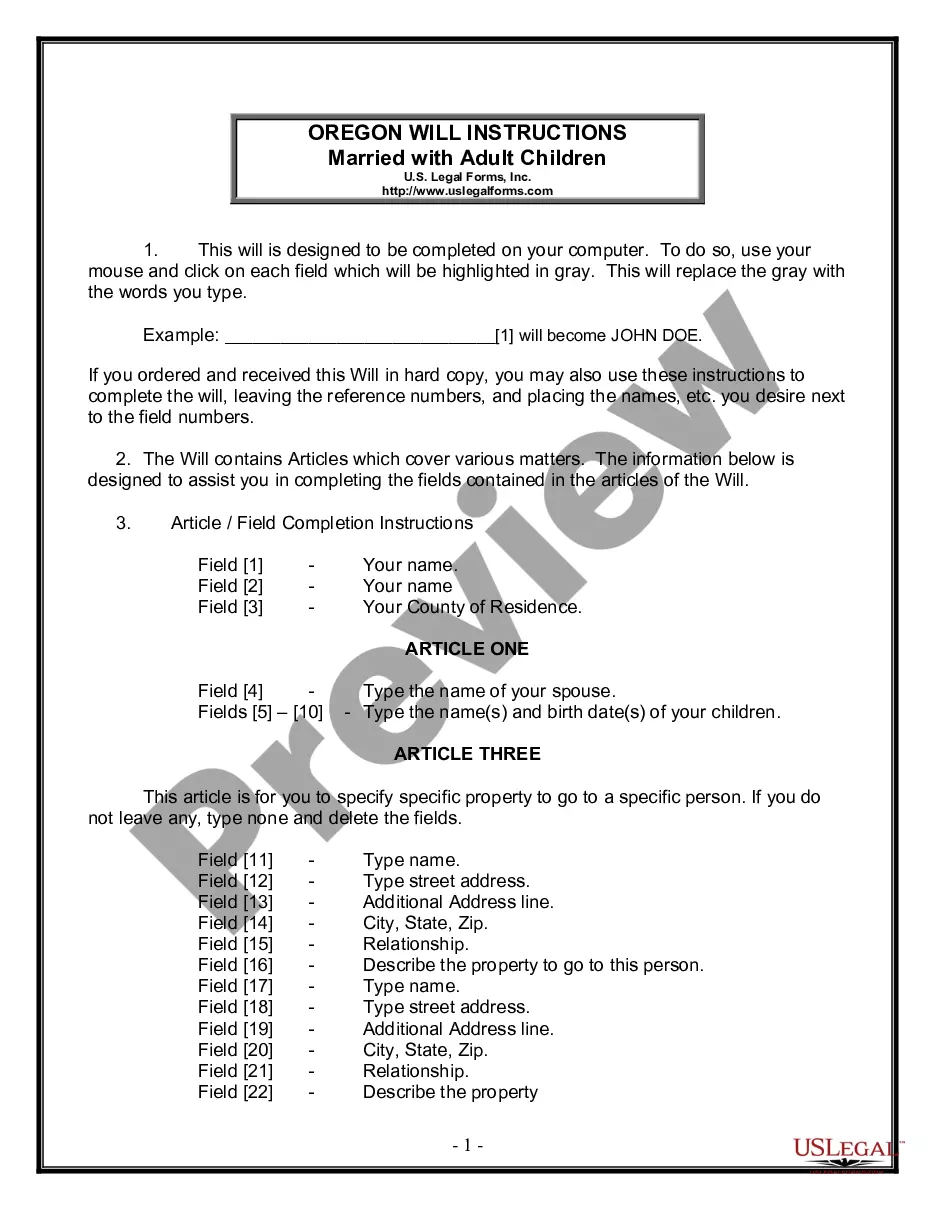

If you work with the US Legal Forms web site the very first time, adhere to the basic directions beneath:

- Initial, ensure that you have selected the right record format to the state/town of your liking. See the form explanation to ensure you have picked out the correct form. If readily available, utilize the Review option to check through the record format at the same time.

- If you want to get an additional model of your form, utilize the Search area to get the format that fits your needs and requirements.

- When you have found the format you desire, just click Get now to move forward.

- Choose the costs strategy you desire, key in your references, and register for your account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal bank account to pay for the legal form.

- Choose the file format of your record and obtain it to your gadget.

- Make adjustments to your record if necessary. It is possible to complete, change and indication and produce Illinois Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act.

Acquire and produce a large number of record templates utilizing the US Legal Forms Internet site, which offers the largest assortment of legal varieties. Use specialist and condition-distinct templates to deal with your small business or personal requires.

Form popularity

FAQ

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills.

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.

The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common. All of the debtor's assets are measured and evaluated, and the assets may be used to repay a portion of the outstanding debt.

This is when you agree to pay a specific sum, typically some of the total amount you owe. In exchange, you are ?forgiven? from paying the remainder of the debt. While this still reduces your overall debt, it isn't without its consequences. Debt forgiveness is seen most often with personal loans and credit card debt.

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.